by Frank Holmes, CEO, CIO, U.S. Global Investors

At the start of every year, we publish our popular Periodic Table of Commodity Returns, an interactive infographic of the gains and losses across the commodities market. Gold stood out as a bright spot in 2024, delivering one of its best annual performances in over a decade, while industrial and agricultural commodities faced significant challenges.

Up an eye-popping 27.2% last year, gold’s performance made clear its enduring role as a safe haven. Central banks continue their aggressive purchases, seeking diversification in an increasingly uncertain global economy. Meanwhile, inflationary pressures and a growing U.S. deficit have further boosted the appeal of the yellow metal, helping it outpace the S&P 500 in 2024.

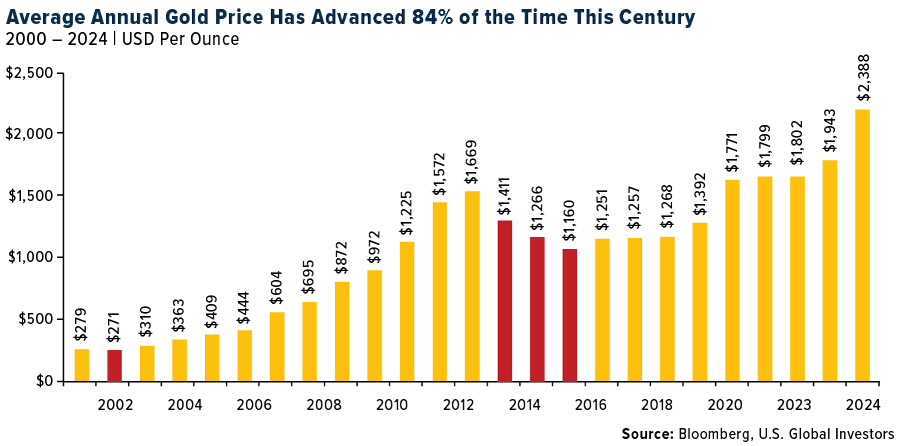

On a year-over-year basis, the average annual price of gold has now advanced 84% of the time this century, notching 21 positive years out of the past 25 years. For the second straight year, gold was the best performing commodity.

Silver also posted strong gains in 2024, climbing 21.7%. I believe the metal’s outlook for 2025 is even brighter. Industrial demand for silver, fueled by its critical role in solar panels and electrification, is expected to set new records. Its dual demand as both a precious and industrial metal places silver in a unique position to outperform gold in the year ahead.

Mixed Manufacturing Results Raises Potential Concerns for Industrial Metals

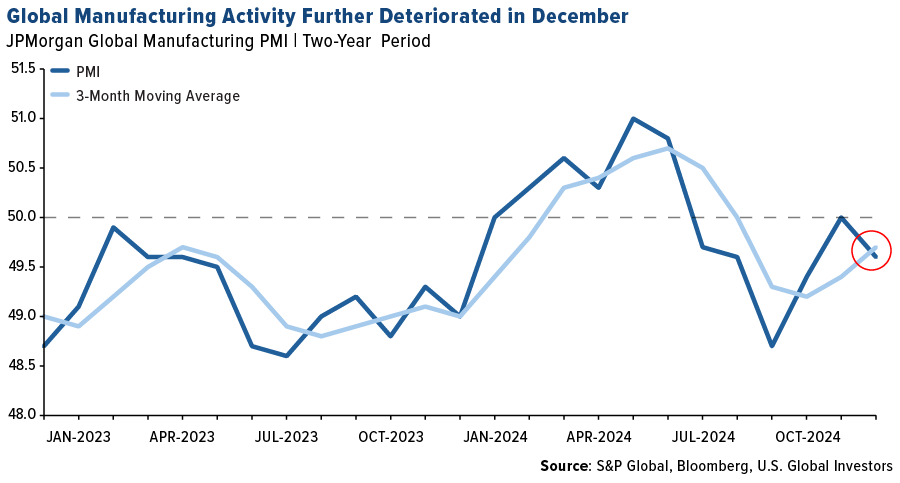

The global manufacturing sector, a bellwether for commodity demand, ended 2024 on a weak note. The JPMorgan Global Manufacturing PMI dipped into contraction territory in December, signaling declining output and new orders. This weakening trend points to a sluggish start for 2025, raising concerns about the demand for key industrial commodities such as copper, aluminum and nickel.

