by Craig Basinger, David Benedet, & Brett Gustafson, Purpose Investments

Second quarter earnings season is wrapping up, and once again, corporations delivered despite ongoing uncertainty. With about 90% of companies having reported, the S&P 500 had an 81% positive surprise rate, which is a bit better than most quarters. Even more impressive was the 70% experienced positive growth for an aggregate 11.4% growth rate.

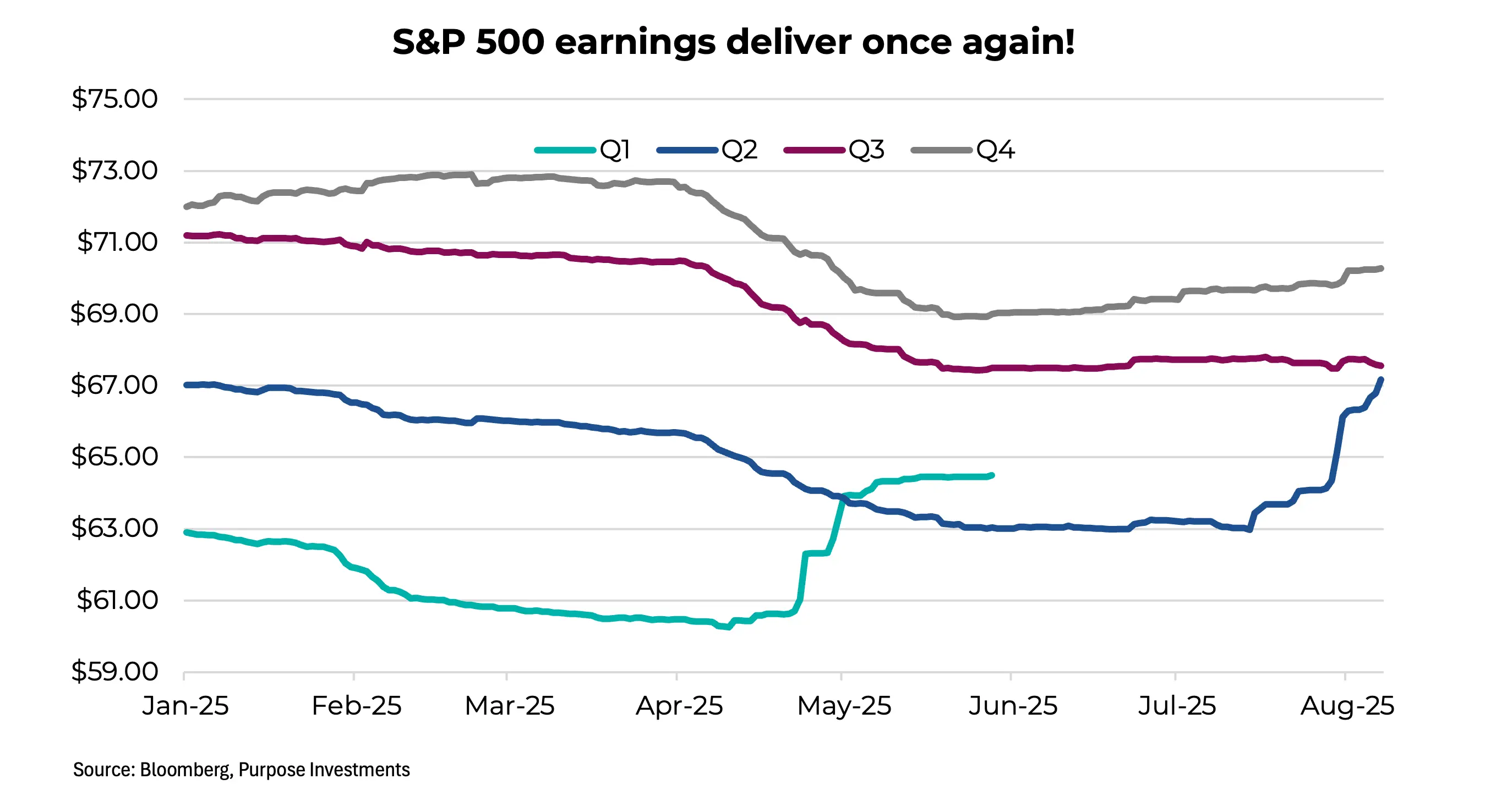

This was the second quarter in a row that saw estimates reduced ahead of earnings season and a big spike when the results hit the tape. Q1 estimates started the year at $63, fell to $60, then jumped to $64.50 during the previous season. Q2 estimates started at $67, dropped to $63, then climbed back to $67 with the hard results.

The weak U.S. dollar certainly helped, as did continued pricing power, given inflation remained somewhat elevated. And while tariffs may put some upward pressure on costs, so far the tailwinds have been more than enough to compensate. Perhaps the cherry on top of Q2 earnings has been some improvement for future quarterly estimates, which arrested their declines in June and have turned mildly positive.

It's safe to say, with hindsight, that the consensus analysts have gotten it wrong so far. Trimming estimates for Q1 and Q2, as the tariff fiasco gripped markets, was premature. Corporations have clearly been able to navigate the uncertainty, even with some stockpiling inventories and have managed to protect profit margins and earnings. Will Q3 be a repeat? Perhaps, although it is worth noting that tariff collection and its impact have only just started in earnest.

We also must acknowledge that tariffs don’t impact that many companies. Perhaps they’ve garnered more attention than they are due. And it really depends on other factors. For instance, most agree that tariffs are inflationary, but it isn’t that simple. Yes, a tariff paid by a U.S. corporation as it imports either an input or a finished product would lead to higher prices if simply passed through to pricing. But some of this may be borne by the exporter.

