by Campbell Harvey, PhD Partner, Senior Advisor, Director of Research, Research Affiliates

Key Points

- Gold’s recent price surge is largely driven by current economic uncertainty as well as a wave of new investment sources, including gold ETFs and China’s de-dollarization efforts, that have significantly increased demand.

- Gold is often viewed as a hedge against inflation, but historical evidence shows that its high volatility makes it an unreliable short-term inflation hedge.

- While gold has offered some protection during stock market downturns by either rising or declining by less than equities, its current high price levels and historical patterns suggest that future returns may be limited.

Campbell Harvey is the corresponding author.“

What motivates most gold purchasers is their belief that the ranks of the fearful will grow…. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As ‘bandwagon’ investors join any party, they create their own truth — for a while.”

— Warren Buffett1

The price of gold was on a historic ascent before the April 2, 2025 tariffs announcement. In March, gold had eclipsed a significant milestone, surpassing $3,000 an ounce for the first time ever. Even on an inflation-adjusted basis, gold achieved an all-time high.

Then the new tariffs sent equity markets plunging. Market sentiment turned decidedly bearish and the benchmark S&P 500, which had already fallen into correction territory earlier in the year, declined even further in the trading days that followed.

Given this backdrop, is gold poised to go even higher in the months and years ahead? After all, in the flight to safety that accompanies equity market swoons, with its low correlation to stocks and reputation as an inflation hedge, gold is regarded as the quintessential safe haven asset. Indeed, unlike few other investments, gold has proven its mettle as a store of value for much of human history, with a track record of millennia rather than decades or centuries. Might that make it especially appealing in times like these?

“[G]old has proven its mettle as a store of value for much of human history, with a track record of millennia rather than decades or centuries. Might that make it especially appealing in times like these?”

To answer these questions, we first need to explore the traditional and nontraditional tailwinds that may be behind gold’s recent trajectory. Two potential drivers, in particular, stand out: economic uncertainty and increased atypical gold investment, particularly the process of de-dollarization.

The Long- and Medium-Term Forces Impacting Gold Prices

Over the past 15 years, the financialization of gold, with the introduction of gold exchange-traded funds (ETFs) and gold-backed stablecoins, for example, has reshaped the gold market. While gold-based futures and derivatives have existed for some time, gold ETFs gave retail and institutional investors alike the ability to add gold to their portfolios in a simple way. Though some investors hold gold coins or even bullion, physical gold has two big risks: It can be stolen, which makes security expensive, and has an illiquid physical market. As easy as it is to buy gold at Costco, it may not be so easy to sell. Financialization removes these impediments.

