by Craig Basinger, Purpose Investments, David Benedet, Portfolio Manager, Purpose Investments

Now, it is still too early to tell if we are out of the current inflationary episode. Domestically, as well as across other developed international countries, inflation remains a concern. Given the current level of macroeconomic uncertainty, tariffs/retaliatory tariffs, and renewed nationalism, rising cost pressure remains a key concern for households as well as businesses. Trying to follow the increasingly vocal ‘Buy Canada’ mantra certainly isn’t going to help the wallet. Inflation expectations have been rising, and two-year breakeven rates are now back above 3%, up 154bps since September.

With inflationary pressures back on the rise, inflation ‘proofing’ portfolios remains popular. It’s impossible to talk about inflation protection and not mention real assets. It is an age-old market truism, in fact, that real assets, in particular commodities, are a standout asset class for inflation protection. The only issue with old market sayings is that they are not always entirely true.

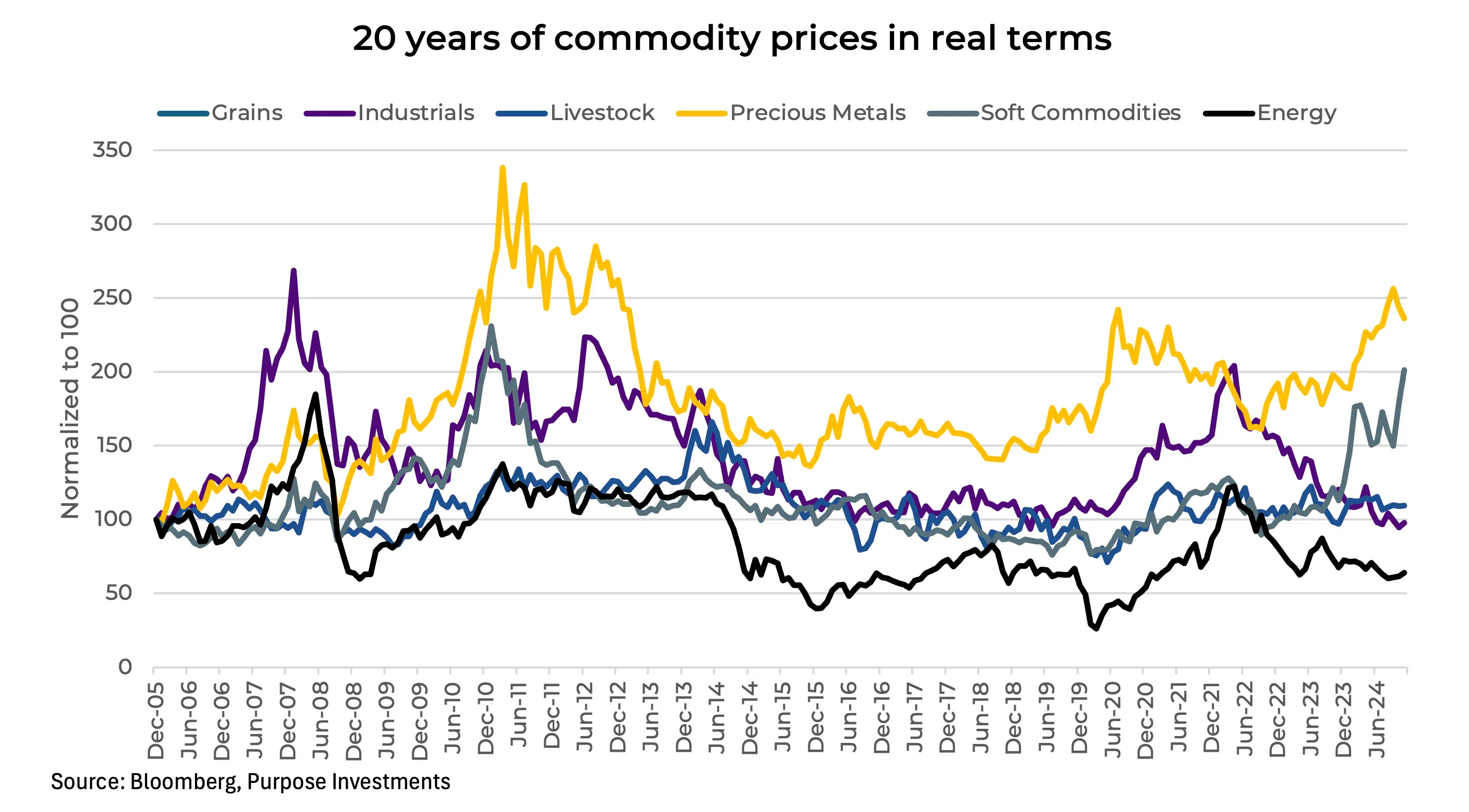

In the chart above, we have plotted the real price performance of twenty major commodities grouped into key categories. A few insights stand out immediately:

One, commodities are cyclical, meaning they move in defined cycles. They are not buy-and-hold forever investments.

Two, commodities are volatile. Within a short period of time, commodities surge higher then subsequently crash back down.

