by Michelle Gibley, CFA, Director of International Research, Schwab Center for Financial Research

Key points

- The manufacturing cost equation is changing to Mexico's benefit.

- Mexican manufacturing growth has resulted in job and income gains, boosting consumer spending and creating a positive feedback loop.

- US fiscal concerns could create opportunities in Mexican stocks, due to close ties between the two economies.

A resurgent manufacturing sector, improved consumer sentiment and manageable inflation have all helped brighten the picture in Mexico. We like its longer-term story and believe that, while the Mexican stock market appears to be expensively valued, volatility related to concerns about economic growth in the United States could give investors near-term opportunities.

Mexico closely tied to the United States

Roughly 80% of Mexico's exports went to the United States in 2011, and exports constitute more than 30% of Mexican gross domestic product (GDP)—which means that the United States generates a quarter of Mexico's economic activity. Over the past two years, the United States has been a good export market because its economy has been one of the most stable globally.

Mexico's manufacturing gaining market share

Geographical proximity to end markets, or "near-shoring," is becoming more desirable for two reasons: The rising price of oil has driven global transportation costs higher in recent years, and manufacturers want to be able to adapt quickly to market changes. Near-shoring has helped Mexico's manufacturing sector, helping grow the country's market share in goods that are expensive to ship because of their bulk or weight, such as televisions, major household appliances and automobiles. Furthermore, we expect US demand for cars to remain strong, driven by consumers' need to replace cars recently lost in Hurricane Sandy as well as the aging American fleet. The average car on the road in the United States is about 11 years old—the highest average in more than 40 years, according to BCA Research.

Another factor contributing to Mexico's growing market share is its workers' advances in areas that require higher skills, such as cars, telecom equipment and aerospace. The labor-cost equation is also moving in Mexico's favor, according to the Boston Consulting Group.1 In 2000, Mexican factory workers earned more than four times as much as Chinese workers. Due in large part to China's double-digit wage increases in recent years, by 2010, Mexican workers earned only 1.5 times as much. BCG estimates that by 2015, the fully loaded cost (including benefits, taxes and indirect costs) of hiring Chinese workers may be 25% higher than hiring Mexican workers.

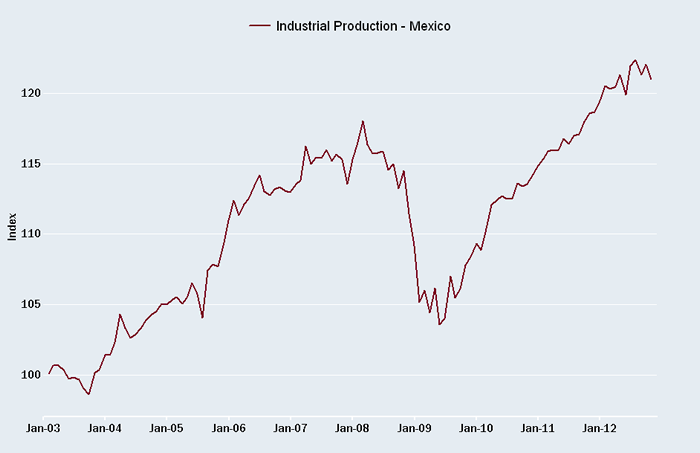

Manufacturing in Mexico continues to grow

Source: FactSet, National Institute of Statistics and Geography (INEGI), as of December 17, 2012. Indexed to 100=January 2003.

Jobs, consumer confidence recovering

Mexico's black market for jobs remains a large part of its GDP and is, by its nature, hard to quantify. But the jobs numbers for the formal economy appear to be strong; the number of private sector jobs has grown 4.6% annually for the past two years, and real wages have increased 0.4% over the same time, according to BBVA Research.2 Consumer confidence has also recovered.

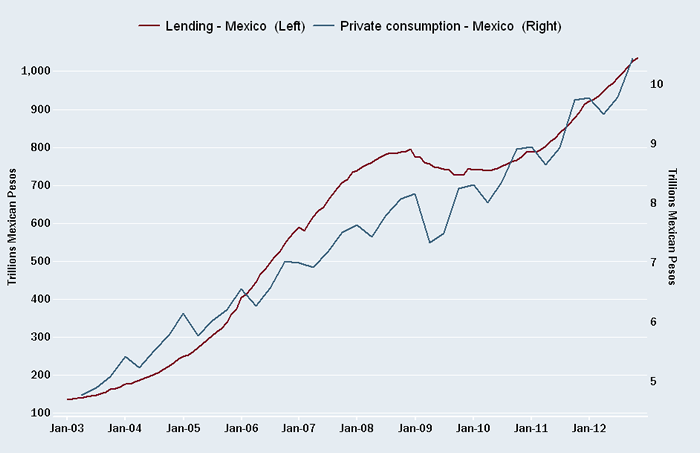

Consumption rising

Source: FactSet, Bank of Mexico and INEGI. As of December 17, 2012.

