by AllianceBernstein U.S. Equity Research

For most of the last two years, the 10 largest US stocks have dominated market returns. Now, amid signs of a shift in performance patterns, investors may want to take a closer look at what happened after similar periods of highly concentrated returns in the past.

For most of the last two years, the 10 largest US stocks have dominated market returns. Now, amid signs of a shift in performance patterns, investors may want to take a closer look at what happened after similar periods of highly concentrated returns in the past.

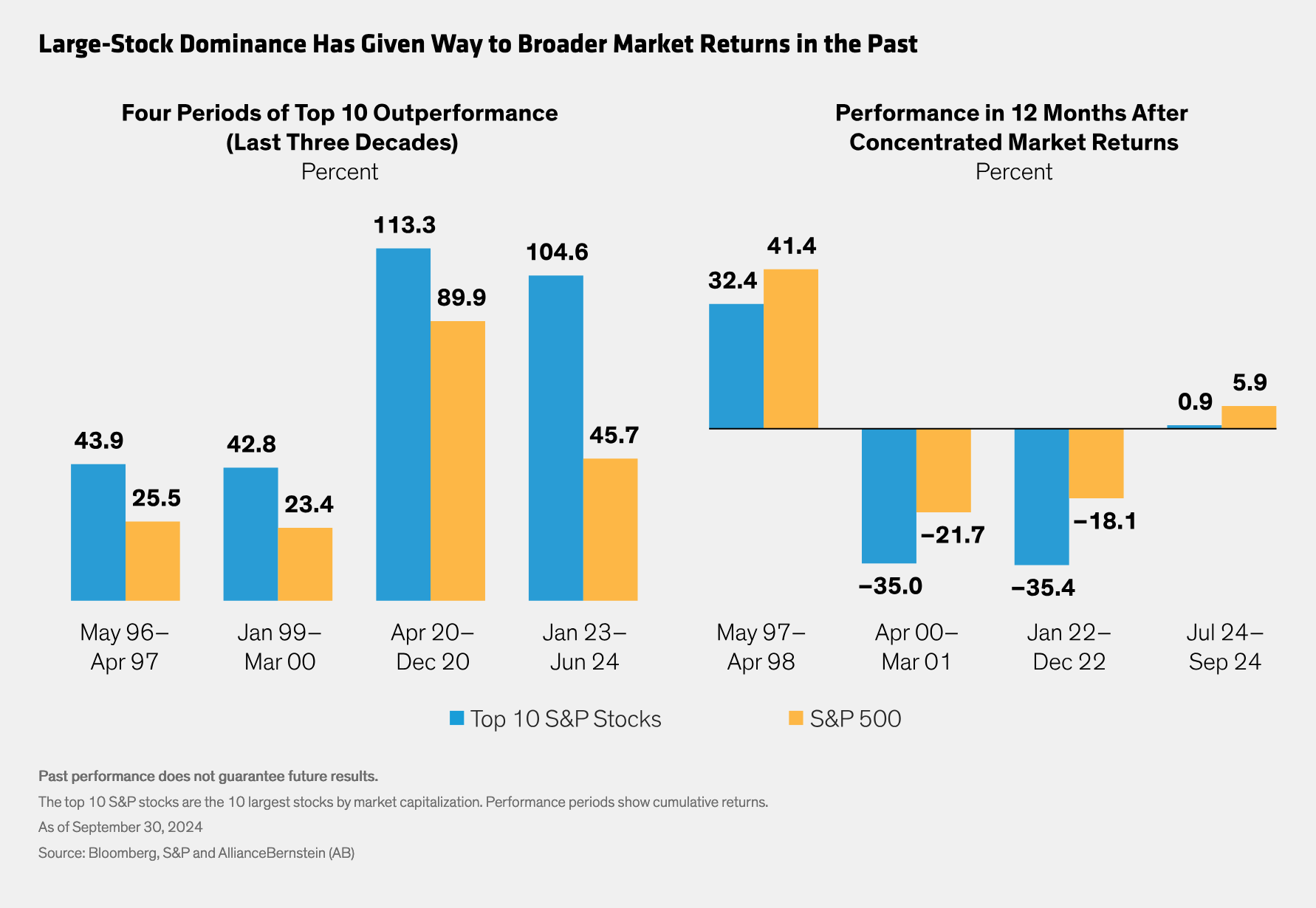

US markets have enjoyed a powerful boost since early 2023, driven by enthusiasm for artificial intelligence and strength in the technology and consumer discretionary sectors. The 10 largest stocks in the S&P 500 returned a staggering 104.6% from January 2023 through June 2024—more than double the broader index return (Display). Since July, however, the S&P 500 rose by 5.9%, outpacing the largest stocks, whose returns diverged sharply in the third quarter.

Nobody knows whether this trend will persist. But it’s not too soon to learn from similar episodes in the past.

Three Previous Concentrated Markets

We looked at three periods over the past three decades during which the 10 largest US stocks performed exceptionally well. In 1996, technology and healthcare companies were heavily represented in the top 10, owing to a confluence of favorable economic and market conditions. Three years later, the dot-com boom fueled outsized returns for the 10 biggest stocks, again heavily weighted in technology. Fast forward to 2020, and technology stocks again powered ahead—but in very different circumstances. This time, it was the COVID-19 pandemic that accelerated the adoption of digital services, e-commerce, remote work and cloud computing.

What happened next? In the 12-month period beginning May 1997, US stocks rallied sharply, while in 2000–2001 and 2022, a bear market ensued. But there was a common denominator: in each period, the broad market outperformed the top 10 stocks. When markets fell, the S&P 500 declined much less than the 10 heavyweights.

These episodes illustrate why it’s risky to own the entire group at benchmark weights, especially after such as strong run. While the biggest names include great businesses, we believe portfolio managers should hold each stock based on a strategy’s philosophy, at carefully considered weights.

Actively Positioning for Change

The market concentration in the last two years was exceptional in historical perspective. As a result, we think positioning passively in equity markets isn’t the best way to prepare for the future. Today, given heightened macroeconomic and geopolitical risk, actively positioning portfolios based on fundamental analysis of the risk/reward trade-off is especially important, in our view. Increased fundamental dispersion across sectors and industries may help to perpetuate the broadening that we saw in the third quarter.

Hidden opportunities abound today. Many companies across industries with high-quality businesses were left behind over the last two years and trade at attractive valuations. Different types of portfolios can access these companies in different ways—from growth or value equities to thematic portfolios to defensive strategies that aim to curb volatility. While the philosophies and processes may differ, the strategic objective should be to capture long-term return potential in markets that may be fueled by vastly different forces in the future than we’ve seen in the recent past.

Copyright © AllianceBernstein U.S. Equity Research