by Craig Basinger, David Benedet, & Brett Gustafson, Purpose Investments

The April correction was caused by policy – or changing policy. We had to look back pretty far to find other corrections that were policy-induced, mainly because over the past 30ish years, policy has been ubiquitously supportive of markets. If Mr. Market got in too much trouble, policy came to the rescue. And if policy was implemented outside periods of market stress, it tended to be supportive or at least not disruptive.

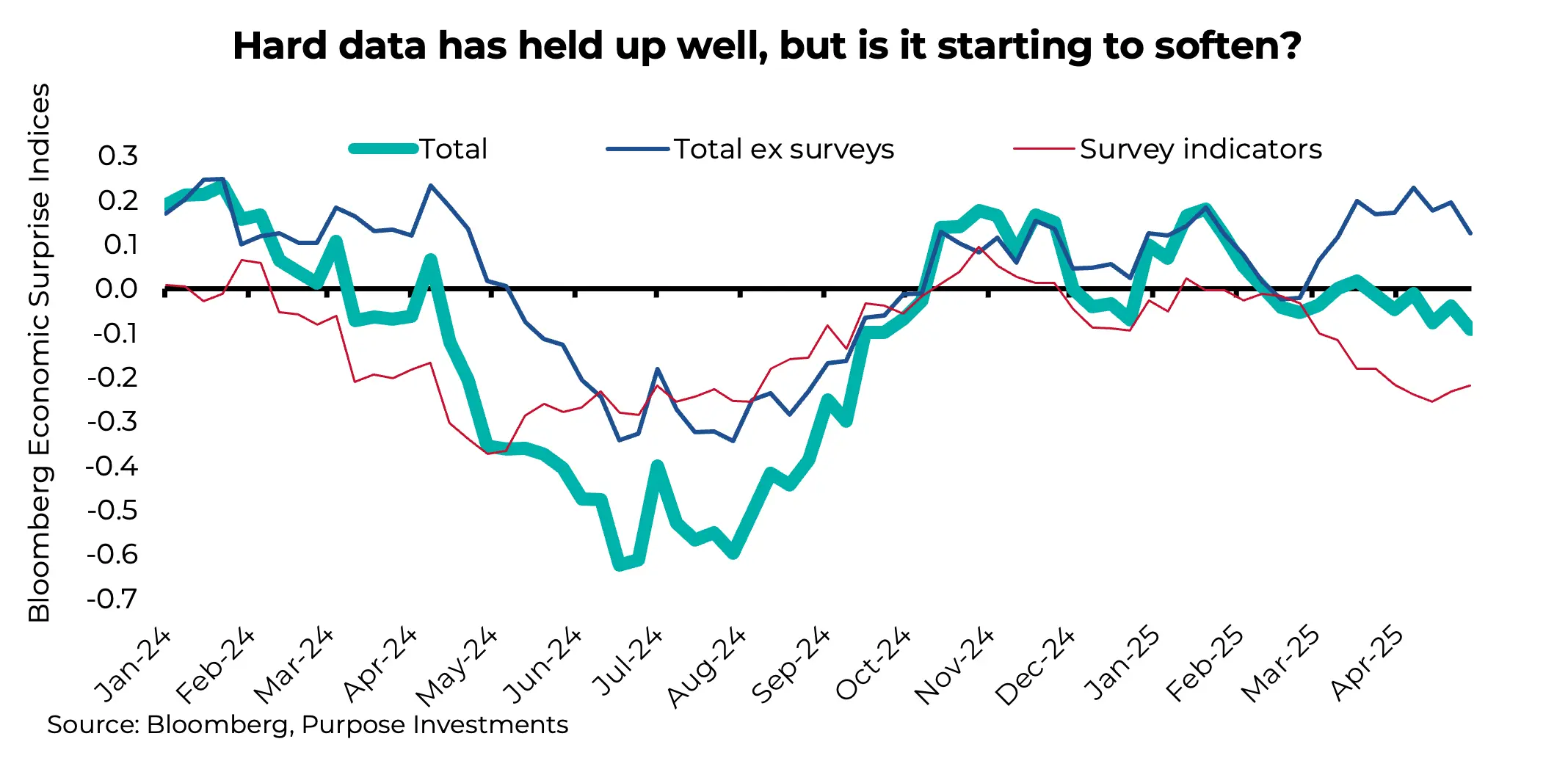

Looking at past policy-induced corrections, they tend to resolve quickly, mainly because the market adjusts to whatever the new rules are and then resumes what markets do. Another interesting characteristic of past policy corrections is that the economic data remains resilient for a longer period. In a normal correction induced by the economy, the sentiment data erodes, then the fast economic data slows, and then this spreads to the slower hard economic data. With policy disruptions, this process takes longer, which is what we are seeing today.