Finally, not all commodities are good inflation hedges. In fact, over the past twenty years, gold and precious metals appear to be the only commodities that have done an admirable job protecting purchasing power and increasing in real value.

In real terms, energy, grains, and industrial metals have all lost value over the past twenty years. Natural gas certainly skews the energy complex, with Henry Hub gas prices down 75% in real terms. We all like to complain about the price of gas. However, in real terms, a barrel of West Texas Intermediary is down nearly 30%. Grains have held onto their value, with the basket only down a couple percent in real terms. Soft commodities have done well recently, but it’s not an inflation protection story; it’s supply-driven circumstances driving coffee prices up nearly twofold in the past year. Each commodity market reacts to its own idiosyncratic supply and demand circumstances.

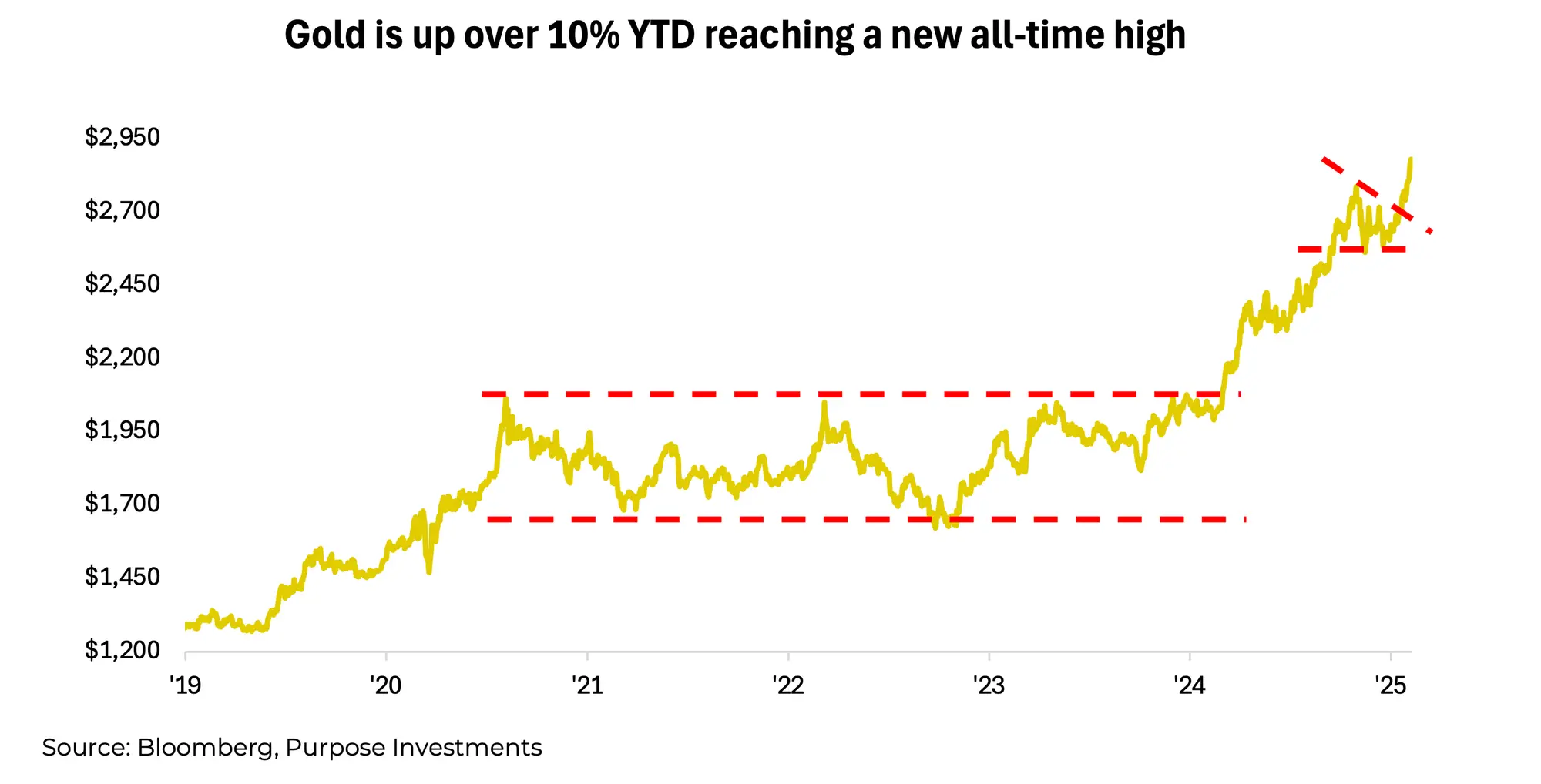

To broadly state that commodities are great inflation hedges is not entirely correct. Over the long term, many commodities do not broadly hold up against inflation. Simply holding up to inflation is a very low bar to begin with, and many can’t even get past that. Gold and precious metals are an exception. Gold should be the preferred choice when the aim is for longer-term inflation protection. You also get the added benefit as one of the de facto safety trades. Despite equity markets showing little regard to surrounding market uncertainty, gold, the original fear index, has been surging, up over 10% so far this year to reach new all-time highs. With few other headlines behind this advance, which coincides with a surging U.S. dollar, it does leave us wondering what the gold market is trying to tell us.