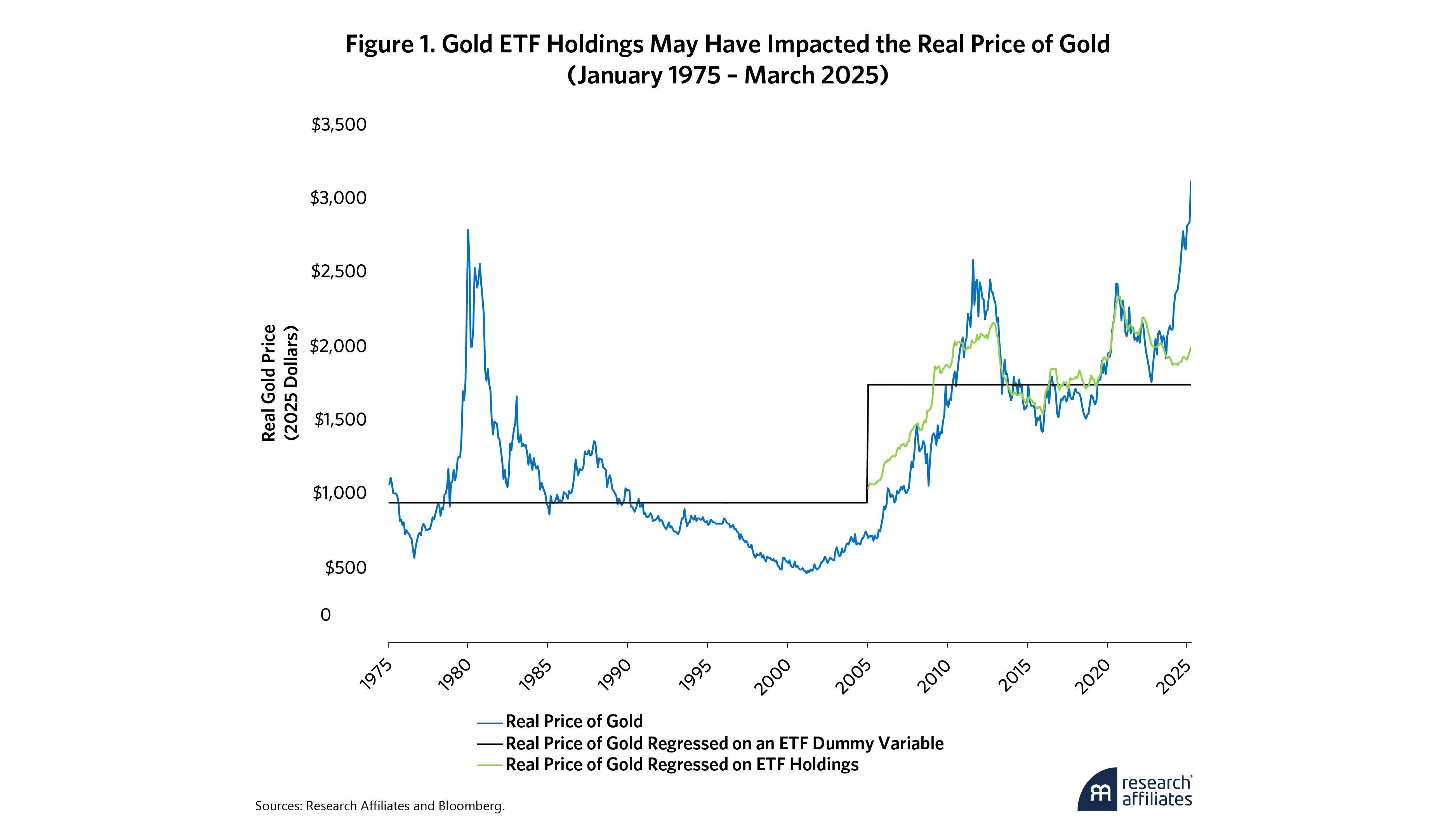

Figure 1 shows the relation between the real price of gold and the amount of gold held by SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), the two top gold-owning ETFs, as measured in troy ounces, which are about 10% heavier than traditional ounces. The real gold price is the nominal price of gold divided by the CPI. This represents the price of gold in 2025 dollars.

The green line in the graph shows a significant relationship between ETF holdings and the real price of gold. Indeed, the average price of gold shifted upwards (black line) after financialization. This indicates a long-term impact on the price of gold.

The medium-term influence is the trend towards de-dollarization. While this likely began in 2022, it is highly relevant even today. De-dollarization accelerated after the Russian invasion of Ukraine in February 2022. In retaliation for the Russian attack, the United States weaponized the U.S. dollar and imposed severe economic sanctions, cutting Russia off from the SWIFT global banking system, among other measures.

China took note. Since the 1944 Bretton Woods agreement, the U.S. dollar has served as the global reserve currency. This has given the U.S. outsized influence in world trade even if, since 1971, the dollar is no longer backed by gold. If the U.S. could deploy the dollar to isolate Russia, it could do the same to China. To mitigate this risk, China needs to wean itself from the U.S. dollar.

In order to accomplish that, China had to increase its own currency’s credibility on the global stage. Buying more gold helps. China’s official holdings have risen 15%, or by 336.2 metric tons, since November 2022.

