by Mark Pinto and Lucas Klein, Janus Henderson

In their 2025 outlook, Head of Americas Equities Marc Pinto and Head of EMEA and Asia Pacific Equities Lucas Klein say a changing macroeconomic backdrop could create new pockets of leadership in global equity markets.

Market performance broadens

Evidence of the market’s broadening has grown increasingly apparent in recent months. The S&P 500 Equal Weight (EW) Index, an equal-weighted version of the large-cap benchmark, outperformed the cap-weighted S&P 500 in two of the last seven quarters – both of which occurred in the last 12 months. Meanwhile, since July, the S&P SmallCap 600 Index has rallied 13.5% versus 5% for the cap-weighted S&P.1 Non-U.S. markets have also been positive, with some regions delivering double-digit returns year to date.

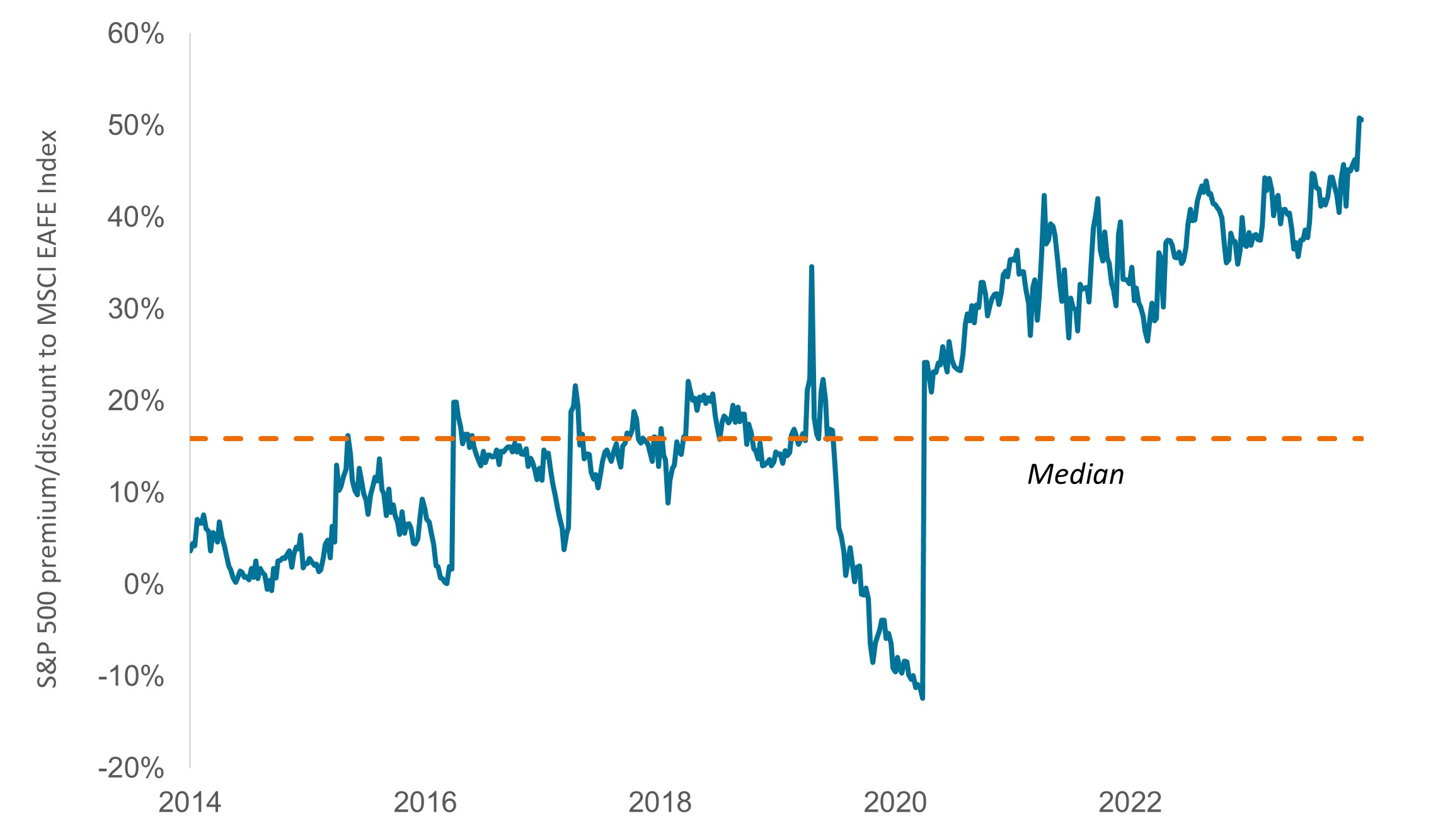

Even then, the potential exists for more upside. While the cap-weighted S&P 500 has a forward price-to-earnings (P/E) ratio of 22, the P/E for the EW benchmark is a comparatively lower 17.2 The S&P SmallCap Index trades near its long-term average, and developed market non-U.S. equities are the most discounted they’ve been relative to the cap-weighted S&P in at least a decade (Figure 1).

Figure 1: U.S. equities have grown increasingly more expensive compared to the rest of the world

Relative forward P/E of the cap-weighted S&P 500 Index to the MSCI EAFE Index

Source: Bloomberg; data reflect forward 12-month price-to-earnings (P/E) ratios. Data are weekly from 28 November 2014 to 15 November 2024. The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada.

Opportunities grow for active investors

