by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

- Labor market - The December US payroll report surprised but provided more evidence that the labor market isn’t driving inflation.

- Tariff talk - Any Trump administration tariffs are likely a one-time price shock, not the start of a new inflationary trend, in my view.

- Stock valuations - S&P 500 valuation metrics are elevated, mainly driven by a handful of stocks that are a sizeable percentage of the index.

The best laid plans of mice and men. Above the Noise had been slated to begin with a conversation on inflation. It’s just my luck that our publication date coincided with DeepSeek, a Chinese artificial intelligence (AI) firm, announcing that it had released an open-source AI model that took only two months and less than $6 million to create.1 Those claims would be far less than the hundreds of billions of dollars that American tech giants such have poured into developing their own models. American businessman Marc Andreessen called it the “AI Sputnik moment.”

Admittedly, I’m not the world’s foremost expert on what’s required to build a large language model, but I’ll offer a few thoughts:

1. The initial headlines may not capture the full story. The reality likely lies somewhere between DeepSeek's $6 million claims, and the billions being invested by the US AI companies.

2. The stocks of many of last year’s high-fliers were hit hard by the news, including but not limited to those companies providing the tools, semiconductor chips, electricity, data storage, and cooling systems to develop and operate AI systems.

3. It’s not all bad news. Think of the possibilities! If DeepSeek represents a game-changing direction in development costs of AI, then it should be beneficial across the economy and broad market.

And now back to our regularly scheduled program.

“Life is like being at the dentist. You always think the worst is still to come, and yet it is over already.” Otto von Bismarck’s quip comes to mind as I think about the recent teeth-gnashing from investors amid a modest pickup in market volatility.

Perhaps we had grown too accustomed to the benign market environment that emerged in 2024 as inflation waned and policy clarity improved. Not long ago, investors were anticipating that the US Federal Reserve (Fed) would cut interest rates six times by the end of this year.2 Fast forward to a few strong economic data releases and inflation remaining at the upper end of the Fed’s perceived “comfort zone,”3 and all but one of those rate cuts have been priced out of the market.4 The new presidential administration’s tariff and immigration policies likely compounded the uncertainty. And as I’ve said before, market drawdowns and volatility are almost always the result of policy uncertainty.

That brings me back to Bismarck. If the market has already priced out the rate cuts, wouldn’t that suggest that the policy uncertainty and market volatility are over already and that the worst isn’t to come? I suppose that could be false hope, and investors may need to brace themselves for additional volatility, but I suspect we know this drill (all puns intended, #dadjokes).