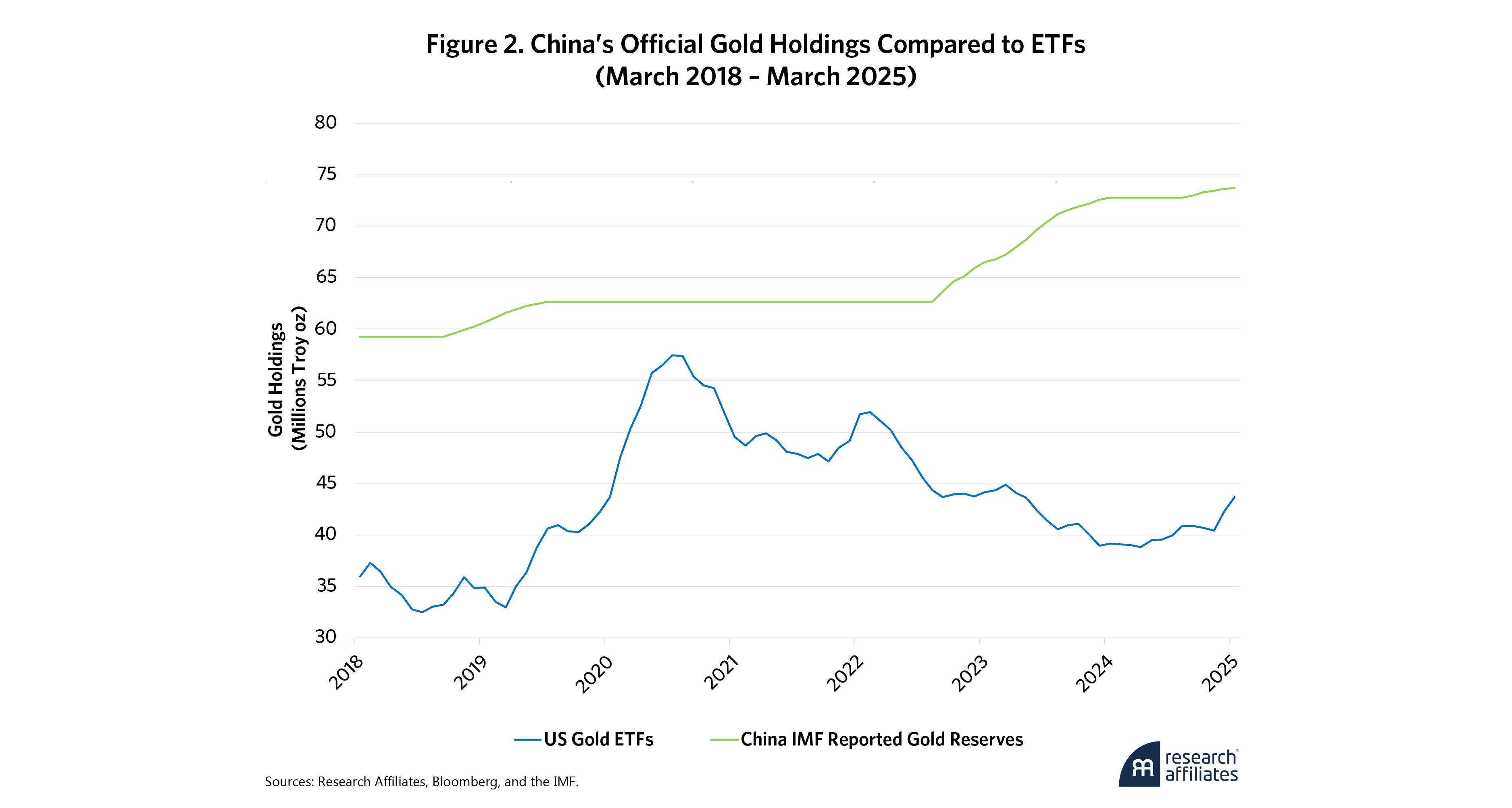

Figure 2 shows China’s gold holdings next to those of gold ETFs. As the gold holdings of ETFs have stalled or declined since their peak during the COVID-19 pandemic, China’s de-dollarization-related purchases have picked up the slack. Importantly, Figure 2 reports the “official” holdings. Many believe that China has conducted significant non-official accumulation of gold as well. Indeed, it is in China’s best interest not to pre-announce a significant buying program—which would immediately increase the price of gold.

Obviously, gold is not like paper currency. Central banks cannot simply turn on the printing presses and churn out a fresh supply. Gold production is expensive and not easily ramped up in response to rising demand. In 2024, 3,330 metric tons were produced according to the World Gold Council,2 and the 2025 figures are not likely to be much higher (or lower). So, with few if any levers to pull on the supply side of the equation, the principal mechanism to address increased gold demand is higher prices, in other words, $3,000-plus an ounce.

While de-dollarization has been ongoing for quite a while, it has accelerated during recent tariff uncertainty. Tariffs mean less global trade. Since the dollar is the world’s reserve currency, less trade means less demand for the dollar to finance that trade. As such, countries sell U.S. bonds and invest in gold and other assets.

Gold Imports

There has been a surge in gold imports over the past four months. Given the uncertainty about the final form of the tariffs, it is likely that some of the imports of gold (and other goods) are designed to get ahead of the tariffs. The Federal Reserve Bank of Atlanta in their GDPNow forecast suggest that the surge in gold imports accounts for 2% of GDP. Indeed, they are forecasting approximately -2% real growth in GDP largely driven by gold imports. Importantly, gold is classified as a financial asset by the Bureau of Economic Analysis (BEA) – gold is not a “good”. While the initial GDP forecast will confusingly include the gold imports, revisions will remove the imports. However, the point is not the treatment of gold in GDP calculations but the magnitude of the imports. Some of the imports represent the movement of gold from offshore vaults. The other part of the imports is likely due to fresh demand. Again, given the limited supply of gold, extra demand immediately impacts prices.

The Golden Constant and The Golden Dilemma

So, given these forces and their role in gold’s current elevated price, how safe is gold as a safe haven asset? That’s the critical question in navigating current markets and requires an examination of history.

An important point to remember: Gold’s reputation does not always align with reality. The notion of gold as an inflation hedge, for example, may not be as ironclad as some believe. With his concept of the “Golden Constant,” Roy W. Jastram (1978) sought to demonstrate that gold’s purchasing power, its “operational wealth,” as he put it, was more or less unchanging over time, in a sense, immune to inflation. Whatever a particular amount of gold could buy 2,000 years ago was about as much as the same amount could buy today.

“Gold’s reputation does not always align with reality. The notion of gold as an inflation hedge, for example, may not be as ironclad as some believe.”

I revisited Jastram’s work in “The Golden Dilemma” (2013) with Claude B. Erb. We validated Jastram’s thesis that the real price of gold was approximately constant over millennia. We calculated how much Roman centurions were paid in gold 2,000 years ago. Their wage in gold, when converted into dollars, closely matched that of a U.S. Army captain today.

However, investors don’t have horizons of millennia or even centuries. Erb and I show that over shorter horizons gold is a highly unreliable inflation hedge. The reason is simple: Gold is volatile and has about as much return volatility as the S&P 500. Inflation rates are not so volatile; inflation’s volatility is less than 2% on an annualized basis.

