Energy and Natural Resources Market Radar (May 28, 2012)

Strengths

- Global mining equities recovered from last week’s sell off with an average gain of 6.5 percent in the NYSE Arca Gold BUGS (HUI) and S&P/TSX Metals & Mining indices.

- The global LNG market has tightened considerably since Japan’s nuclear industry was shut down in 2011 after a serious nuclear power accident. Japan’s LNG imports grew 14.9 percent to 6.91 million tons in April from a year earlier according to the finance ministry.

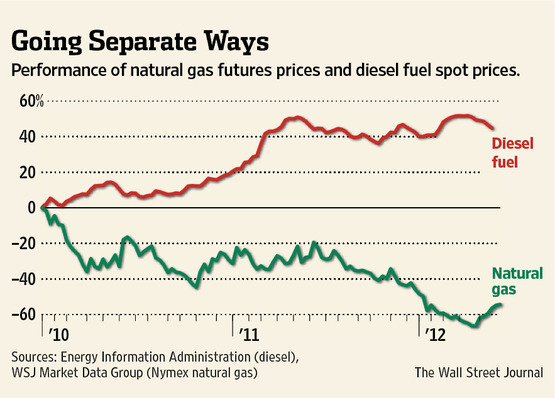

Will Truckers Ditch Diesel?

Weaknesses

- Natural gas futures closed lower this week after a 6-week rally. Weekly inventory data from the Department of Energy knocked down prompt futures by about 18 cents per mmbtu from the prior week to close under $2.58 per mmbtu.

- Steel output in China declined in April from a record as buyers sought to defer imports of raw materials such as iron ore and coking coal, Bloomberg reported. China’s crude-steel production declined 1.6 percent to 60.57 million metric tons after soaring to a record 61.58 million tons in March, the World Steel Association said.

Opportunities

- The shale gas boom in the U.S. has led to a big drop in the country’s carbon emissions, as power generators switch from coal to cheap gas. According to the International Energy Agency, U.S. energy-related emissions of carbon dioxide, the main greenhouse gas fell by 450 million tons over the past five years.

- The Financial Times reported that China is moving to accelerate investment in major infrastructure projects. The official China Securities Journal said that the government was stepping up approvals for infrastructure projects. “Some projects that were to have started in the second half of the year are being shifted to the first half, with the allocation of central government funding being brought forward,” the newspaper quoted a “related person” as saying. “There is a clear acceleration of the allocation of investment from the government budget this year compared with the last two years,” it said.

- Xstrata expects copper demand in China to recover in the second half of 2012 as it takes steps to boost its economy, Bloomberg reports. “The commentary from China that they’re going to look to re-stimulate the economy in some areas is positive,” Bloomberg reported citing Charlie Sartain, CEO of the company’s copper unit. Demand for white goods and household appliances, as well as continuing year-over-year growth in China’s power generation sector, will benefit from China’s stimulus efforts, Sartain said. “We see those parts of the economy in China as still pretty robust,” he said. “This decade we are going to see generally tight conditions in the copper market” he said, adding that higher costs related to new sources of production will help to keep copper prices at historically elevated levels in the future.

Threats

- U.S. manufacturers have attacked JP Morgan Chase’s plans to launch an exchange traded fund backed by physical copper, arguing that the ETF would drive up the cost of the metal and be detrimental to the global economy.

- China stainless steel demand growth this year will probably be the slowest since 2001, said Lu Ping, assistant general manager of Baosteel Stainless Steel. Demand in China may only rise 3 percent to 5 percent to about 10 million metric tons as a result of the slowdown in economic growth, Lu said. Output of stainless steel in China is likely to grow 3 percent to 5 percent to 12 million to 12.5 million tons.