by David Wheeler, CFA, Erin Bigley, CFA, Ian McNaugher, CFA, Jayme Lisiewski, AllianceBernstein

Though the new US policy focus is on oil and gas, wider opportunities still beckon.

Abundant low-cost energy is foundational for President Trump’s program. Yet, while his initiatives to fast-track oil and gas development have grabbed the headlines, they’re only a part of the energy picture. We believe equity investors will continue to find good opportunities in renewable energy and particularly in the infrastructure for electricity transmission and storage.

Power Needs Are Growing

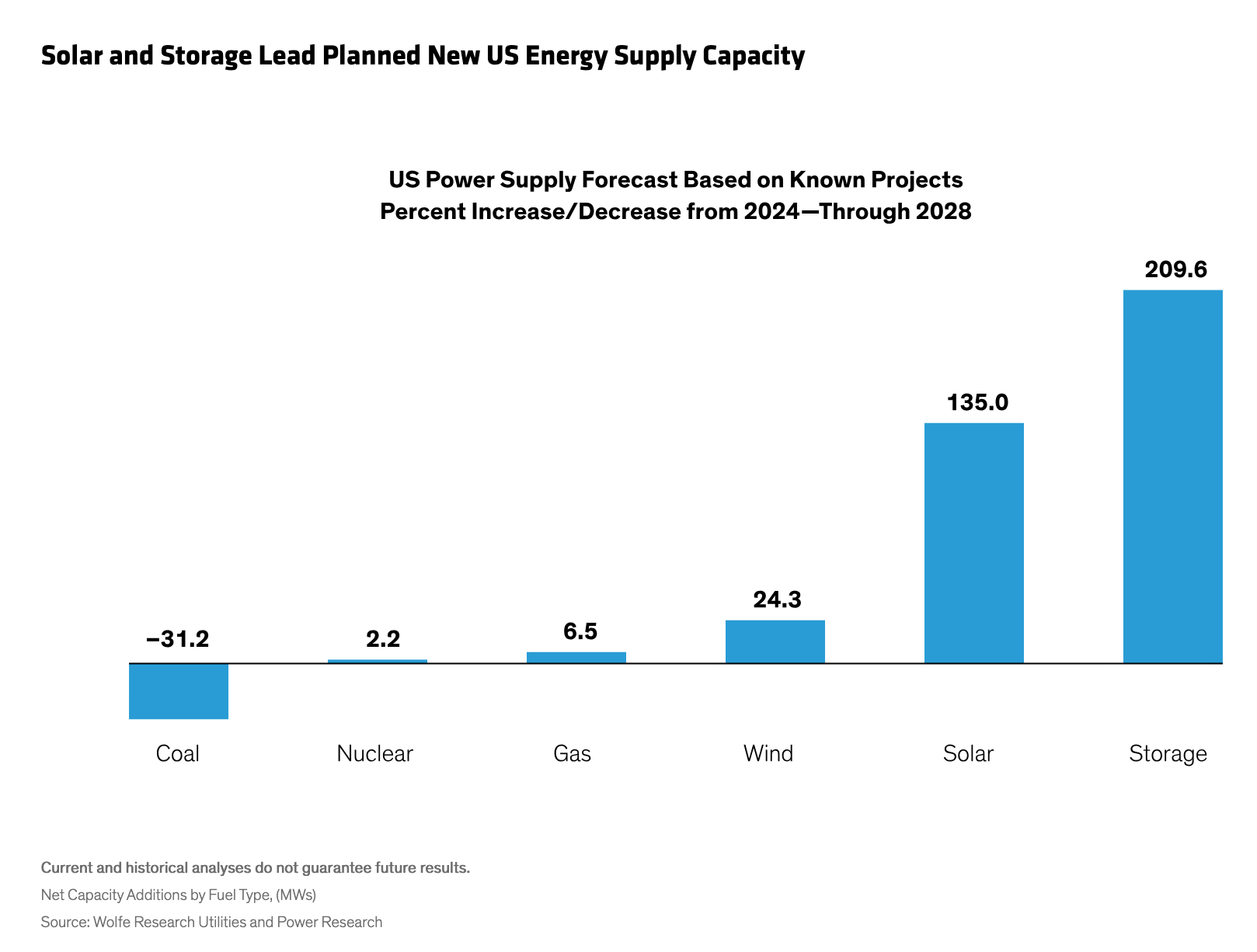

Power needs in the US and across the world are growing at a pace and scale that require multiple power generation solutions. Renewable energy projects are set to become a much larger part of the mix because of two key advantages: low costs and speed to market. Though recent policy changes in the US—and budget pressures across Europe—may temper that trend, they won’t stop it, in our view (Display).

The Need for Speed

Speed to market is an important consideration. In the US, for instance, AI is substantially increasing power demand at a time when significant amounts of coal-fired power generation are being retired: the vast majority of coal plants are too old and costly to run. Wind and solar are often the only viable replacements for two reasons: first, they can come onstream fastest; and second, even without subsidies, they are cost-competitive—when paired with battery storage—versus carbon-based alternatives. In addition, equipment costs are the lowest they’ve ever been, and the cost of producing clean power continues to fall across the globe.

All else equal, a loss of government subsidies for renewables would make gas relatively more attractive. But wind and solar would remain viable just based on economics, in our view. We also believe the new US policies will likely be less damaging than feared for low-carbon solutions. In particular, we don’t expect a full repeal of the Inflation Reduction Act (IRA) which provides significant federal funding / tax incentives across renewables, other clean technologies and electricity transmission. (The IRA has created many jobs across the US, too.) State-level and utility spending will also likely remain robust, favoring utility-scale, commercial and industrial, and community projects.

Look Beyond Familiar Investment Opportunities

Of course, the path to renewable profits and returns hasn’t been smooth. For example, some renewable developers have been badly hurt by post-COVID interest-rate rises and cost inflation, and even at current share price levels we believe investors should be highly selective in this subsector. But the scale and breadth of developments in the power transition are often underestimated, in our view. We think these dynamics are creating major opportunities in electrification and energy efficiency.

