2013 ... A Return to Investment Normalcy?

by James Paulsen, Chief Investment Strategist, Wells Capital Management

If the last two economic cycles are any guide, the capital markets may soon jump to a new risk-reward frontier quite different from the trade-off exhibited by balanced portfolios so far in this recovery . During the early-1990's recovery and again early in the post dot-com 2000's recovery, stock and bond market volatilities (risk) were significantly elevated. Both times, however, once the economic cycle broadened and matured providing investors with a sense of sustainability and economic normalcy , the financial markets calmed and return volatilities dropped to very low levels for a number of years. Moreover , during these periods of “investment normalcy” the risk-reward frontier (the relationship illustrating the trade-off between higher returns and added risk as portfolio weightings between stocks and bonds are altered) differed radically from its character the rest of the time. Consequently , similar to the last two recoveries, if investment normalcy emerges again (perhaps in 2013?), investors may want to prepare for a jump to a new risk-reward frontier.

Defining Investment Normalcy

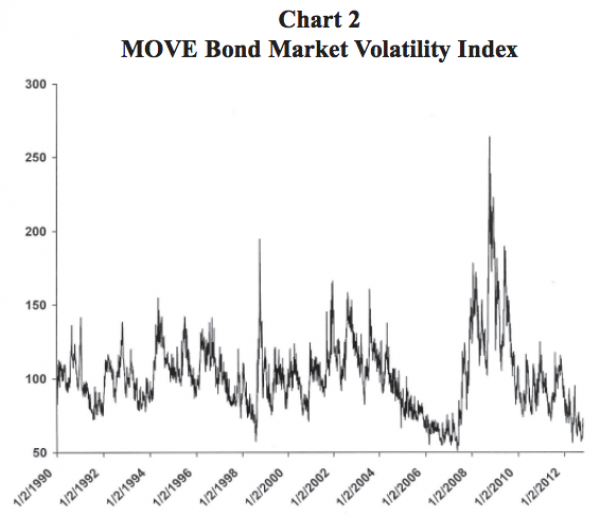

When are markets normal and when are they abnormal? While there is no widely accepted definition, old investment hacks may simply define it as—“we know it when we see it.” Certainly , the silver market of the late-1970s, the great stock market crash of 1987, the sur ge in bond yields in early-1994 which blew apart Orange County, the Asian panic in 1997, and the Great Recession crash of 2008 would qualify as abnormal. Perhaps financial market panics and periods of investment normalcy are best defined by the VIX and MOVE Indexes (illustrated in Charts 1 and 2). Both measure implied option price volatility— the VIX Index for the stock market and the MOVE Index for the bond market. Financial market panics are typically reflected by a spike in price volatilities whereas low VIX and MOVE readings signal periods of investment normalcy.

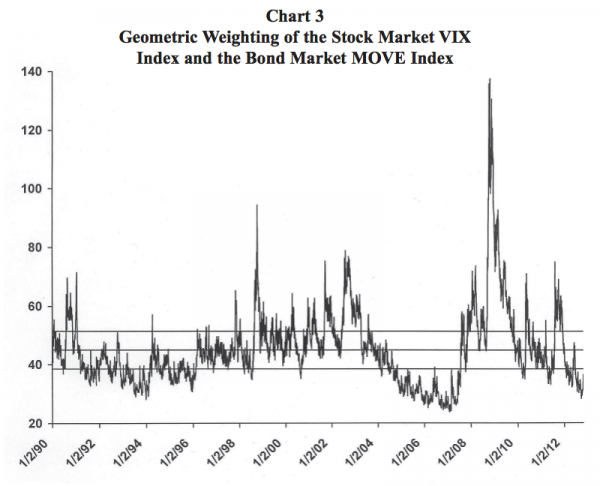

Chart 3 illustrates a geometric weighting (approximates an equal weighting) of the VIX and MOVE Indexes since 1990. Market volatility spiked in all three recessions—1990, 2001, and 2008. Financial markets also became abnormally agitated during other mini-panics including the 1994 Orange County crisis, the 1997 and 1998 Asian and Russia debacles, and during the eurozone flares in 2010 and 201 1. What is also noticeable from Chart 3, however, is both recovery cycles since 1990 exhibited a multi-year period of investment normalcy when stock and bond price volatilities declined and persisted at subpar levels.