It may be confirmation bias but…

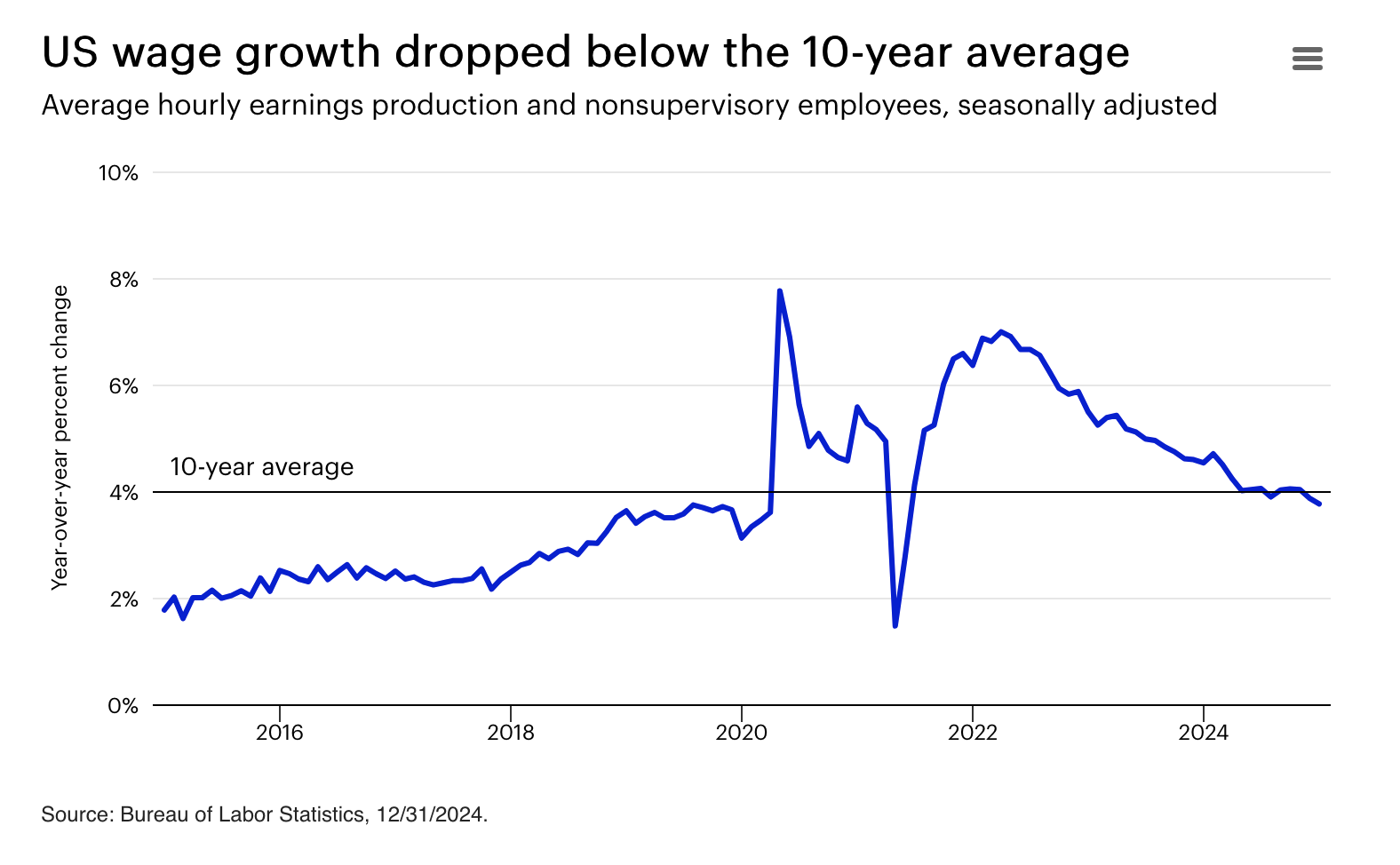

…the inflation concerns are likely overdone. The December US payroll report may have been a big surprise, but it provided further evidence that the labor market is not a significant source of inflation.5 Wage growth for non-managerial employees came in at the lowest since 2021 and is below the 10-year average.6

Remember the sticky shelter inflation? It should have come as no surprise that shelter inflation had been sticky. It’s not as if rents reset daily. It was going to take time. The growth in owners’ equivalent rent — what a homeowner would pay if they rented their home — has been trending lower and appears to be moving toward its long-term average.7

Since you asked (part 1)

Q: How concerned are you about the return of the bond vigilantes?

A: Many investors sound like the little girl in Poltergeist II: “They’re back.” Admittedly, I never saw that sequel, so I can’t tell you how it ends. Accidentally seeing the first one while still in grade school was distressing enough for me, but I digress.

I find it hard to believe that the recent spike in the 10-year US Treasury is a sign that the bond vigilantes are back to bully the fiscal policymakers. Rather, long-term Treasury rates appear to be following the lead of the Fed. Long rates plunged in the fall when the Fed pivoted from its tightening stance.8 Long rates surged in the winter as strong US nominal growth diminished rate cut expectations.9 I expect the bond market to continue to reprice based on US nominal growth and its impact on Fed expectations, not on the fiscal health of the country. A few weaker-than-expected economic data releases are likely all it would take for investors to forget about the bond vigilantes.

Since you asked (part 2)

Q: How can you be optimistic about US stocks with valuations as elevated as they are?

A: Valuations are not timing tools. Starting valuations have tended to have almost no relationship to short- to intermediate-term returns.

