Responding to Inflation: A Multi-Asset Approach

by Nicholas J. Johnson, Ronit M. Walny, PIMCO

- PIMCO sees the long-term risk of inflation increasing due to poor fiscal conditions and heavy debt loads in many developed markets, prolonged accommodative monetary policies, and stress on commodity supplies from emerging market demand growth.

- Typical investment portfolios contain a heavy mix of stocks and bonds, which tend to respond negatively to inflation surprises, potentially leaving them ill-prepared for a move higher in inflation.

- PIMCO’s Inflation Response Multi-Asset Strategy can help provide a solution by investing in assets that tend to respond well to inflation, including TIPS, commodities, REITs, non-dollar currencies and gold.

After two decades of stable inflation in the U.S., many investors have relaxed their vigilance – even though unanticipated inflation can significantly harm investment returns. Today, as long-term inflationary risks loom, we believe investors may benefit from reassessing their portfolios’ sensitivity to inflation. PIMCO has designed the Inflation Response Multi-Asset Strategy (IRMAS) to enhance portfolio responsiveness to inflation.

The strategy seeks to take advantage of inflation and improve real (inflation-adjusted) returns. It aims to do this by incorporating asset classes that have historically responded well to inflation, especially to unanticipated increases, while tactically managing for what is causing inflation and how inflation is priced into each asset class. All asset classes already have some degree of inflation expectation built into their prices, and changes in those expectations can influence asset prices.

We have found that over the last 40 years, both stocks and bonds have tended to respond negatively to inflation surprises – inflation in excess of what is already priced in and anticipated. This is especially relevant today because we see the long-term risk of inflation increasing, but the market has not yet priced in higher inflation expectations. As a result, we believe this is a good time to incorporate inflation hedging and realign the inflation sensitivity of portfolios.

Risks of higher inflation

Inflation in the U.S., as measured by the Consumer Price Index or CPI (which estimates the average change in prices for a basket of goods and services), averaged a fairly benign 2.5% in the two decades from September 1992 through September 2012. However, PIMCO expects U.S. inflation to trend higher over the next three to five years, mainly due to three forces:

- Poor fiscal conditions and heavy debt loads in the U.S. and other developed countries

- Prolonged accommodative and unconventional monetary policies

- Continued stress on global commodity supplies from emerging market demand growth

Inflation-sensitive asset classes

PIMCO’s Inflation Response Multi-Asset Strategy incorporates five critical asset classes that have historically responded positively over different time frames to inflation and inflation surprises (as shown in Figure 1).

- Treasury Inflation-Protected Securities (TIPS) are U.S. Treasury bonds whose value is contractually linked to CPI. TIPS therefore typically respond to a wide range of inflation sources and can act as a cornerstone of an inflation-hedging portfolio, hedging against increases in wages, education costs, medical expenses and more. In our view, they are most effective at hedging portfolios in a low-growth and high-inflation environment.

- Commodities may help hedge against rising food and energy prices, which comprise a quarter of CPI and are its most volatile components. Commodity investments can therefore act as a shock absorber for inflation surprises.

- Real Estate Investment Trusts (REITs), which invest in income-producing properties and pay dividends, offer a potential defense against increases in the costs of housing, which make up over 30% of CPI. While REITs have a high correlation to inflation over longer time periods, they have a high correlation with equities over shorter time periods.

- Non-dollar currencies may help combat inflation driven by higher prices for imported goods which are brought about by a weaker U.S. dollar.

- Gold has characteristics of both a commodity that is easily stored for a long period of time and a currency. It may help provide value in the event of competitive currency devaluations.

(For more details on how various asset classes respond in different inflationary environments, including periods of high inflation and inflation surprises, please see “Inflation Regime Shifts: Implications for Asset Allocation,” by Nicholas Johnson and Sébastien Page.)

Bonds and stocks, on the other hand, have historically responded negatively to surprises in inflation. Bond prices tend to fall because inflation erodes the value of investments with a fixed income, or yield; it is also associated with rising interest rates. In theory, bonds with yields linked to short-term interest rates, such as Treasury bills, could move in tandem with inflation, but with the Fed pegging short-term rates near zero since late 2008 and likely to hold rates there through 2015, short-term instruments have become generally unresponsive to inflation.

