Pre-opening Comments for Friday April 26th

U.S. equity index futures were lower this morning. S&P 500 futures were down 5 points in pre-opening trade.

Index futures weakened further following release of first estimate of first quarter annualized real Gross Domestic Product. Consensus was a gain of 3.2% versus an increase of 0.4% in the fourth quarter. Actual was a gain of 2.5%.

First quarter earnings reports continue to pour in. Companies that reported after the close yesterday included Starbucks, Expedia, Amazon.com, Weyerhaeuser, VF Corp, DR Horton, Chevron and Tyco.

Domtar (UFS US$68.40) is expected to open lower after JP Morgan downgraded the stock from Overweight to Neutral.

Facebook added $0.44 to $26.58 after Raymond James upgraded the stock from Outperform to Strong Buy. Target is $37.

Boeing improved $0.61 to $92.28 after BB&T upgraded the stock from Hold to Buy.

Exxon Mobil fell $0.32 to $87.75 following a downgrade by ISI Group from Buy to Neutral. Target is $95.

Interesting Chart

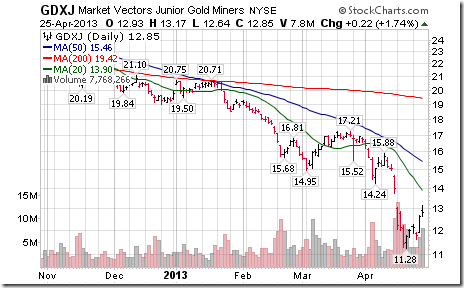

Gold and gold stocks on both sides of the border have recovered strongly from oversold levels during the past few trading days.

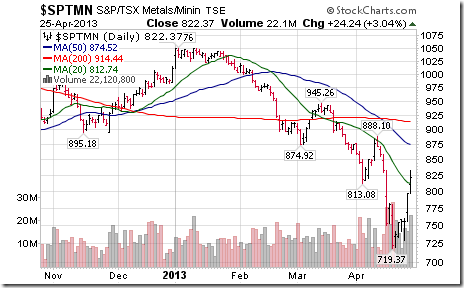

Strength in gold and other precious metals prompted a strong gain in the TSX Metals and Mining Index.

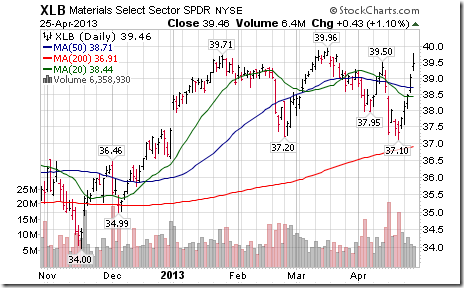

Strength in metals and metals equities and their related ETFs spilled into Materials SPDRs

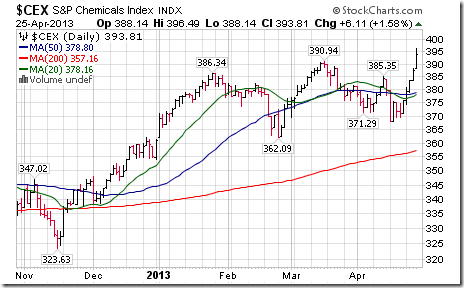

However, the greatest reason for strength in Materials SPDRs came from the Chemical component in the unit. The weight of Chemicals in the sector is approximately 69%.

