James Paulsen: Investment Outlook (January 17, 2012)

For Domestic Investors, is the Euro Crisis Really About Europe?

by James Paulsen, Chief Investment Strategist, Wells Capital Management (Wells Fargo)

The ratings downgrade of France last Friday reminds investors how sensitive the U.S. stock market has been to the daily news flow emanating from the euro zone. Recently however, U.S. economic momentum has increasingly delinked with euro-zone economic performance and, as it has, the U.S. stock market has been much less vulnerable to European news.

Actually, the sensitivity of the U.S. stock market to the European crisis has varied widely since it first arrived on the global scene in January 2010. While crisis news surrounding the euro zone has produced dramatic stock market volatility whenever U.S. economic growth has been sluggish, the stock market has also exhibited remarkable resiliency and indifference towards euro-zone news whenever U.S. economic reports were strengthening. Consequently, what should domestic stock investors be most focused on when accessing the potential impact of the European crisis? Should the primary focus be the euro zone or is the performance of the U.S. economy (not developments in Europe) more important in determining the riskreward outcome of the U.S. stock market?

How Sensitive is the U.S. Stock Market to the Euro Crisis?

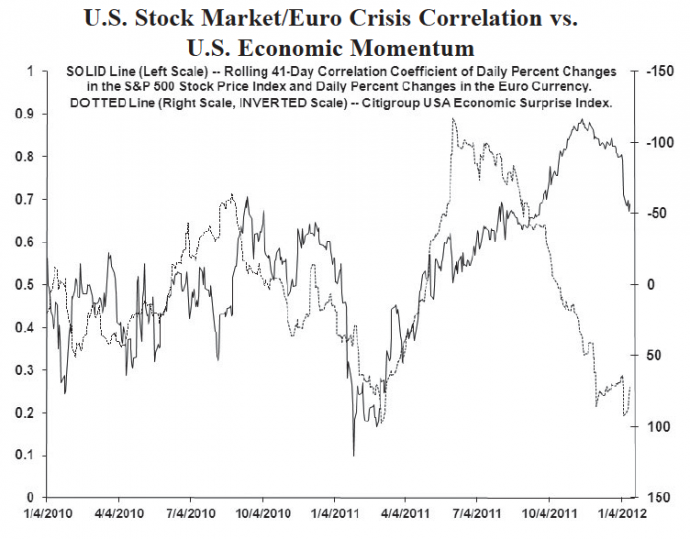

The solid line in the accompanying exhibit illustrates how closely and significantly the ebb and flow of European crisis news has impacted the daily volatility and performance of the U.S. stock market. It displays a rolling 41-day trailing correlation coefficient of daily percent changes in the S&P 500 Stock Price Index with the daily percent changes in the euro-dollar currency rate. Relating movements in the U.S. stock market to changes in the euro currency is a proxy for the sensitivity of the U.S. stock market to European crisis events. A coefficient about zero indicates no relationship whereas the more positive (negative) the coefficient, the stronger is the direct (inverse) relationship exhibited by the two variables.

When the European crisis first broke on the world scene in January 2010, the correlation between the U.S. stock market and the euro currency was around 0.5. This positive relationship did not change much (even though events in the euro zone became recognized as a “crisis” in early 2010) until the summer of 2010 when it rose substantially reaching a level above 0.7 by fall 2010. Then, the correlation steadily declined during the next seven months reaching about 0.15 (a reading suggesting virtually no relationship between the euro zone and the U.S. stock market) by the early spring of 2011. However, from April 2011 until October 2011, the impact of the euro zone on the U.S. stock market strengthened considerably—the correlation coefficient rose steadily reaching a peak near 0.9 in October (a coefficient suggesting a near perfect and strong daily relationship). Finally, since last October, the correlation has persistently diminished and most recently the speed of its collapse is similar to its drop in early 2011.

Obviously, the sensitivity of the U.S. stock market to problems in the euro zone has oscillated widely during the last two years. However, as the accompanying exhibit insinuates, U.S. stock market sensitivity may depend more on the performance of the U.S. economy than on problems in the euro zone. The dotted line shows the Citigroup U.S. Economic Surprise Index. It is shown on an inverse scale so when the dotted line rises (falls) U.S. economic reports are disappointing (surpassing) expectations.

Although not perfect, the relationship between the U.S. stock market and the euro currency seems highly connected to “U.S. economic momentum.” While the euro-zone crisis emerged in January 2010, events in this region did not materially impact the U.S. stock market until the U.S. economy began to disappoint in the spring. Thereafter, European crisis news increasingly dominated U.S. stock market performance until the U.S. economy began reaccelerating again in the last part of 2010. As the U.S. economy continued to outpace expectation into early 2011, the relationship between the U.S. stock market and the eurozone crisis noticeably calmed (even though the European crisis never went away). However, euro-zone news again became “the only news” which seemed to matter for the U.S. stock market during the late summer/early fall of 2011. Why? Because U.S. economic reports weakened considerably and persistently between April and October 2011 culminating in a widespread outbreak of imminent U.S. recession fears in September. As U.S. recession fears intensified, the correlation between the euro and the U.S. stock market surged to about 0.9! Finally, as U.S. economic reports have again improved substantially in recent months, the correlation between the U.S. stock market and euro-zone news has weakened considerably.

Should Investors Fixate on Euro Zone News or Remain Focused on the U.S. Economy?

For domestic investors, is the daily news flow emanating from the euro zone really of paramount importance? Or, is the momentum of the U.S. economic recovery much more crucial in determining the performance of the stock market? Undoubtedly, the euro-zone crisis is important and will certainly impact the future of both the global and U.S. economic recoveries. However, as the accompanying chart illustrates, the euro-zone crisis seems to dominate the U.S. stock market “only when and only because” U.S. economic momentum proves disappointing.

It seems European fears will likely be part of the global fabric for years, but should not be overly significant for U.S. stock investors as long as the U.S. economic recovery remains healthy. Currently, in our view, the U.S. economic outlook appears reasonably favorable. Job creation is now strong enough to produce a slow but steady decline in the U.S. unemployment rate which should boost confidence throughout the economy this year. Moreover, plenty of economic stimulus has been added to the U.S. economy in the last year. The 30-year mortgage rate was above 5 percent a year ago and is now below 4 percent. The annual growth in the M2 money supply was only about 5 percent last summer and is now about 11 percent. The U.S. dollar is still about 10 percent below where it peaked in 2010 boosting U.S. export competitiveness. Finally, because commodity prices declined last year, particularly food and energy costs, the rate of consumer price inflation is set to decelerate this year potentially providing a large boost to “real” household income growth during 2012.

It’s been two years since the European crisis first arrived on the global scene and along the way, many investors have been scared out of the stock market. The S&P 500 has risen by about 200 points during this time (from about 1100 in January 2010 to about 1300 today) and with dividends included, has provided investors with about a 10 percent annualized return! Although the euro-zone crisis has certainly been associated with “high drama,” it has also provided ongoing solid stock returns. So, worry about Europe, but stay invested while you worry!