by John Kerschner, CFA, Head of US Securitised Products, Portfolio Manager, Janus Henderson

John Kerschner, Head of U.S. Securitized Products, discusses April’s inflation print and what the implications may be for the bond market, the Federal Reserve (Fed), and fixed income investors.

The numbers

Like March’s reading, inflation came in softer than expected in April, given the 0.2% month-over-month (MoM) rise in both headline (+0.221%) and core (+0.237%) inflation. This brings the headline Consumer Price Index (CPI) year-over-year (YoY) number to 2.33%, down materially from 3.35% a year ago. Core CPI was up comparatively more than headline, at +2.78% YoY, but was also down materially from 3.62% a year ago.

In our view, the most important takeaway from April’s report was the big reduction in core services excluding housing (aka, supercore inflation) to 2.8%, a significant drop from 4.8% a year ago.

What it means for the bond market

Unfortunately, given the overarching tariff situation, this was probably one of the least important CPI prints since the inflation spike of 2022.

Market participants are more concerned with the expected uptick in inflation due to the tariffs announced on Liberation Day, which will likely not show up until May or June’s numbers are released. The market will wait with bated breath for those readings before determining where we stand on tariff-induced price increases. We think market uncertainty – coupled with interest rate volatility – may remain elevated in the interim.

We expect that bond prices and yields are likely to stay rangebound (as they have been so far in 2025) until we get more clarity on the fluid tariff situation and the Fed’s reaction to anticipated higher inflation in coming months.

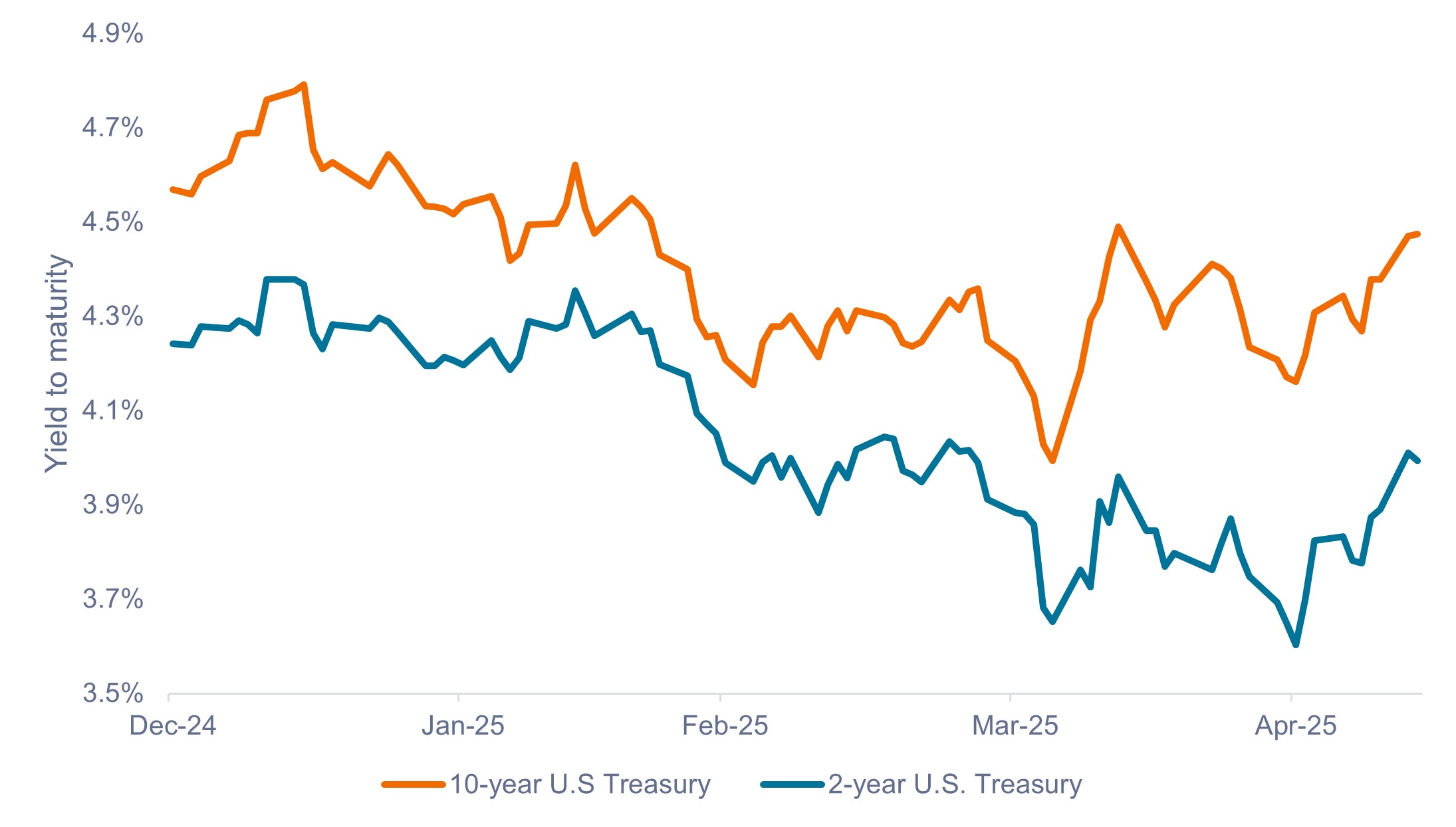

Exhibit 1: Yields on U.S. Treasuries (Jan 2025 – May 2025)

Treasury yields likely to remain rangebound until the full impacts of tariff policy become clear.

Source: Bloomberg, as of 13 May 2025. Past performance does not predict future returns.

What it means for the Fed

In our view, April’s benign inflation numbers mean that the Fed will probably be on hold for the foreseeable future, as inflation has continued to fall and unemployment has held steady thus far.

As of 13 May 2025, the market is pricing in only an 8% and 41% chance of a cut at the Fed’s June and July meetings, respectively. Notably, the market was pricing in nearly a 100% chance of a cut by July at the end of April.

What it means for investors

Rangebound bond yields may be anathema to investors hoping for rapid bond price appreciation due to a drop in yields, but we think it is important not to miss the forest for the trees.

Coupon, or interest income, has historically been the most significant contributor to total returns on fixed income, and we anticipate that trend will continue in the current environment. Consequently, current starting yields have historically been a highly reliable predictor of 5-year forward returns on fixed income.1

With interest rates remaining around their highest levels since 2007, we believe investors should view rangebound yields as an opportunity to continue reinvesting at attractive yields – something they likely wouldn’t be able to do if yields fell sharply.

Copyright © Janus Henderson