by Scott Minerd, Chief Investment Strategist, Guggenheim Partners LLC

August 2012

The Faustian Bargain

In Goethe’s 1831 drama Faust, the devil persuades a bankrupt emperor to print and spend vast quantities of paper money as a short-term fix for his country’s fiscal problems. As a consequence, the empire ultimately unravels and descends into chaos. Today, governments that have relied upon quantitative easing (QE) instead of undertaking necessary structural reforms have arguably entered into the grandest Faustian bargain in financial history.

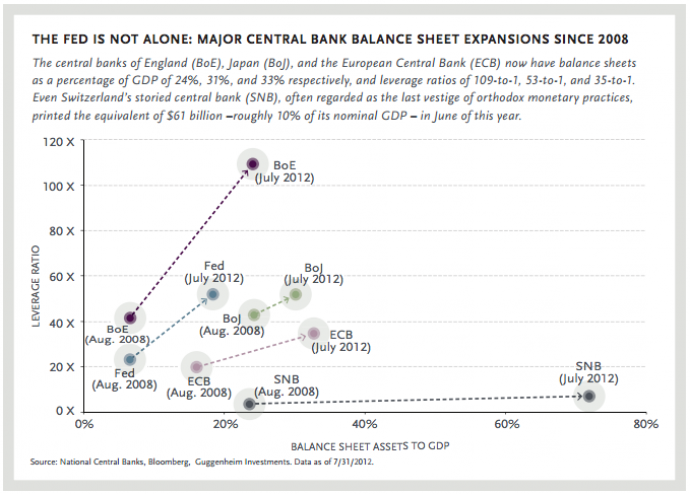

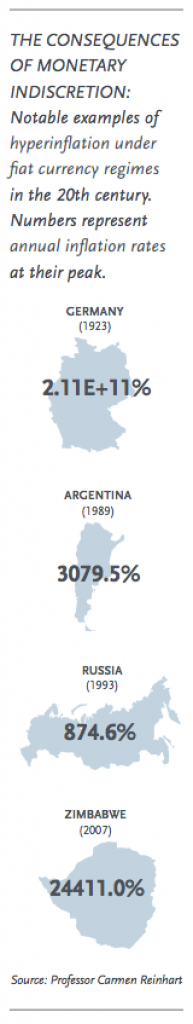

As a result of multi-trillion dollar quantitative easing programs, central banks around the world have compromised their ability to control the money supply, making them vulnerable to runaway inflation. When interest rates rise, the market value of central bank assets could fall below the face value of their liabilities, potentially rendering the banks incapable of protecting the stability and purchasing power of their currencies.

As a result of multi-trillion dollar quantitative easing programs, central banks around the world have compromised their ability to control the money supply, making them vulnerable to runaway inflation. When interest rates rise, the market value of central bank assets could fall below the face value of their liabilities, potentially rendering the banks incapable of protecting the stability and purchasing power of their currencies.

In the Beginning, There Was Gold

To better understand the potential consequences of quantitative easing, it is useful to review the historical evolution of central banking. Early central banks acted as clearing houses for gold. Individuals and trading companies placed their bullion on deposit at a central bank and received a claim that could be redeemed upon demand. The system’s strength was largely derived from its simplicity. This innovation had a profound effect on global trade. In the British Empire, for example, it meant a gold-backed pound note from London could be used for commercial purposes in Bombay.

