Current headlines are filled with talk of gas prices falling below $3 a gallon. It’s a welcome bit of good news for US consumers and 4th of July travelers, and slow global growth is likely to keep oil prices down in the near term. But in a post early last month, I gave three reasons why I expect crude prices to rebound in the long term: marginal supply is increasingly coming from unconventional higher cost sources, many large oil producing companies require a high crude price to balance their budgets and OPEC has very little spare capacity.

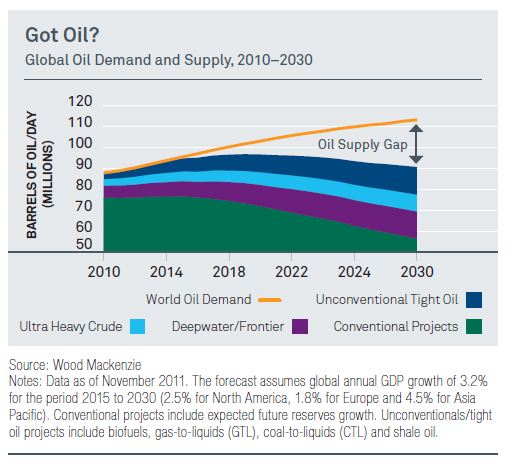

Now, I have another reason to add to my list of why I expect crude price to rise – this chart. Included in a new BlackRock Investment Institute paper, “US Shale Boom: A Case of (Temporary) Indigestion,” the chart shows that global oil demand is likely to greatly outstrip supply by 2030.

Global energy consulting firm Woods Mackenzie expects the oil supply gap to be 20 million barrels of oil daily by 2030. As the Institute’s paper points out, the gap may not end up being this large. Annual global growth, for instance, may not turn out to be as strong as the 3.2% assumption in Woods Mackenzie’s analysis. In addition, higher oil prices could end up weakening demand and new technologies such as shale could help fill in the gap.

Still, I believe that oil prices will move higher in the longer term. As a result, I continue to hold an overweight view of global energy companies. Investors can access these stocks through the iShares S&P Global Energy Sector Index Fund (NYSEARCA: IXC).

Source: Bloomberg

Russ Koesterich, CFA is the iShares Global Chief Investment Strategist and a regular contributor to the iShares Blog. You can find more of his posts here.

The author is long IXC.

In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Narrowly focused investments typically exhibit higher volatility.