by Don Vialoux, Timingthemarket.ca

Interesting Charts

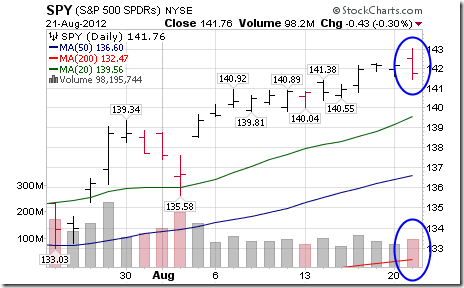

Early signs of start of at least a short term correction in U.S. equity markets have appeared. Interesting technical action by the S&P 500 Index yesterday! According to Mark Leibovit, “We’re experiencing a ‘Key Reversal Day’ today – higher high, followed by a lower low (as compared to the previous trading session in both cases) accompanied by a slight increase in volume. Not a good sign”. The reversal comes at a critical time. The S&P 500 Index briefly broke above its four year high at 1,422.38, but was not able to attract buying interest.

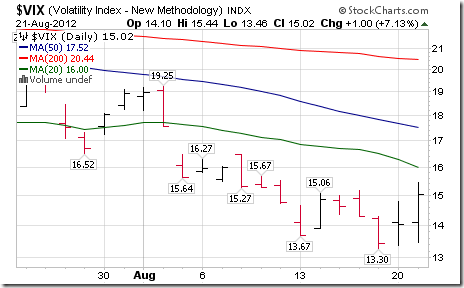

The VIX Index spiked from deeply oversold levels.

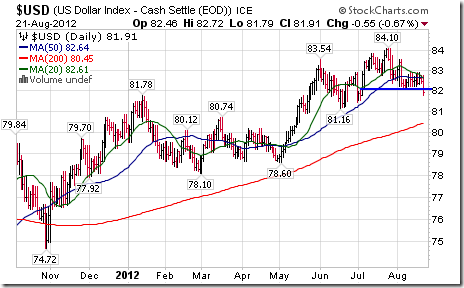

Currency moves had a significant impact on commodity markets. The Euro broke above its 50 day moving average and short term resistance at 124.42.

Conversely, the U.S. Dollar broke short term support at 82.04.

Commodity prices responded to weakness in the U.S. Dollar. Gold broke above resistance at $1,642.40 on higher volume. Intermediate trend changed from down to up.

Gold stocks and related ETFs moved higher and are outperforming gold.

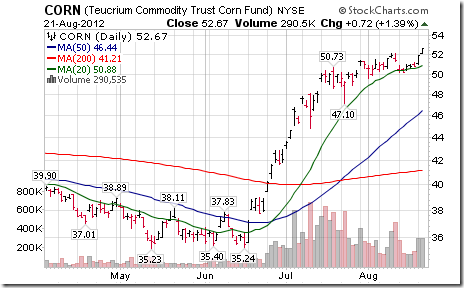

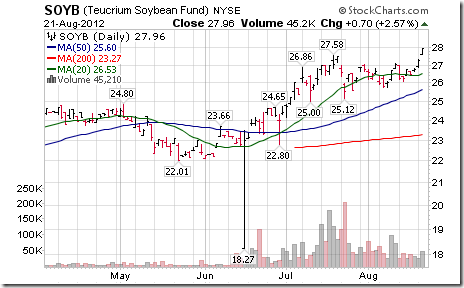

Grain prices reached new highs.

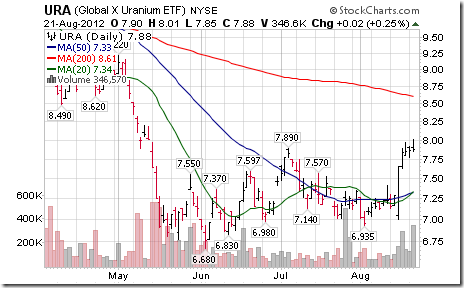

Uranium stocks and their related ETF continue to move higher on increasing volume.

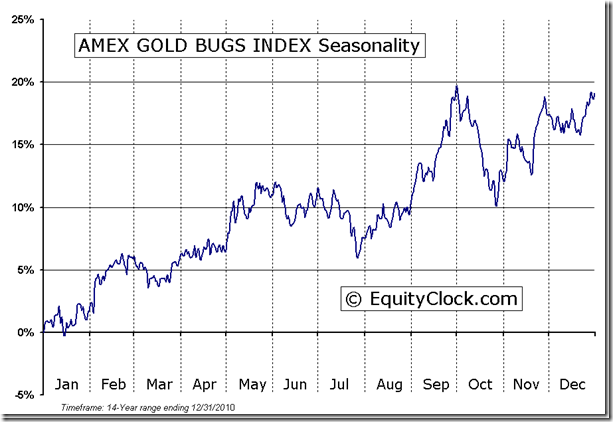

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

FP Trading Desk Headline

FP Trading Desk headline reads, “Forget the fiscal cliff. Food is the real crisis”. Following is a link to the report:

http://business.financialpost.com/2012/08/21/forget-the-fiscal-cliff-food-is-the-real-crisis/

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

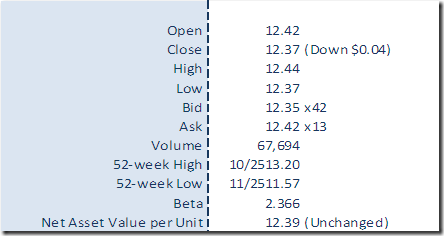

Horizons Seasonal Rotation ETF HAC August 21st 2012