Interesting Charts

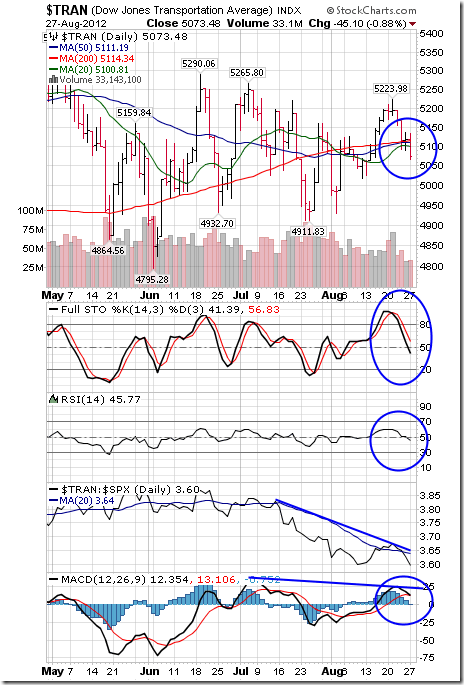

The Transportation sector led U.S. equity markets on the downside yesterday. The Dow Jones Transportation Average fell below its 20, 50 and 200 day moving averages. Short term momentum indicators continue to trend down. Strength relative to the S&P 500 Index remains negative.

The Shanghai Composite Index continues to move lower on talk that inventory levels in China are high and rising. So far, the Index has yet to show signs of bottoming on a real or relative basis.

Don Vialoux on BNN Television

Don Vialoux substituted as host for Larry Berman who is on holidays in Asia. Following is a link to the presentation:

http://watch.bnn.ca/#clip748052

http://watch.bnn.ca/#clip748053

http://watch.bnn.ca/#clip748054

Following are notes used during the presentation:

BNN August 27th 2012

Possible Topics for Discussion in Block #1

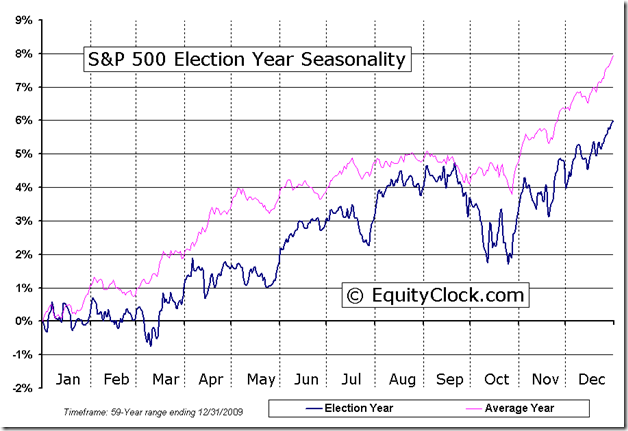

U.S. equity markets in U.S. Presidential Election years

Equity markets in the month of September

· Weakest month of the year. Average loss per period for the Dow during the past 60 periods is 0.5%.

· Average loss per period during the past 10 Septembers:

Dow Jones Industrials: 1.44%

S&P 500: 0.95%

NASDAQ Composite: 1.25%

TSX Composite: 1.40%

U.S. equity markets currently are intermediate overbought and vulnerable to a correction. When Percent of S&P 500 stocks trading above their 50 day moving average rollovers from above the 80% level, at least a short term correction normally happens. Percent began to roll over from above the 80% level last week.

Important events to watch this week

· August U.S. Consumer Confidence on Tuesday: 65.5E versus 65.9A

· Merkel and Monti meeting on Wednesday

· August Chicago PMI on Friday: 53.5E versus 53.7A

· Bernanke’s Jackson Hole speech at noon on Friday

· ECB Chairman Draghi on Saturday

· August China PMI on Saturday:49.8E versus 50.1A

Educational Section

Last Tuesday, the S&P 500 Index and its related ETFs recorded a rare bearish key reversal on the charts implying that the Index has passed at least a short term peak. Requirements for a bearish key reversal are:

· An open higher than the previous day’s close

· A move above the previous day’s high

· A close below the previous close

· A move below the previous day’s low

Several sector SPDRs also recorded key reversals last week including Technology, Industrials and Consumer Staples.

FP Trading Desk Headline

FP Trading Desk headline reads, “Finding opportunities in Canadian oil patch” . Following is a link to the report:

http://business.financialpost.com/2012/08/27/finding-opportunities-in-canadian-oil-patch/

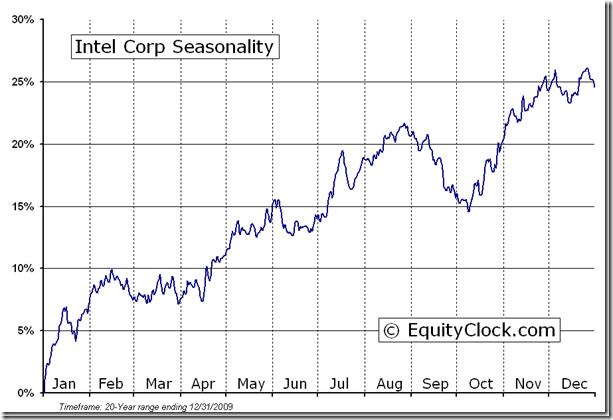

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Intel Corporation (NASDAQ:INTC) Seasonal Chart

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

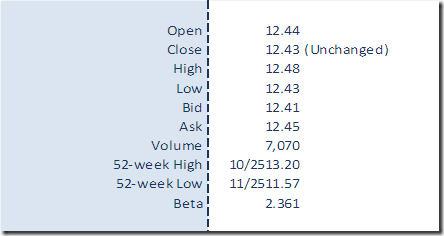

Horizons Seasonal Rotation ETF HAC August 27th 2012