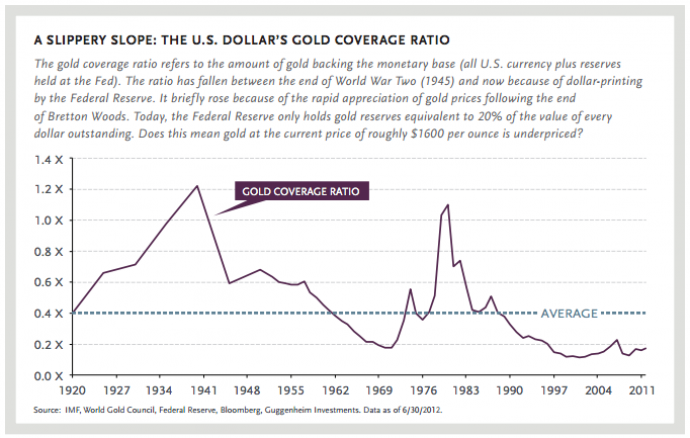

Today, the gold standard no longer exists and for the first time the entire global monetary system is built on a foundation of fiat currencies. This monetary paradigm works because of an abiding faith that paper money will be accepted as a medium of exchange and remain a store of value. At the core of this system is the presumption that central banks, as the issuers of paper money, have enough assets that can be readily sold in the event that their currencies’ value begins to fall and the money supply needs to be reduced. When confidence in a central bank’s ability to reduce its money supply in a sufficient amount to maintain its currency’s purchasing power is drawn into question, there is a risk of a currency crisis or even hyperinflation.

While Europe has had central banking since the 17th century, the United States did not have a central bank until the beginning of the 20th century. As a direct result of the panic of 1907, the Progressive political movement created the Federal Reserve System in 1913. Under the newly created Federal Reserve, the definition of eligible central bank reserve assets was extended beyond gold to include short-term bills of trade such as bankers’ acceptances. By expanding the definition of reserve assets the Federal Reserve had the ability to temporarily increase the money supply in excess of the amount of its gold reserves, to provide elasticity to credit markets. This incremental flexibility in money creation was designed to reduce the risk of panics which had plagued the U.S. through most of the 19th century under the gold standard.

During the Great Depression of the 1930s the Federal Reserve sought greater flexibility and leverage. In 1934, the Federal Reserve noteholders’ right to convert paper to gold on demand was unexpectedly revoked and the U.S. government seized all of the citizenry’s gold holdings. Subsequently, the Treasury arbitrarily re-valued the price of gold from $20.70 to $35 per ounce. Nevertheless, the presumption remained that every U.S. dollar was “as good as gold” because the Federal Reserve continued to hold bullion as its primary reserve asset.

A Dangerous Game

In 1935, the Federal Reserve was also granted “temporary” emergency powers allowing it to begin using Treasury securities, or government debt, as a reserve asset. The problem with Treasury securities as a reserve asset is that, unlike gold, they are affected by changes in the level of interest rates. The impact of interest rates on the value of these securities is commonly measured in units of time and price sensitivity referred to as duration.

The higher the duration of an asset, the more sensitive its price is to changes in interest rates. For example, an upward move in interest rates will cause the value of a bond with a duration of 10 years to fall by 10 times the value of a bond with a duration of one year. As the Federal Reserve’s holdings of Treasury securities increased relative to its gold holdings, its portfolio took on greater duration risk. For the first time, the potential existed that rising interest rates could cause the market value of the Federal Reserve’s assets to fall below the face value of its liabilities (Federal Reserve notes). This was not a concern under the tautological gold-backed system because the value of a central bank’s outstanding notes was directly tied to the amount of gold in its vaults.

The higher the duration of an asset, the more sensitive its price is to changes in interest rates. For example, an upward move in interest rates will cause the value of a bond with a duration of 10 years to fall by 10 times the value of a bond with a duration of one year. As the Federal Reserve’s holdings of Treasury securities increased relative to its gold holdings, its portfolio took on greater duration risk. For the first time, the potential existed that rising interest rates could cause the market value of the Federal Reserve’s assets to fall below the face value of its liabilities (Federal Reserve notes). This was not a concern under the tautological gold-backed system because the value of a central bank’s outstanding notes was directly tied to the amount of gold in its vaults.

The way to minimize the risk of a meaningful decline in the value of balance sheet capital resulting from a rise in interest rates was for central banks to maintain a relatively low debt-to-equity ratio while keeping a relatively short interest rate duration on its assets. By maintaining this discipline the Federal Reserve was virtually assured of having enough liquid assets at market levels to repurchase dollars without incurring large losses on its portfolio.

