by Matt Tucker, iShares

Its building block time again! I recently wrote a post about different ways that ETFs can help investors meet their income objectives. The two options were: 1) “No assembly required,” through a pre-packaged ETF of ETFs such as IYLD (the iShares Morningstar Multi-Asset Income Index Fund), and 2) “DIY,” using individual ETFs as building blocks to construct a customized portfolio. My main point was that a pre-packaged solution can be a great option for investors who don’t have the time, expertise, or inclination to create and continuously manage a portfolio on their own.

For investors who don’t have those challenges, a DIY approach to managing a fixed income portfolio may be the way to go. Each of our fixed income iShares ETFs is essentially its own building block, and they can be combined in a variety of ways to create a wide range of fixed income portfolios.

Why take this approach? For one thing, within the “fixed income” category, there are a variety of sectors that have very different risk and return characteristics. And since fixed income investors can have very distinct goals, meeting portfolio objectives typically requires more than a one-size-fits-all approach. For example, a portfolio that’s designed to generate income should look very different from one that has a goal of delivering alpha.

One strategy we are always talking about with clients is taking a broad benchmark like the Barclays US Aggregate Bond Index (“the Agg”), buying ETFs that represent its various sectors, then tilting exposures based on market factors, sentiment, and/or research calls. It’s kind of like constructing the toy vehicle shown on the building block box, and then giving it your own custom modifications.

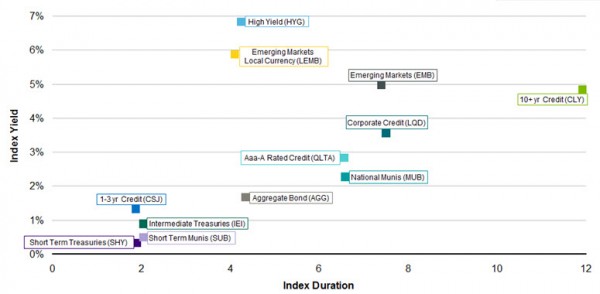

The reason investors typically start with the Agg is because it’s generally considered to be a good representation of the broad US fixed income market. It combines six unique fixed income sectors – Treasuries, Agencies, Credit, Mortgage Backed Securities (MBS), Commercial Mortgage Backed Securities (CMBS) and Asset Backed Securities (ABS). As you can see below, each sector has a unique risk and return profile:

Components of the Aggregate – Relationship Between Yield, Duration & Credit Risk

Fixed income ETFs are a great tool for implementing this kind of strategy because, in addition to typically being low cost and tax efficient, there’s such a breadth and depth of products available today. For example, an investor might start with a strategic allocation that mimics the breakdown of the Agg (which is updated on a regular basis here), using ETFs to represent each sector. Then, they can customize based on their specific objectives. If income is the goal, they might lighten up on the lower yielding sectors in order to overweight those that are yielding more. In fact, investors can use our free Fixed Income Portfolio Builder tool (demo here) to explore fixed income portfolios that have the same duration characteristics as the Agg, but with the potential for higher yield. Investors can also make adjustments based on how much credit or duration risk they’re willing to take, or make tactical plays based on the current market environment. The idea is that the fine-tuning is in the investor’s hands.

Fixed income ETFs are a great tool for implementing this kind of strategy because, in addition to typically being low cost and tax efficient, there’s such a breadth and depth of products available today. For example, an investor might start with a strategic allocation that mimics the breakdown of the Agg (which is updated on a regular basis here), using ETFs to represent each sector. Then, they can customize based on their specific objectives. If income is the goal, they might lighten up on the lower yielding sectors in order to overweight those that are yielding more. In fact, investors can use our free Fixed Income Portfolio Builder tool (demo here) to explore fixed income portfolios that have the same duration characteristics as the Agg, but with the potential for higher yield. Investors can also make adjustments based on how much credit or duration risk they’re willing to take, or make tactical plays based on the current market environment. The idea is that the fine-tuning is in the investor’s hands.

You have all the blocks, what do you want to build?

Matt Tucker, CFA is the iShares Head of Fixed Income Strategy and a regular contributor to the iShares Blog. You can find more of his posts here.

Source: BlackRock, as of March 2012. Tickers shown in the table are related iShares ETFs that correspond to each index. Indexes used are: iBoxx $ Liquid High Yield Index (HYG), JPMorgan EMBI Global Core Index (EMB), iBoxx $ Liquid Investment Grade Index (LQD), S&P Nat’l AMT-Free Muni Bond Index (MUB), Barclays Capital U.S. Aggregate Bond Index (AGG), Barclays Capital U.S. 1-3 Year Credit Bond Index (CSJ), Barclays Capital U.S. 3-7 Year Treasury Bond Index (IEI), S&P Short Term Nat’l AMT-Free Muni Bond Index (SUB), Barclays Capital U.S. 1-3 Year Treasury Bond Index (SHY), BofA Merrill Lynch 10+ Year US Corporate & Yankees Index (CLY), Barclays Capital Emerging Markets Broad Local Currency Bond Index (LEMB), Barclays Capital U.S. Corporate Aaa – A Capped Index (QLTA). Yield represents the average YTM; Duration represents the effective duration

Index returns are for illustrative purposes only and do not represent actual iShares Fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. For actual iShares Fund performance, please visit www.iShares.com or request a prospectus by calling 1-800-iShares (1-800-474-2737).

Bonds and bond funds will decrease in value as interest rates rise.

Transactions in shares of the iShares Funds will result in brokerage commissions and will generate tax consequences. iShares Funds are obliged to distribute portfolio gains to shareholders.

Copyright © iShares