There is a high probability that the economic and earnings data year-to-date have been helped by the tariff uncertainty. Shipping volumes spiked higher ahead of the tariff risk as importers endeavoured to bring in goods to the U.S. ahead of the constantly moving tariff deadline. This also likely goosed industrial production, and may also be evident in consumer spending.

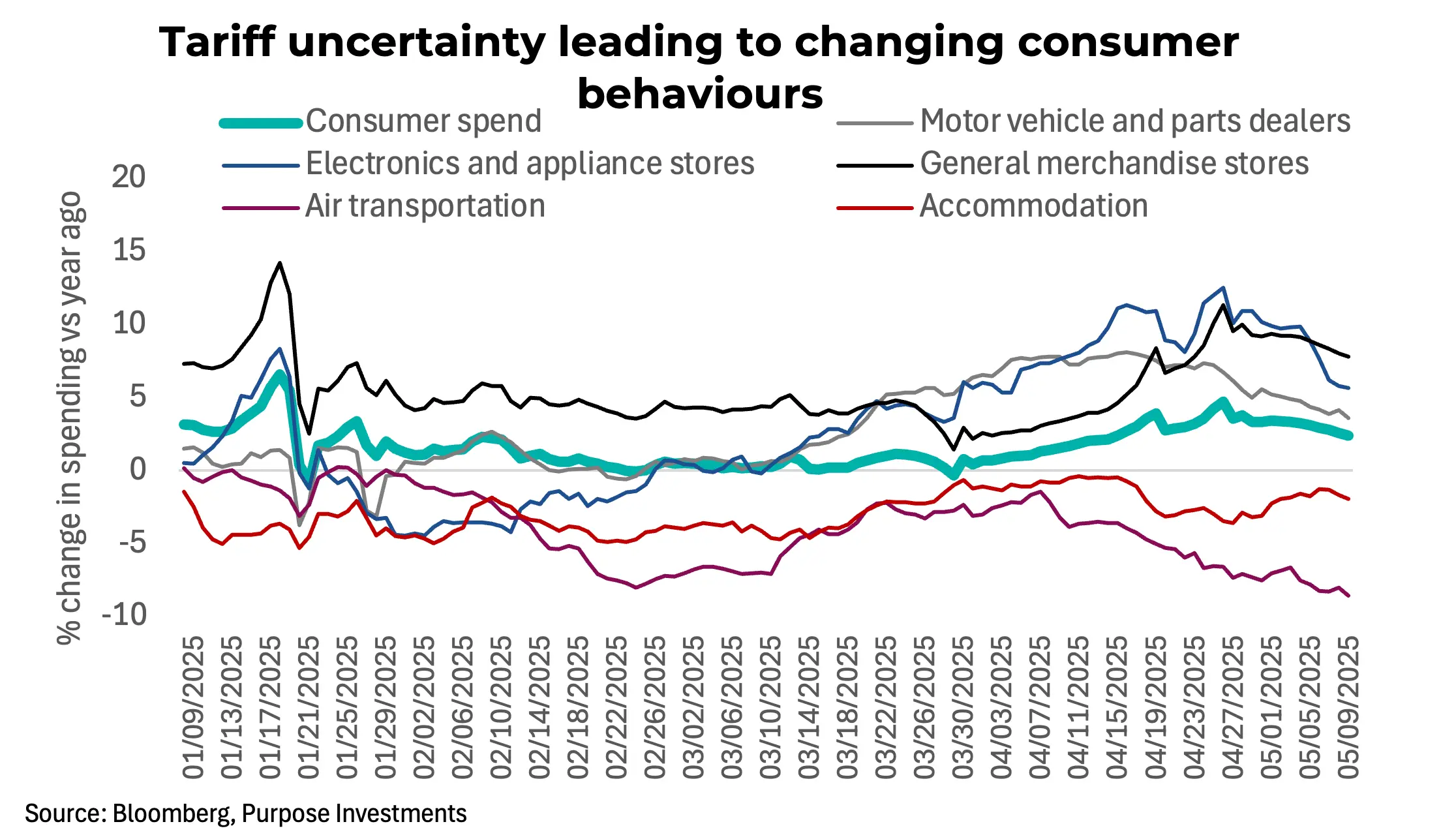

Based on daily credit and debit card transactions, the U.S. consumer appears in aggregate to be holding up nicely (thicker aqua line in the chart below), up about 2.4% year-over-year. But over the past month, it has been really helped by goods spending in electronics, autos, and general merchandise, the categories that could see tariff-induced price increases. Meanwhile, spending on leisure has been very weak, including for air transportation and accommodation.