The tariff may be partially absorbed by trimming margins. Consumers may buy less, leading to lower volumes and capping price increases. Companies may stockpile ahead of tariffs, protecting margins for longer than one would expect, or be more creative with sourcing goods to sidestep some of the tariff impact. There are a lot of moving parts, and so far, companies have been navigating things well.

A similar trend of actual results beating falling estimates was also evident in Canada for Q1 and Q2. Plus, estimates for Q3 and Q4 have started to trend higher. The rise of the TSX is pretty impressive; it’s up 14.4% so far this year. So those estimates better get moving faster, as the TSX is now trading at 16.3x consensus earnings for the next 12 months. That’s the highest valuation since early 2021, when earnings were still depressed coming out of the Covid recession.

Is 16.3x a bit expensive for a market facing tariffs and a still-sluggish housing market? Maybe. The bigger problem may be what brought the TSX to these new, fresh highs. Banks have done well and are now historically expensive, with only 4% earnings growth forecast over the next year. Shopify helped a good amount, about 2% for the TSX’s 14.4% gain.

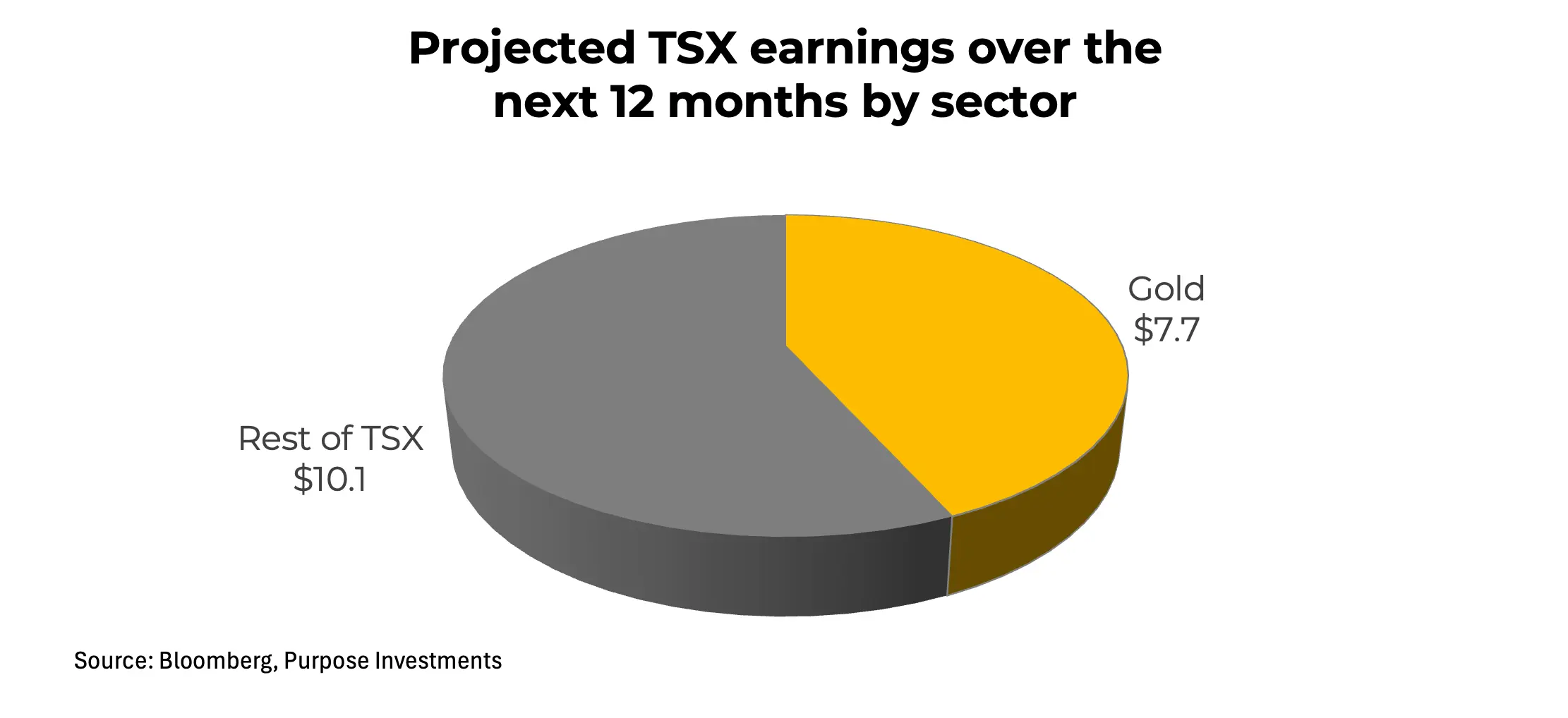

The other big piece is gold stocks. The materials sector, which is now heavily gold-weighted, contributed about a third of the TSX’s gains this year. And for earnings growth, gold miners are forecast to grow earnings by $7.7B over the next year, while the rest of the TSX contributes a mere $10.1B.

Don’t take this as us being negative on gold or gold miners; we’re still positive on gold for a number of reasons. This is more about the TSX. Gold earnings, or really any kind of earnings that are very cyclical. They usually carry a lower valuation multiple, even when they’re growing, because those earnings can change course quickly and materially. The market will pay more for stability in earnings (consumer staples) or consistent growth (technology).

Final Thoughts

This has been a good earnings season for both America and Canada, which has helped move markets higher. Let’s give credit where credit is due. And forward estimates are trending a bit higher.

But given how the consensus overreacted to the downside risks in previous quarters, is the collective now ignoring the risks after being burned in Q1 and Q2? Perhaps. The bigger issue may be for the TSX, given that so much of its gains and future expected earnings growth are coming from gold.

Maybe gold is Canada’s NVIDIA. As it goes, so could go the index.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,”“will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.