by Don Vialoux, EquityClock.com

Upcoming US Events for Today:

- The Chicago Fed National Activity Index for July will be released at 8:30am.

Upcoming International Events for Today:

- The Reserve Bank of Australia Board Minutes for August will be released at 9:30pm EST.

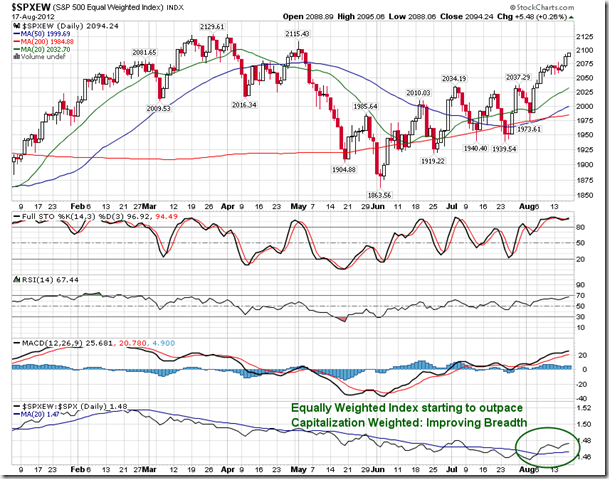

Markets pushed marginally higher on Friday, helped by improving data pertaining to Consumer Sentiment. The University of Michigan’s Consumer Survey provided a reading of 73.6, beating estimates of 72.0 and improving over last month’s read of 72.3. This is important as we are entering the big season for retail sales into the end of the year with back-to-school spending already underway, followed by a series of holidays, including Thanksgiving and Christmas, which are often crucial for overall year-over-year profitability of companies. Strong consumer sentiment often translates into robust retail sales numbers into the remaining months of the year.

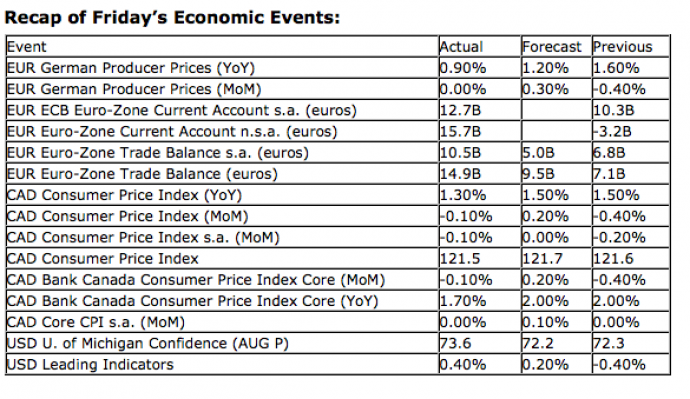

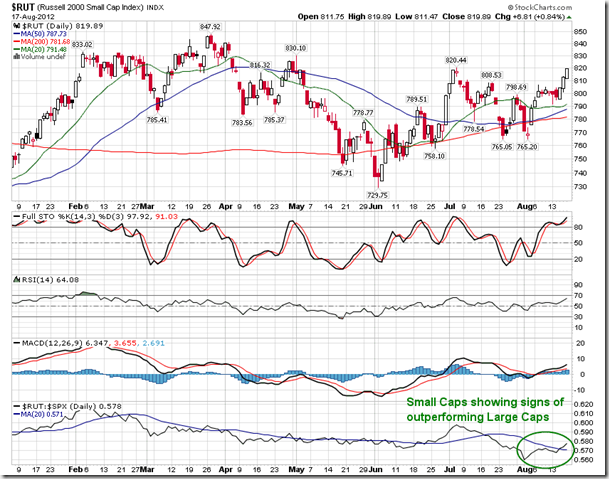

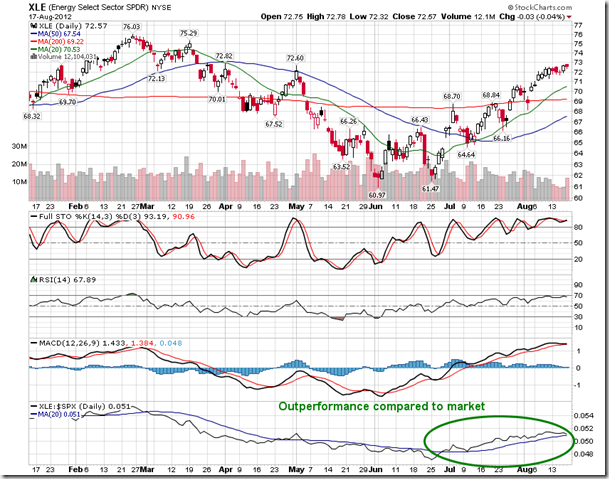

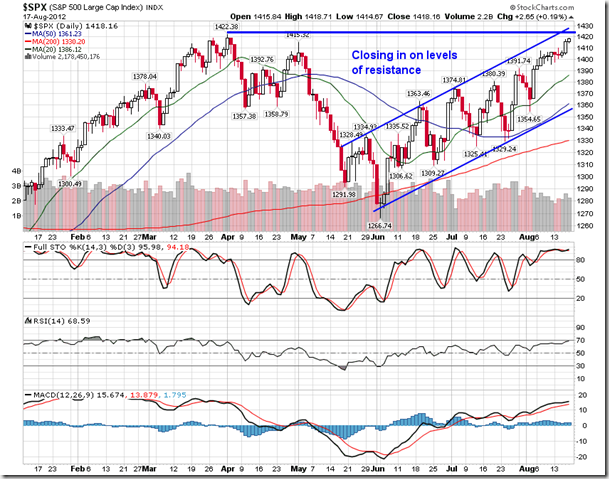

Looking at equity markets, the bullish trend that began in June continues to prevail, not only maintaining a positive bias, but also showing signs of improving. Risk sentiment continues to improve, as gauged by the performance of high beta benchmarks, such as the Russell 2000 Small Cap Index, relative to market benchmarks, such as the S&P 500. Cyclical Sectors, such as Energy and Industrials, are leading the market higher, while recent crowd favourites in Defensive sectors are lagging market performance, trading flat to negative as a result.