The negative relationship between equities and inflation surprises may not seem as intuitive. Think of equities as a discounted stream of future cash flows. When inflation rises, the discount rate applied to those cash flows rises, which lowers their current value. Higher interest rates also increase the cost of capital to corporations, and higher inflation means that earnings may be overstated since they depreciate historical cost rather than replacement cost of assets. While equities can serve many critical investment objectives (such as higher return potential), they tend to leave an investor with a negative inflation beta. However, an active equity manager can help by carefully focusing on companies with enough pricing power to counter the negative impact of higher inflation.

Measuring asset class sensitivity to inflation

By thoughtfully combining assets – considering risk, return, inflation sensitivity and the contributing factors of inflation – PIMCO developed the Inflation Response Index (Bloomberg ticker: INFNRSPN). This index is composed of 45% TIPS, 20% commodities, 15% currencies, 10% REITs and 10% gold. (These asset classes are represented respectively by: Barclays U.S. TIPS Index; Dow Jones UBS Commodities Total Return; J.P. Morgan Emerging Local Markets Plus; Dow Jones Select REITs; and Dow Jones UBS Gold Subindex Total Return.)

From the early days of the TIPS market in early 1997 through September 2012, the index returned 7.7% annually, over five percentage points higher than the annual rate of inflation for the same time frame, with a modest volatility level of 7.7% and a monthly inflation beta of 2.9.

To show how an inflation-sensitive portfolio would have performed over a longer time period that includes different economic scenarios, with both rising and declining interest rates as well as periods of higher inflation, PIMCO simulated returns as far back as all the index data were available, from the second quarter of 1973. This includes a simulation of historical TIPS performance to capture a more robust timeframe than the period since TIPS were introduced in 1997, which has been dominated by declining real rates. Of course, future periods may have very different inflation dynamics than those since 1973, and historical returns may not be indicative of future ones.

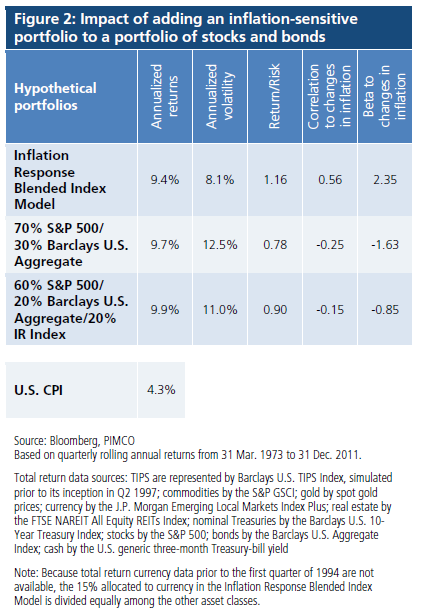

We found that by including just a 20% allocation to this Inflation Response Blended Index Model in a portfolio of 70% stocks and 30% bonds (reducing the allocations to 60% and 20%, respectively), the inflation beta of the portfolio increased from -1.62 to -.85. (Inflation beta quantifies the magnitude of an asset’s response to inflation; for every 1% change in the rate of inflation, returns move by a multiple reflected by its inflation beta.) Since early 1973, the Inflation Response Blended Index Model alone returned 9.4% – about five percentage points over the average annual 4.3% rate of inflation.

When added to a portfolio of stocks and bonds, the inflation-sensitive index model portfolio increased the inflation beta of the full portfolio, reduced the overall volatility profile and improved risk-adjusted returns, as illustrated in Figure 2.

Opportunities for active management

In addition to using the weighting methodology of the Inflation Response Index, the Inflation Response Multi-Asset Strategy seeks to add value by taking advantage of PIMCO’s active management capabilities. Tactical allocation among the different asset classes can help position the portfolio to respond to the particular sources of inflation in a given economic environment. In addition, the strategy aims to find relative value opportunities when anticipated economic environments or inflation are priced differently among various asset classes.

