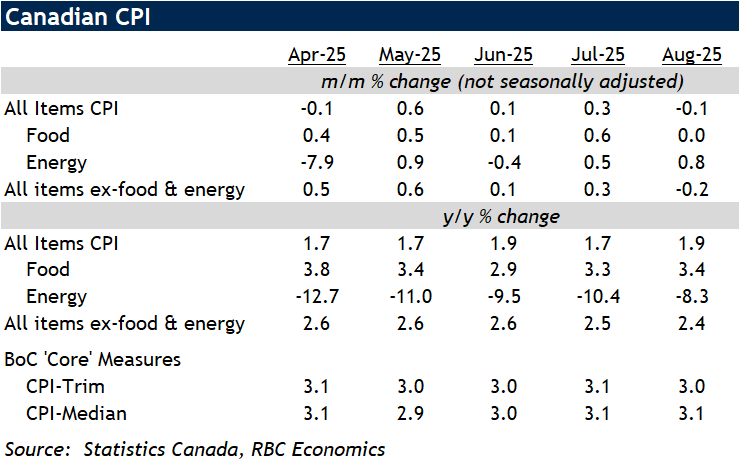

Canada’s inflation story added a new wrinkle in August. Prices crept up again, with headline inflation hitting 1.9% year-over-year. That’s a touch below expectations of 2.1% but still higher than July’s 1.7%. For the Bank of Canada, it’s one more reminder that the path back to target is anything but smooth.

Abbey Xu, Economist at RBC, puts it plainly1: “Canadian headline inflation rose to 1.9% year-over-year in August, slightly lower than our expectations for a 2.1% reading but still up from 1.7% in July.” The culprit? Energy prices didn’t fall as sharply as before. “Gasoline prices declined at a slower pace, pushing headline inflation higher and making July’s slowdown short-lived,” Xu explains.

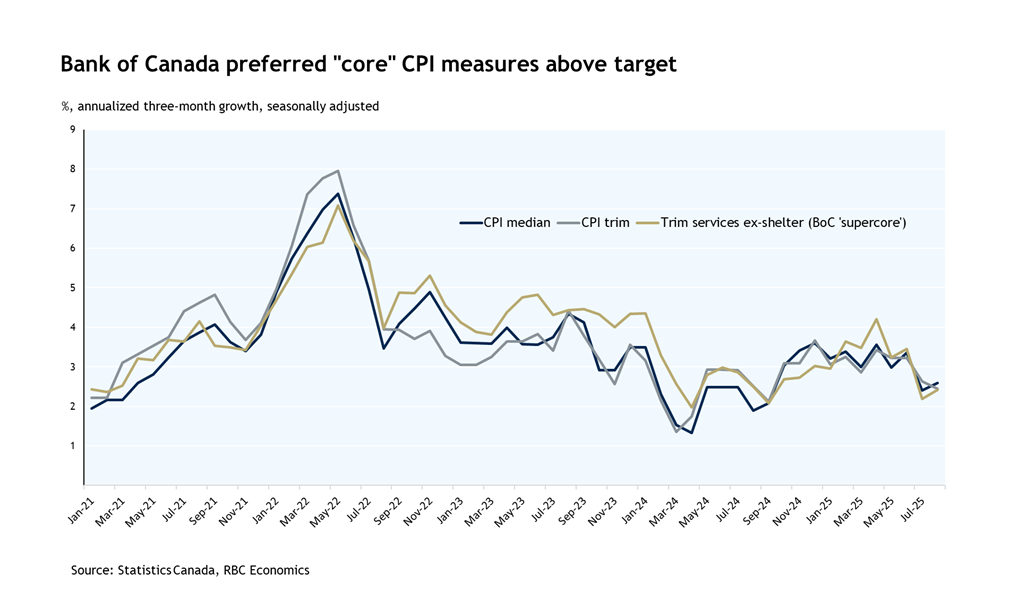

Core Pressures Still Too High

The headline number may have been softer than feared, but the underlying picture is harder to ignore. Xu highlights that “CPI excluding food and energy products remained steady on a year-over-year basis at 2.4%, while the Bank of Canada’s trim and median measures stayed elevated, hovering around 3%.”

That’s the sticking point. Core inflation isn’t budging, and it’s still sitting above the BoC’s 2% target. Xu drives it home: “All core metrics remain persistently above the BoC’s 2% inflation target, underscoring entrenched inflationary pressures.”

Growth Slows, Recovery Flickers

Inflation is one side of the story. Growth is the other—and the signals are mixed. Xu notes, “Evidence of economic softening is apparent: unemployment is rising, and Q2 GDP contracted as trade flows weakened despite robust domestic demand.”

But it’s not all gloomy. Xu points to some green shoots: “Early signs of recovery are emerging in Q3, with exports and manufacturing and wholesale sale volumes posting gains, suggesting the Q2 slowdown could be temporary.”

So the economy is slowing, but not collapsing. That’s what makes tomorrow’s policy decision such a tough call.

Rate Cuts vs. Fiscal Firepower

Even if the BoC wanted to cut rates more aggressively, other forces are in play. Sticky inflation and strong consumer spending complicate the picture. And Ottawa isn’t standing still either.

Xu puts it this way: “The BoC will also have to consider upside inflation risks from sticky core inflation, resilient consumer spending, and planned fiscal stimulus that is likely more effective at addressing the targeted economic impact of trade-related disruptions than interest rate cuts.”

What’s Driving Prices

Looking deeper into the August data shows a shifting inflation landscape:

- Energy: Prices dropped -8.3% year-over-year, compared to -10.4% in July. The slower drop nudged headline CPI higher.

- Food: Inflation crept up again, from 3.3% in July to 3.4%.

- Core basket: Xu observes, “The breadth of inflation pressures across the CPI basket narrowed slightly in August, though it remained conspicuously broad,” with half of the basket still running above 3% annualized.

- Housing: Mortgage interest costs eased to 4.2% as earlier BoC cuts filtered through. Rent inflation also moderated, landing at 4.5%.

- Clothing: A surprise mover—“inflation surged to 2.1% year-over-year, marking its highest reading in over two years.”

- Travel tours: The opposite story here. Prices plunged further, from -1.7% in July to -9.3%, the fourth straight monthly drop.

The Bottom Line: No Easy Choice

For markets, all eyes are on the BoC’s next move. Xu sums it up: “Today’s inflation report does little to sway that assessment, and we continue to think the Bank of Canada’s decision tomorrow will be a close call between a 25 basis point cut to the overnight rate and a hold.”

Inflation isn’t beaten. Growth is slowing, but showing resilience. And fiscal policy is adding more complexity. However the BoC leans, one thing’s clear: this decision will be anything but straightforward.

✅ Advisor takeaway: Expect some market turbulence around the BoC announcement. Inflation pressures remain broad, while growth sends mixed signals. Policy is finely balanced, and investors shouldn’t expect easy answers.

Footnotes:

1 RBC Economics. Xu, Abbey. ”Canadian inflation ticked higher in August" RBC, 16 Sept. 2025