Updates on Recommended Seasonal Trades

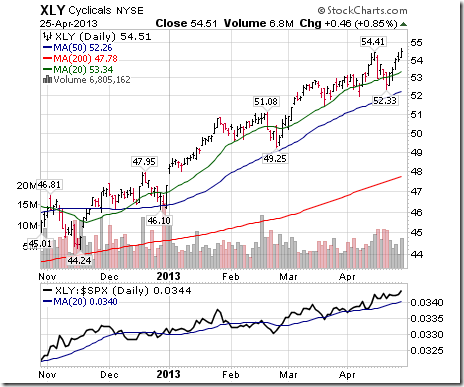

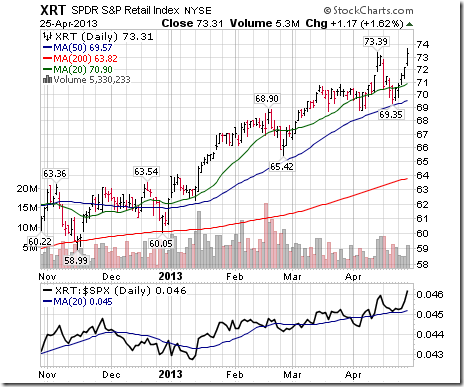

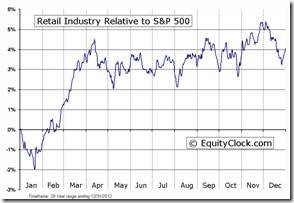

Two of our recommended seasonal trades, Consumer Discretionary SPDRs (XLY) and Retail SPDRs (XRT) passed the end of the period of seasonal strength earlier this week. Both have been stellar performers on a real and relative basis since mid-November. XLY is up 23% and XRT is up 24%. Seasonal influences turn negative for both into summer. It’s time to take seasonal profits.

