by David Benedet, Portfolio Manager, Purpose Investments

For some, the famous Jane Austen book Sense and Sensibility was required reading back in high school. One of the main themes was the contrast between logic and emotion represented by the main characters. Evidently, the battle between logic and restraint versus emotion was just as notable in 19th-century England as it is in 2025. If we were to do a modern-day rewrite drawing on the events of the past week, Nonsense and Sensibility would be a far better title.

It's hard to find any sense over the past week and a half. We have our doubts that this was “textbook, Art of the Deal,” as tweeted by a certain U.S. hedge fund manager with a wide following. What is lacking is a logical approach with measured decision-making, and markets have certainly taken notice.

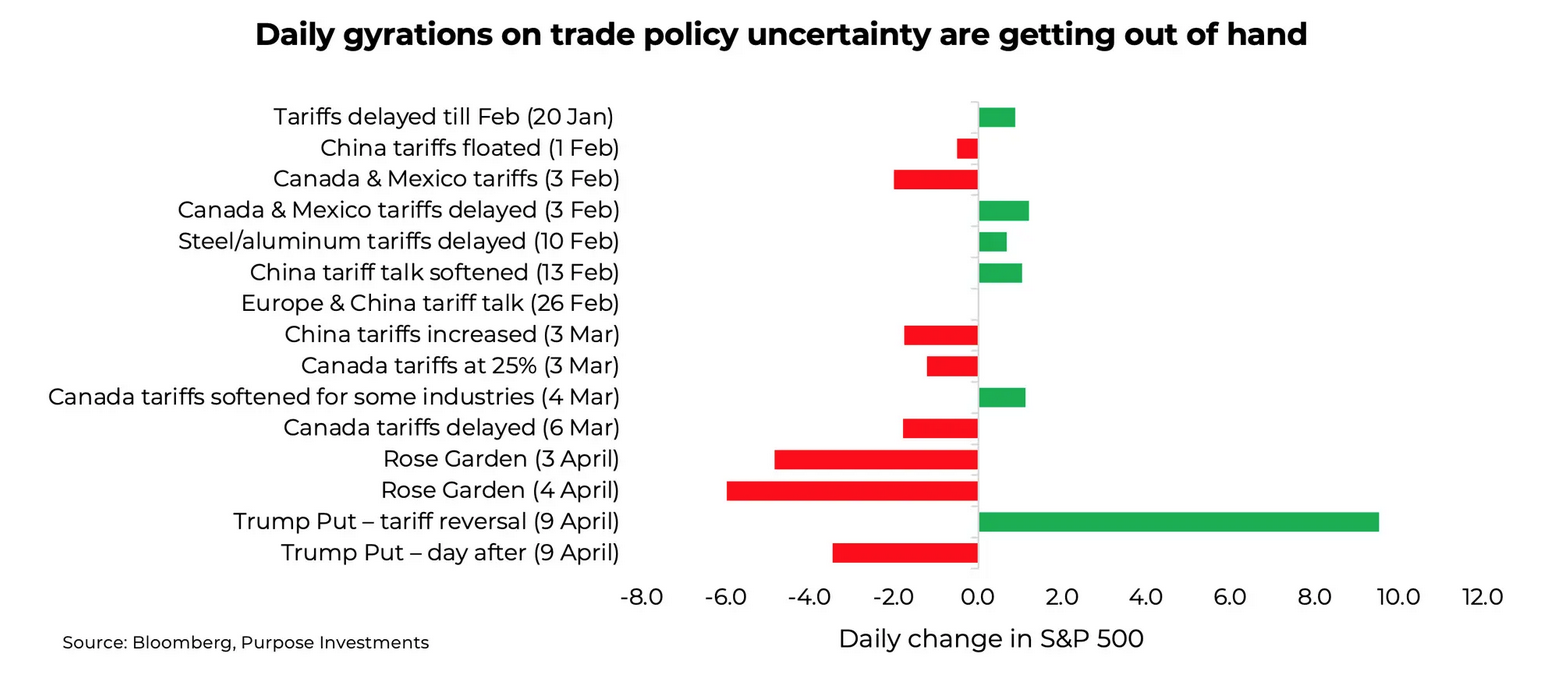

There is, however, plenty of emotion. We’re seeing sentiment extremes and massive market swings. Just look at the daily market moves that we’ve been seeing since all of the tariff talks began. The volatility has increased and so has the fear. The VIX index hit a high of 60 earlier this week, a clear indication that emotion has taken over. There is just so little logic can do when the possible outcomes are uncountable.