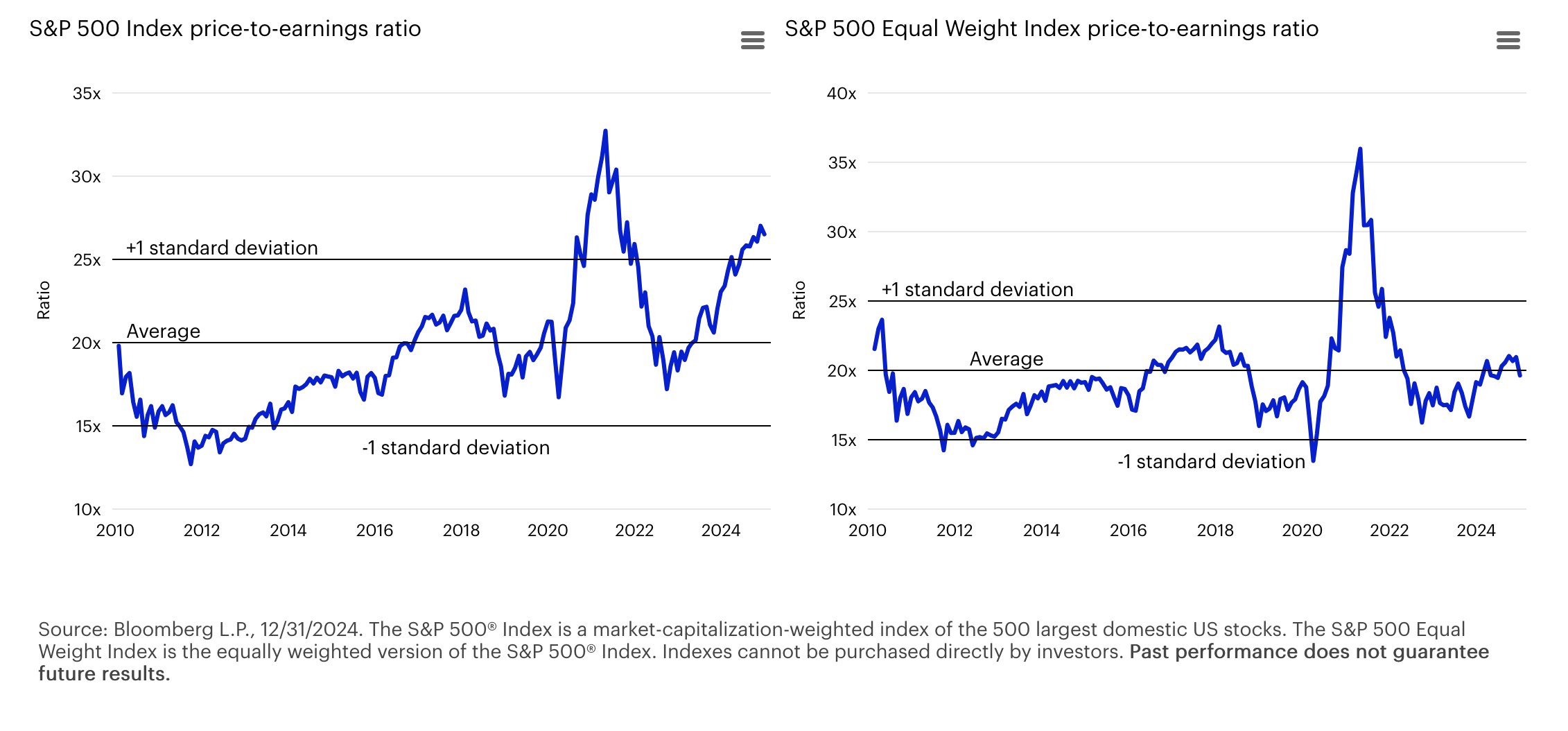

Further, while it’s true that the valuation metrics, such as the price-to-earnings ratio of the S&P 500 Index, are elevated, much of that is being driven by a handful of stocks that represent a sizeable percentage of the index. If you take the same 500+ companies and weight them equally, then the valuations are trading more in line with history.10

It was said

“…the United States is not going to default on its debt if I am confirmed.”

