by Jeffrey Rosenberg, Managing Director, & Team Systematic Fixed Income, BlackRock

Key points

- Heightened fiscal, trade, and policy dynamics challenge the performance, stability, and diversification potential of 60/40 portfolios.

- Strategies that look beyond directional market opportunities to take advantage of return sources of dispersion in idiosyncratic risk may help rebuild portfolio resilience.

- We highlight two strategies as potentially better ways to play stocks (BDMIX) and bonds (BIMBX) in this new regime.

The 60/40 portfolio, where 60% is invested in stocks and 40% in bonds, is the initial starting point for many portfolios. The exact asset mix is often adjusted based on an investor’s time horizon, risk tolerance, and financial goals, but the simple, proportional stock-bond combination is what is often considered a “balanced” portfolio.

But in recent years, the driving forces behind the success of the 60/40 have come under pressure, first with post-COVID inflation uncertainty, and today with heightened fiscal, trade, and policy changes. What does this mean for portfolio construction? Rebuilding portfolio resilience may require more dynamic alternatives to traditional stock and bond allocations.

The 60/40 portfolio today

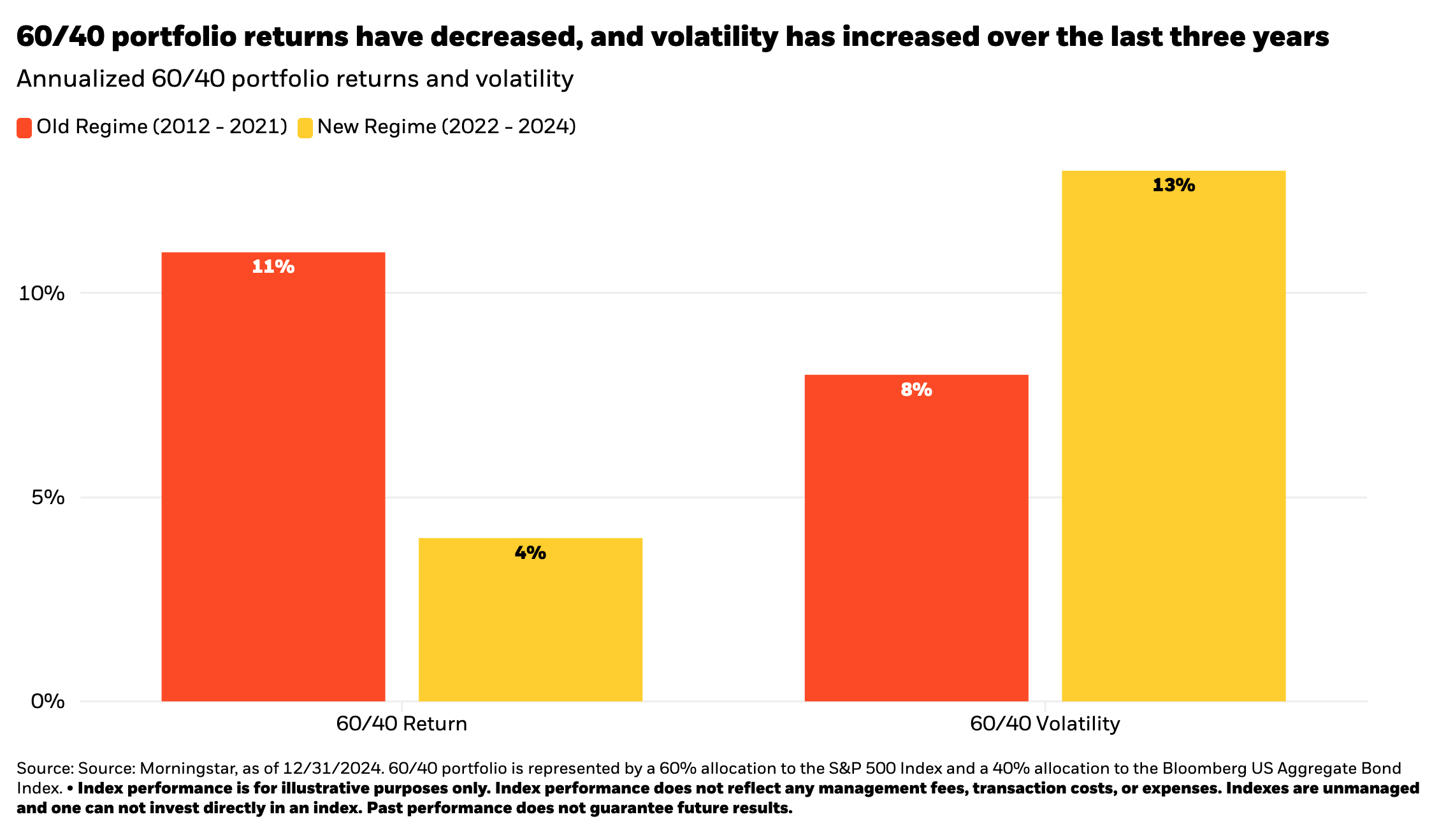

The shift to a world of higher overall interest rate volatility amid greater macroeconomic, policy, and market uncertainty is shaping a new regime for investing. The below chart highlights the impact on 60/40 portfolio outcomes, showing reduced return potential and increased volatility over the last three years relative to the previous decade.