China, the world’s largest consumer of metals, was an unexpected bright spot as its manufacturing sector showed modest expansion. However, the broader outlook remains cautious, with business sentiment reaching a three-month low.

Clean Energy Boom Highlights Need for Investment in Mining Projects

Commodities tied to clean energy and electrification showed resilience in 2024, despite the global manufacturing slowdown. Copper and aluminum posted gains of 2.2% and 7.7%, respectively, supported by demand from renewable energy projects, electric vehicles and grid modernization efforts. Bloomberg New Energy Finance (BNEF) reported robust growth in clean energy deployment last year, with solar installations up 35% and energy storage installations surging by 76%.

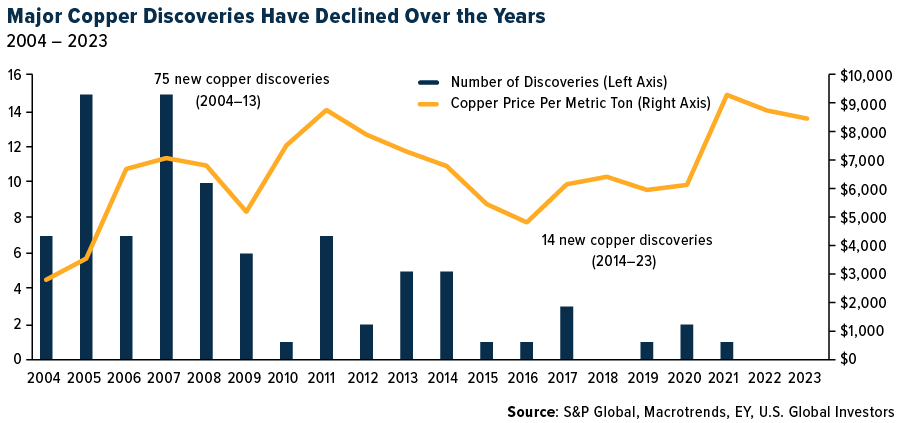

Meeting the exponential demand for metals critical to the energy transition will require significant investment in exploration and production. Ernst & Young (EY) projects that achieving global net-zero goals will necessitate 41 million metric tons of copper annually by 2050, a massive target given the lack of substantial new mining projects. According to S&P Global, only 14 new copper projects were discovered between 2014 and 2023; that’s significantly lower than the 75 new discoveries that were made between 2004 and 2013.

While energy transition metals show promise, other commodities faced sharp declines in 2024. Natural gas prices plunged nearly 71%, weighed down by mild weather in Europe. Agricultural commodities also struggled, with wheat and corn falling 40.9% and 28.8%, respectively. Lithium, a key component of electric vehicle batteries, saw a significant drop of 21.8%, reflecting temporary oversupply and slowing demand growth in China.

Interest Rate Uncertainty Adds Pressure to Commodity Outlook

The outlook for 2025 presents several headwinds for commodities. President-elect Donald Trump’s plans to expand fossil fuel production and roll back electric vehicle (EV) mandates may slow progress on the energy transition. Proposed tariffs on China and other trading partners could further disrupt global trade, potentially reducing demand for industrial and energy commodities. Wood Mackenzie warns that these protectionist measures could shave 50 basis points off global GDP growth, with significant implications for oil and gas consumption.

Interest rate policy adds another layer of complexity. While the Federal Reserve is expected to cut rates in 2025, the pace of easing may fall short of market expectations. Higher rates for longer could weigh on economic activity and dampen demand for raw materials.

Gold and Silver to Maintain Their Roles as Safe Haven Assets

Despite the challenges, long-term opportunities remain abundant. Gold and silver are likely to retain their appeal as hedges against uncertainty, while metals like copper and nickel stand to benefit from ongoing investment in electrification and clean energy infrastructure.

The Periodic Table of Commodity Returns highlights the cyclical nature of markets and the importance of staying informed. As 2025 unfolds, investors can position themselves to weather the challenges ahead and seize opportunities in the next phase of the global economy.

To view the 2025 Period Table of Commodity Returns, click here!

Copyright © U.S. Global Investors