by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

In this article, Russ Koesterich discusses why he believes U.S. exceptionalism is a trend that is likely to continue.

Key takeaways

- U.S. equities are once again leading global equities in 2024. While not cheap, we think they are worth the premium.

- Strong performance has been driven by a resilient economy and concentration of fast-growing companies, trends that we think will continue and merit an overweight.

In many ways, 2024 is starting to look like 2023 where the equity markets rally has been led by the United States. U.S. relative strength is hardly a recent phenomenon. During the past 10 years, US stocks (as represented by the S&P 500 Index) have posted a total return of more than 270%, versus approximately 170% for Japan (as represented by the TOPIX Index in USD) and just 70% for Europe (as represented by the SX5E Index in USD). Years of outperformance have led investors to worry about the elevated level of U.S. valuations and wondering whether the trend can last. My own take: U.S. equities are not cheap, but they are worth the premium. As a result, I am comfortable remaining overweight U.S. stocks.

Year-to-date the US stocks have returned roughly 22%. In dollar terms both Japanese and European equities are up less than 10%. True, Japan looks better if returns are measured in yen, but even then, it is significantly behind the U.S. Even faster growing emerging markets are having trouble matching U.S. gains, with Taiwan a notable exception.

This begs the question on what accounts for this consistent U.S. outperformance that many have dubbed U.S. exceptionalism. Our take is that the U.S. benefits from a surprisingly resilient economy and a concentration of fast-growing companies. Both trends that I believe are likely to continue.

U.S. Growth: Not dead yet

Much like Mark Twain’s famous aphorism, the imminent death of the U.S. expansion, i.e. the likelihood of an imminent U.S. recession remains greatly exaggerated. September’s non-farm payroll report confirmed a still healthy labor market while recent retail sales data demonstrates that U.S. consumers continue to spend. This resiliency can in part be explained by the recent restatement of U.S. income data, evidencing both stronger income growth and a higher savings rate than previously reported.

This growth differential between the U.S. and rest of the world is likely to continue. The median of a Reuters poll of economists has the U.S. growing at roughly 2.6% in 2024 before slowing towards a trend rate of approximately 2% in 2025. In contrast, expected growth in the euro area is 1.2% and 1.4% respectively, while in Japan it is barely 1%.

Faster economy also yields faster growing companies

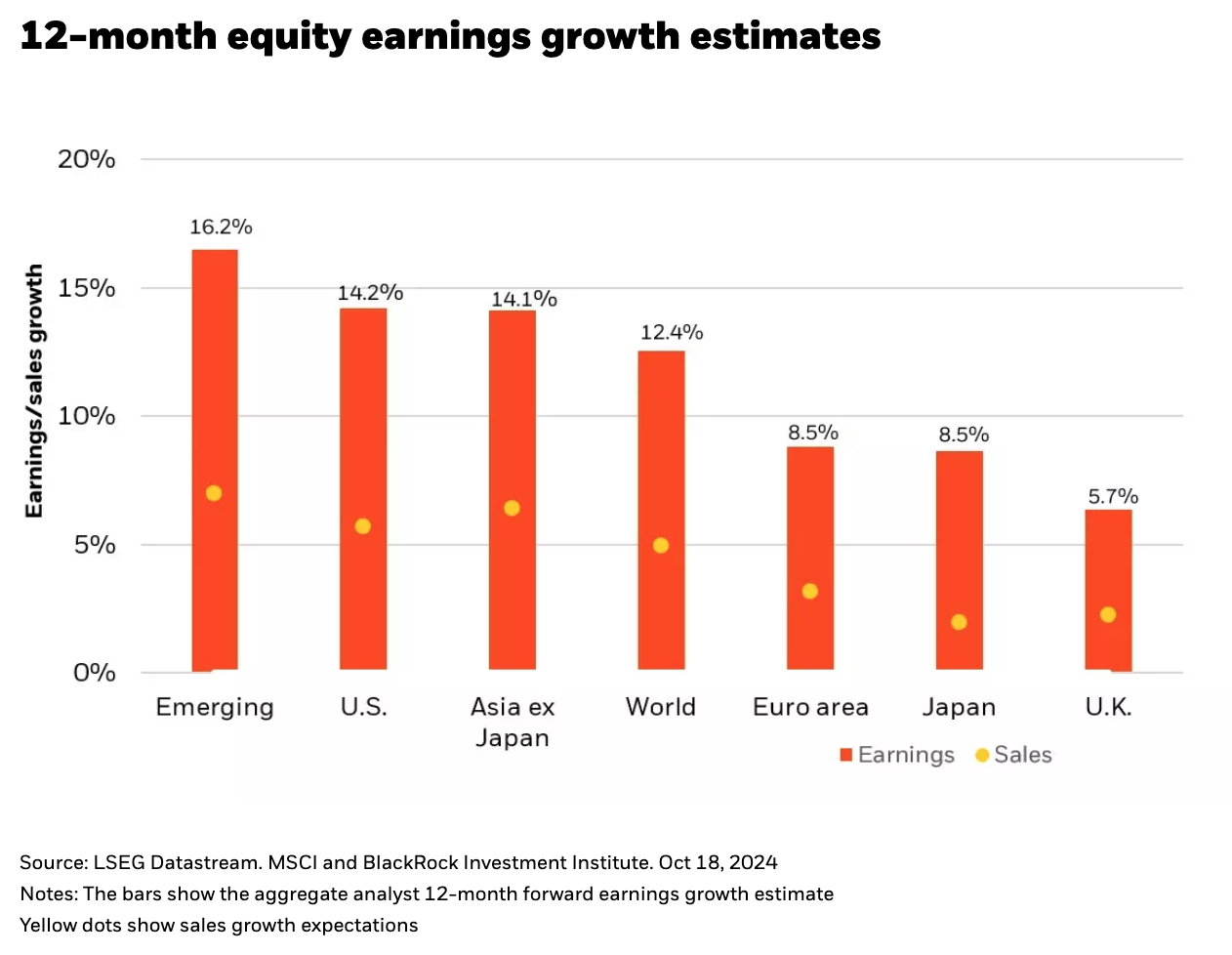

One reason for the resilience of the U.S. economy is the strength of the corporate sector. The United States continues to play host to dominant companies in the fastest growing industries, from AI to social media. The preponderance of secular growth companies has generally led to faster earnings growth. On a 12-month basis, U.S. equities are expected to grow earnings by roughly 14%, versus 8.5% for Europe or Japan (see Chart 1).

Chart 1.

This highlights an important source of U.S. outperformance. While the U.S. stock market has benefited from higher valuations, most of the outperformance can be attributed to U.S. companies outearning their international competitors (i.e. earnings growth over multiple expansion).

Own the globe but overweight the United States

To be clear, this is not a call that diversification is dead as there are good arguments for owning international stocks. There are a significant number of world leading companies in semiconductors, fashion and autos with a global footprint that simply happen to be based in Europe, Japan or elsewhere. That said, I would continue to overweight the U.S., both for its economy and the companies that drive it.

Copyright © BlackRock