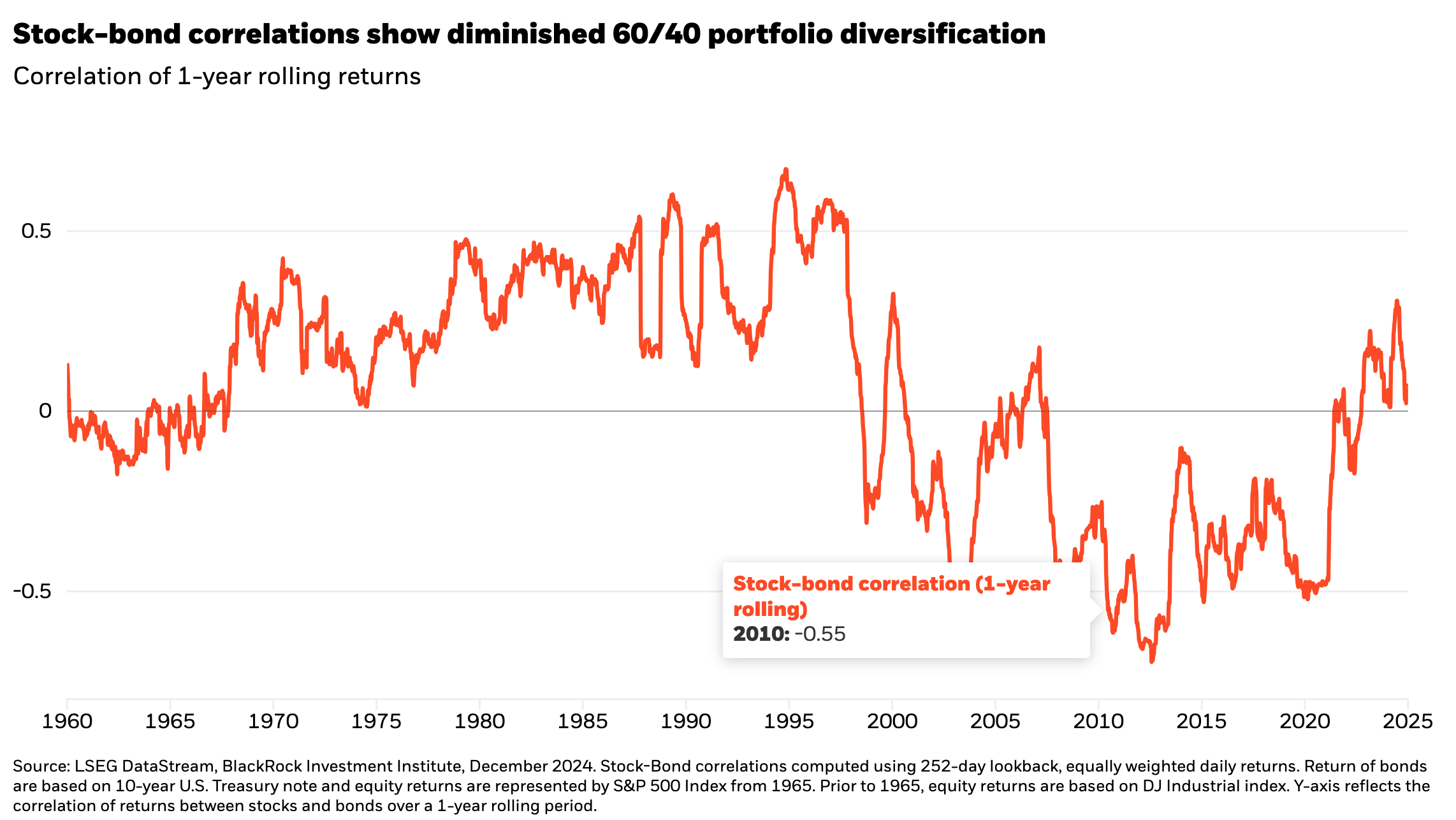

These characteristics of the “new regime” also challenge the diversification of 60/40 portfolios. The chart below shows the rise in stock-bond correlations from consistently negative levels that persisted for over a decade following the Great Financial Crisis (and mostly negative for the decade prior). Among other factors, the transition from an environment of inflation remaining below the US Federal Reserve’s 2% target to the current backdrop of above-target inflation has challenged this diversifying relationship. Since the start of 2022, bonds have lost money in 14 of the months where stocks were negative, with the US Aggregate Bond Index participating in nearly half the downside of the S&P 500 Index on average.1

The hedging efficacy of bonds has also become more nuanced over time, highlighting the importance of where investors hold duration exposure along the curve. For example, despite the start of the Fed’s rate-cutting cycle last year, long-term yields increased due to factors such as inflation and rising term premia. These dynamics dominated the direction of long-end rates, leaving them less responsive to the path of Fed policy than in past cutting cycles. This has made it so that simply owning traditional bonds hasn’t delivered the same performance and hedging results as historically.

A more granular view of stock-bond correlation broken down by maturity shows a higher degree of ballast in shorter-term bonds where inverse yield movements have been the strongest during recent risk-off episodes. We did see a return of longer-term bonds providing ballast as recession fears emerged in Q1 of 2025,2 reflecting the expectation for policymakers to swiftly react to any weakening in the economy while tolerating above-target inflation.

But overall, the potential for continued sticky inflation, rising term premia from historically suppressed levels, and the impacts of fiscal and broader policy dynamics may continue to undermine the performance and hedging efficacy of longer maturities. However, we should also note the potential that a more significant increase in long term interest rates could prompt a larger fiscal and/or monetary policy response that attempts to contain the term premium widening. The prospects for stagflation where longer-term yields rise with higher long-run inflation expectations (while shorter-term bonds follow the Fed policy trajectory) underscores the importance of where interest rate exposure is held.

In addition to these implications for bond market performance and diversification, today’s uncertain and challenging macroeconomic and policy backdrop will likely remain a source of volatility in the stock market with the potential for frequent market reversals and rapidly shifting narratives ahead. This type of investment backdrop creates an opportunity to rethink portfolio allocations by looking beyond broad market index exposures and beta-tilted strategies.

Rebuilding portfolio resilience with new return sources

One approach is considering alternatives to stocks and bonds that are less dependent on the overall direction of markets to generate returns. For example, a strategy that can invest long and short across the stock market can target a different and diversifying return source that isn’t captured in the traditional 60/40 construct.