Within each asset class, we also see opportunities for active management. PIMCO’s real return team has a time-tested history of managing each asset class, combining the firm’s top-down global macroeconomic views with bottom-up research on each asset class.

The strategy incorporates tail-risk hedging, which aims to manage the risk of extreme events, such as a financial crisis, when a single risk factor can have a significant impact on portfolio value. The tail-risk hedge seeks to reduce overall portfolio risk, creating opportunities to use capital more effectively when prices are cheaper.

A comprehensive inflation solution

With inflation risks increasing over the secular horizon, we think investors should evaluate their portfolios’ ability to deal with a rise in inflation. Typical investment portfolios contain a heavy mix of stocks and bonds, which tend to respond negatively to inflation surprises, leaving them ill-prepared for a move higher in inflation. PIMCO’s Inflation Response Multi-Asset Strategy offers a solution that is designed to enhance responsiveness to inflation, improve diversification and provide better risk-adjusted return potential. By investing in multiple inflation-sensitive asset classes while managing volatility, hedging tail risk and seeking value via active management, IRMAS aims to better position investors’ portfolios for inflation.

Thanks to our PIMCO colleague Kate Botting for her contributions to the analysis in this article.

Important Disclaimer

Past performance is not a guarantee or reliable indicator of future results. Investing in the bond market is subject to certain risks, including market, interest rate, issuer, credit and inflation risk. Inflation-linked bonds (ILBs) issued by a government are fixed income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Treasury Inflation-Protected Securities (TIPS) are ILBs issued by the U.S. government. Commodities contain heightened risk including market, political, regulatory and natural conditions, and may not be suitable for all investors. REITs are subject to risk, such as poor performance by the manager, adverse changes to tax laws or failure to qualify for tax-free pass-through of income. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. All investments carry risk.

Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. Barclays U.S. TIPS Index is an unmanaged market index comprised of all U.S. Treasury Inflation Protected Securities rated investment grade (Baa3 or better), have at least one year to final maturity, and at least $250 million par amount outstanding. Performance data for this index prior to 10/97 represents returns of the Barclays Inflation Notes Index. The Barclays U.S. Treasury Index is a measure of the public obligations of the U.S. Treasury. The Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics. There can be no guarantee that the CPI or other indexes will reflect the exact level of inflation at any given time. The Dow Jones UBS Commodity Total Return Index is an unmanaged index composed of futures contracts on 20 physical commodities. The index is designed to be a highly liquid and diversified benchmark for commodities as an asset class. Prior to May 7, 2009, this index was known as the Dow Jones AIG Commodity Total Return Index. Dow Jones-UBS Gold Total Return Index reflects the return of fully collateralized positions in the underlying gold futures. The Dow Jones U.S. Select Real Estate Investment Trust (REIT) IndexSM is an unmanaged index subset of the Dow Jones Americas U.S. Select Real Estate Securities (RESI) IndexSM. This index is a market capitalization weighted index of publicly traded Real Estate Investment Trusts (REITs) and only includes only REITs and REIT-like securities. The FTSE NAREIT Equity Price Index (“North American Real Estate Investment Trust Equity Index”) includes REITs listed on the New York Stock Exchange, Nasdaq, and American Stock Exchange. JPMorgan Emerging Local Markets Index Plus (Hedged) tracks total returns for local currency-denominated money market instruments in 24 emerging markets countries with at least U.S. $10 billion of external trade. The S&P Goldman Sachs Commodity Index (S&P GSCI) is a composite index of commodity sector returns, representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. Inception Date: 12/31/69. The S&P 500 Index is an unmanaged market index generally considered representative of the stock market as a whole. The index focuses on the Large-Cap segment of the U.S. equities market. It is not possible to invest directly in an unmanaged index.

This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO and YOUR GLOBAL INVESTMENT AUTHORITY are trademarks or registered trademarks of Allianz Asset Management of America L.P. and Pacific Investment Management Company LLC, respectively, in the United States and throughout the world. ©2013, PIMCO.

Copyright © PIMCO