While market volatility now looks closer to fair value than it did in early May, I still believe that investors should remain defensive. Stocks remain very much exposed to a potential disorderly Greek exit (“Grexit”) from the euro and any accompanying contagion.

While market volatility now looks closer to fair value than it did in early May, I still believe that investors should remain defensive. Stocks remain very much exposed to a potential disorderly Greek exit (“Grexit”) from the euro and any accompanying contagion.

One defensive play I particularly like: dividend paying stock funds, including those consisting of equities in traditionally volatile emerging markets.

As I write in my new Market Update piece, dividend stocks generally have been less volatile than the broader market, which can make them a good defensive choice.

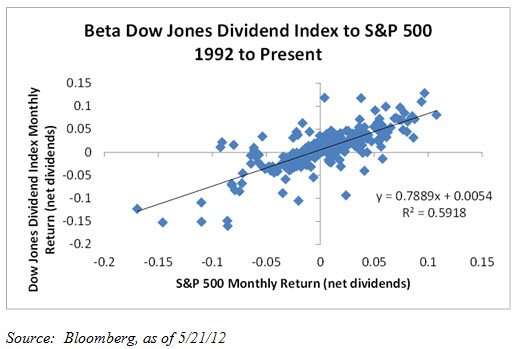

Since 1992, the beta (a measure of the tendency of securities to move with the market at large) of the Dow Jones Select Dividend Index to the S&P 500 has been around 0.8. That means that for every 1% the market moves this index typically moves around 80 basis points (see how I calculated the beta in the chart below).

In the case of the Morningstar Dividend Yield Focus Index, the beta has historically been even lower, at around 0.7.

This historical pattern has continued during the most recent downturn. As of Thursday’s market close, the S&P 500 was off approximately 6% from its May peak, while the Dow Jones Select Dividend Index and the Morningstar Dividend Yield Focus Index were down 3% and 2% respectively.

Even in emerging markets, typically a more volatile sector of the market, dividend stocks tend to cushion the downside. For instance, the Dow Jones Emerging Markets Select Dividend Index has a beta of roughly 0.80 to the broader MSCI Emerging Market Index.

Given the ongoing uncertainty surrounding Greece and the overall European Union, near-term market volatility is likely to remain high and I continue to advocate that investors have a high allocation to high dividend equity funds. In particular, I like the iShares High Dividend Equity Fund (NYSEARCA: HDV), given its low beta and quality screen, and the iShares Emerging Markets Dividend Index Fund (NYSEARCA: DVYE). Another potential solution focusing on US equities is the iShares Dow Jones Select Dividend Index Fund (NYSEARCA: DVY).

Russ Koesterich, CFA is the iShares Global Chief Investment Strategist and a regular contributor to the iShares Blog. You can find more of his posts here.

Source: Bloomberg

The author is long HDV