– Scott Bessent

Unnecessary reassurances make me uneasy. Nonetheless, I’ll take the word of Bessent, Trump’s nominee for US Treasury Secretary. The comment came after Bessent proclaimed that he wouldn’t support eliminating the debt ceiling. Alas, the nation’s least favorite pastime — the periodic debates over whether to raise the debt ceiling — will continue. Never mind that the US is only one of two nations to have a set nominal debt limit,11 nor that raising the debt limit allows the government to finance obligations that were made in the past. The political games of chicken will continue. Ultimately, we expect the nation’s political leaders to take the necessary steps to stave off financial crisis.

Phone a friend

Bitcoin has already risen by more than 40% since the 2024 election, surpassing the $100,000 mark.12 Why do many believe that the bull market in cryptocurrencies is just getting going? I asked Invesco’s resident expert on digital currencies, Ashley Oerth. Her response:

“The bull case is predicated on the sound macro backdrop as well as improving sentiment for the asset class.

1. President Donald Trump has signaled a slew of crypto-friendly policies, including his desire for a strategic bitcoin reserve and the installation of crypto-friendly policymakers at the Securities and Exchange Commission and the Commodity Futures Trading Commission.

2. Investing in cryptocurrencies is getting easier. The launch of spot bitcoin exchange-traded funds made investing in bitcoin more readily available to more investors.

3. There’s a favorable market backdrop. Resilient US growth coupled with potentially lower US policy rates will likely support a risk-on year in markets.

4. Tokenization is building momentum. We believe that today’s financial system will likely realize multiple benefits through tokenization, such as reduced counterparty risk, faster payment and settlement, and improved customizability in client investing experiences.”

Politics with mixed company

I spent the last year telling investors that elections haven’t historically mattered much for markets. It’s been somewhat validating that the so-called “Trump trade” dissipated quickly. The S&P 500 Index has been essentially flat since the election, as investors rightfully turned their attention away from politics to US growth and the path of monetary policy.

Above the Noise is getting a lot of questions about tariffs, so here are a few points to consider:

- I believe tariffs should be seen as a one-time price shock rather than the start of a new inflationary trend. In 2018, there was a noticeable price increase in tariff-affected categories, but the prices of other core goods remained unaffected.13

- Tariffs are expected to result in less optimal economic outcomes but are unlikely to drive the US economy into a recession. A bigger risk to the economy is a prolonged period of uncertainty related to trade policy, which could hinder “animal spirits” and result in declining activity.

- Risk assets were challenged during the prolonged trade war in 2018, only for the bull market to continue once greater clarity regarding the terms of trade emerged.14

On the road again

My travels took me to Atlanta, Georgia, where I was fortunate to be invited to an event at Truist Park, home of the Atlanta Braves. The cold snap in the area prevented me from spending much time on the field. I was able to meet Derek Schiller, the president and CEO of the Atlanta Braves, and hear his philosophies on innovation, customer service, and client engagement, which resonate across industries. Schiller appeared to take joy in mixing it up with the New York sports fans. I’m always up for some good ribbing.

Footnotes

1 DeepSeek, 1/25.

2 Source: Bloomberg L.P. Based on Fed Funds implied rates in September 2024.

3 Source: US Bureau of Labor Statistics, 12/31/24. Based on the US Consumer Price Index.

4 Source: Bloomberg L.P., 1/16/25. Based on fed funds implied rates.

5 Source: US Bureau of Labor Statistics, 12/31/24.

6 Source: US Bureau of Labor Statistics, 12/31/24.

7 Source: US Bureau of Labor Statistics, 12/31/24.

8 Source: Bloomberg L.P. The 10-year US Treasury rate fell from 4.70% in April to a trough of 3.62% in September.

9 Source: Bloomberg L.P. The 10-year US Treasury rate climbed from a trough of 3.62% in September to a recent peak of 4.79% in the middle of January.

10 Source: Bloomberg L.P., 1/16/25. Based on the price-to-earnings ratio of the S&P 500 Index and the S&P 500 Equal Weight Index.

11 Source: World Economic Forum, “The US has just lifted its debt ceiling - but what is it?,” 6/8/2023. The other one is Denmark.

12 Source: Bloomberg L.P., as of 1/16/25.

13 Source: US Bureau of Labor Statistics, 12/31/24.

14 Source: Bloomberg L.P., 12/31/24. Based on the returns of the S&P 500 Index in 2018 and 2019.