by Jurrien Timmer, Director of Global Macro, Fidelity Management & Research Company

This information is provided for educational purposes only and is not a recommendation or an offer or solicitation to buy or sell any security or for any investment advisory service. The views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Opinions discussed are those of the individual contributor, are subject to change, and do not necessarily represent the views of Fidelity. Fidelity does not assume any duty to update any of the information.

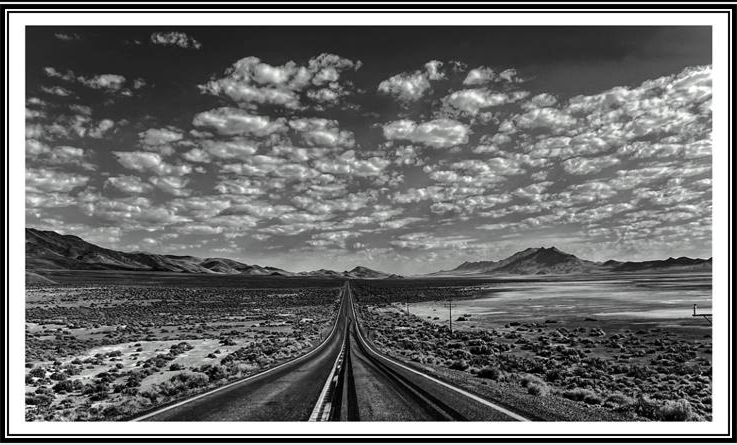

All Roads Lead to the Playa

It’s that time of year again, when I unplug my computer for two weeks and drive 600 miles to the middle of nowhere to do this thing called Burning Man. This will be my seventh year, and my 5th year running a food camp called Feed the Artists (FtA). Like so many things, the experience has evolved over time.

The wide-eyed spectacle of the sights and sounds and elements and people that knocked me over the head during my first burn have faded somewhat over time. In its place comes the experience of community, service, impermanence, and lasting friendships.

This is especially true for this (mostly) left brainer who spends most days working on spreadsheets, getting on airplanes, and presenting to audiences, in what burners call the “default” world. The playa is a welcome reprieve, which serves to reset, ground, and recenter. I wouldn’t want to make a lifestyle out of camping in the desert, but I wouldn’t feel complete either if I skipped this annual pilgrimage.

One of the principles of burning man is “immediacy,” which is where impermanence comes in. Out of nothing we build a city of 70,000 people with all the infrastructure that cities have, and two weeks later we break it down and leave the desert in exactly the same way that we found it. During those two weeks we experience dust storms, extreme heat, amazing people, incredible art, and in our case, great food.

Artists build massive wood sculptures, only to burn it down at the end. I didn’t understand the point of this in my first year, when a wooden sculpture in the shape of a birthday cake that took weeks to design and build was burned down in a matter of minutes. The artists explained to me that it’s no different from when we bake an actual cake for someone’s birthday. It takes effort to prepare and decorate the cake, and then it’s consumed. Immediacy.

At Feed the Artists, we make some seven thousand meals during these two weeks, using a full commercial kitchen that we haul to Black Rock City in our shipping containers. During what’s called build week (the week before the gates open when the city gets built), we feed the artists, and then during burn week we feed the community at large.

Food is our love language, and this year 90 FtA campers from all over the world and every walk of life will assemble in the coming days to execute on our mission to nourish the community through delicious food.

I’ll be back with a post-burn WAAR on September 7th. Until then, I will be off the grid hoping for sunny days and quiet markets.

On to the Markets

Another week, and another new high for most equity indices. The S&P 500 cap-weighted index now sits at 6481, which is quite a feat considering it traded at 4835 just a few months ago. The glass seems to be mostly full these days, with investors embracing the animal spirits of fiscal expansion and soon monetary accommodation, while looking past the tariff question for now. The Mag 7 continues to power this train, leaving the rest of the market in OK shape.

On-trend

Looking at the S&P 500 equal-weighted index, we see a market that sits right on its rising trendline (just short of making new highs), with about two-thirds of the market above their moving average. Meanwhile the equal-weighted forward P/E ratio of 18.3x is a smidge above its average of 17x. Looking at this chart, I do not see a market that is over its skis.

Earnings & Valuation

In terms of earnings and valuation, 2025 is unfolding as a year in which earnings are doing the heavy lifting, while valuation is zigging and zagging.

Following the earnings estimate markdowns in April, estimates are being marked back up. The Q2 earnings seasons produced a formidable bounce $4/share, well beyond what we typically see.

For the calendar year, the estimate has recovered half of the April markdown and now sits at 9.2%.

Earnings estimates for the Mag7 also continue their climb, powering the AI train seemingly ever forward.

Seasonals

The one fly in the ointment for the bullish momentum are the seasonals, which will remain weak until mid-October. These types of indicators always come with the “all else being equal” caveat, but in this case the seasonal dip is complemented by a dip in the presidential cycle as well.

The Fed & Rates

With the Fed now fully expected to ease in September, the bigger news will be to what extend Chair Powell’s remaining months at the helm of the Fed might be overshadowed by the next Chair, and to what degree their directives might be at odds. At least for now the main difference will presumably be the speed and magnitude of rate cuts, rather than the direction of policy.

Support for rate cuts seems to stem from weakness in the labor market, although from my non-economist angle I don’t see any. The JOLTS report, Weekly Economic Index, and jobless claims, all point to an economy in balance from where I am sitting. It suggests a neutral Fed policy, which in my view should be around 3.75%.

An Expansive Menu

Beyond the direction of the S&P 500 index, there is much to be celebrated for equity bulls and asset allocators. As the periodic table shows below, the pond is full of fish right now. Beyond the Mag 7, both developed and emerging equities are participating in this bull market, as are other assets like gold and bitcoin.

Looking at Sharpe Ratios over the past 52 weeks, there have been many asset classes to choose from in terms of delivering risk-adjusted returns. The S&P 500 is not even in the top half with its Sharpe Ratio of 0.87.

Ex-US Bull

International equities have continued to shine in both USD and local currency terms, and breadth is at a healthy 74%.

In terms of relative momentum, ex-US equities have the momentum (blue line), taking the baton from the US (pink line).

With the Fed now poised to ease, and in 2026 potentially becoming a more willing accomplice to fiscal dominance, the dollar seems to have only one place to go. Maybe that’s too obvious, but a weaker dollar will help with the currency translation of non-US allocations.

Gold & Bitcoin

While gold has taken a rest in recent weeks, Bitcoin made another all-time high last week at $124k. On a 4:1 basis (which is how I think of a gold & bitcoin pairing), the two stores of value are currently right in balance which each other.

118536.33.0

Copyright © Fidelity Management & Research Company

This post was originally published on Linkedin on August 21, 2025.