This alternative return source is called dispersion, which is the difference in individual security returns across the market. Factors like higher interest rates and macroeconomic uncertainty have contributed to a world shaped by higher dispersion in company results, creating a rich opportunity set for long/short alpha strategies at a time of potentially more muted directional market returns.

Long/short strategies take advantage of cross-sectional dispersion by forecasting which stocks will outperform and underperform on a relative basis—regardless of whether overall markets are rising or falling. The result is a return stream that can be uncorrelated to broad markets with the potential to enhance the “60” or the “40” of portfolios depending on the goal of the strategy.

Better ways to play stocks and bonds?

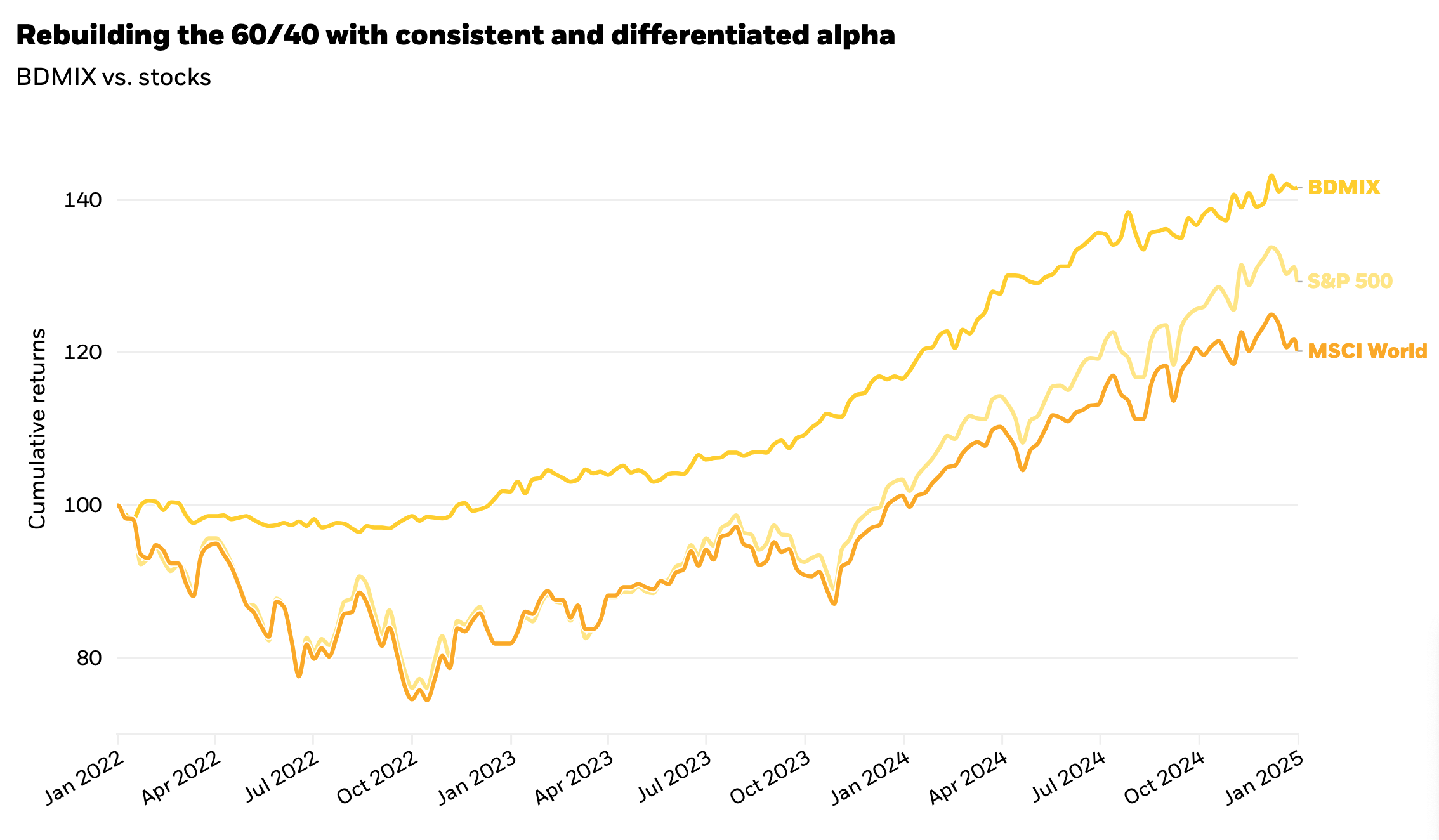

Rebuilding the 60: Our Global Equity Market Neutral Fund (BDMIX) seeks to generate consistent stock-like returns with less volatility and a near-zero correlation to the market. The strategy invests across ~7,000 global equities with a relatively even split of long and short positions, leveraging data-driven insights to dynamically adapt and exploit relative winners and losers as markets evolve.