Could the fear of tariffs have caused the consumer to try and pick up goods sooner rather than later? If so, that could spell a reversion down in the coming months that may be starting to take hold. This could be the case for container ships and industrial production.

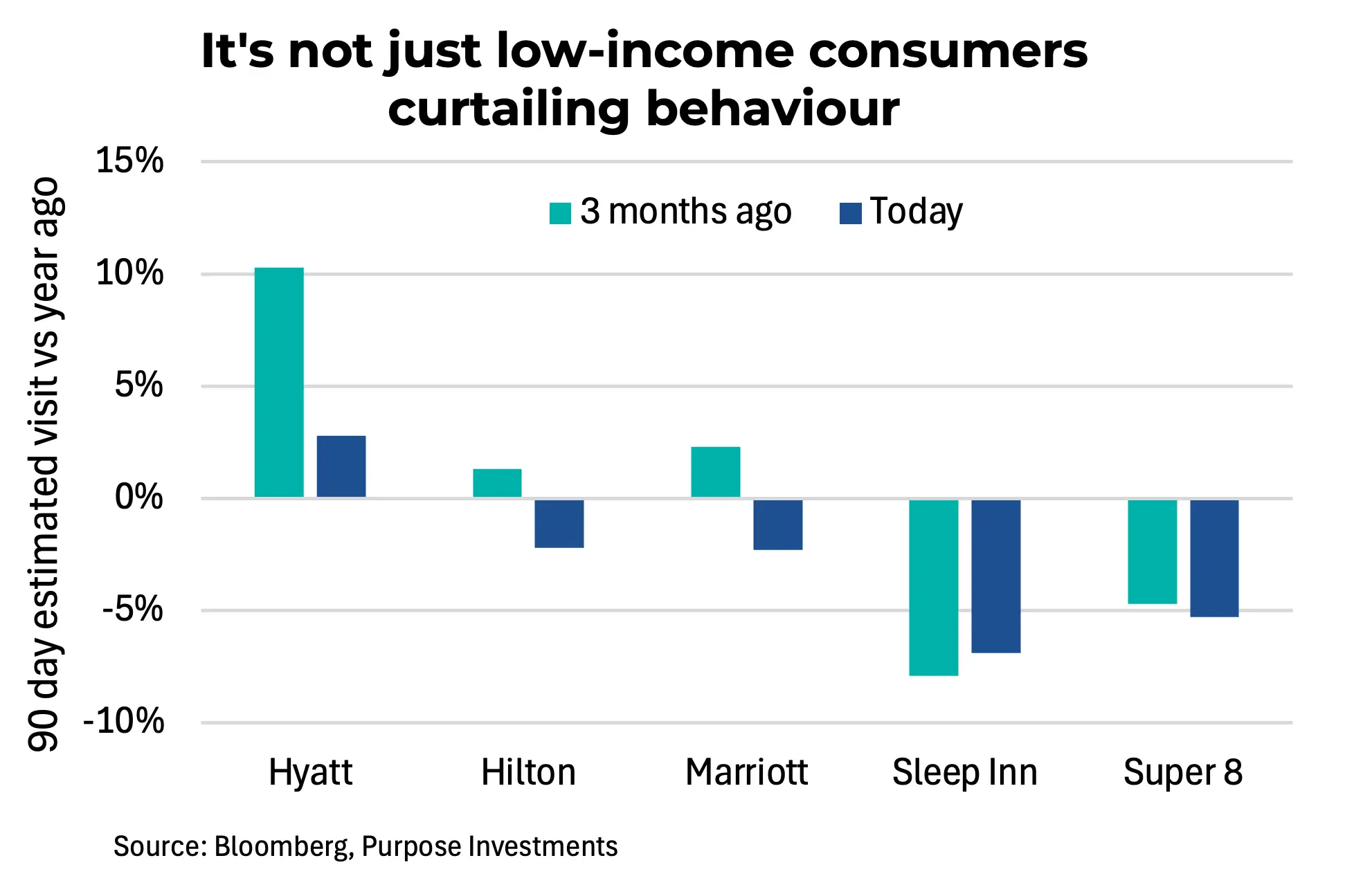

Accommodation is an interesting one. The norm over the past year is that the higher-income consumer was healthy, and spending and the lower end was having troubles, given inflation. Breaking down a number of national hotel chains, it would appear the pain is moving up the income spectrum. The chart below shows the change in estimated visits to various chains on a year-over-year basis. Looking at the pace from both three months ago and today, the lower-cost hotels have been suffering for a while, but even the higher-end hotels (Hyatt, Hilton, Marriott) are now seeing an erosion in visits.