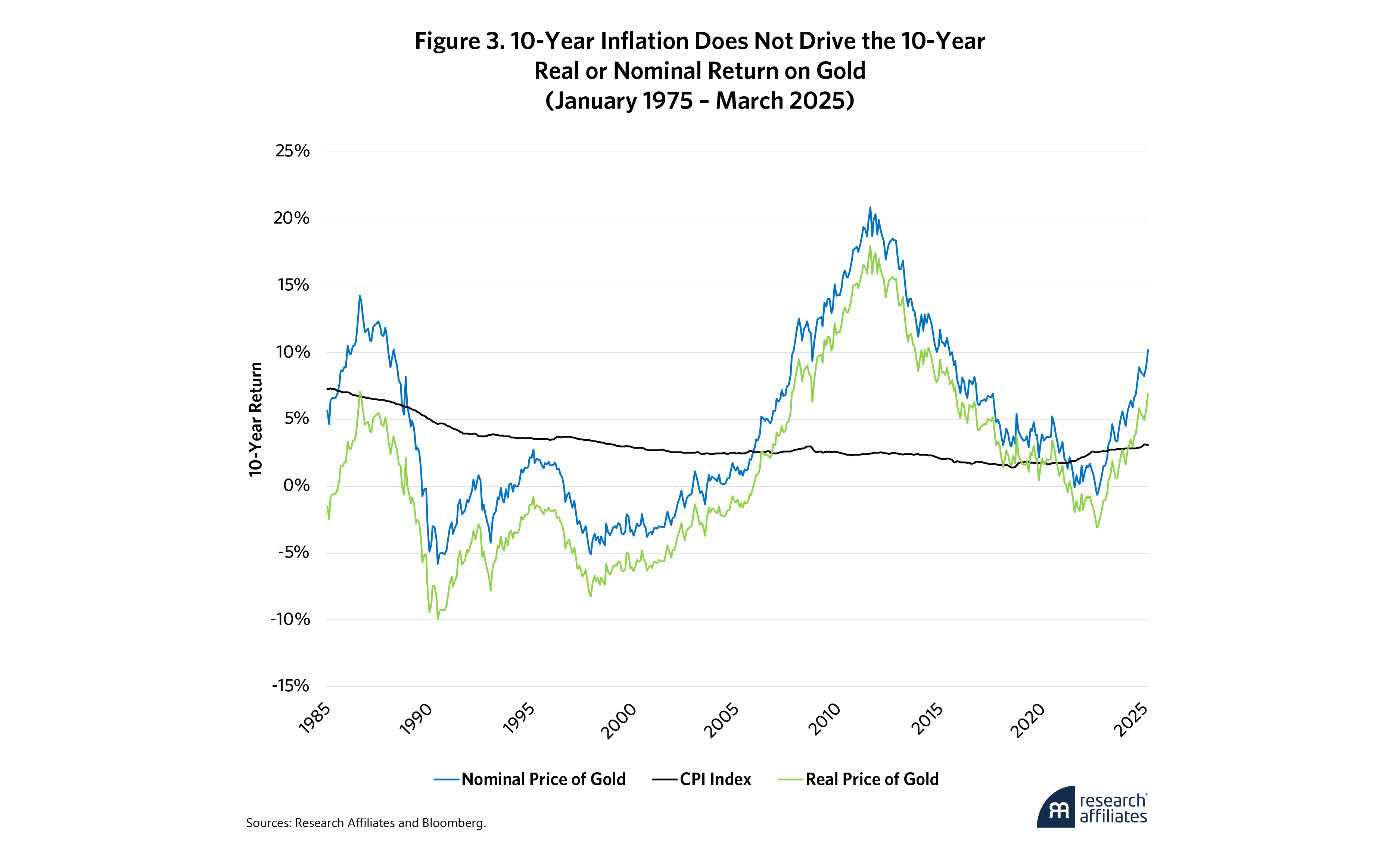

The difference in the volatility of gold and inflation is starkly represented in Figure 3, which compares 10-year gold returns with the 10-year inflation rate. The sample starts in 1975, when U.S. investors were once again permitted to own and trade gold following the enactment of Public Law 93-373.3 The blue line represents the inflation rate, the CPI, which the real and nominal prices of gold should have tracked—assuming gold is a perfect inflation hedge. But, in fact, gold prices indicate little if any correlation to the 10-year inflation rate.

In the recent 20-year period, gold generally outperformed inflation and was thus a good hedge. But in the 20 years before, gold underperformed inflation and so was a poor hedge. This is exactly what we would expect when an asset with 15% volatility is used to hedge an asset with less than 2% volatility. It is an unreliable hedge.

So, if the new tariffs usher in a period of resurgent inflation, gold may not be an effective antidote.

Bear Markets: Has the Golden Hedge Held?

But what about the price of gold in market drawdowns? If gold is not always and everywhere an inflation hedge, might it still offer a reliable safe haven in market downturns?

