Upcoming US Events for Today:

- Retail Sales for October will be released at 8:30am. The market expects a month-over-month decline of 0.1% versus an increase of 1.1% previous. Excluding Autos, expectation is an increase of 0.2% versus an increase of 1.1% previous.

- Produce Price Index for October will be released at 8:30am. The market expects a month-over-month increase of 0.2% versus an increase of 1.1% previous. Core PPI is expected to increase by 0.2% versus unchanged (0.0%) previous.

- Business Inventories for September will be released at 10:00am. The market expects an increase of 0.4% versus an increase of 0.6% previous.

- FOMC Minutes from October 24th will be released at 2:00pm.

Upcoming International Events for Today:

- Great Britain Jobless Claims Change for October will be released at 4:30am EST. The market expects unchanged (0) versus a decline of 4000 previous.

- Greece GDP for the Third Quarter will be released at 5:00am EST.

- Euro-Zone Industrial Production for September will be released at 5:00am EST. The market expects a year-over-year decline of 1.3% versus a decline of 2.9% previous.

- The Bank of England Inflation Report will be released at 5:30am EST.

The Markets

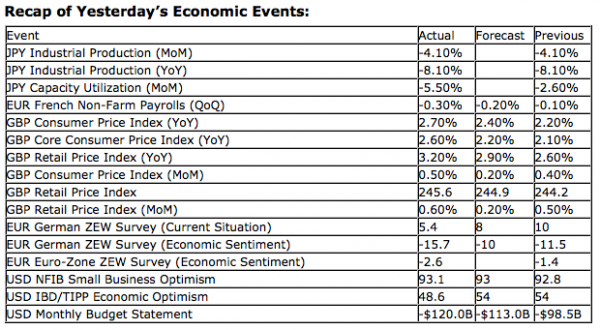

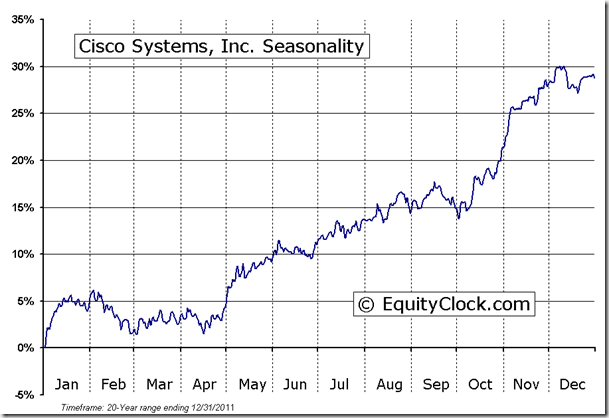

Equity markets failed to hold onto gains on Tuesday, selling off into the last two hours of trade as fiscal cliff fears once again dominated trade. After the closing bell, Cisco issued their quarterly report that beat on both the top and bottom lines. The technology titan reported net income growth of 18% for the quarter just ended, while sales rose 5.5%. Shares of the company were up almost 8% in after-hours trading, bouncing back to around the 200-day moving average. Seasonal tendencies for the stock remain positive through to February, along with the technology sector.

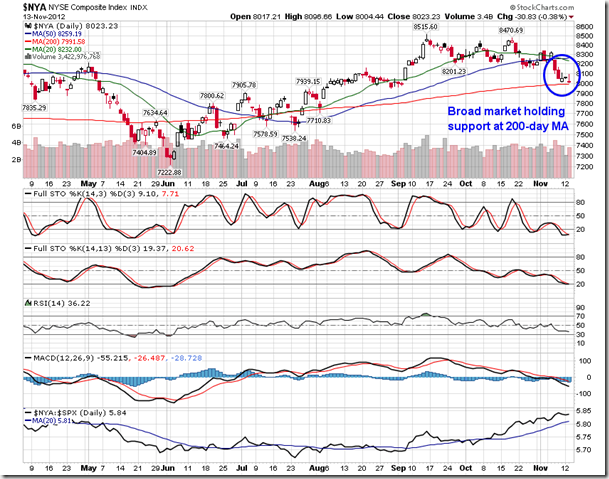

Despite continued losses on Tuesday, the technical profile of equity markets remains unchanged. The short-term trend remains negative and momentum indicators have yet to indicate fading selling pressures. The S&P 500 pushed marginally below its 200-day moving average on Tuesday, while the NYSE Composite held this key level. The S&P 500 remains within a range of support that stretches down to 1365, a break of which could likely see a test of the summer lows and beyond. However, it remains premature to suggest declines below the present range.