To some extent, lofty valuations in the cap-weighted S&P could be explained by a changing macroeconomic backdrop. In the wake of the U.S. election, expectations have grown that president-elect Donald Trump will usher in a more business-friendly environment – from lower corporate tax rates to deregulation – that could propel domestic economic growth. In addition, though rate cut forecasts have come down given the potential for faster economic growth (and perhaps stickier inflation), the Federal Reserve (Fed) is still projected to make two additional 25 basis-point cuts by mid-2025, which stock prices may already be discounting.

We agree rates should continue to trend lower in the U.S., barring the passage of extreme policy proposals. But at the same time, many non-U.S. markets are also pursuing policies to drive growth and/or anticipate geopolitical changes. In addition, we are beginning to see the impacts of artificial intelligence (AI) on the broader economy, creating investment opportunities that go beyond the Mag 7.

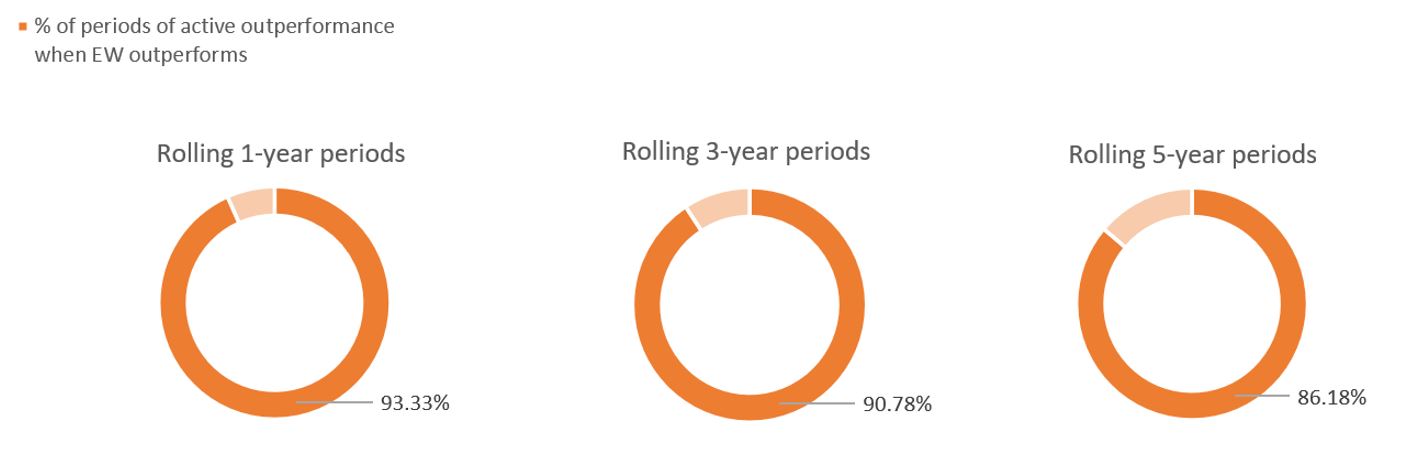

All of this could be good news for active investors. Our research shows that when the S&P 500 EW has outperformed the cap-weighted S&P 500 Index over a one-year period, the top-performing quartile of actively managed, large-blend U.S. equity funds has also outperformed 93% of the time. Similar advantages continued over three- and five-year periods (Figure 2). (When averaging across all periods, including when the S&P 500 EW doesn’t outperform, the percentage drops to 74% over one year and to 62% and 56% over three and five years, respectively.)