A Quantitative Quagmire

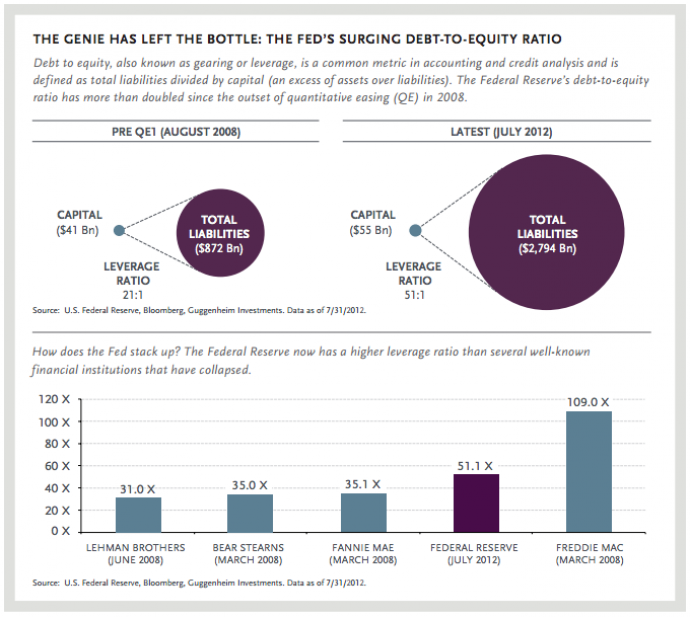

From the 1930s until the early part of the current century, the Federal Reserve was able to engage in relatively effective monetary policy. In 2008, just prior to the first of two rounds of quantitative easing, the Federal Reserve had $41 billion in capital and roughly $872 billion in liabilities, resulting in a debt-to-equity ratio of roughly 21-to-1. The Federal Reserve’s asset portfolio included $480 billion in Treasury securities with an average duration of about 2.5 years. Therefore, a 100 basis point increase in interest rates would have caused the value of its portfolio to fall by 2.5%, or $12 billion. A loss of that magnitude would have been severe but not devastating.

Beginning in 2008, the monetary orthodoxy of the previous 95 years quickly disappeared. By 2011, the Federal Reserve’s portfolio consisted of more than $2.6 trillion in Treasury and agency securities, mortgage bonds, and other obligations. This resulted in an increase in the central bank’s debt-to-equity ratio to roughly 51-to-1. Under Operation Twist the Federal Reserve swapped its short-term Treasury securities holdings for longer-term ones in an attempt to induce borrowing and growth in the economy. This caused an extension of the duration of the Federal Reserve’s portfolio to more than eight years.

Now, a 100 basis-point increase in interest rates would cause the market value of the Federal Reserve’s assets to fall by about 8% or approximately $200 billion which would leave the Federal Reserve with a capital deficit of $150 billion, rendering it insolvent under Generally Accepted Accounting Principles (GAAP). Although this may not happen in the immediate future, if interest rates rose five percentage points the Federal Reserve could lose more than a trillion dollars from its fixed income portfolio.

Staring Into a Monetary Abyss

Unlikely as it seems in a world of zero-bound interest rates, someday, as the economy continues to expand, the demand for credit will increase to the point that interest rates will begin to rise. In time, significantly stronger growth will create economic bottlenecks, placing upward pressure on prices. At that time the Federal Reserve would be expected to restrain credit growth by selling securities, resulting in a further increase in interest rates. As interest rates rise, the market value of the Federal Reserve’s assets will fall. It could then become apparent that the face value of the Federal Reserve’s obligations had become greater than the market value of its assets. This could leave the Federal Reserve without enough liquid assets to sell to protect the purchasing power of the dollar, resulting in a downward spiral in its value.

If the dollar weakens relative to other currencies, its use as a reserve currency, and the safety of U.S. Treasuries, could falter. Given the United States’ dependence on foreign capital to finance its large fiscal deficits, a reduction in foreign flows could cause Treasury securities to lose a significant amount of value. The Federal Reserve could then find itself having to support the price of the country’s debt by becoming the buyer of last resort for Treasury securities. This scenario would closely resemble events unfolding in the periphery of Europe today. By printing increasing amounts of money to finance the national debt, the Federal Reserve would lose control of its ability to manage the money supply, leaving the government hostage to its printing press.

