by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

In this article, Russ Koesterich discusses why the equity market rally following the U.S. presidential election could continue into year-end

Key takeaways

- U.S. equities are up 25% for the year, with a 4% gain coming from last week. While some may question the sustainability of rally from here, Russ discusses factors that could support further growth, notably seasonal strength and investor optimism over potential fiscal stimulus and regulatory relief.

- In this environment, he believes that cyclical sectors are likely to continue to lead strength, with consumer discretionary and financials companies being well positioned. Across bonds, he continues to like corporate bonds and securitized assets for the incremental yield pick-up.

With the U.S. election decided, investors moved off the sidelines and aggressively bid up stocks and other risky assets. The S&P 500 rallied 4.7% on the week, it’s best showing since October 2022.

The rally was supported by hopes for stronger growth and a lighter regulatory touch, particularly in financials. With the election and initial market reaction now behind us, what should investors expect into the end of the year? I would focus on a few themes: continued equity strength, led by cyclical stocks, and a steeper yield curve.

With the U.S. equity market up 25% year-to-date and already trading at a significant premium, both to other markets and its history, are further gains realistic? In the near-term, I think they are. In addition to consumer led growth and monetary easing, stocks could benefit from seasonal strength and optimism over additional fiscal stimulus and the prospect of regulatory relief.

Market leadership

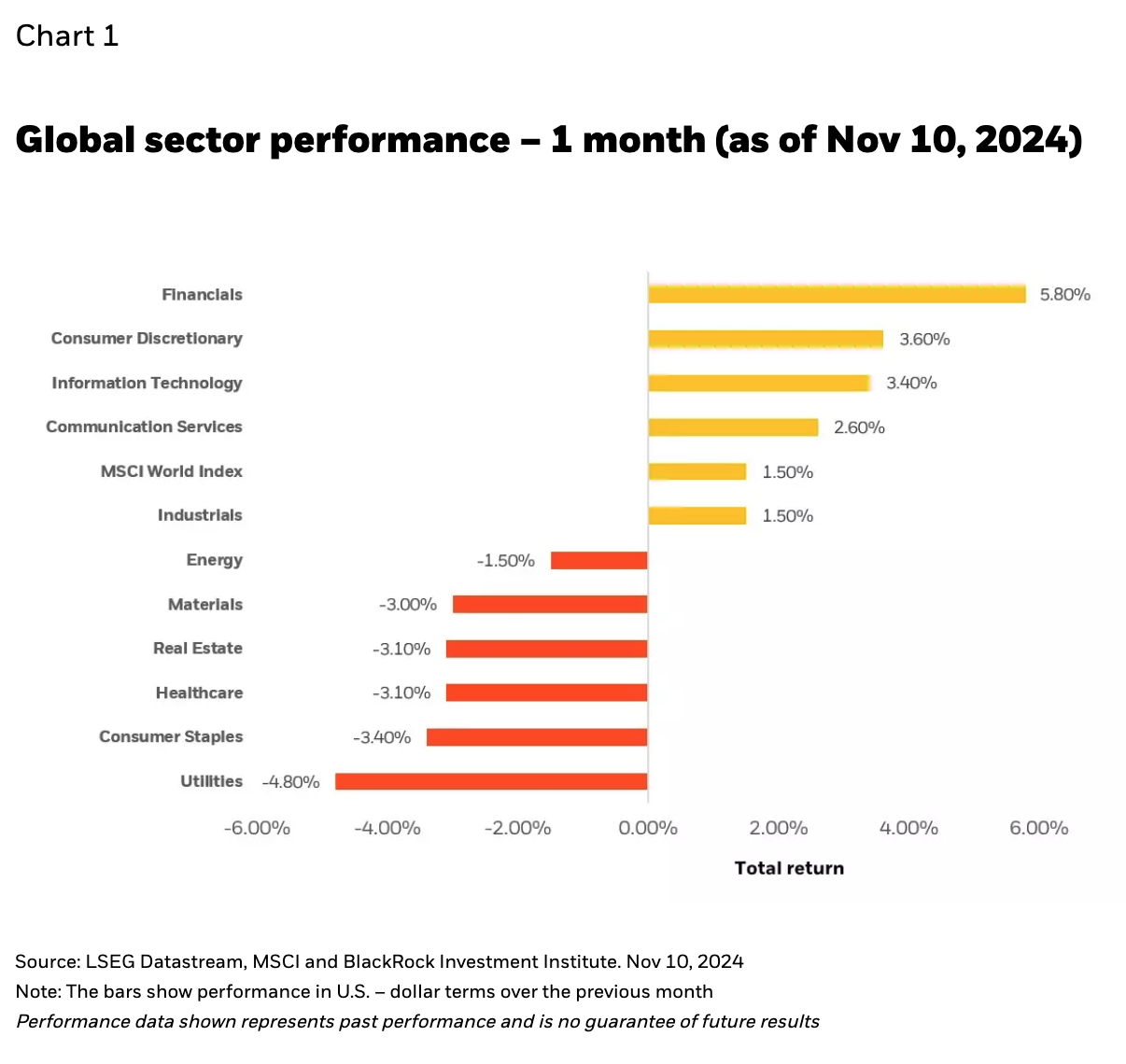

I would expect cyclicals to continue to lead, as they have for much of the past few months. While I don’t expect a major acceleration in growth, with the economy already growing at a healthy 2.50% to 3.00%, investors may continue gravitating to companies and market segments that have operating leverage (ability to increase operating income by increasing revenue). This includes consumer discretionary firms, which led the post-election gains (see Chart 1), as well as financials. The latter group benefits not only from a stronger economy and steeper yield curve but, potentially, a less onerous regulatory environment under a Republican administration.

Outside of equities, the environment for bonds and rates is also likely to be impacted, particularly for longer-term U.S. Treasuries. There are several reasons for this. Additional stimulus into an already strong economy may alter the pace and extent of future Fed interest rate cuts. And apart from monetary policy, debt funded tax cuts and/or stimulus risks adding to an already historically large U.S. fiscal deficit and the accompanying supply of Treasuries.

While bond yields have already backed up from the September low, the term-premium, i.e. additional yield investors receive as compensation for taking duration risk, remains modest by historical standards. If bond investors start to assume even larger multi-year deficits, long-term yields are likely to rise further and faster than short-term yields, creating a steeper yield-curve.

Positioning to consider

As I discussed a few months back, I would maintain a modest overweight to equities into year’s end, with an emphasis on financials, consumer discretionary and select technology names. I would fund that overweight with a smaller position in ‘defensive’ sectors, notably consumer staples. On bonds, there are still good opportunities to pick-up yield in corporate bonds, securitized and other forms of credit. That said, I’d be more cautious on long-dated Treasuries. With the bond market already struggling to absorb record supply, long duration bonds may suffer further pain in the months and years ahead.

Copyright © BlackRock