Figure 2: Historically, when the S&P 500 EW Index has outperformed, top-performing actively managed equity funds have also excelled

% of periods of outperformance by actively managed, large-blend U.S. equity funds when the EW index outperforms

Source: Morningstar Direct. Data from 31 December 1990 to 31 October 2024.

Such data is compelling. A growing number of forecasts now suggests that, over the next decade, U.S. large-cap equity indices could average only low-single-digit annual returns. Should these projections materialize, we think it will be all the more important for investors to seek out stocks that can beat the average.

Rate cuts and the return of small caps

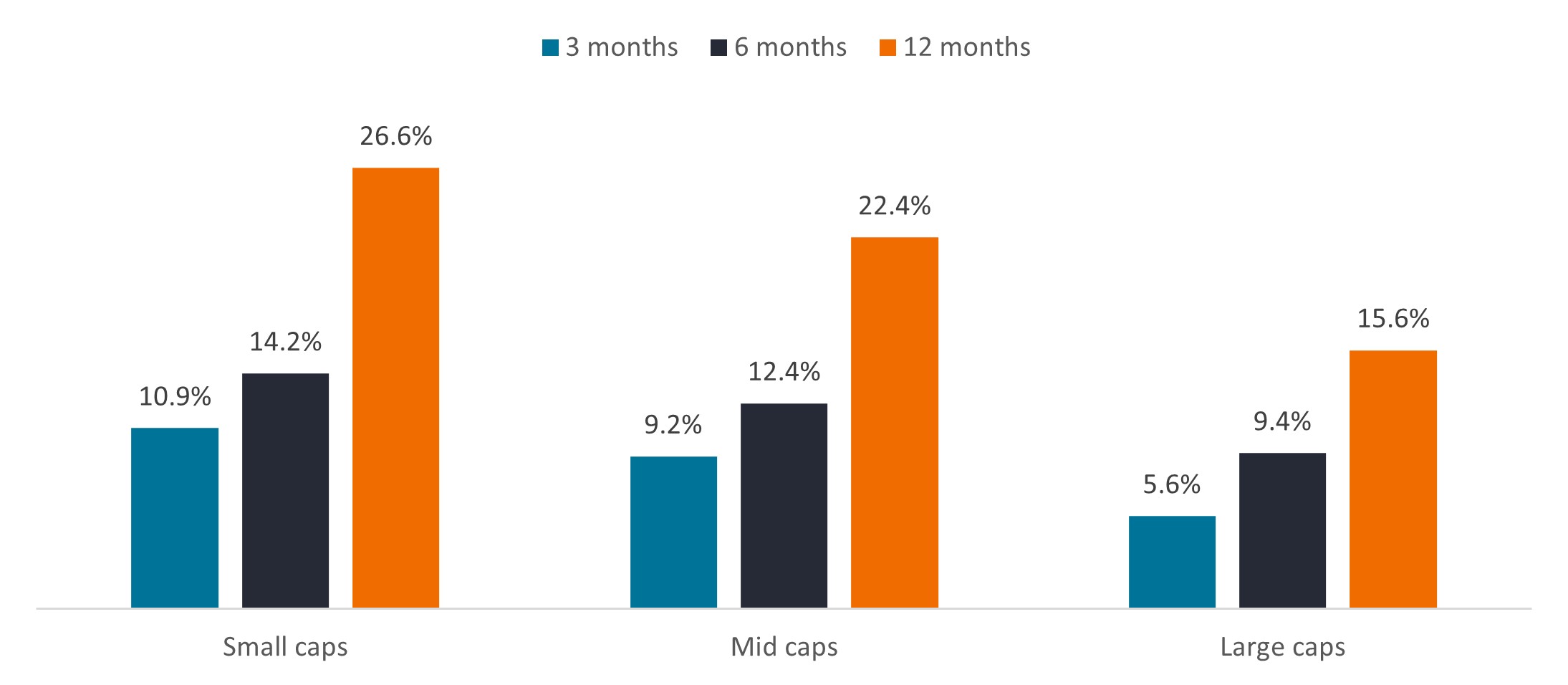

One area to look is small caps. Historically, small- and mid-size firms tend to outperform during periods of declining rates since these companies often have levered balance sheets and therefore benefit from lower interest expense, boosting earnings. Reduced borrowing costs can also spur mergers and acquisitions or help minimize concerns about company liquidity.

Figure 3: Average returns three, six, and 12 months after the first Fed rate cut

Source: Federal Reserve Board, Haver Analytics, Center for Research in Security Prices, University of Chicago Booth School of Business, Jefferies, Janus Henderson Investors. Data based on the federal funds rate from 1954 to 1963, the Fed discount rate from 1963 to 1994, then the fed funds rate from 1994 onward. Past performance does not predict future returns.

