by Sober Look

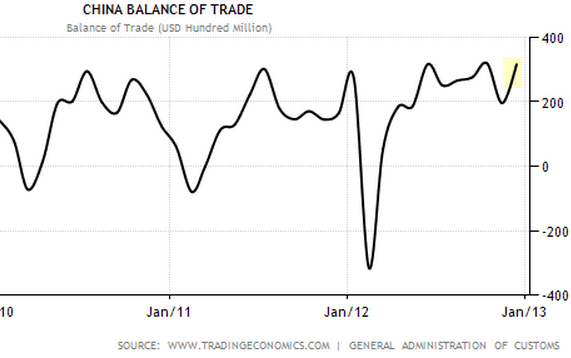

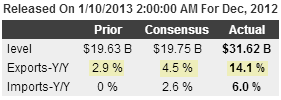

An unexpected rise in China's trade surplus announced today had a material impact on global markets. The increase in trade activity shows that China's economy may be picking up steam faster than originally anticipated (see discussion).

Source: Tradingeconomics

Exports rose 14% on a YoY basis against 4.5% consensus.

Source: Econoday

Global markets responded with the "risk-on" trade. The dollar sold off while commodities rallied.

CRB Commodity Index (source: barchart.com)

One of the broader developments in recent weeks in response to the China growth story has been the rally in US transport shares. DJ Transports index has materially outperformed DJI since mid-December.

Cognito: - China is the world’s second largest and most rapidly growing major economy. It is also the world’s largest exporter. As a result, a bottom and potential turn in China’s international shipments can be reasonably viewed as a sign of a bottom and potential turn in worldwide trade. Many of the twenty companies comprising the Dow Jones Transportation Average are engaged in the international shipment of goods. Hence their sales and earnings would benefit from an increase in global trade. Global transportation bellwether Federal Express/FDX is a prime example. Perhaps not coincidentally, FDX is attempting to emerge from a substantial reverse head-and-shoulders consolidation spanning more than two years!

This is not unique to the US, with Australian transport shares rallying as well. An improvement in the transport sector is good news for global growth because it tends to lead economic expansion.

DJ Transport vs. DJ Industrials (source: Yahoo/Finance)

Copyright © SoberLook.com