The combination of these factors with improved access to credit is buoying consumer spending. Growth in consumer lending has outpaced private consumption over the past two years, partially driven by banks reducing interest rates and collateral requirements. However, there doesn't appear to be a consumer debt bubble, as household debt and bank credit as a percent of GDP remain relatively low and the banking sector is highly capitalized, according to BBVA Research.2

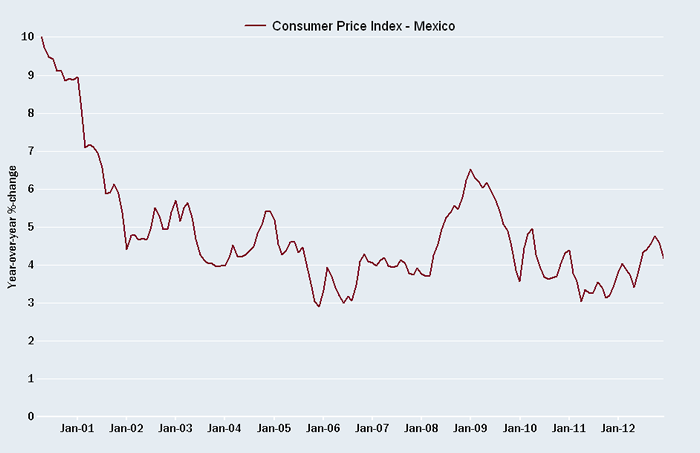

Inflation in check

One headwind for Mexico during 2012 was rising food costs, due in part to the impact of bird flu on the prices of chicken and eggs. Recently, however, inflation has slowed and at its November 30 meeting, the Mexican central bank considered the reduction "noteworthy" enough to postpone a rate hike. Nevertheless, inflation remains a risk for the future, particularly if wage increases stoke a generalized increase in prices across a broad range of sectors.

Mexican inflation contained for now

Source: FactSet, Bank of Mexico. As of December 17, 2012.

New government could bring reforms

After a 12-year hiatus, the Institutional Revolutionary Party (PRI) returned to power this year on a reform platform that could end a decade's worth of policy paralysis and stagnant growth. The new government unveiled a "Pact for Mexico" of 95 loosely defined proposals signed by the leaders of all three main political parties, which include economic themes such as opening telecom and television sectors to competition, and improving infrastructure and education. The new government has already passed a bill with sweeping labor-market reforms that will allow companies to pay hourly wages, improve the flexibility of the labor market, and outsource work.

However, despite early talk about opening up the state-controlled oil and petrochemicals sectors to private investment, the future is uncertain. The "Pact" says that hydrocarbons remain the property of the country, but that there needs to be competition in refining, basic petrochemical and transportation. Oil-sector revenues to Mexico's government have declined amid deterioration in both investment and production. Oil-sector reform has been listed by credit rating agencies as a condition to upgrade to Mexico's credit rating.

Mexico's economy not immune to slowing

According to Mexico's National Institute of Statistics and Geography (INEGI), the country's economy slowed to a lower-than-expected 1.8% annualized rate in the third quarter of 2012. The industrial sector subtracted from growth in the third quarter for the first time since 2009, as export demand slowed. However, the HSBC Mexico Manufacturing Purchasing Managers' Index™ (PMI) bounced back in October and November, ending at 55.6, and the services PMI continues to strengthen. The November HSBC Manufacturing PMI showed strong output growth and new orders increasing at the fastest pace since April 2011.

Mexico's stock market

In contrast to many other emerging markets, Mexico's stock market has a lower weight in cyclical sectors and larger exposure to consumer-related sectors, which constituted over 50% of the Mexico IPC Index (Indice de Precios y Cotizaciones) as of December 14. Additionally, the telecommunications company America Movil constitutes over 20% of the index, so investors may want to have a view on that company if using index-related investments.

We like Mexico's longer-term story but the stock market appears somewhat expensively valued. Investors may want to take advantage of market volatility to buy on dips, in particular if the market declines during "risk-off" trading periods, potentially related to fiscal headwinds in the United States.

Outlook on the Peso

By Tatjana Michel, Director of Currency Analysis

Despite headwinds from the global economy, we believe that Mexico has relatively strong fundamentals that could continue to support the peso. Barring major external shocks, Mexico's central bank may refrain from easing policies in the first half of 2013, given the country's combination of inflation and robust growth. The peso would likely strengthen against other currencies if the Federal Reserve and other central banks continue to ease their monetary policies.

Mexico's debt and deficit levels have improved significantly since the 1994-95 peso crisis and are now lower than those of most developed countries. Moreover, Mexico's central bank has significantly increased its holdings of foreign reserves since 2008, giving the peso a safety cushion should a global crisis or slowdown lead to strong capital outflows. Lastly, the new government's promise of reforms could make the economy more attractive for foreign investors and create more foreign demand for pesos.

The main risks for the peso are slowing US economic growth and the European debt crisis. If the debt crisis escalates and investors seek dollars and yen as "safe-haven" alternatives to the euro, the peso is likely to weaken as it's seen as a more risky investment.

Next Steps

For more on international investing, contact Schwab's Global Investing Services team at 800-992-4685, or log in to International Research.

1. Boston Consulting Group, "Made in America, Again," August 2011.

2. BBVA Research 3Q 2012 Outlook.

Subscribe:

Subscribe to Emails (clients only) Subscribe via RSS Download the On Investing® iPad® App

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market or geopolitical conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

International investments involve additional risks, which include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks.

Indexes are unmanaged, do not incur management fees, costs and expenses (or "transaction fees or other related expenses"), and cannot be invested in directly.

The Mexican IPC index is a capitalization weighted index of the leading stocks traded on the Mexican Stock Exchange.

Thumbs up / down votes are submitted voluntarily by readers and are not meant to suggest the future performance or suitability of any account type, product or service for any particular reader and may not be representative of the experience of other readers. When displayed, thumbs up / down vote counts represent whether people found the content helpful or not helpful and are not intended as a testimonial. Any written feedback or comments collected on this page will not be published. Charles Schwab & Co. may in its sole discretion re-set the vote count to zero or remove the modules used to collect feedback and votes.