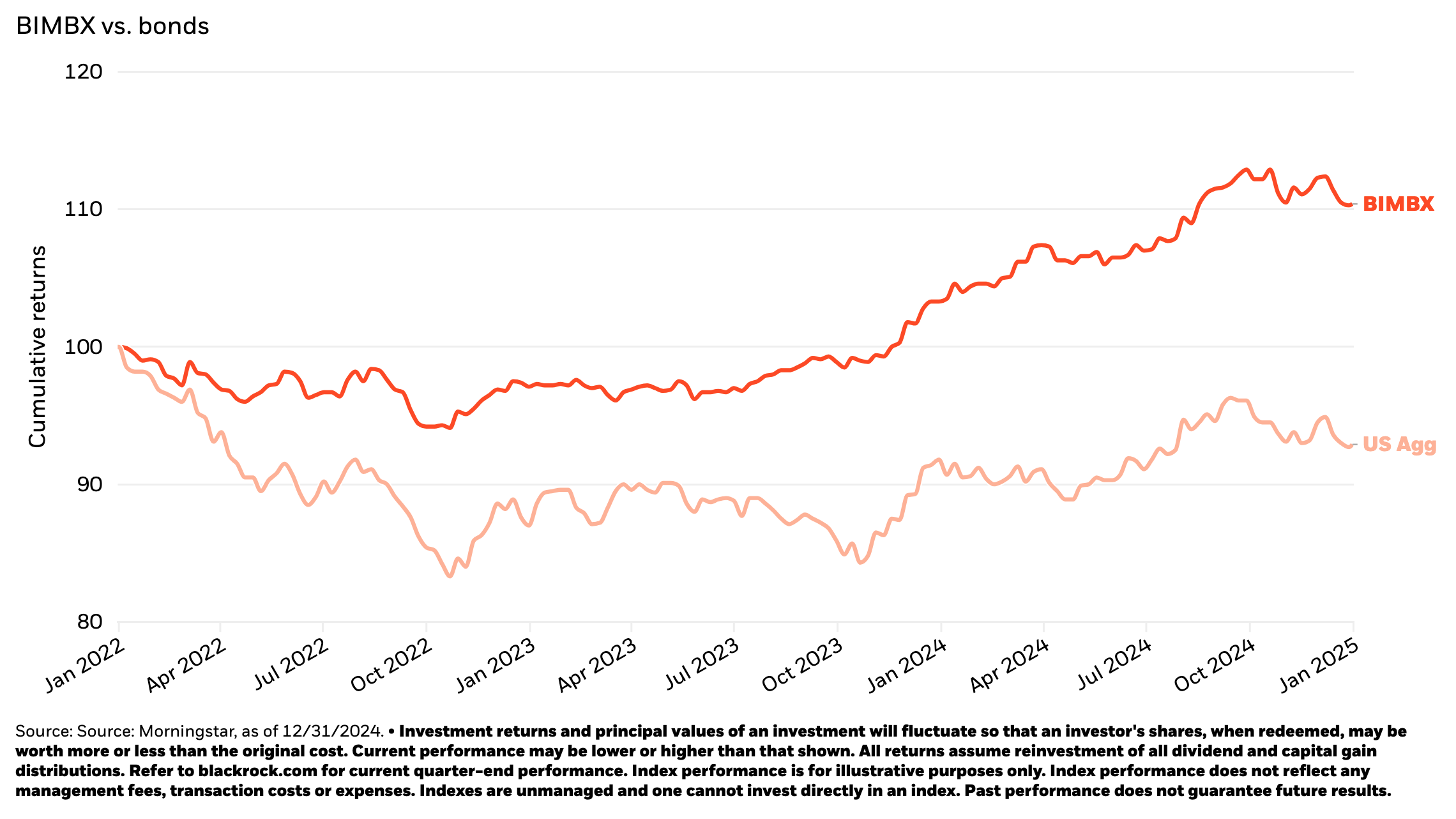

Rebuilding the 40: Our Systematic Multi-Strategy Fund (BIMBX) is designed to be a better way to play fixed income, targeting outperformance with less volatility compared to traditional bonds. We do this by combining directional fixed income exposure with long/short alpha strategies. The alpha component provides an uncorrelated, defensive return stream that adds an alternative source of diversification to traditional duration.