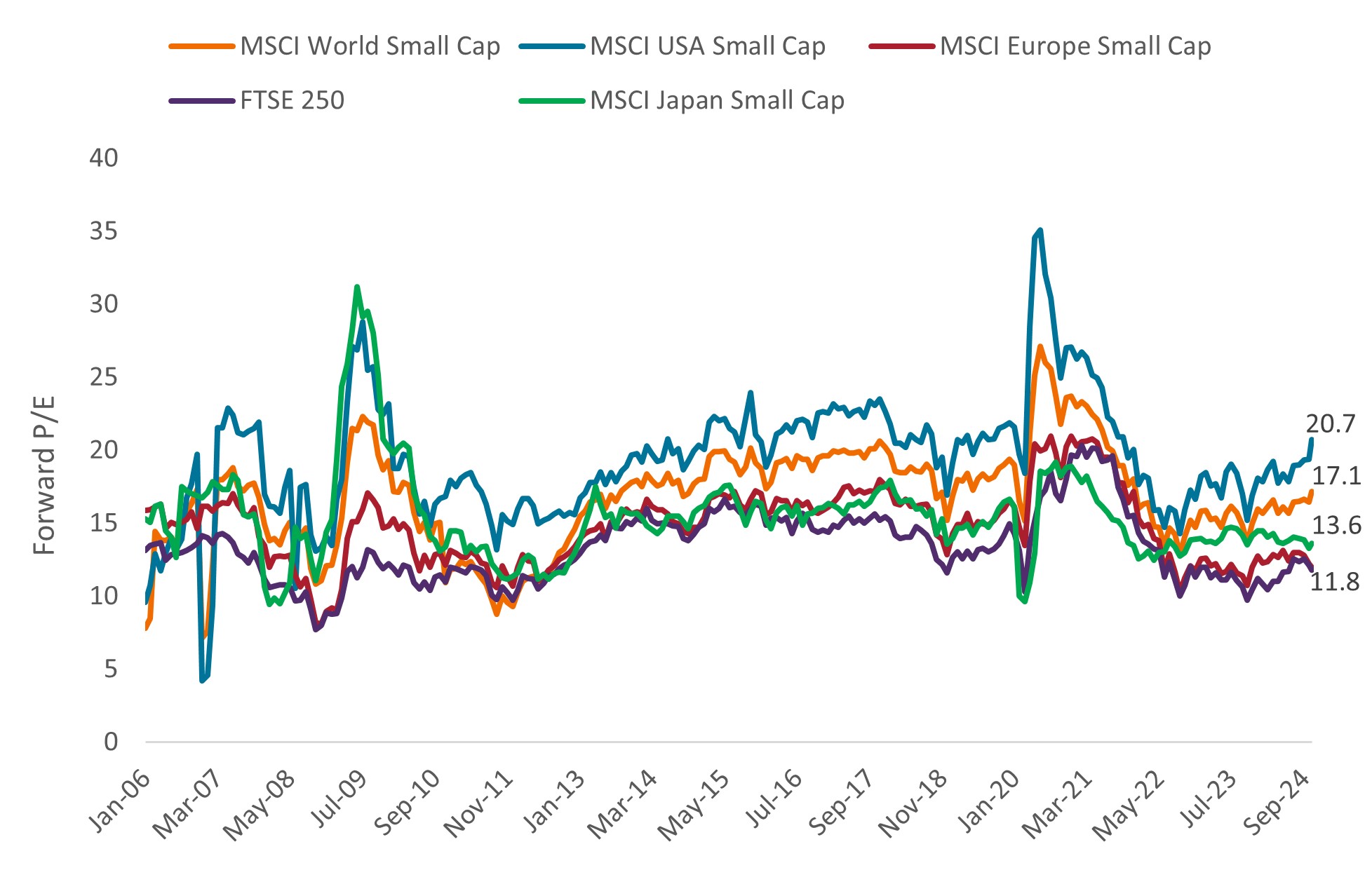

The relative outperformance of large caps could also be getting long in the tooth. Historically, cycles of large- and small-cap outperformance typically alternate every six to 14 years.3 The current run of large-cap dominance is butting up against the far end of that range. Small caps also have large weightings in industrials and materials and could benefit from the onshoring of supply chains. And globally, small caps now trade at relatively attractive valuations (Figure 4).

Figure 4: Around the world, small-cap stocks trade near or below their long-term average

Source: Datastream, MSCI regional small-cap indices, Janus Henderson Investors. Data from 30 January 2006 to 14 November 2024. Forward price-to-earnings (P/E) ratios based on estimated 12-month forward earnings. There is no guarantee that past trends will continue, or forecasts will be realized.

Valuations support non-U.S. equities

Low valuations could be an advantage for non-U.S. stocks generally in 2025. Many ex-U.S. markets are deeply discounted relative to the U.S. Slower growth in some regions could justify that spread. The U.S. presidential election also raises uncertainties for global markets, particularly as it relates to the possibility of punitive tariffs and the strengthening of the dollar.

But it is also worth remembering that each year for the past decade, an average of 82 of the top 100 performing stocks in the MSCI All Country World Index were domiciled outside the U.S.4 In addition, the reality of what happens under the Trump administration is likely to be more nuanced than headlines suggest.

Other factors will also be at play. In Europe, for example, facing an economic slowdown, the European Central Bank appears on track to pursue deeper cuts than the U.S., to the potential benefit of risk assets. In Japan, reforms aimed at improving shareholder value, along with the end of a protracted deflationary period, could continue to support the region’s stocks, many of which still trade below book value. In India, Narendra Modi’s reelection will likely mean another five years of policies that favor building out manufacturing hubs and improving infrastructure. And in China, the government’s recent stimulus push could draw a line under the country’s struggling equity market and help lift economic growth.

