Announcement: [00:00:00] This is the Insight is Capital podcast.

Announcement Disclaimer: The views and opinions expressed in this broadcast are those of the individual guests and do not necessarily reflect the official policy or position of Advisoranalyst.com or of our guests. This broadcast is meant to be for informational purposes only. Nothing discussed in this broadcast is intended to be considered as advice.

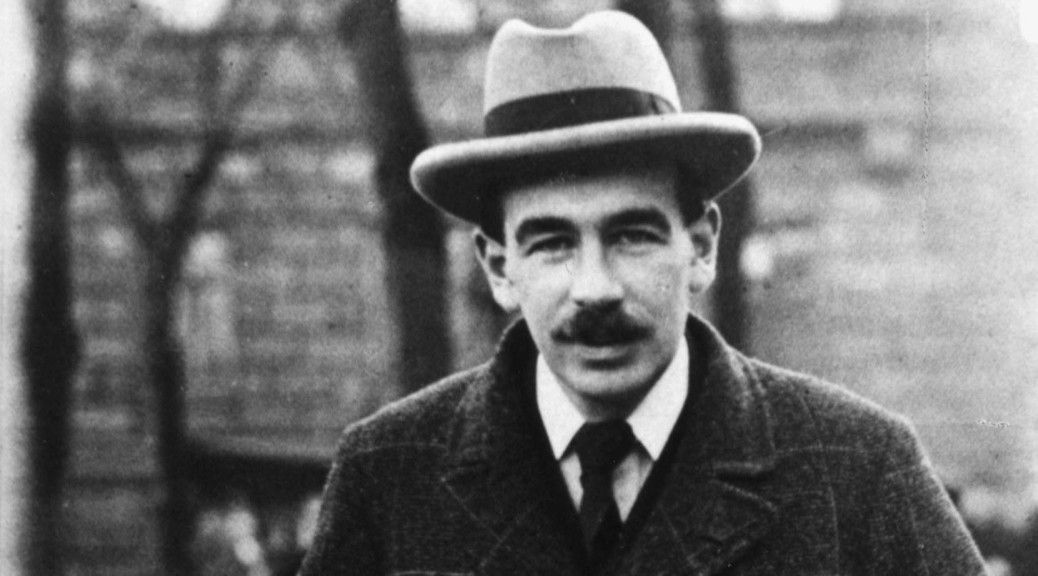

Pierre Daillie: Welcome back. This is the Insight is Capital podcast. I’m your host, Pierre Daillie. This episode, I’m excited to have Ilan Kolet. Institutional Portfolio Manager with the Global Asset Allocation Team at Fidelity Investments back on the show. Ilan brings a wealth of experience to the table with a deep expertise in Canadian asset allocation strategies and a strong focus on portfolio management and investment philosophy.

He’s been with Fidelity since 2014 where he’s held key roles both in Boston and Toronto, including leading the Global Asset Allocation Group’s Inflation and Commodities Research. Before that He was an editor at Bloomberg news and an [00:01:00] economist at the Bank of Canada. His extensive background and unique insights into the global economy always make for a fascinating conversation about all things, markets, macro and asset allocation.

Thank you so much for listening. And without further ado, my conversation with Ilan Kolet. Ilan, welcome back and thank you for being here. It’s great to have you back and to catch up with you.

Ilan Kolet: Yeah, it’s, it’s really great to be here. I always enjoy these, uh, these discussions. I think the hardest part is sort of.

You know, keeping them to, uh, less than two hours, but I, I’m excited for the chat today.

Pierre Daillie: Yeah, uh, likewise. Um, I’ve been looking forward to this for a while. Um, Ilan, what a year to date 2024 has turned out to be, right? I mean, despite all of the uncertainty that we have contended with, uh, US stocks are skirting all time highs.

Bond yields have receded, but you know, I just noticed the, the 10 year U. S. Uh, at three 92, which is not that much from, from its [00:02:00] peak, uh, from, you know, from, from this year’s highs. And, uh, so they’ve kind of wobbled here and they’ve gone down lower and then come back. We’ve got a no landing economic consensus for the U S economy.

And then we’ve got the final exception to that. I mean, to what we’re going to be talking about today as well, aside from all the good news, we’ve got a far different and less optimistic outlook for the Canadian economy. So just to begin, what are your thoughts on the Fed’s bold decision to go and kick off easing with a 50 beeps cut?

And, and then, you know, it’s a bit of a compound question. What does the Fed’s decision imply about the U S economy?

Ilan Kolet: Yeah, I think again, Pierre, thanks again for the invite. I really enjoy these chats and I think that’s a good place for us to start. Um, You know, the way that the Fed communicated that 50 basis point cut was a strong start, right?

