by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

Key Takeaways

- Within equities, fundamentals continue to favor large-cap growth, particularly tech and related names, where earnings have consistently surprised to the upside in recent quarters.

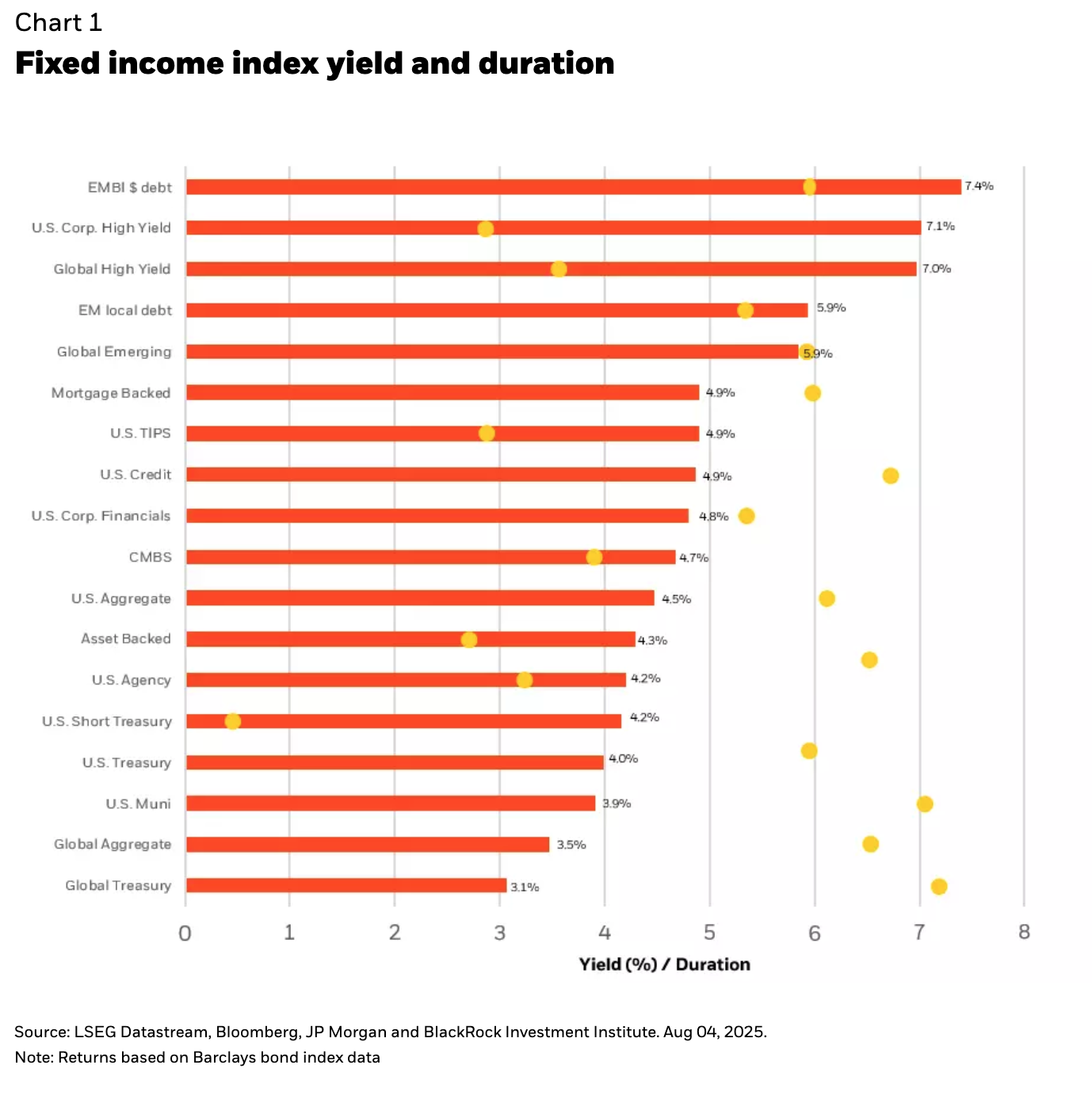

- Meanwhile, high-quality credit and other spread products currently offer investors high absolute yields of 6-7%, complimenting equity growth with both income and carry.

In a year marked by frequent and violent market inflection points, the August 1st release of July’s non-farm payroll probably represents another. Prior to the release, not only had stocks been hitting new highs, but July’s reputation for contrarian trends, i.e. year-to-date laggards rallying, played to script.

With the calendar turning and economic data softening, how should investors position for what may be a more volatile fall? I’d emphasize two themes: Spread products for income and high-quality growth stocks for long-term growth. What I’d leave out of the mix: low-growth, low-beta stocks.

I’ve tended to focus most of my blogs on equity exposure, but it’s worth highlighting the changing role of fixed income in multi-asset portfolios. Unlike the previous decade, when yields were low, but U.S. Treasury bonds offered an effective hedge, this decade fixed income is playing a different role. With inflation still elevated, long duration bonds are no longer a reliable hedge against equity risk. The good news: For the first time in more than a decade you can assemble a portfolio of high-quality credit and other spread products and generate a 6-7% yield (see Chart 1). In an environment where the economy is likely to muddle through and default rates remain low; investors should take advantage of high absolute yields to add some income and carry to portfolios.

On the equity side, the fundamentals still favor large-cap growth, particularly tech and related names. Technology and adjacent companies, such as the communications sector and online retail, continue to deliver superior earnings growth, a trend that is expected to continue during the coming year.

What would I avoid? With softer economic data and a potential seasonal headwind, some are once again looking to low-volatility and low-beta stocks. This strategy worked well in March and early April when investors piled into this space to insulate themselves from tariff uncertainties and recession risk.

However, while low-beta stocks briefly outperformed in the spring, year-to-date this style has significantly underperformed. The problem is that while these stocks are less economically sensitive, in many cases they are more fundamentally challenged. Earnings revisions for consumer staples and healthcare, both classic defensive sectors, are heading lower. Staples companies are particularly vulnerable, with some of the weakest forward earnings and sales estimates of any sector.

Bonds for income, stocks for growth

The market has enjoyed a spectacular run since early April. While I believe the market can end the year modestly higher, the next few months may feature more volatility as investors digest softer economic data, and the Fed decides on its next move. To ride this out, I would lean into stocks for growth and high-quality spread products for income.

Copyright © BlackRock