by Martin Sibileau, A View From the Trenches

All this means that, as of January 30th, there will be a demand in the Euro funding market that was absent during 2012.

Click the link to read this article in pdf format: January 21 2013

In our last letter, I wrote that: “…The case of Wells Fargo and the temporary pause in the flight of deposits from the periphery of the European Union suggest that the process towards a meltdown, if any (and I believe there will be one) will be a long agony. Furthermore, in the short term, at the end of January, European banks have the option to repay the money lent by the European Central Bank in the Long-Term Refinancing Operations from a year ago, on a weekly basis. I expect them to repay enough to cause more pain to those still long of gold (including me, of course)…”

Today, I want discuss the implication of the repayment of loans made under the Long-Term Refinancing Operations. These loans were extended at the end of 2011 and at the beginning of 2012. The first thing that comes to mind, of course, is the irony that last Friday (i.e. January 18th), a $200 million 7-day repo operation by the Federal Reserve pushed the price of gold up $10/oz, while a EUR529.5 billion 3-yr collateralized loan from the European Central Bank (also known as the 2nd LTRO) made on February 29th, 2012 triggered a $100/oz sell-off. Should we expect the price of gold to rise upon the first repayment on January 30th?

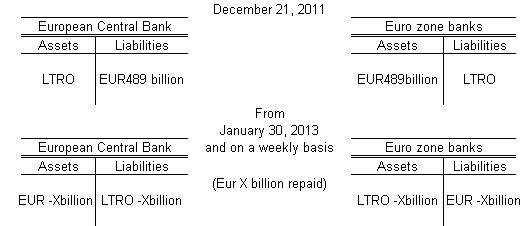

A Long-Term Refinancing Operation consists in the European Central Bank loaning funds (with a 3-yr maturity) to a bank, against collateral. Banks have the option to begin repaying loans taken under the first LTRO (made for EUR489 billion, at 1%) on January 30th, and on every week thereafter. The figure below (on the first LTRO only) should help visualize the above:

It is clear that an LTRO is a collateralized lending transaction. Why then is a repayment all of a sudden relevant? Because thanks to the backstop of Open Monetary Transactions, jump-to-default risk on the collateral used in the LTRO is perceived as non-existent. This suggests that the repayments will therefore not affect the assets purchased with the loans from the ECB. In other words, if the assets (i.e. Euro sovereign debt) that the banks had pledged as collateral are now backstopped, upon repayment of the loans, the banks will not feel the urge to get rid of them. Banks will simply have the option to fund their investments elsewhere, if appropriate. And lately, deposits in the periphery of the Euro zone seem to have ceased to flee.

All this means that, as of January 30th, there will be a demand in the Euro funding market that was absent during 2012. A bank that wants to ensure access to funds at reasonable prices may fall prey to the concept of certainty equivalence. To such bank, guaranteed funding today may seem more valuable than probably cheaper funding tomorrow, as sourcing funds in the fragile Euro market is nothing short of a non-cooperative game. But this means that in the absence of further interventions by the Central Bank, time has value (again)!!! In a world of zero-interest rate policy, such an achievement may have a relevance that goes beyond a steepener curve in the EUR funds market or the new dynamic between the EONIA and Refi rate. At the moment, one can only intuit that it will be supportive of risk and hence the Euro.

Initially, it may very well confuse the market, representing an opportunity to buy risk, including (physical) precious metals for the long term. But as I proposed earlier, in 2013 I expect imbalances to grow, and the most important gauge of these imbalances will be the value of the Euro. The higher it gets, the more difficult it will become for the Euro zone periphery to repay its debt. And I will have more to say about this in coming letters.

Martin Sibileau