by Frank Holmes, CEO, CIO, U.S. Global Investors

Last week, at the North American Blockchain Summit in Dallas, Texas, I had the distinct privilege of moderating a fireside chat with former Canadian Prime Minister Stephen Harper.

Our conversation explored how blockchain technology can strengthen the economy, increase transparency and create new investment opportunities.

One standout moment was Harper’s reflection on the role the middle class plays in winning elections. In his 2018 book Right Here, Right Now, the prime minister urged fellow conservatives to focus on pragmatic solutions to everyday problems faced by the middle class. That was the key to winning elected office, he said.

He’s absolutely right. Here in the U.S., the middle class drove much of the enthusiasm for President-elect Donald Trump and his “America First” policies. Exit polls show that Trump overwhelmingly won the vote of those without a college education and those making between $30,000 and $49,000.

A Tale of Two Prime Ministers

Harper also spoke of his commonsense, fiscally conservative approach to dealing with the 2008–2009 global financial crisis. Canada, believe it or not, was the only G7 country that fully regained and even surpassed the business investment that was lost during the recession.

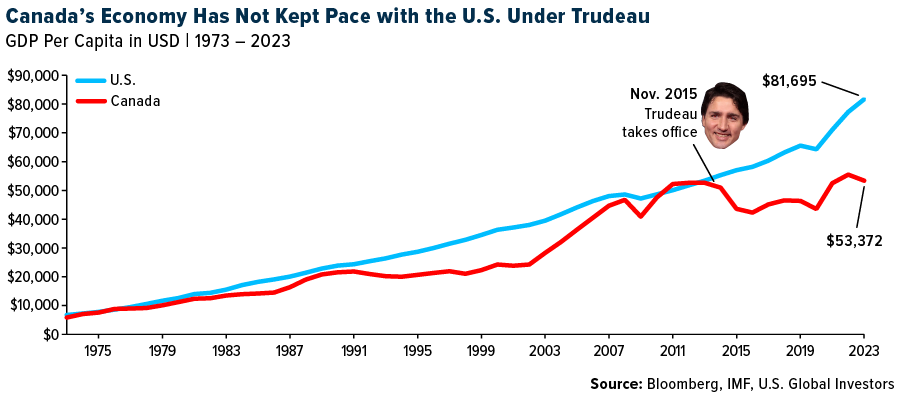

Unfortunately, my dear home country’s economy has struggled greatly under current Prime Minister Justin Trudeau, who has prioritized social issues over solutions to middle-class problems. During Trudeau’s administration, annual GDP-per-capita growth has averaged just 0.3%. Canadians are now significantly poorer than their U.S. counterparts.

The DOGE Initiative: Cutting Costs and Regulations

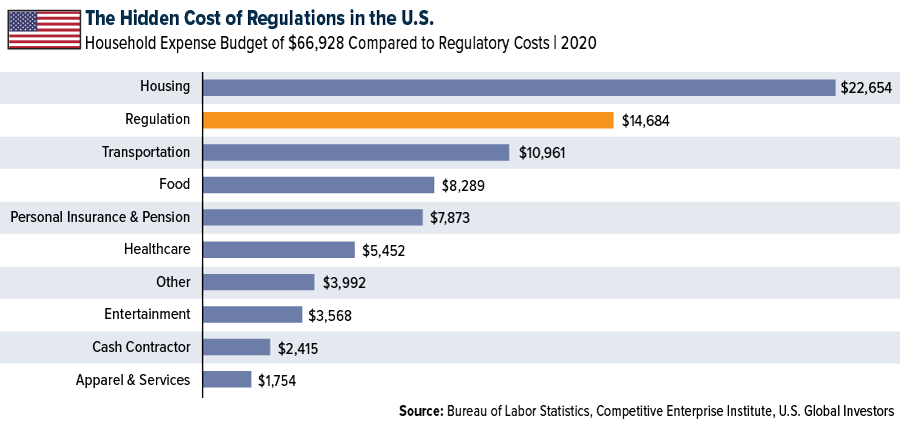

Harper’s insights tie directly into the economic anxieties felt by many working-class Americans. U.S. national debt now tops $36 trillion. Federal regulations cost approximately $2.1 trillion every year, representing around 7% of the country’s GDP, according to the Competitive Enterprise Institute (CEI).

This places a significant strain on middle-class households. The CEI estimates that the average American household pays over $14,500 annually in “hidden” regulatory taxes, exceeding what they spend on nearly every other expense except housing.

Trump’s decision to form the Department of Government Efficiency (DOGE), co-chaired by Elon Musk and Vivek Ramaswamy, aims to alleviate this burden. In a WSJ op-ed last week, Musk and Ramaswamy described their mission to cut wasteful government spending and regulations and massively deduce headcount:

“DOGE intends to work with embedded appointees in agencies to identify the minimum number of employees required at an agency for it to perform its constitutionally permissible and statutorily mandated functions.”

This reminds me of how Musk addressed runaway spending at Twitter, now rebranded as X, after he acquired the platform in April 2022. The Tesla chief reduced the company’s workforce by about 80%, yet X continues to operate just as well as ever.

Gold and Bitcoin

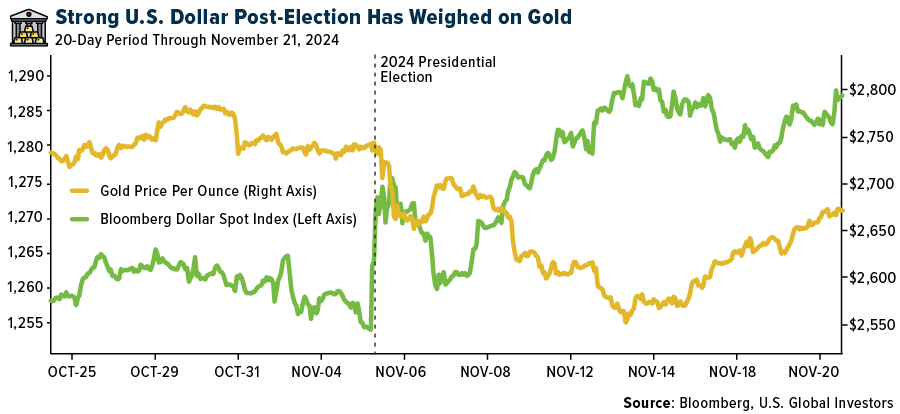

Economic uncertainty has led investors to seek safe havens. Gold has been one of the strongest-performing commodities in 2024, rising more than 31%. As you can see in the chart, the yellow metal took a hit after the election when the U.S. dollar rallied, weighing on commodities priced in the greenback.

Last week, Goldman Sachs forecast that gold could reach $3,000 an ounce by the end of 2025, supported by demand from central banks, geopolitical tensions and investors hedging against economic volatility.

Meanwhile, Bitcoin continues to trade in the $90,000s as Trump’s promise to turn the U.S. into the world’s “Bitcoin superpower” lights a fire under investors.

Senator Cynthia Lummis’s recent proposal to sell federal gold reserves to purchase Bitcoin has sparked debate. While Bitcoin’s potential is undeniable, I believe the U.S. would be unwise to abandon its gold, a cornerstone of financial stability for over 5,000 years.

Going forward, I believe that diversification remains key, especially as geopolitical tensions support the need for safe-haven assets like gold and Bitcoin.

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Copyright © U.S. Global Investors