Gold very often moves ahead of inflation, so perhaps there is another upward move coming for general prices. Then again, the list of reasons gold has been rising is plenty – from Chinese buying to fear over all the political headlines. Our view has remained consistent: the inflationary spike exacerbated by the pandemic reverberations would fade in 2024. But inflation would not go back down to previous levels due to structural factors and would become a more volatile recurring problem during the coming years.

Perhaps it is coming back now.

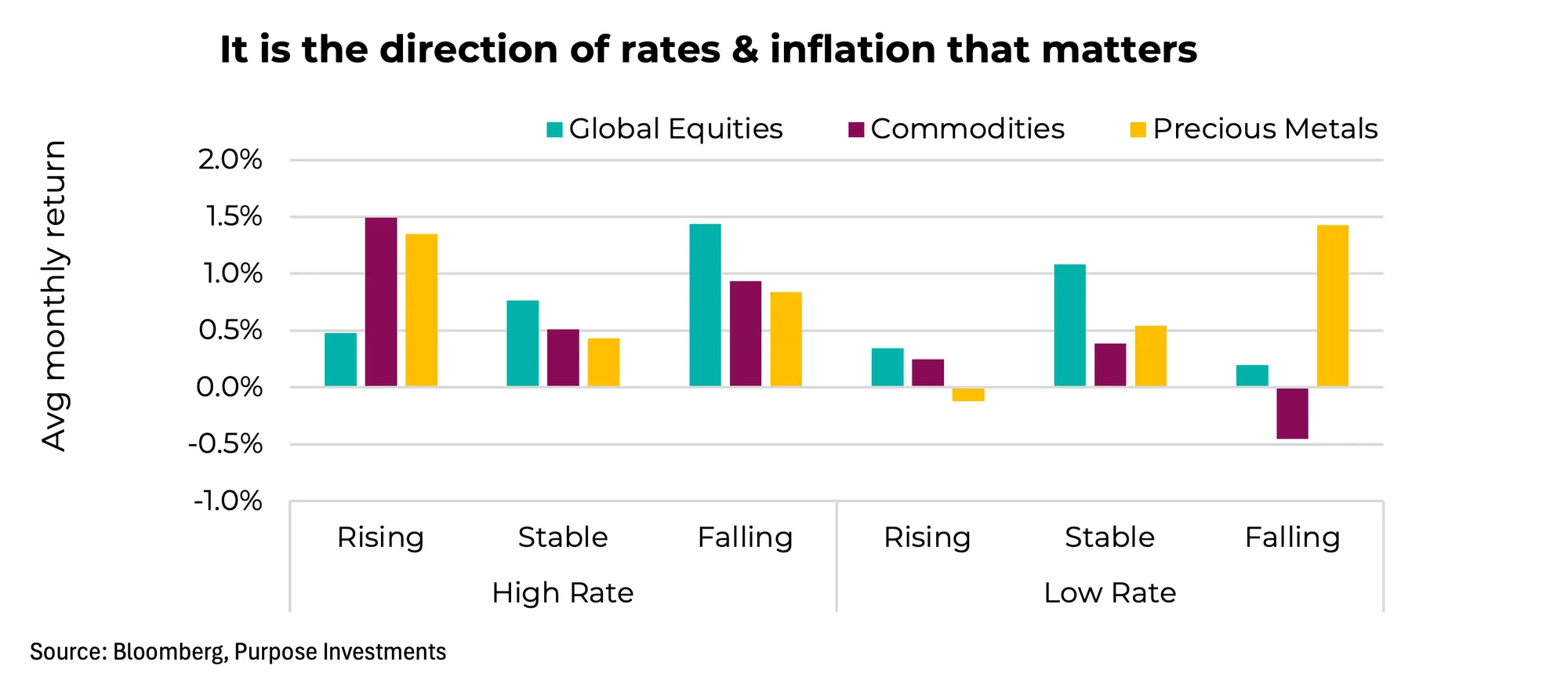

The good news for commodities today is that rates are high. During high-rate periods, commodities and gold tend to do better than in low-rate environments. And if we get a surprise resurgence of inflation, rates will tick higher, which is even better for commodities. The chart below slices returns into high- and low-rate environments, then breaks things down based on the direction of rates.

Final Thoughts

During periods of elevated inflation or higher rates, commodities do tend to perform well, adding value to a portfolio. And that does appear to be the current market environment. Still, commodities should not be viewed as a static allocation given that long-term inflation protection is limited and cyclicality is high. Gold does appear better, with less economic cyclicality and a safe haven factor. But at $2,850/oz, this party has been going on for a while.

One additional consideration: the TSX carries a good amount of gold exposure (8%) and other commodity exposure (20%). This is one of the reasons the TSX tends to often outperform broader equity markets in higher inflationary environments.

However you get your inflation protection, at this time, we continue to believe some is warranted in portfolios.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

— Derek Benedet is a Portfolio Manager at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L. P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.