Innovation and productivity could propel earnings

Earnings should be another guidepost for investors. Globally, profits look set to rise in 2025 amid a generally positive economic backdrop (Figure 5). But we think productivity gains driven by new AI applications, as well as innovation, could be key to determining which companies meet or exceed these expectations – and which don’t.

Figure 5: Estimated earnings growth and shareholder yield in 2025

Source: Bloomberg, FactSet, LSEG Datastream. Yield data as of 30 September 2024. EPS figures are as of 28 October 2024. Forward price-to-earnings (P/E) ratios are based on 12-month estimated earnings. Earnings per share (EPS) growth for 2025 are projected.

In the U.S., labor productivity has expanded an average of 2.5% year over year for the past five quarters, well above the 1.6% 10-year average. (Labor productivity increases output without the need for additional employees or materials, thus boosting profits.) At the same time, S&P 500 revenue per employee has steadily increased since 2021 after flatlining during the 15 years prior.5 Companies that capitalize on these trends could continue to realize efficiencies and pull ahead.

Meanwhile, innovation is also opening up new end markets, including in non-tech sectors such as healthcare. There, dramatic improvements in scientific understanding and research tools are leading to the launch of groundbreaking products, such as GLP-1s for obesity. Already, these drugs – which are yielding weight loss levels in patients once achievable only through surgery – are annualizing more than $50 billion in sales and growing by 50% annually.6

It’s just one example of the many innovations that we think could drive returns in the year ahead and lead to a more dynamic playing field for equity investors.

Copyright © Janus Henderson