In case you missed it, Trump blinked on Wednesday afternoon, announcing a 90-day pause on some tariffs while increasing tariffs on China to 125%. Canada once again was largely out of the news and our status remains largely unchanged. The S&P 500 surged 9.5%, the NASDAQ up 12%, while the TSX rose a mere 5%. These are remarkable moves.

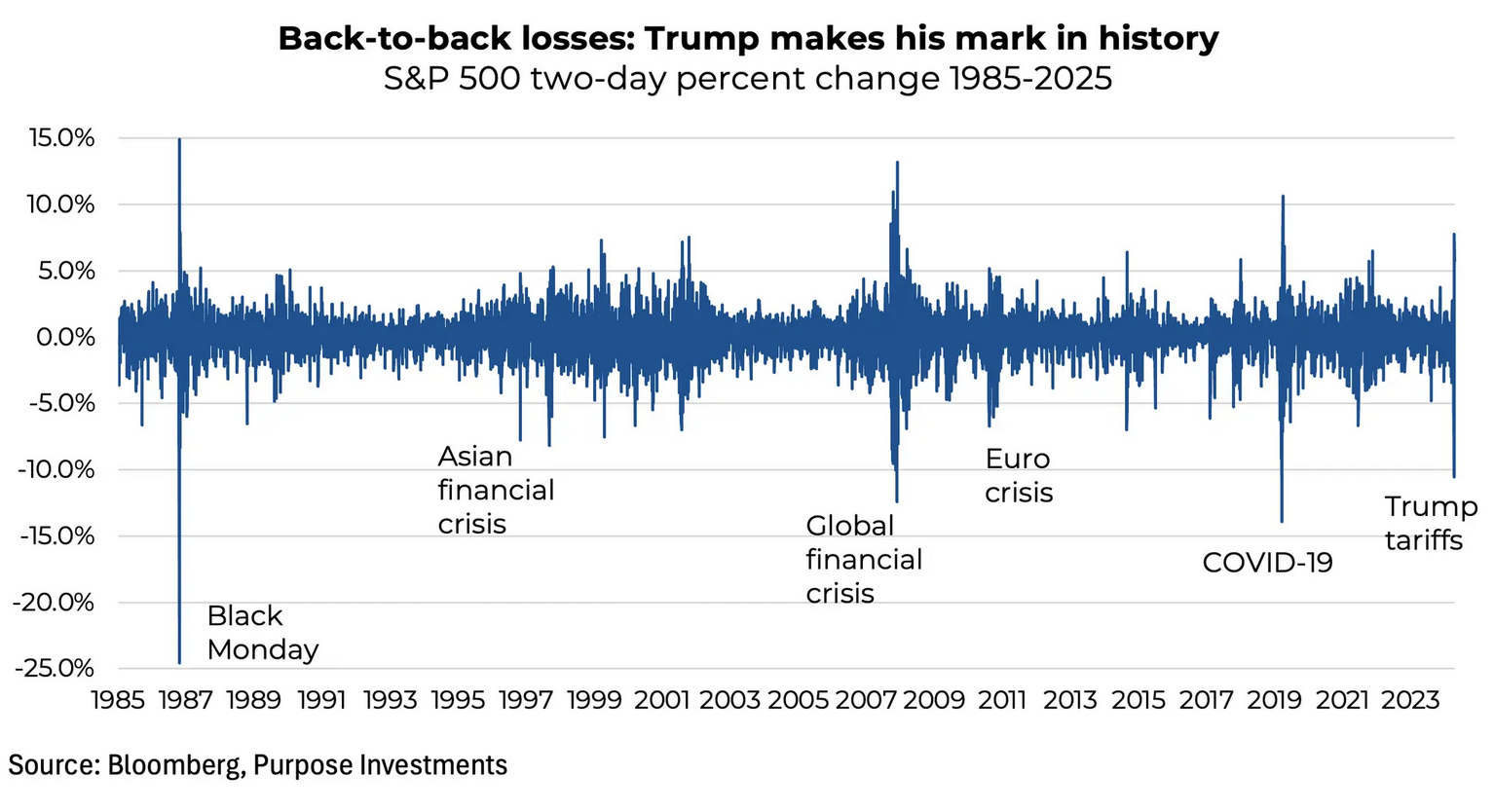

But one thing stands out when you look at the chart below. These big up days always occur right after the massive down days. This is known as volatility clustering. Another thing is clear: What markets are going through right now is very rare. The degree of volatility is reminiscent of some of the other most notable dark periods in market history.

Calm negotiation and rational restraint can lead to stability, which we believe the market will be happy with. We got a brief reprieve, but it only took a day for markets to move on from what turned out to be the third-largest one-day rally (+9.5%) for the S&P 500 over the past 50 years. These types of one-day moves are rarely the “all clear” signal. If you took a step back to rationalize the move, you’d be stumped.