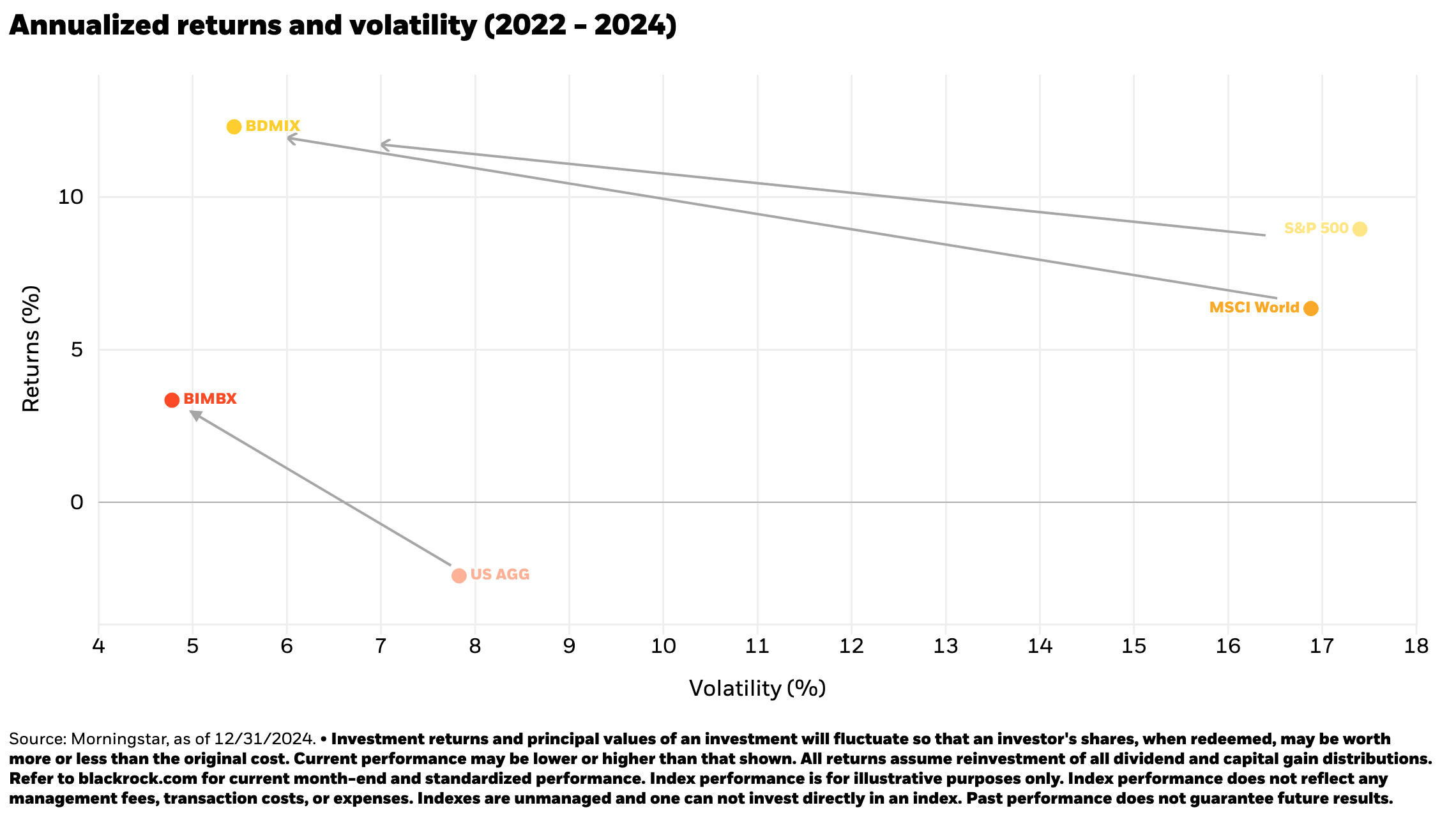

These strategies share the common link of harnessing cross-sectional opportunities, capitalizing on today’s elevated dispersion to enhance return potential and consistency while boosting portfolio diversification. The below charts show how over the last three years, these flagship strategies have consistently outperformed stocks (for BDMIX) and bonds (for BIMBX) across a wide range of market environments.

Importantly, these results have been achieved with less volatility than their traditional asset class counterparts. The low correlation between BDMIX and BIMBX (0.11 as of 12/31)3 suggests they have the potential to be complementary when used in the same portfolio.

Rebuilding resilience in 60/40 portfolios

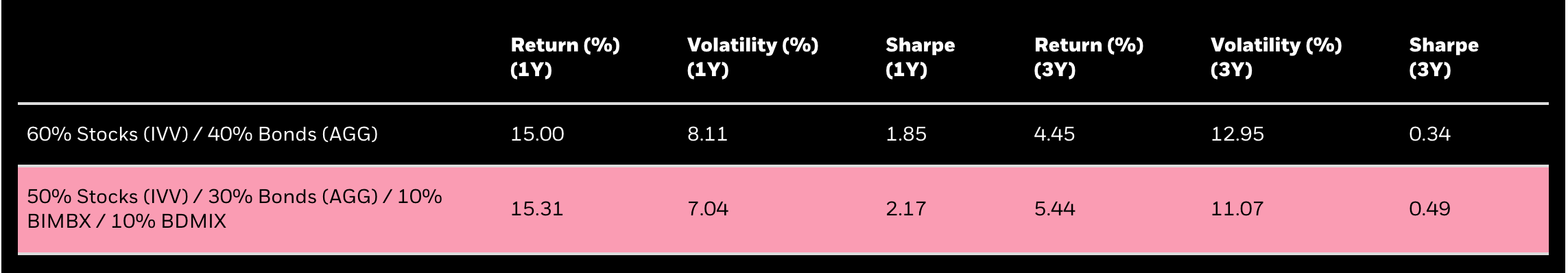

The below table illustrates the impact of adding 10% allocations to BDMIX and BIMBX, sourced from stocks and bonds, respectively. Compared to the 60/40 allocation, the “redesigned” portfolio has generated higher returns with lower volatility and more efficient risk usage (higher Sharpe ratio) over the 1- and 3-year periods.

Putting it all together

The 60/40 portfolio faces challenges in the new investment regime. Portfolios have become more volatile while diversification and return potential have decreased over recent years. Investors can build more resilient portfolios by considering different ways to play stock and bond markets—for example incorporating strategies that take advantage of new and differentiated return sources. These alpha-seeking strategies have the potential to turn market beta headwinds into tailwinds, taking advantage of higher volatility and dispersion to enhance portfolio outcomes.