More on responses to first quarter earnings reports

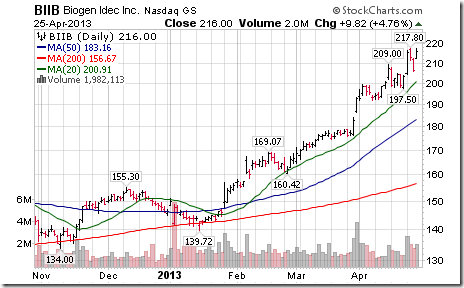

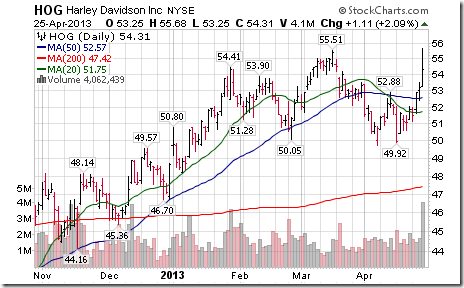

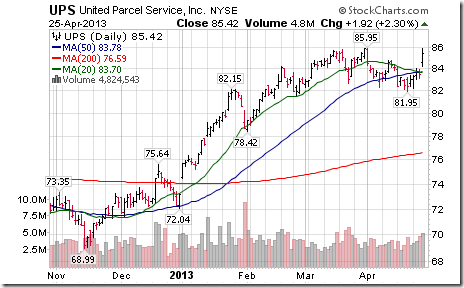

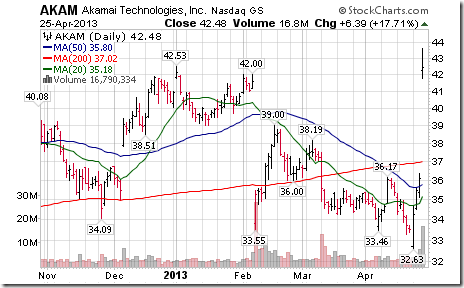

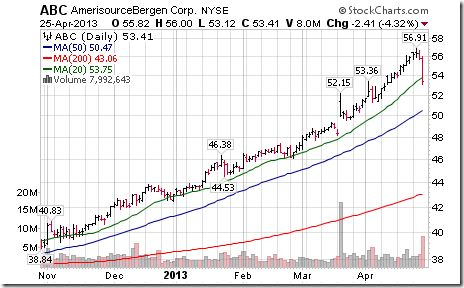

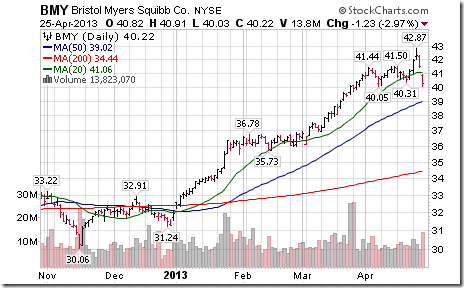

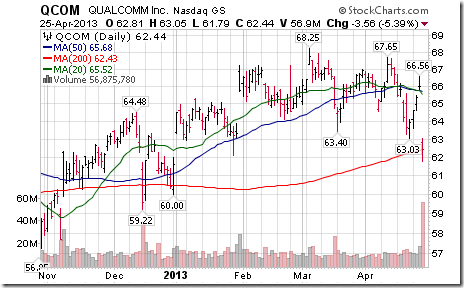

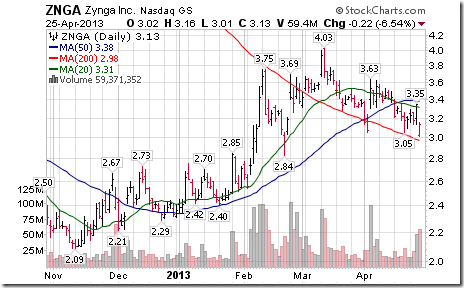

Volatility continues. Yesterday earnings continued to outperform consensus estimates. When earnings were significantly above consensus, stock prices responded strongly on the upside (e.g. Biogen Idex, Dow Chemical, Harley Davidson, UPS, Akamai). When earnings were in line or slightly less than consensus, stock prices responded strongly on the downside (e.g. Amerisource Bergen, Bristol-Myers, Qualcomm, Citrix, Zynga).

Eric Wheatley’s Column

Good morning all,

I had an online discussion with someone on how options are listed. Given that this is a subject I’ve had to clear up in the past with other people, I figured it’d be worthy of a commentary.

Companies do not decide whether or not to list options on their stocks (options conferred to their employees are not the same as those listed on an exchange). Indeed, they have no say in the matter. Exchanges have varying listing requirements whereby only fairly liquid, large-cap stocks are eligible and if the exchange deems there to be sufficient demand for options on a given stock, it will decide to list them. The companies are usually quite happy when this happens, because it creates greater interest in their shares, which begets greater liquidity and, potentially, higher share prices.

How individual options (and futures) contracts get created is also a point of some confusion. Contrary to shares and ETFs, which are issued in discrete quantities, options are created when two parties get together and agree on a transaction. Just as with Bob & George’s napkin, an option is simply a contract between a buyer (the person who pays money for the contract) and a seller (the person who receives the money and takes on the contract’s obligations). When the transaction takes place, a new contract gets “listed” and the clearing corporation will insert itself between the two parties. It will also update what is known as the “open interest”, i.e. the number of contracts outstanding for a given options series.

Now, if a contract already exists and one of the parties decides to close out his or her position, that person will buy it back (if the person had previously been the option’s seller) or sell it (if he/she was the buyer) from yet another party, who will now take on either the contract or its obligations. The unintuitive thing is that no new contract is created or dissolved and the open interest stays at the same number. An example:

· Party A buys an option from Party B.

· A month later Party A decides to sell his option.

· Party A sells his option to Party C.

· Party C is now the holder of the option. Party B still has her same obligations. No new contract is created.

In this example, Party A has to tell his broker that it is a “closing” transaction. This isn’t really for the broker’s benefit – the broker will have one long position and one short position on its books, so its obligations offset – but rather for the clearing corporation’s. You see, the clearer doesn’t know nor care about the ultimate holder or seller of the option; its relationship is at arm’s length with the various brokerages. Brokerage A could have a client who is long a given contract and another client who is short a different contract of a same series. The open interest would therefore reflect two different contracts. In the case of a closing transaction, the clearing corporation has to be advised so that it doesn’t add an additional contract to its statistics.

The final takeaway here is that contracts are only dissolved (and the open interest reduced) in the case of a closing transaction on both sides of a trade. This may seem to be an infrequent coincidence, but in fact many times closing transactions close out a contract. This is because most trades are done against a market maker who would often have an open position on a given series. If the market maker is net long a given series and someone comes along to buy the contract, the market-maker’s selling of the contract would close it out.

I hope this wasn’t too mind-numbing. Sometimes people are curious about arcane details.

Cheers!

Éric Wheatley, MBA, CIM

Associate Portfolio Manager, J.C. Hood Investment Counsel Inc.

eric@jchood.com

514.604.2829; 1.855.348.2829

*****************

Little known fact about John Charles Hood #66

John Charles Hood is greeting spring in his usual manner. This year’s peacocks are named Rupert and Annie.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. Notice that most of the seasonality charts have been updated recently.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

S5RETL INDEX Relative to the S&P 500 |

S5RETL INDEX Relative to the Sector |

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

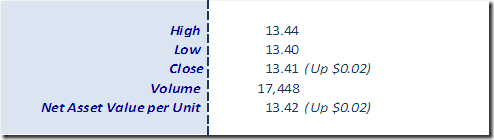

Horizons Seasonal Rotation ETF HAC April 25th 2013