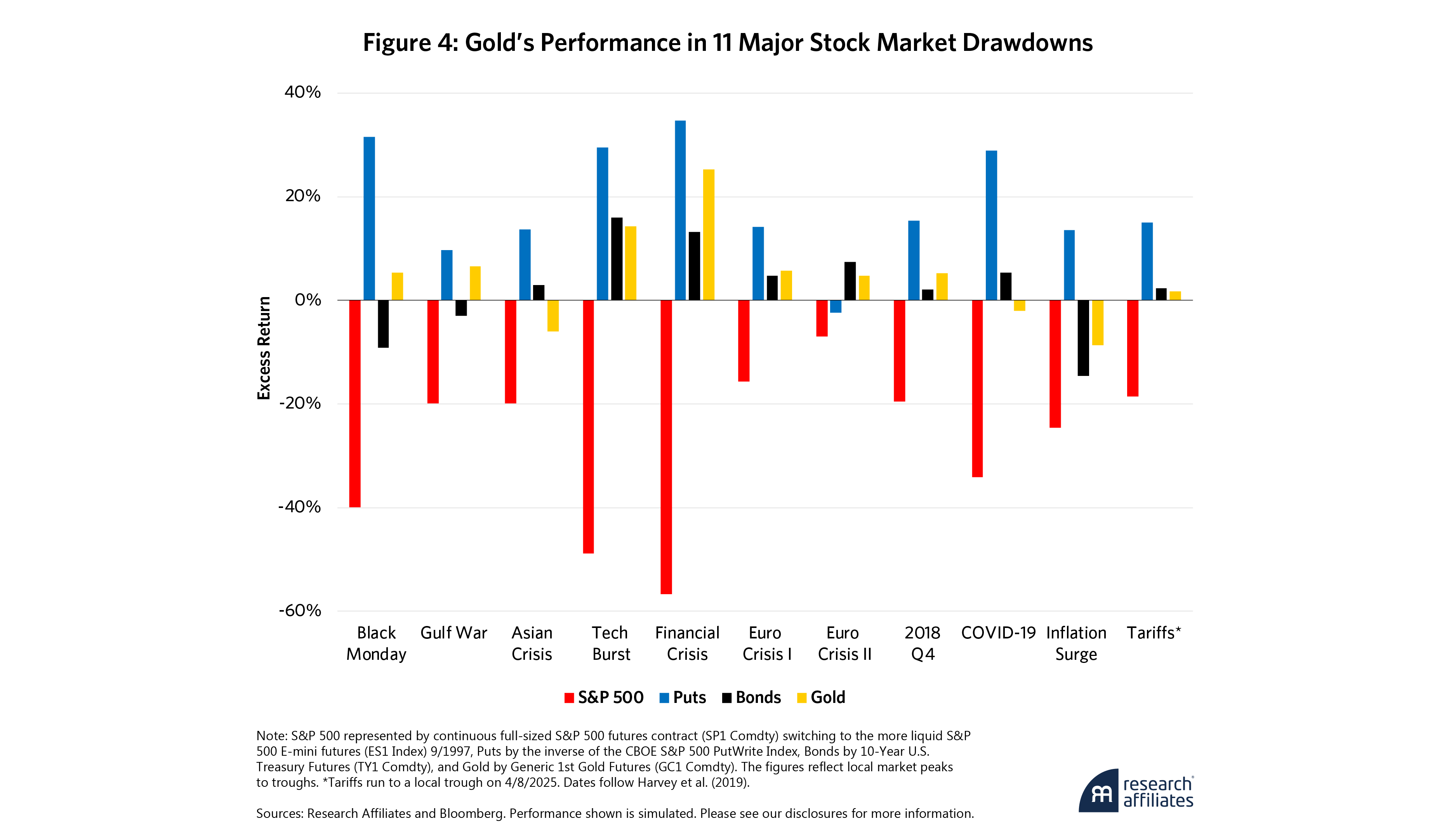

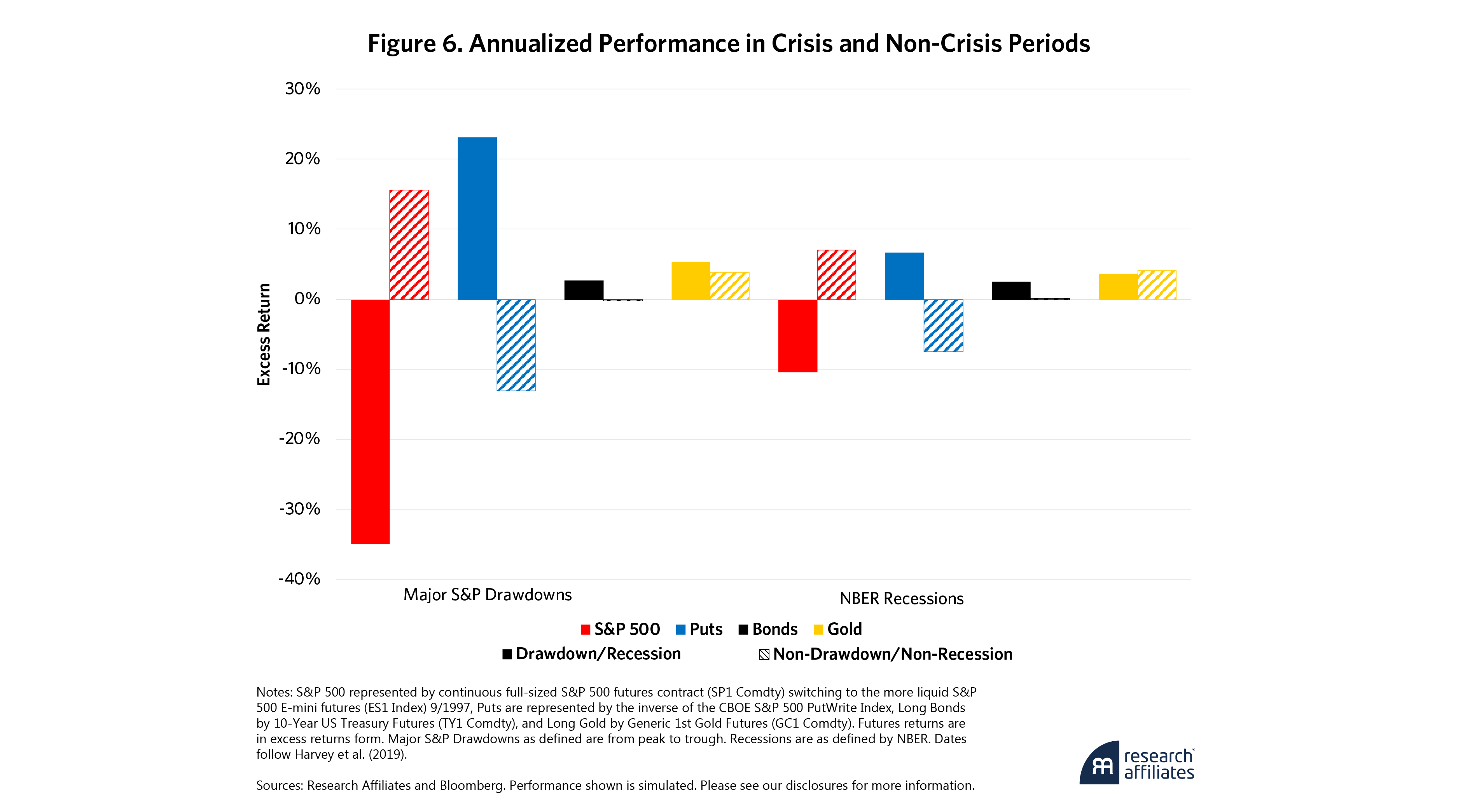

To find out, we consider gold’s performance in the 11 major stock market drawdowns.4 For comparison, we also include two additional hedging candidates: Treasury bonds and S&P 500 puts taken 5% out of the money. Figure 4 shows that the price of gold went up in eight of the 11 S&P 500 drawdowns. In the remaining three, the price fell but the drop was far smaller than the S&P 500’s. Thus, gold