In another optimistic sign, breadth is also showing signs of improvement, reaffirming the strength in the overall market. The S&P 500 Equally Weighted Index is starting to outpace the Capitalization Weighted index and the Cumulative Advance-Decline line across the benchmarks are also improving.

A recent setup in the US Dollar Index suggests that equity markets may still have a little way to go before topping out. The currency, often an inversely correlated asset to equity market strength, continues to show a short-term head-and-shoulders top combined with a bear-flag formation. The target of each formation points to a low at 81, a target that would keep the intermediate positive trend intact, which has negative longer-term implications for equity markets, assuming the negative correlation to equities continues.

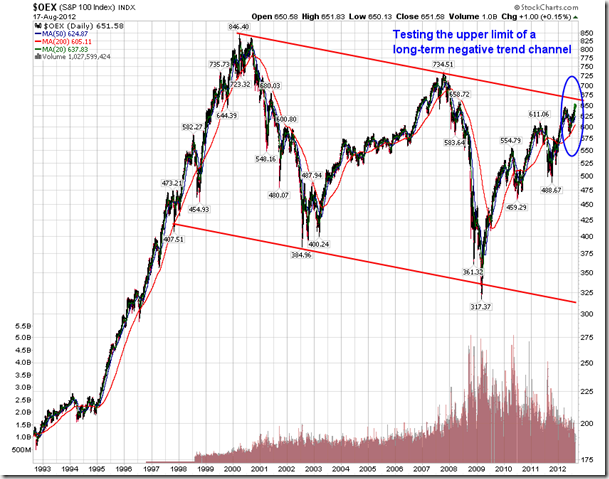

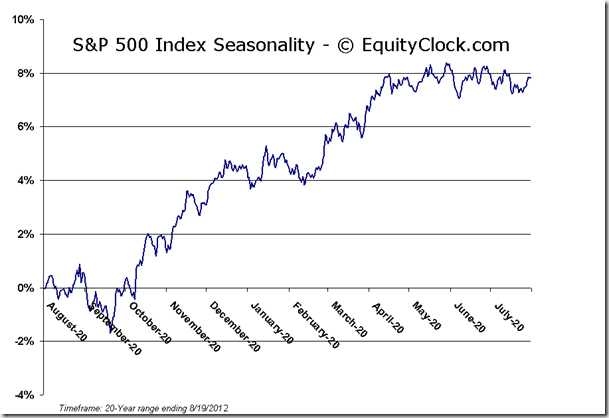

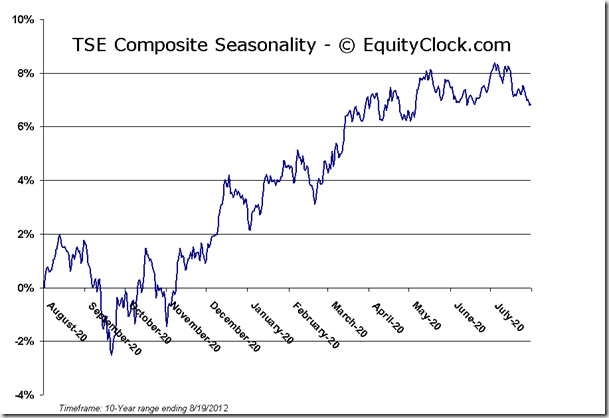

All of this data suggests that equities continue to maintain a Hold rating, following the Buy signals that were initiated over two months ago. With that being said, given how mature this rally has become and the levels of overhead resistance above, provided by previous significant highs and long-term trendlines, a correction of some magnitude appears inevitable. As such, a certain amount of skepticism of the recent positive price action is warranted, especially given the significantly low volumes and surging complacency, which is sitting at the highest levels of the year. Seasonal tendencies turn particularly weak into September and October, so we are well within a window in which a correction is probable.

Sentiment on Friday, as gauged by the put-call ratio, ended at 0.75, one of the lowest ratios of the year. Complacency is at an extreme, a fact that is also evidenced via the volatility index (VIX) which hit the lowest level since 2007. Volatility remains seasonally positive through to October, so the recent decline that is counter to the seasonal trend may not persist unimpeded.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

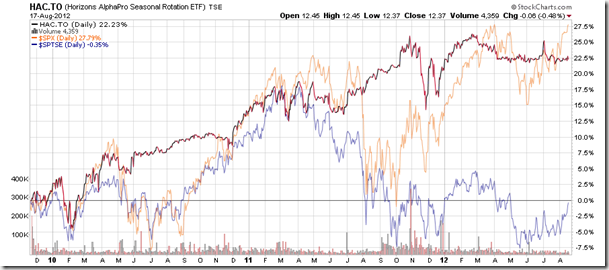

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.37 (down 0.48%)

- Closing NAV/Unit: $12.39 (down 0.07%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 1.74% | 23.9% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.