The three straight lines in Chart 3 represent the mean price volatility level since 1990 and a range about this mean equal to one standard deviation. During the 1990s recovery , by at least 1992, investment market volatility declined below average and with only brief exceptions (e.g., the 1994 bond market panic) remained mostly below average until 1997. A much more consistent period of investment normalcy is recognizable during the 2000’s recovery when price volatility remained below average continuously from the end of 2003 until the start of 2008. In similar fashion, will investor sentiment eventually calm in the contemporary recovery? Indeed, does the recent decline in financial price volatility evident in Chart 3 already suggest investment normalcy is returning? And, if so, what does this imply about future investment trends?

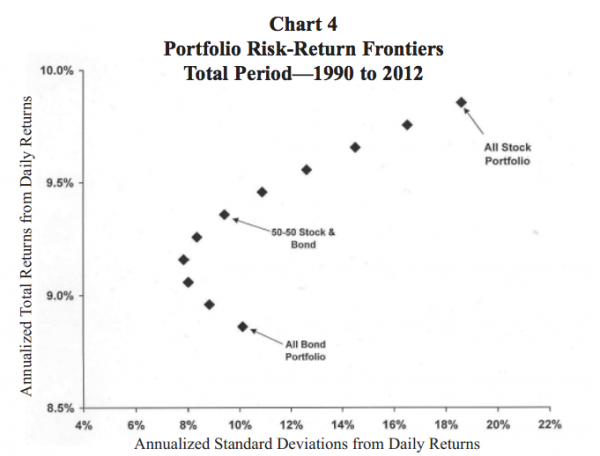

A Changing Investment Landscape Financial markets in panic mode react very dif ferently than they do in normal times. This is best illustrated by the examining the market’s risk-reward frontier shown in Chart 4. Since 1990, the riskreward frontier exhibits traditional characteristics. The all-bond portfolio provided a lower return with lower risk compared to the all-stock portfolio. Moreover , also traditional, as stocks initially were added to the portfolio, the expected return rose and risk declined since adding some exposure to stocks diversified the portfolio and mitigated volatility. Eventually, however, in this case around the 30 percent stock/70 percent bond portfolio, additional stock exposure while boosting returns also increased return volatility. Overall, for the entire period since 1990, the portfolio risk-reward frontier has a very traditional C-shaped pattern. This frontier, however, is really the product of two distinct investment characters—one derived from periods of investment normalcy and one from the rest of the time.

Jumping Portfolio Frontiers

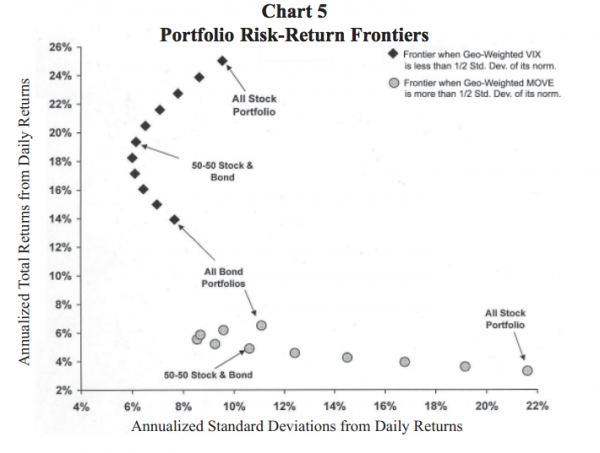

From Chart 3, assume periods of investment normalcy are defined by price volatilities which are at least one-half a standard deviation below normal (i.e., when price volatility is below the lower range line). Using this definition, since 1990, financial markets have reached “normalcy” about one-third of the time. Based on this definition, Chart 5 illustrates the portfolio risk-return frontiers since 1990 when investment normalcy reigns (black squares) and the portfolio frontier for the rest of the time (gray circles). Obviously, the character of the financial markets as evidenced by these two portfolio frontiers could not be more different. Perhaps it is only sensible when financial price volatilities are either average or far above average (i.e., market panics) that markets possess a very dif ferent character compared to when price volatility is very low, market sentiment calms and confidence dominates.