Energy Infrastructure Needs Upgrading

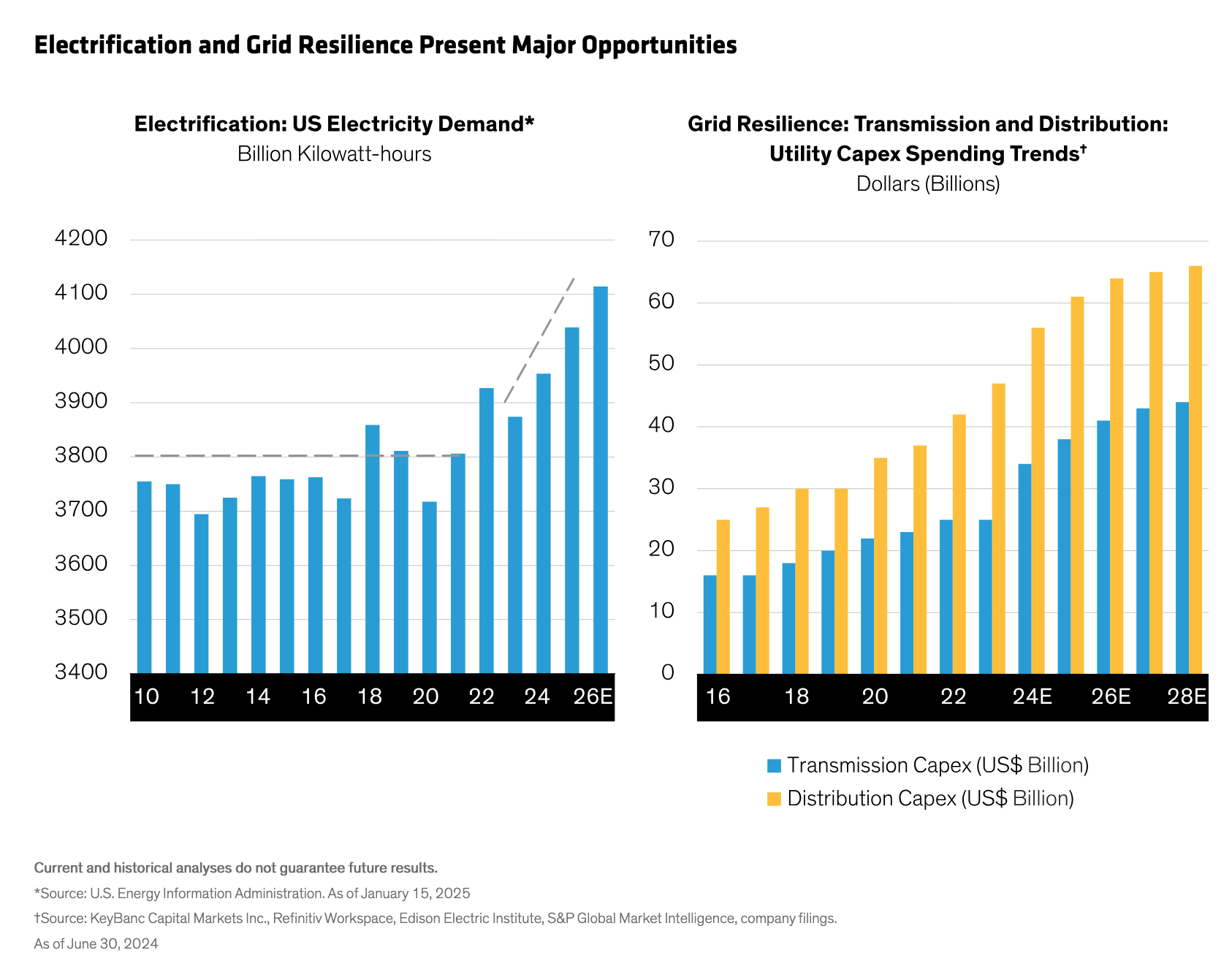

Upgrading and reinforcing electricity grids will be a particularly important focus. In the US and across the developed world, grids are approaching or have exceeded their planned life but need to carry massively increased loads, especially considering AI-related power demands and the increasing need for grid resilience to mitigate climate, geopolitical and other risks.

The push for energy efficiency, the increase in data centers and local regulations are all driving electrification.

Companies such as Prysmian (copper and fiber cables, systems and accessories), Hitachi (cables and transformers), Hubbell (cable distribution) and Schneider (“smart grid” solutions to improve grid reliability and flexibility) have all benefited from grid spending. Their markets have backlog visibility extending several years ahead. US policy changes that encourage reshoring will also benefit stocks involved in the push for electrification. But investors will need to be selective—not all component suppliers benefit from the same competitive advantages.

Watch Points for Investors

Investors in these industries should pay particular attention to companies’ operational efficiency metrics as well as identifying which regulations, tailwinds and headwinds are material for their prospective investments.

Given the global nature of many of these businesses, it’s important to ensure that companies across the supply chain provide adequate data disclosures. Countries outside the US may have stringent sustainability requirements that require companies with supply chains in their jurisdictions to comply with local sustainability regulations. Offenders may face fines and greater difficulty raising capital.

Selectivity Is Key

Some of the early optimism around clean energy companies has dissipated, and new US policies may have a negative impact in specific areas. That said, the power transition is still very much underway and continues to offer a wide range of opportunities.

For investors, the keys to success will be thorough analysis and continued vigilance. That means investors must focus not only on the business models and fundamentals of their selected companies, but also how the businesses are affected by the evolution of regulation and government policies.

Copyright © AllianceBernstein