Waiting for Bernanke

Equity markets continue to stall prior to Bernanke’s speech at Jackson Hole on Friday morning. Short term momentum indicators continue to roll over from overbought levels.

The Dow Jones Transportation Average is leading U.S. equity markets on the downside.

Percent of stocks trading above their 50 day moving average continued to drift lower from intermediate overbought levels.

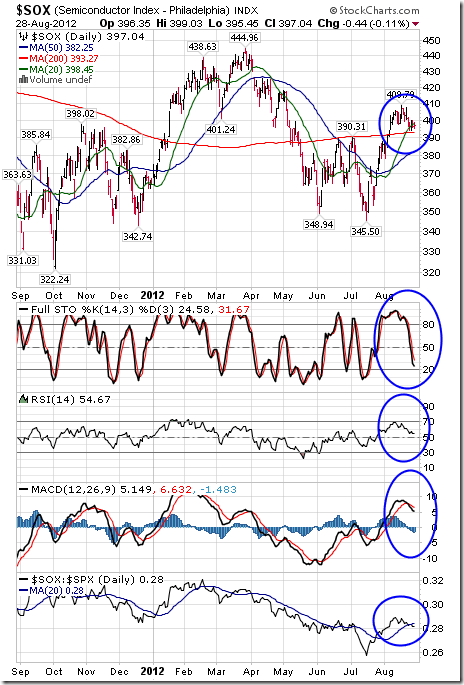

The Semiconductor sector is starting to show signs of rolling over as it enters its steepest period of seasonal weakness. Yesterday, the sector fell below its 20 day moving average. Short term momentum indicators have rolled over from overbought levels. Strength relative to the S&P 500 Index also has rolled over. Meanwhile, revenues in the industry have stalled. See chart provided by the Semiconductor Industry Association through this link:

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

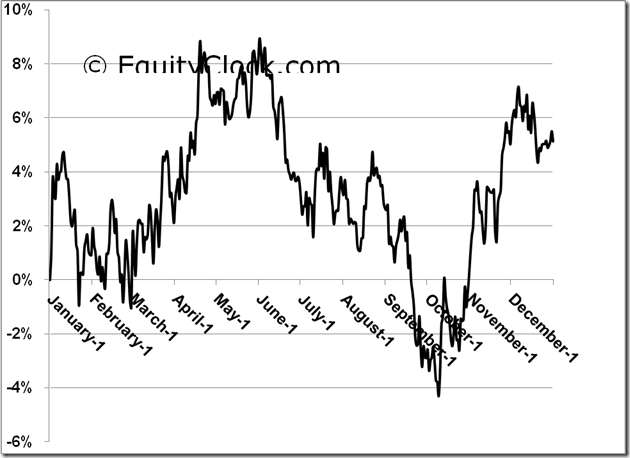

Following is an example: 10 year seasonality on the Philadelphia Semiconductor (SOX) Index. Two ETFs are available for the trade: SMH and SOXX.

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

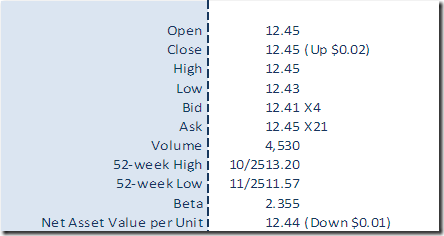

Horizons Seasonal Rotation ETF HAC August 28th 2012