by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

In this article, Russ Koesterich discusses gold may continue to serve as a store of value in the current environment.

Key takeaways

- Despite the strong rally YTD, there are several factors that could allow the price of gold to go higher.

- A weaker US dollar and declining real rates has historically served as a tailwind for gold. Longer-term, central banks buying of gold is likely to continue.

- An environment of slowing economic growth, central bank easing, and outsized government deficits may serve as additional support for the price of gold.

Many investors, including myself, were frustrated with the performance of gold in 2021 and 2022. Amidst the biggest surge in inflation in 40 years, gold traded sideways, with a total return close to 0. In contrast, in the current year when inflation is finally normalizing gold is having a stellar year.

Gold’s performance a few years ago is less surprising given gold’s mixed record as a short-term inflation hedge. But while gold can be an inconsistent hedge, this year demonstrates its value as a long-term store of value, particularly in a time of stratospheric government debt.

I last discussed gold back in mid-July. At the time, I suggested that while the traditional macro drivers – the path of the dollar and real or inflation-adjusted interest rates – were not yet supportive, longer-term factors were lifting gold.

Since then, gold has climbed another 10%. Year-to-date gold is up more than 25%, outpacing stocks and easily beating a traditional 60/40 portfolio. In other words, any allocation to gold would have significantly improved the return of just about any multi-asset portfolio.

Going forward, I continue to see a case for including a modest allocation to gold (think 2-5%). This is largely due to the combination of near-term economic factors having turned favorable, and the longer-term drivers remaining very much in place.

Short-term economic factors

Looking at the past six months, both the dollar and real rates have turned from headwinds to tailwinds. In recent months the historically negative relationship between gold and the dollar has reasserted itself (i.e. the price of gold has risen as the dollar weakened). A similar dynamic holds for real rates. Since the spring, the correlation between the daily change in the price of gold and daily change in real 10-year yields has been -0.30.

This is important as both the dollar and rates have reversed their early ’24 trends. The Dollar Index (DXY) peaked in April and is now down -6% from its spring top. Real 10-year yields also peaked at around 2.2% April. Today, they are around 0.60% lower, at 1.60%. Going forward, with inflation heading back to trend and the economy slowing, more rate cuts are likely, offering the potential for further gains in gold.

Sustained long-term drivers

In addition to an inflection in the macro-outlook, the longer-term support from central bank demand I discussed back in July remain very much in place. Central banks continue to add to their gold portfolios. Based on data from Bloomberg, China’s central bank gold holdings are roughly 45% higher today than in the summer of 2022.

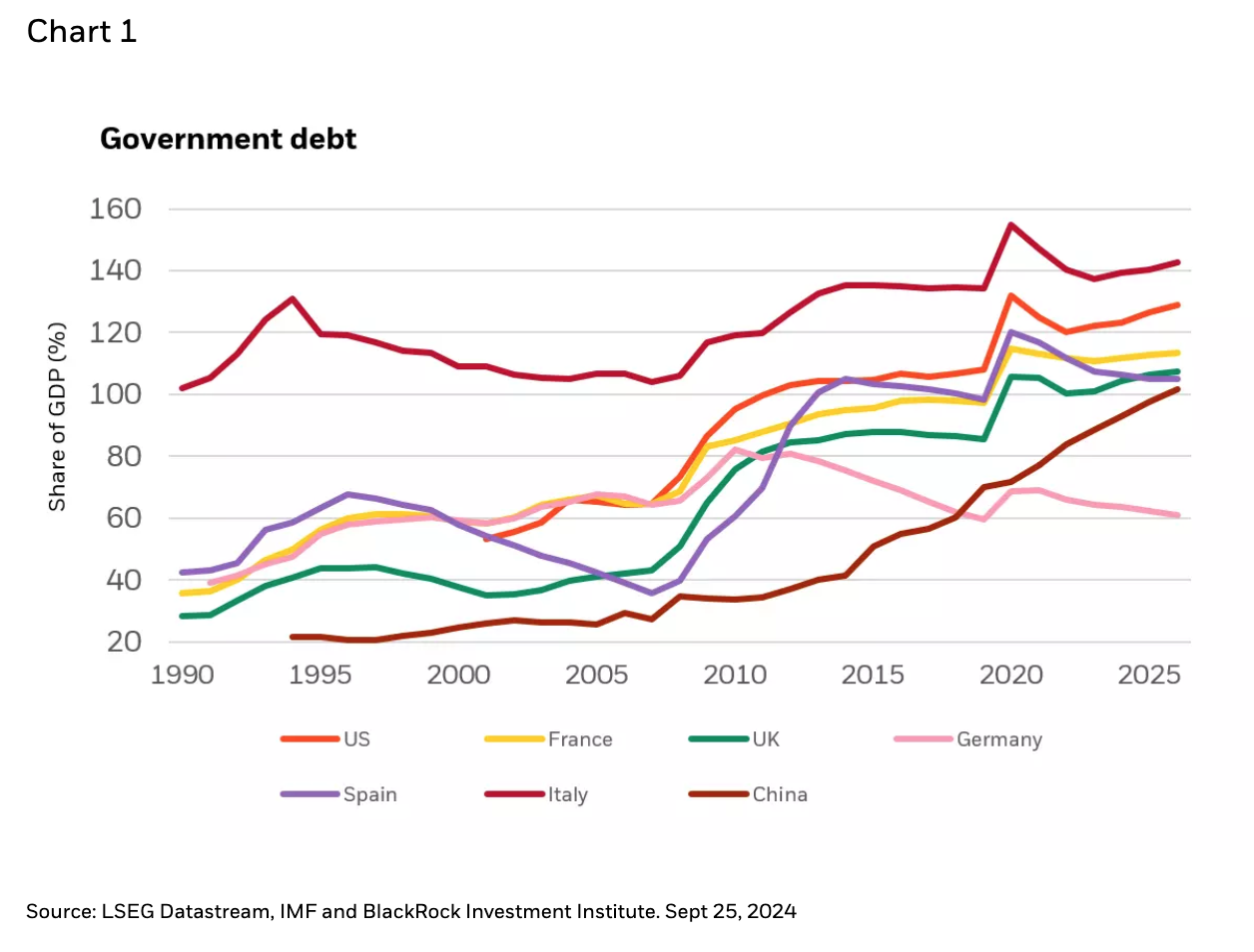

Beyond central bank buying, gold continues to get a bid as investors react to structural U.S. fiscal deficits. Debt continues to pile up as the U.S. runs an annual budget deficit equivalent to 6-7% of gross domestic product (GDP). The result is aggregate public debt (which includes debt held by the Federal Reserve) accumulating to near $35 trillion and a growing % of GDP (see chart 1). Relative to the size of the economy, debt of these levels was last seen in the aftermath of WW II.

With the economy slowing, central banks easing and governments still racking up debt at an outsized pace, gold still makes sense, particularly if we see continued weakness in the dollar. While it’s been a great run, I believe the price of gold can go higher and I’d advocate keeping a modest gold position as a store of value in uncertain times.

Copyright © BlackRock