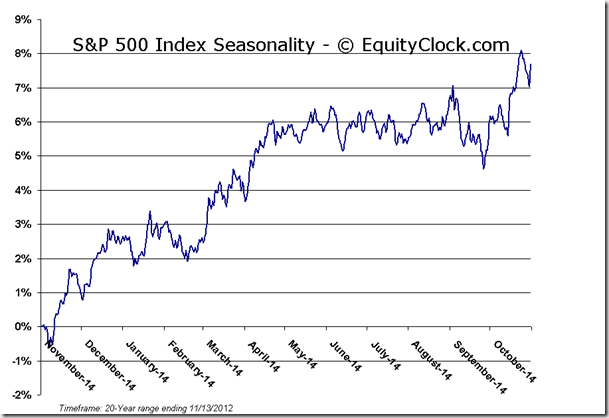

Equity markets have reached an interesting point from a timing perspective. Recently we noted that past pullbacks have generally lasted around two months from the previous high to the subsequent low. With the present pullback having started mid-September, we are closing in on that two month mark, suggesting that the pullback has now reached maturity. Bespoke Investment notes a similar stat of 42 trading days encompassing the range of the previous market decline in April and May. Today marks day 42 and the decline from the mid-September high to yesterday’s low accounts for a loss of 6.99% for the S&P 500. Typical pullbacks fall within the range of 5% to 10%. Although the present pullback has yet to show signs of concluding, from a timing and magnitude perspective, equity markets are trading in-line with what would account for a typical pullback, which are commonly realized two to three times a year.

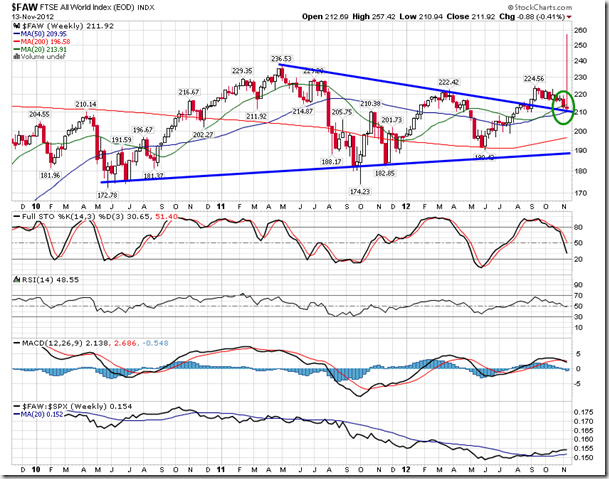

Looking at the weekly charts of some of the worldwide equity benchmarks, key technical levels continue to hold as support. The FTSE All World Index has now pulled back to touch the upper limit of a triangle consolidation pattern from which it broke out of in September. The MSCI EAFE and MSCI World is holding firmly above the recent consolidation range, maintaining support at significant weekly moving averages. Outperformance in each of these benchmarks compared to the S&P 500 is being realized as technology acts as a significant weight on US benchmarks. So although the pain in the US may seem significant, equity market declines continue to be orderly, leaving the potential for the positive intermediate trend to continue.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.83. The VIX has followed the plunge in put option volumes over the past few days as investors seek to settle expiring option positions prior to the end of the week.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

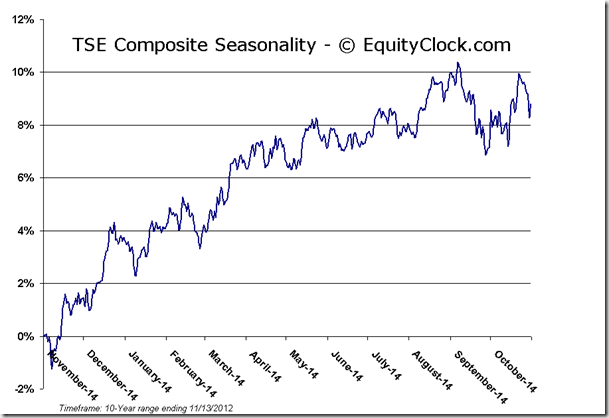

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.25 (down 0.57%)

- Closing NAV/Unit: $12.25 (down 0.35%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 0.57% | 22.5% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.