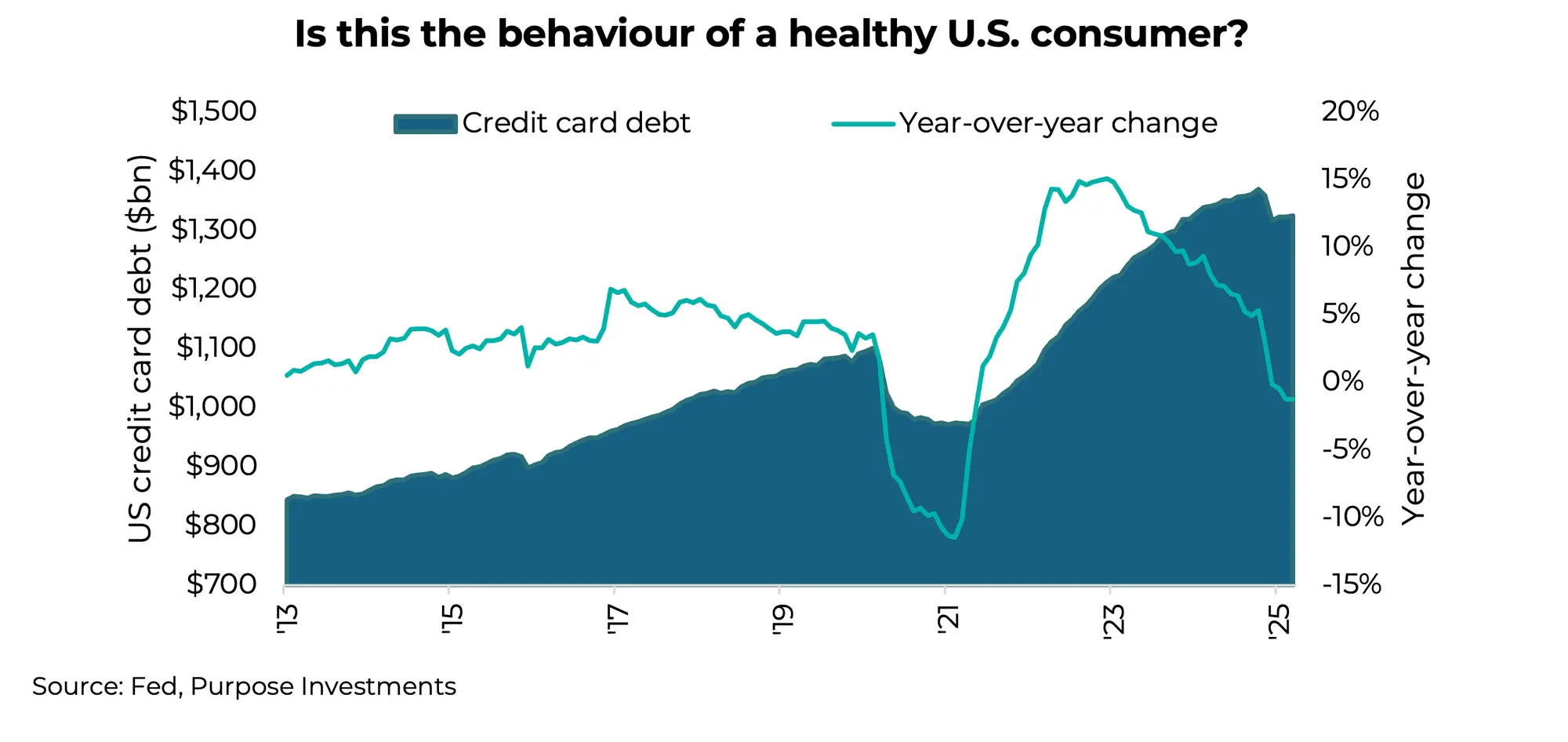

As further evidence that the U.S. consumer may be running low, we turn to credit card data. Now, this has been an interesting trend because Covid caused many to migrate to a more cashless world. As a result, aggregate credit card debt rose substantially. But this was more a behaviour change in the choice of payment options. The challenge of late is that spending on cards is starting to contract. Just a bit so far, but this could be a sign the consumer is more tapped out.

