Global oil markets are working through many disruptions.

by Carl Tannenbaum, Chief Econmist, Northern Trust

Jimmy Carter turned 100 years old earlier this month, the first former U.S. President to reach that age. Carter’s humanitarian work over the past four decades is notable; some suggest he has been a bigger success since leaving office than he was when he held office.

That characterization is a bit unfair, as President Carter was the victim of circumstances that were beyond his control. Two oil price shocks during the 1970s damaged the competitiveness of U.S. heavy industry, raised inflation and interest rates to intolerable levels and diminished America’s confidence.

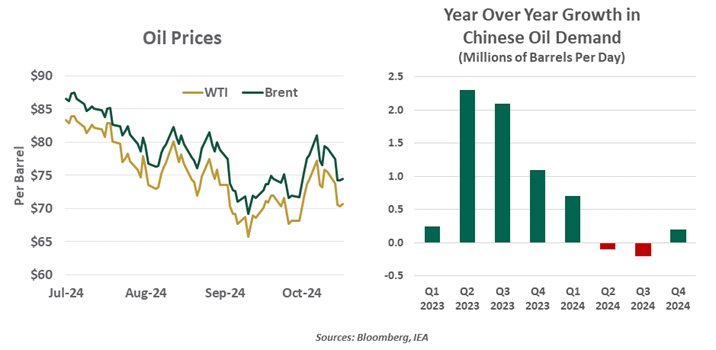

Inflation is once again a central economic issue in the 2024 election. But energy prices have not been a leading concern until very recently, when the conflict in the Middle East escalated. Oil prices had been falling for much of the year, but war has introduced a risk premium. Uncertainty in the market for this essential commodity is likely to be with us for some time.

Post-pandemic inflation was already ascending when Russia invaded Ukraine in 2022. Sanctions against Russia altered global supply dynamics and led crude prices well over $100 per barrel. Sensing the political consequences of rapid increases in the price level, the Biden administration authorized releases from the strategic petroleum reserve (SPR) and opted not to aggressively enforce sanctions against Iran’s oil shipments.

The Middle East conflict has oil markets on edge.

Iran has increased its daily oil output from less than 2 million barrels per day in 2020 to more 3 million today. 1.5 million of that is exported, with China a top client. The earnings from that activity are critical to Iran and a target for Israel, one reason why some analysts suggest that the Islamic Republic has little appetite for a regional war that could curb its output. As a deterrent, the Biden Administration recently banned additional entities from involvement in Iranian oil exports.

Should the war expand, Iran would be in a position to block shipments through the Strait of Hormuz, through which 30% of global oil exports travel. Attacks on critical energy infrastructure could be conducted by Israel or by Iran’s proxies. Under that scenario, crude prices could jump to $150 per barrel or more.

Fundamentals, however, are placing downward pressure on oil prices. One central factor is reduced demand from major manufacturing countries. Early last year, China took initial steps to stimulate its sluggish economy; among them were incentives and instructions for heavy state-owned industries to raise production. This resulted in an increased appetite for fuel.

It also resulted in increased inventories of goods that were difficult to sell, either domestically or internationally. The supply glut added to deflation risks, prompting Chinese officials to turn to other avenues to improve growth.

A second governor on oil markets this year has been U.S. output, which is at a record level. The discovery of new reserves and technology have contributed to this achievement. While the current administration has prioritized the development of alternative fuels, it has declined to implement measures that would limit traditional energy sources. This is due in part to a desire to keep prices low, and to rebuild reserves. Some modest additions have been made to the SPR, but it remains more than 40% lower than it was in 2020.

America has been on a 50 year search for an effective energy policy.

As the United States considers the environmental and geopolitical consequences of energy, it finds itself struggling to balance competing objectives. We want cheap energy, we want clean energy and we want it to come from reliable places. Resolving this “trilemma” will require policies that promote production and manage utilization across sources, supported by investments in technology and infrastructure.

That was the challenge that faced Jimmy Carter nearly fifty years ago, and it remains a challenge today. Then, as now, the Middle East is in some tumult, with Iran at the center. Then, as now, America was trying to achieve better balance in its sourcing of energy. Perhaps the next administration will have the kind of success in setting energy strategy that has eluded its predecessors.

Copyright © Northern Trust