As shown in Chart 5, since 1990, when investment normalcy was evident (i.e., price volatilities from Chart 3 are below the bottom range line), the relationship between stock and bond returns (illustrated by the black squares) exhibited a normal C-shaped portfolio frontier , annualized returns from stocks exceeded returns on bonds (by a wide mar gin of about 11 percent) and stock price volatility exceeded bond price volatility (only by about 2 percent—about 10 percent compared to about 8 percent). Moreover, adding stocks to an all-bond portfolio did provide good diversification results (by lowering risk while raising returns) up to about a 40 percent stock/60 percent bond portfolio.

By contrast, as shown by the gray circles in Chart 5, when investment normalcy was not in force, the portfolio frontier was an “inverted” C-shape, bond returns actually exceeded stock returns, stock volatility was almost double bond volatility (i.e., annualized standard deviations from the all-stock portfolio was about 22 percent compared to only about 1 1 percent from an all-bond portfolio) and finally diversifying with stocks worked in reducing volatilities up to only about a 20 percent stock/80 percent bond portfolio.

Moving Towards Investment Normalcy?

As the U.S. economic recovery broadens and slowly shows more signs of sustaining (e.g., in the last year, the unemployment rate is declining faster than ever before), the U.S. labor force is rising at its fastest pace of the recovery, the household debt service burden has declined close to record lows, bank lending is steadily rising again, housing activity is finally increasing, home prices are finally rising, consumer confidence is at a five-year high, and the stock market is close to new all-time highs) overall confidence is slowly being resurrected calming the financial markets. Indeed, as Chart 3 shows, with only a brief exception, financial market volatility has declined and persisted at a very low level this year (i.e., volatility has persistently been below the lower range line). Therefore, an important question for investors to consider, like each of the last two recoveries since 1990, is whether the financial markets have entered a new period of “investment normalcy” which may persist for a few years?

If so, as Chart 5 illustrates, portfolios may require adjustment to better align with and to take advantage of what may be a very dif ferent financial market character. While we are not suggesting the next few years will produce a risk-return frontier which is perfectly portrayed by the squares in Chart 5, we are suggesting a potential jump from a frontier whose character is approximated by the gray circles to one whose character is more similar to the black squares. This is a relatively unique opportunity for investors since it has only occurred about one-third of the time since 1990.

Most of the time, as suggested by the gray circles, the investment environment has been portrayed by stock and bond returns which are nearly equal, where risk or volatility from stock holdings is extremely high and where there has been very little diversification benefit from adding stocks to the portfolio. However, if we have indeed entered a period of “investment normalcy ,” a calmer financial market demeanor may cause a jump to a financial frontier which produces higher returns in the next few years from both asset classes (although this seems unlikely from Treasury bonds whose yields are currently near record lows), much lower volatility (risk) in both the bond and stock markets, and finally much improved inter-class diversification attributable to adding a higher proportion of equities.

Summary

Despite a litany of ongoing fears this year (e.g., a slow growing U.S. recovery , eurozone issues, a weak China, an uncertain election and the impending fiscal clif f), the financial markets have remained remarkably calm as evidenced by persistently low readings for the stock market VIX and bond market MOVE Indexes. Similar to the past two economic cycles, the contemporary recovery may be entering a multi-year period of “investment normalcy” whereby economic confidence improves producing a calmer financial market sentiment.

In the past, this has led to a much more “risk-on” friendly investment climate where stock returns improve significantly, financial market volatility decays, and inter -class diversification returns. Perhaps it is a good time for investors to tweak portfolios accordingly as we head into 2013.

***

Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions. The views expressed are those of the author at the time of writing and are subject to change. This material has been distributed for educational/informational purposes only, and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product. The material is based upon information we consider reliable, but its accuracy and completeness cannot be guaranteed. Past performance is not a guarantee of future returns. As with any investment vehicle, there is a potential for profit as well as the possibility of loss. For additional information on Wells Capital Management and its advisory services, please view our web site at www.wellscap.com, or refer to our Form ADV Part II, which is available upon request by calling 415.396.8000.

Copyright © WELLS CAPITAL MANAGEMENT® is a registered service mark of Wells Capital Management, Inc.