provided some diversification benefit and could indeed be a valuable hedge against stock market volatility in the current environment.

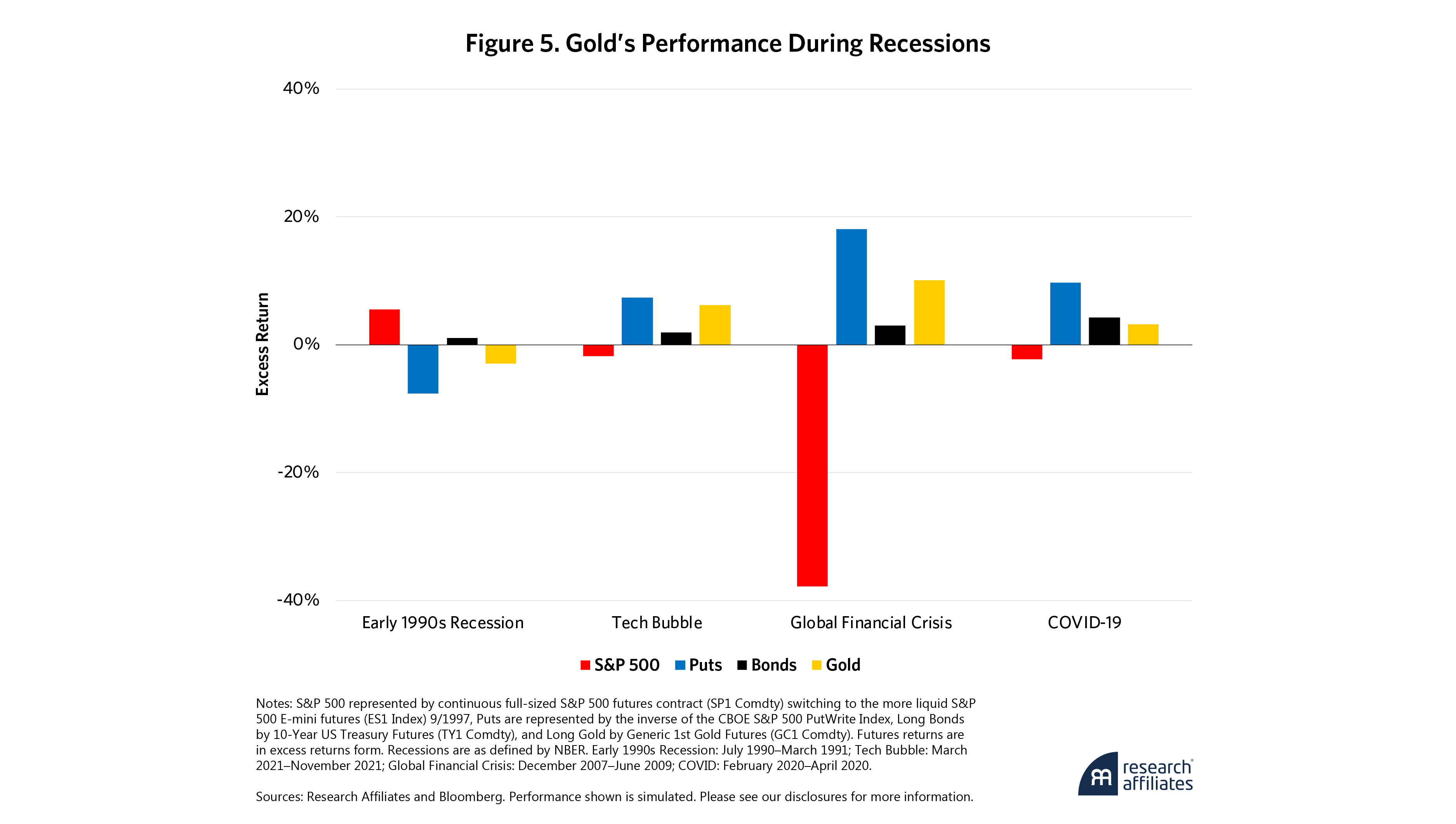

Figure 5 shows a similar pattern during recessions. In three of the four recessions when the S&P 500 declined, the gold return was positive. In the 1990–1991 recession, when the S&P 500 rose, gold registered a small decline, which is consistent with its low or negative correlation to stocks.