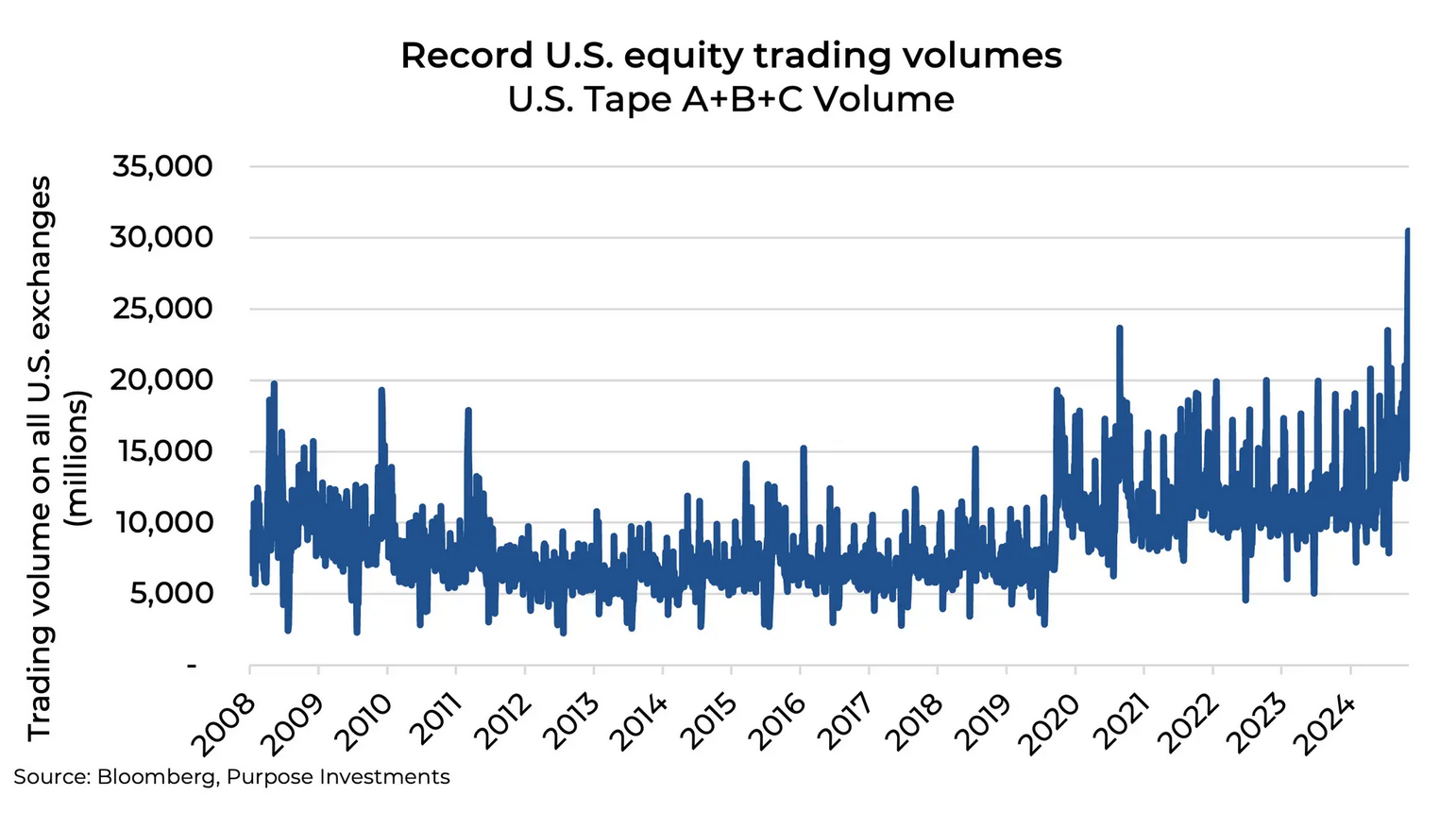

One glaring example is Apple, which rose 15%+, but given their significant China exposure, it really didn’t make a lot of sense. You can blame it on the algos or fast money driving nearly all stocks higher. It was clear that there was rampant ETF buying, the fast money vehicle of choice.

This week saw some of the most active days ever in the ETF space, not just in the U.S. but in Canada as well. Wednesday’s overall ETF volume was $12.8B, the third highest in history, following Monday’s record $14.6B and Friday’s $13.5B. We saw a similar type of outsize volume in the U.S. The chart below shows that this week saw record U.S. equity trading volume.

A day after the biggest stock-buying wave in years, assets tied to the economic cycle started to sink again. Investors are rushing to game out how the effective freezing of Chinese trade will impact companies and growth. With the hard data lag, it’s still too soon to quantify the damage done to the economy.

Earnings season and guidance (or lack thereof) will help digest how the uncertainty is impacting the real world. Tone and guidance will be top of mind. Right now, what happened in the last three months is of way less importance compared to how companies are positioning, maneuvering, and preparing for the quarters ahead.