Investment Implications

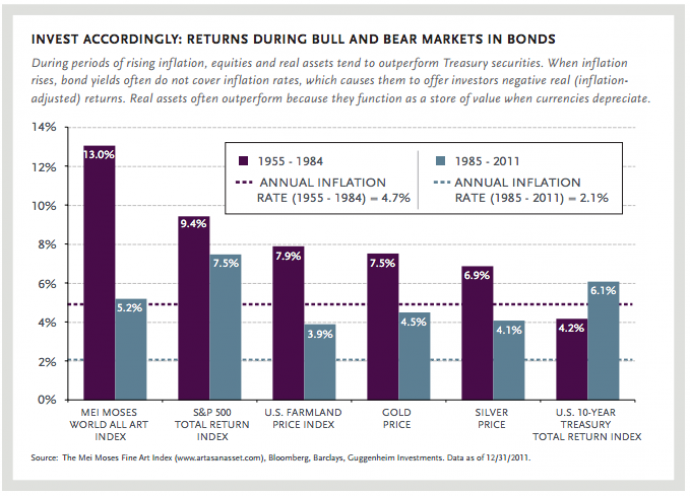

To hedge against deterioration in the dollar’s purchasing power, investors have already begun migrating toward hard assets such as gold, commercial real estate, artwork, collectibles, and rare consumer products like fine wines. Such diversification may have significant barriers to entry, however, considering the risks built into financial assets, long-term investment portfolios should be at least partially composed of tangible assets. Other areas that are likely to perform well in the immediate term due to effects of quantitative easing are credit-related instruments including bank-loans and asset-backed securities. High yield debt should perform well because abundant liquidity means default rates will remain low. Additionally, the ongoing balance sheet expansion by the European Central Bank means European equity prices are likely to outperform U.S. equities over the coming years.

Long-duration, fixed-rate assets such as government bonds are likely to underperform. Given the primacy of Treasury securities in the Federal Reserve’s current yield curve management program, Treasury bonds will come under the greatest pressure once the Federal Reserve ends QE. This asset class’ yields have fallen by over 1100 basis points in the past three decades. While no one knows if we have reached the bottom for Treasury rates, staying in the market for the final 50 or 60 basis points appears imprudent. As Jim Grant has noted, investors’ perception of U.S. Treasuries – and most sovereign debt – is shifting from representing risk-free return to “return-free risk.” Now is a better time to sell Treasury securities than to buy them, and for the stout of heart this is an opportunity to set short positions in the asset class.

An Uncertain Future

Half a year before the centennial of central banking in the U.S., neither policymakers nor investors have much to celebrate. By abandoning monetary orthodoxy and pursuing large-scale asset purchases, global central banks have increased the risk of inflation and compromised their ability to stamp it out. Inordinately higher leverage ratios and the extension of central bank portfolio duration means governments now face the potential for central bank solvency crises. It is too early to predict exactly how this Faustian bargain will play out; but, with each additional paper note that rolls off the printing press or gets conjured up in the ether, the likelihood of a happy ending becomes increasingly evanescent.

Download PDF

Disclaimer

Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy or, nor liability for, decisions based on such information.

This article is distributed for informational purposes only and should not be considered as investment advice, a recommendation of any particular security, strategy or investment product or as an offer of solicitation with respect to the purchase or sale of any investment. This article should not be considered research nor is the article intended to provide a sufficient basis on which to make an investment decision. The article contains opinions of the author but not necessarily those of Guggenheim Partners, LLC its subsidiaries or its affiliates. The author’s opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and nonproprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed as to accuracy.

This article may be provided to certain investors by FINRA licensed broker-dealers affiliated with Guggenheim Partners. Such broker-dealers may have positions in financial instruments mentioned in the article, may have acquired such positions at prices no longer available, and may make recommendations different from or adverse to the interests of the recipient. The value of any financial instruments or markets mentioned in the article can fall as well as rise. Securities mentioned are for illustrative purposes only and are neither a recommendation nor an endorsement.

Individuals and institutions outside of the United States are subject to securities and tax regulations within their applicable jurisdictions and should consult with their advisors as appropriate. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC.

Copyright © 2012, Guggenheim Partners, LLC.