Hedging performance must always be weighed against the cost of hedging. As Figure 4 and Figure 5 show, long puts work. But they work for a reason—they are very costly to implement.

High Real Gold Prices: What Comes After?

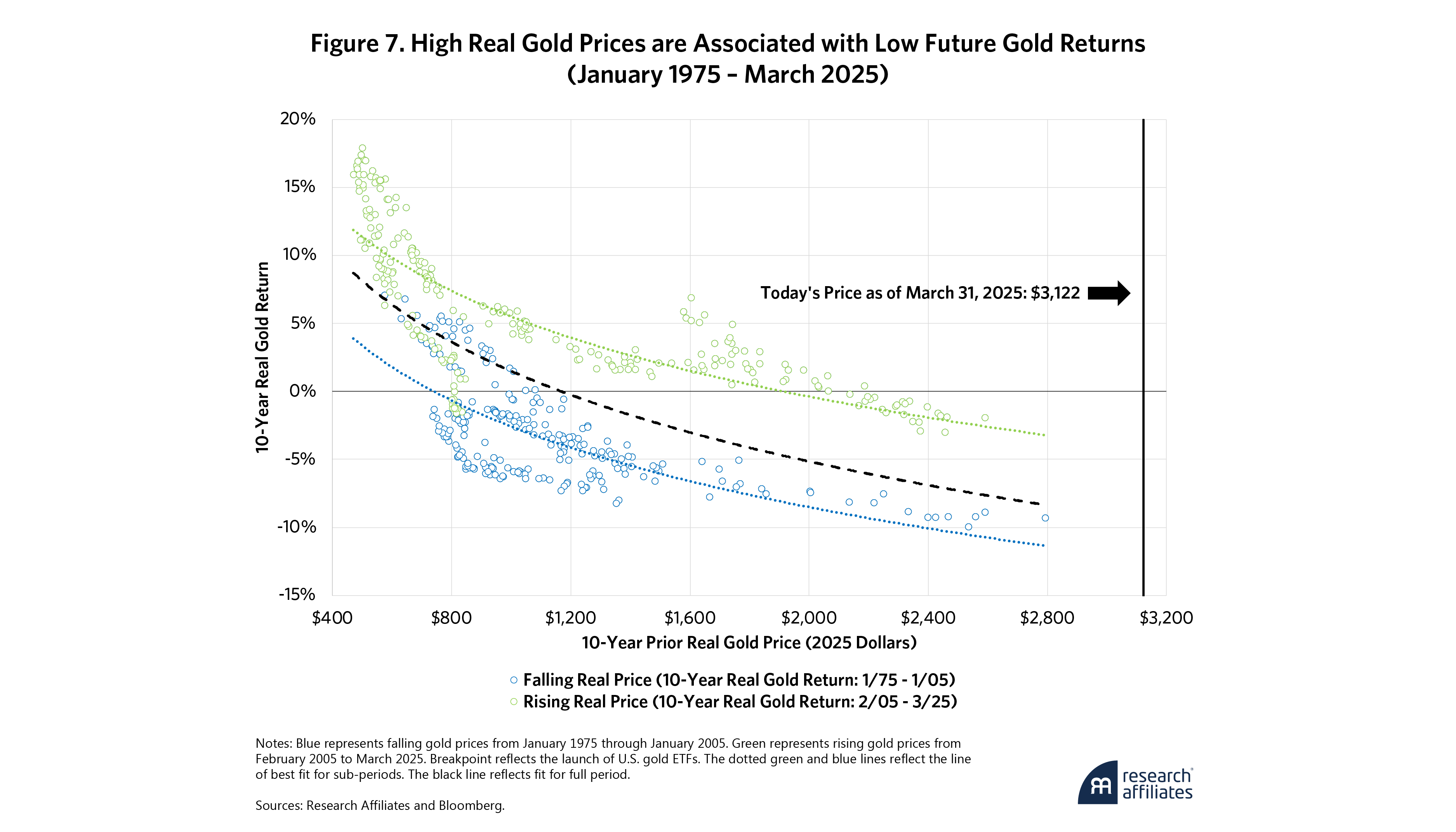

Currently, gold prices are at or near all-time highs. If gold prices revert towards the mean, they may not offer much in the way of protection. Looking back, gold’s performance in the years following price peaks has tended to be low or even negative. Figure 7 shows that 10-year real gold returns are low following highs.

“Currently, gold prices are at or near all-time highs. If gold prices revert towards the mean, they may not provide much in the way of protection. Looking back, gold’s performance in the years following price peaks has tended to be low or even negative.”

Addressing the Golden Dilemma

The golden dilemma that Erb and I first proposed more than a decade ago remains unresolved: Either this time really is different and recent trends in gold prices represent a new normal and a perhaps permanent structural change, or gold prices will revert towards their historical mean.