The New Pain Trade

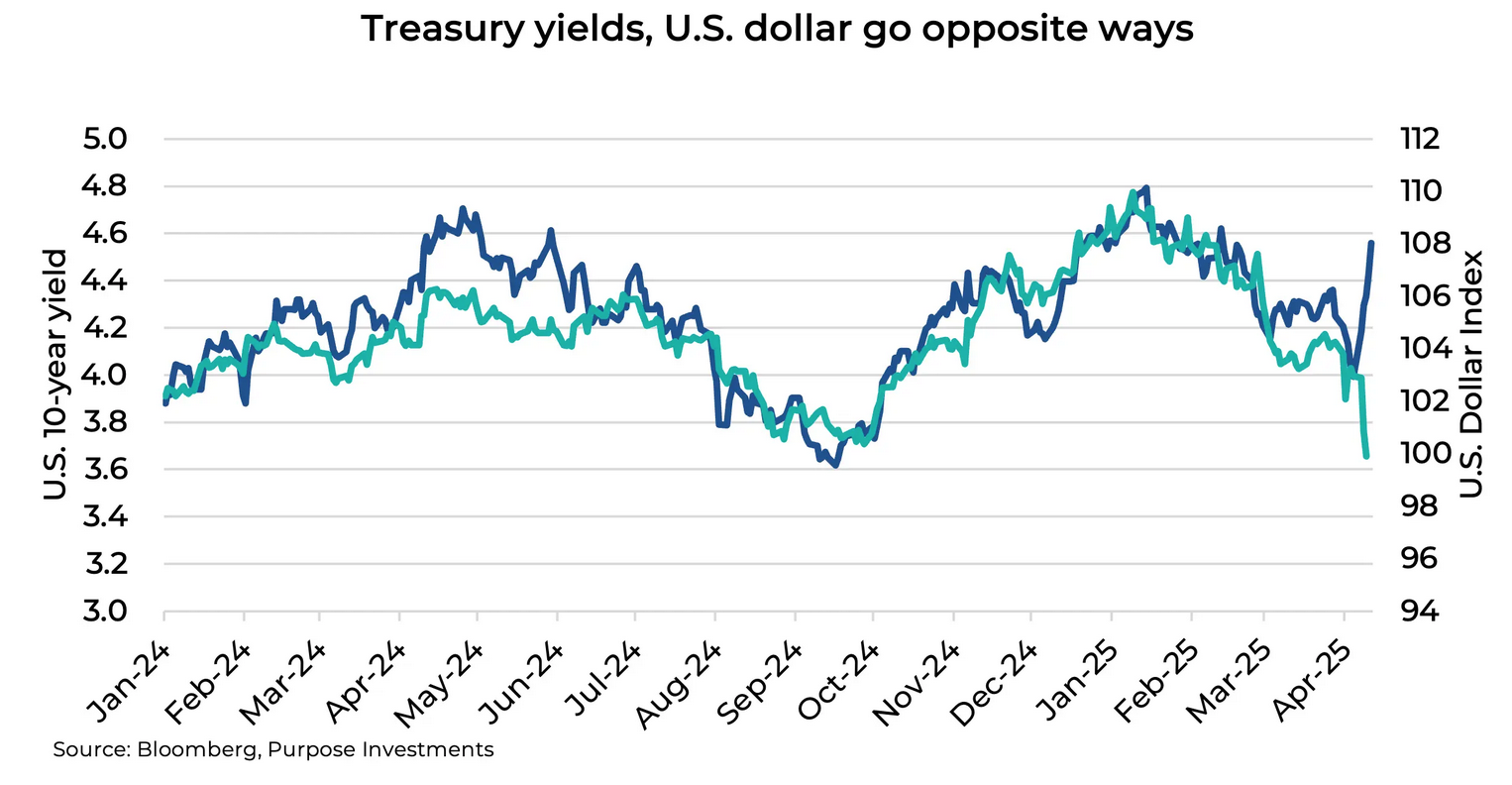

Reading through the noise is important, but the most interesting event this week was not in the stock market but in the bond market. The recent surge in U.S. Treasury yields, notably the 10-year yield climbing to 4.50%, is reportedly what caught Trump’s attention and brought about his change of heart.

The rise in yields has been attributed to several key factors. President Trump's implementation of broad tariffs led to market volatility and rising inflation fears, prompting investors to sell off Treasuries, which inversely caused yields to rise. Additionally, the unwinding of the "basis trade" – a leveraged hedge fund strategy exploiting price differences between Treasury bonds and U.S. interest rate swaps – contributed to market instability as these massive trades were stopped out. This strategy's collapse forced hedge funds to liquidate positions, further driving up yields.

The intraday peak for the 10-year marks the highest the yield has been since the weeks after Trump first took office. Bonds have not really acted like haven assets yet, and neither has the U.S. dollar, which has broken down despite yields rising. If the economic environment does indeed soften to the point of an economic contraction, we would expect Treasury yields to fall from current levels. However, another narrative has taken hold, at least temporarily – the decline of the U.S. as a safe-haven destination.

Final Thoughts

Diversification is still important; it’s a message we try to reiterate as often as possible during times like these. This doesn’t just apply to stocks and bonds but to the entire allocation of diversifiers. It’s important to have some bonds, and duration can be your friend in a real growth scare.

But bonds aren’t the only form of defence. Gold might be boomer Bitcoin, but it hit a new all-time high on Friday and continues to shine. Within multi-asset portfolios, we also advocate for a diversity of products that can further reduce volatility. Option writing funds tend to shine during periods of elevated volatility, as well as tactical strategies that can dynamically adjust to market conditions.

No two corrections or bear markets are ever the same. What protected investors best previously might not work quite as well the next time, which is why diversity is the winning strategy.

— Derek Benedet is a Portfolio Manager at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L. P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Copyright © Purpose Investments