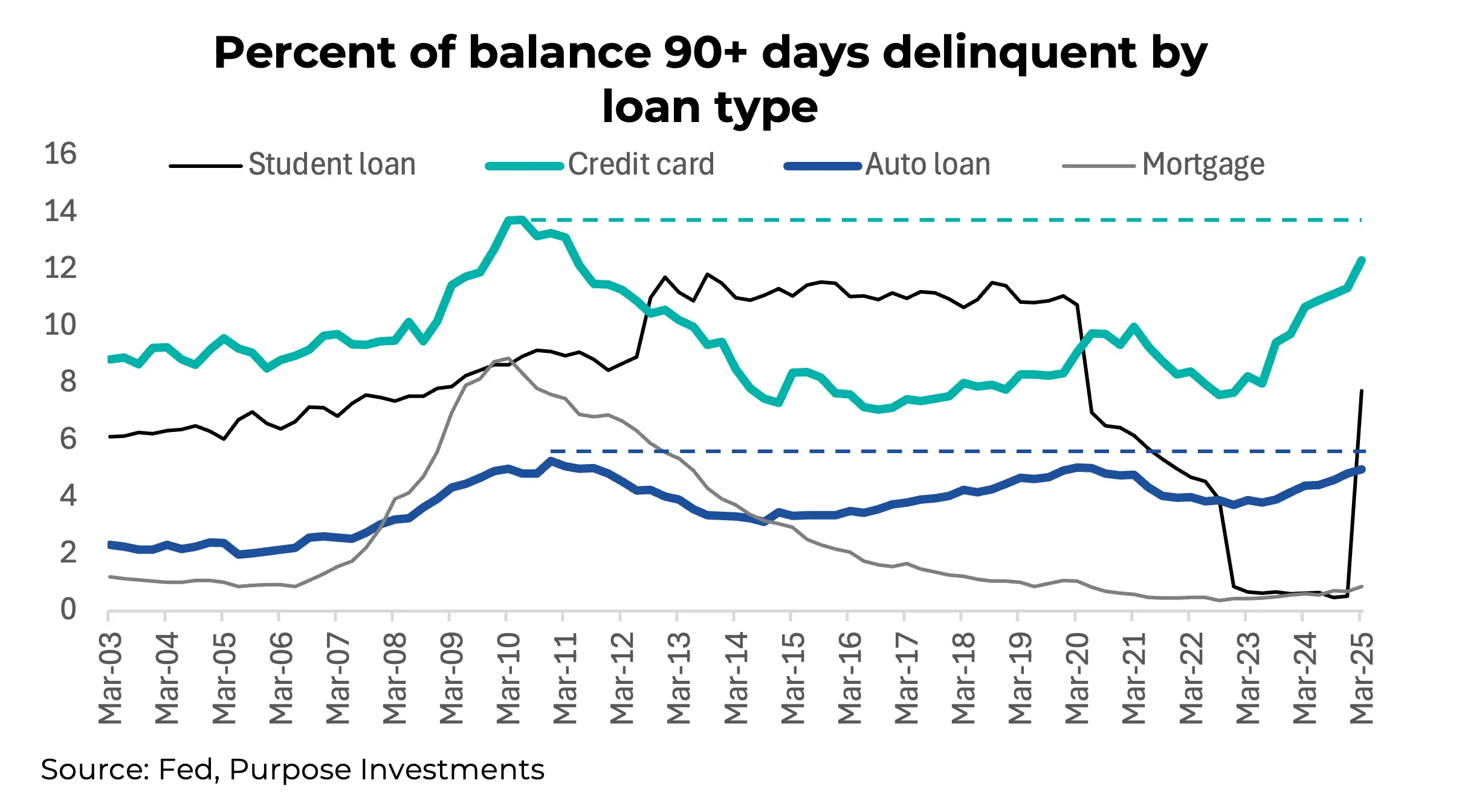

More disturbing are delinquencies. This is the percentage of balances that are 90+ days delinquent by category. We will ignore student loans, as those have been odd given changing legislation in the U.S. And mortgage delinquencies are very low.

However, credit card delinquencies are getting close to the peak levels that followed the global financial crisis, and this has happened with a supportive labour market and no recession. Auto loans are also seeing rising delinquencies. Inflation and high rates are clearly taking a toll on the consumer, and it is starting to show up more and more.

Final Thoughts

The U.S. consumer has a long history of finding ways to keep spending. The saying goes that if they earn $1, they spend $1.20. Still, they do appear to be waning, or at least losing momentum at a time when wage growth is good and the labour markets are decent.

The policy uncertainty has not helped, nor have the DOGE efforts. This does appear to be further evidence supporting a potential economic growth scare in the coming months or quarters. Or at the very least, we believe it could be a warning to be very selective in the consumer discretionary space.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L. P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,”“will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.