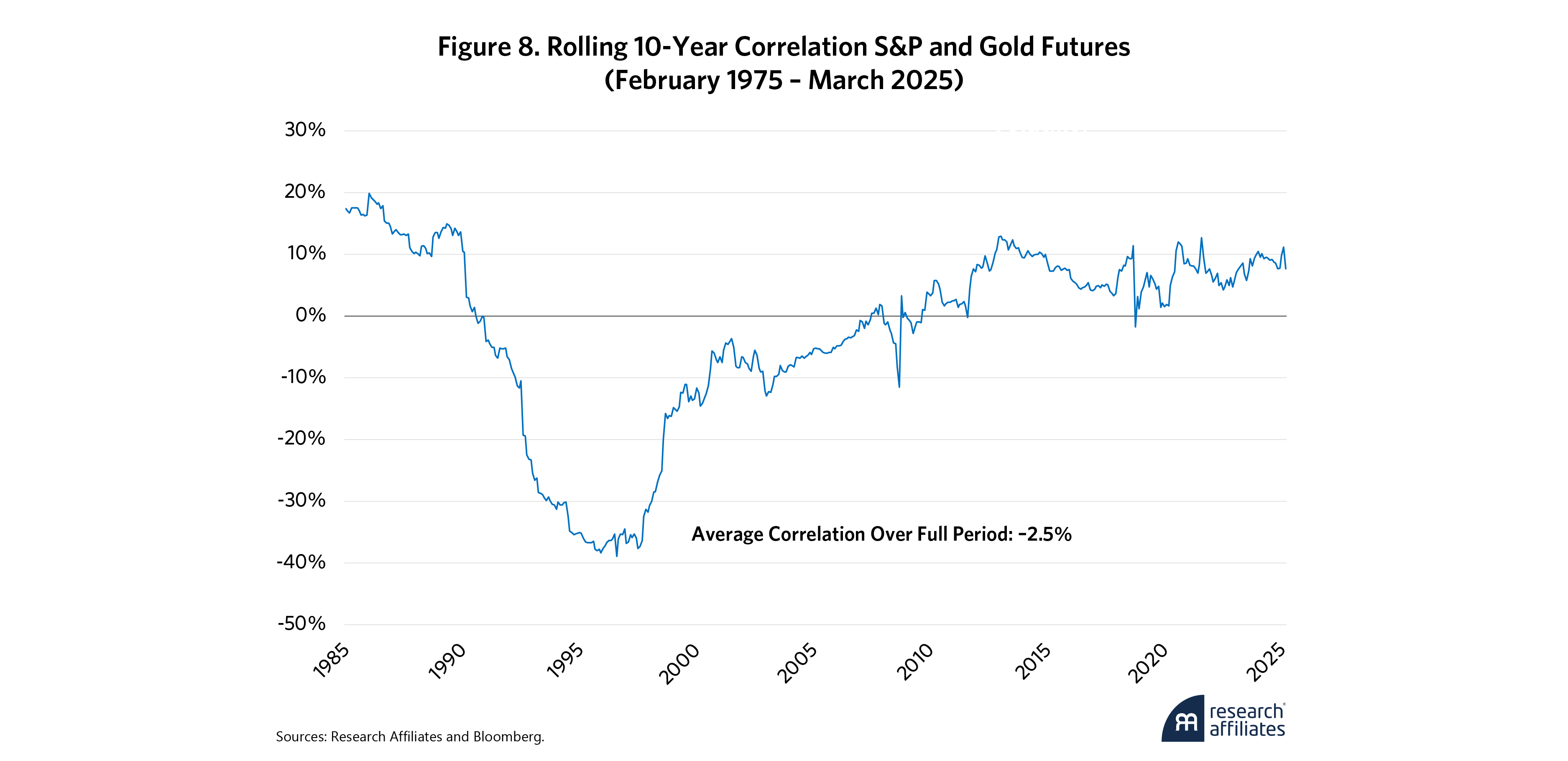

Certain key points are worth remembering. The first and most obvious: Gold is volatile—as volatile as the S&P 500. But while it may not offer reliable protection against inflation, gold is relatively uncorrelated to the stock market. Figure 8 shows the average correlation is near zero. While the correlation has increased over the past 25 years, it is less than 10% today.

“Either this time really is different and recent trends in gold prices represent a new normal and a perhaps permanent structural change, or gold prices will revert towards their historical mean.”

This low correlation qualifies gold as one among a class of assets and strategies that provide protection in market drawdowns, inflationary episodes, and recessions. But gold should not be the only asset in this sleeve. Diversified commodity portfolios, inflation-protected bonds, and such positive convexity strategies as long put options and trend-following strategies may offer similar downside protection.

Warren Buffett’s admonition about gold’s potential flaws as an investment is worth keeping in mind. “Gold,” he opined, “has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.”5

In the end, gold has a long history as a hedging asset with consistently low correlation to the stock market. But expectations must be tempered. Gold is as volatile as the stock market. That means that we cannot always count on gold to do the job.

Further, the golden dilemma still exists. The real price of gold resembles a price-to-earnings ratio for equities. Very high P/Es are often followed by low expected returns. Gold’s historical record suggests a similar pattern. The dilemma is that this time might be different. A collapse in confidence in the U.S. dollar as the world’s reserve currency could thrust gold into a new regime.

Copyright © Research Affiliates