by Robin Prendes, Equity Investment Analyst, Capital Group

When robotaxis debuted in the Bay Area a couple years ago, people stopped and gawked. Now they barely look up from their phones, as driverless cars and whirring black sensors move seamlessly through traffic in San Francisco, Los Angeles and Austin.

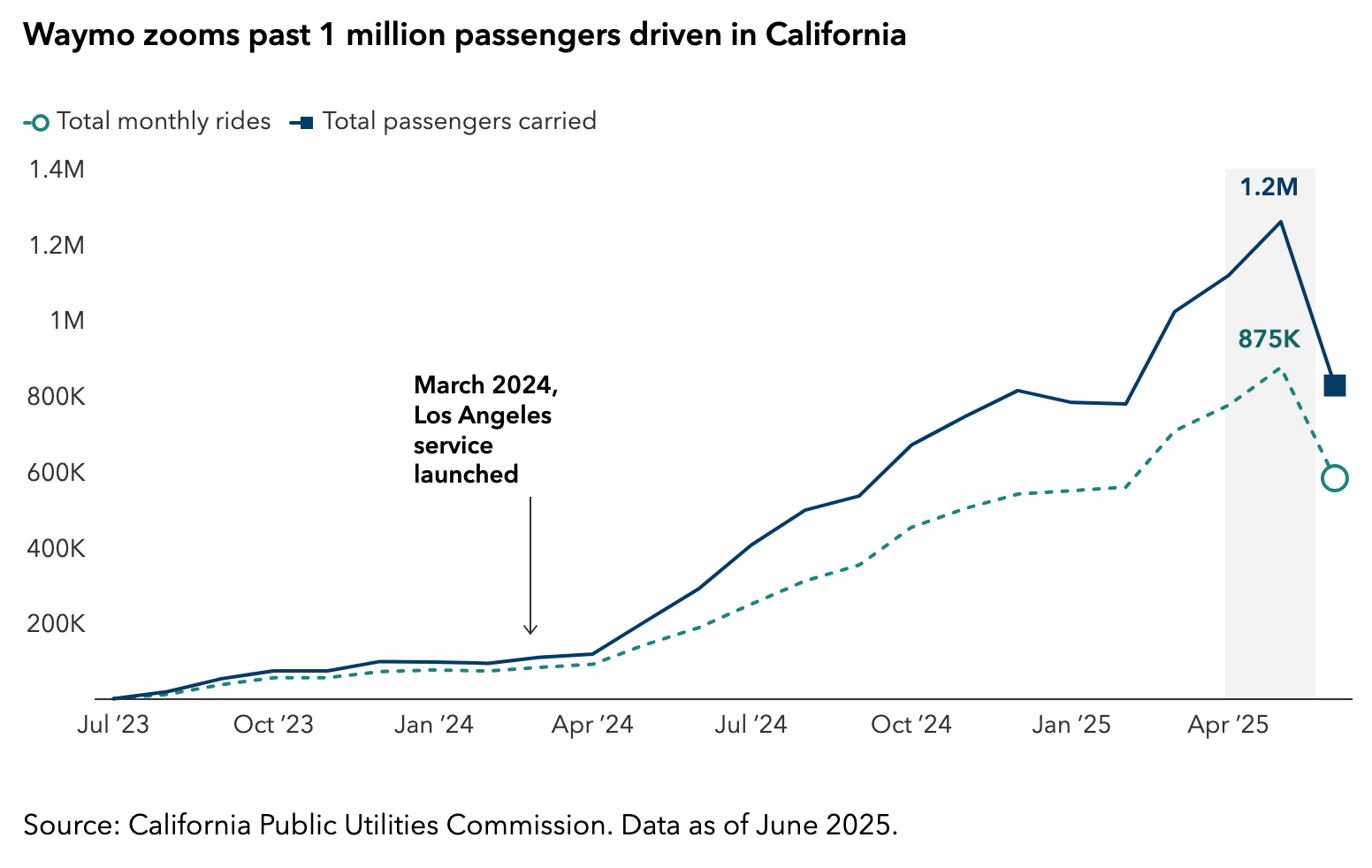

Waymo, owned by Google parent Alphabet, surged past the one-million-rides mark in California this past May. Waymo is coming to more big cities soon: It’s been given the green light to test in New York City, and services are launching in Dallas, Miami and Washington, D.C. Meanwhile, Tesla recently rolled out its first robotaxi program in Austin.

The age of robotaxis, or fully autonomous ride-hailing vehicles (AVs), is clearly no longer science fiction. So, what’s next for this burgeoning industry?

From an investment perspective, the ultimate question is: What will it take for companies to achieve long-term leadership in a business that seemed fantastical just a few years ago?

From an investment perspective, the ultimate question is: What will it take for companies to achieve long-term leadership in a business that seemed fantastical just a few years ago?

Two of the biggest names in robotaxis — Waymo and Tesla — have taken different approaches.

Waymo sends sensor-packed vehicles into new cities to methodically map roads and obstacles. Its vehicles have sophisticated light detection and ranging sensors that allow each car to perceive its surroundings in 3D, even in low visibility conditions. For Alphabet, Waymo may not be a huge contributor to earnings, but as adoption continues, investors will get a better handle on the business potential of AVs.

Tesla, by contrast, is leveraging a software-first, hardware-light model that only uses cameras. Its strategy is to let AI handle everything else, training its model with the massive amounts of real-world driving data from the millions of Tesla cars already on the road.

Building a robotaxi is part of the battle. Operating a fleet is something else entirely. It’s a logistical business that requires user acquisition, ongoing vehicle maintenance, community outreach and cooperation with local regulators.

This is why I believe the long-term winners in the robotaxi race won’t just be the companies with the top software. They’ll be those with the best operational playbook to launch successfully in new markets.

Though the technology may seem futuristic, the themes around building a successful business are familiar: scaling profitably, establishing safety and trust, and getting the details right.

Scaling the AV industry will face inevitable hurdles, but these are expected. Think of Uber in its earliest days. Ride sharing faced a plethora of doubts from regulatory resistance to financial viability. Now, Uber is profitable. And in urban hubs such as New York, Uber has grabbed plenty of market share from traditional taxis. Robotaxis may follow a similar playbook.

Robin Prendes is an equity investment analyst with two years of investment industry experience (as of 12/31/2024). He holds an MBA from Stanford and a bachelor's degree in economics and finance from Princeton.

Copyright © Capital Group