That’s how they sort of, they, they communicated it. Um, and there’s a couple of things [00:03:00] for us to unpack in terms of the motivation for the, for that strong start, and what the implications are and what it means for, uh, for the U. S. economy. And the feds assessment of the U S economy. I spent the early part of this week, um, at the 66th annual, uh, national association for business economics conference down in Nashville, Tennessee.

Right. Um, you know, interesting place for a conference. You kind of worry about the morning sessions, I think at, in a place like Nashville, but, uh, but everyone showed up. Um, and, uh, You know, it was a really, really productive, productive discussion. Chair Powell gave a luncheon address, um, in, on Monday and I, I introduced him.

And then on Tuesday I was lucky enough. Yeah, it was, it was a really, it is. It really is. Um, and on Tuesday I chaired a session with Loretta Mester, who was the president of the Cleveland Fed for 10 years. And Seth Carpenter, the, uh, the chief global economist for, for Morgan Stanley. So just, [00:04:00] I mean, you know, it’s, it’s For a nerd like me, this is like a three day curated TED Talk for me to really soak up a lot of information.

But, let’s really talk about this 50 basis point cut. Um, And, you know, it comes from a few places. First, uh, the U. S. is in the midst of a productivity expansion, right? I mean, we are in the midst of something pretty remarkable, I think. And this is a view that we first formed on our team, myself, David Wolfe, David Tulk, the global asset allocators, uh, based in Canada.

This is a view that we first formed A year ago, right? So October, 2023, we wrote a paper called potential, probably the, the, the nerdiest paper we’ve ever written, but the most, most useful. Um, and we sort of put forth this thesis that maybe because of investments in clean technology or advancements in AI, or, you know, really significant structural to [00:05:00] the structural changes to the U S labor market.

Maybe the stall speed of the U S economy was higher. And by, by stall speed, I mean, maybe the U S economy could grow in the threes instead of the twos, still have slowing inflation, still have a healthy labor market with, and then get earnings to revise higher and stocks to push higher. And I mean, this is a view that we had in October of last year, and we implemented a material and significant overweight to U S to U S equities.

And if you fast forward to today, we know, we know what’s happened, right? So, right. I think we’ve seen a few things we’ve seen the danger of betting against the U.S right. I mean, again, I pulled some numbers this morning in preparation, the U.S has decidedly pulled away the U.S economy in inflation adjusted terms today is 14 percent larger than it was at the start of 2019.

Okay. The number for Canada is seven. All right. So not bad. The number for [00:06:00] Germany and Japan is less than a percent, right? So we’re in the midst, it really is. Um, and And so we’re in the midst of this productivity expansion. We should talk about it. I mean, like North

Pierre Daillie: America is like an island, right? I mean, we’re, we, we, we’re like an economic island away from the Asian and European mainland.

So,

Ilan Kolet: yeah, I mean, it’s, it’s really fascinating. I think, you know, productivity expansions. Um, they’re very, very rare, right? Uh, and this, this will speak to the motivation for a 50 basis point cut. They’re very rare. They’re, you know, the last time we had one, again, I think I’ve mentioned this before, was when Al Gore invented the internet in the 1990s.

And, uh, you know, so, In our lifetimes, we’ll probably only have two or three significant productivity expansions, and we believe we are in one, right? And it’s very hard because it doesn’t show up properly in the data, right? And so if you ask, uh, uh, you know, if you’d asked me when I was sitting at the central bank 20 years ago, is the U S in the midst of a [00:07:00] productivity expansion, I would have said no, because the trend and the data looks like it’s just joined the trend that we had sort of pre COVID.

And so You have to be suspicious of productivity statistics. Um, because again, it’s not impossible that the statistical agencies a year or two from now say, Oh, by the way, in 2024 and 2023, you were in, in the midst of a productivity expansion. These, these statistical agencies are very good at forecasting the past, but, um.

You know, we don’t have that luxury as investors. And, and again, to, to link it back to the, to the first, uh, the first 50 basis point Fed cut, which again, they’ll refer to as normalization is, um, A productivity expansion is very, very hard to achieve, and it’s even harder to keep going, right? The Fed, particularly the Jay Powell, the under, under Chairman Powell, and Governor Waller, right, remember that name, is a different type of Fed, right?

These are not, [00:08:00] um, I would say sort of rule following, um, academics that have been raised in the Federal Reserve System. Um, Uh, you know, their, their allegiance is really not to any specific sort of doctrine, they’re, they’re data dependent. Right. Um, and the 50 basis point strong start is. It is a show that, you know, they’re serious about keeping this really healthy economy going and sticking the landing.

And, um, and, and, and so it’s interesting. I mean, anyone who says they were expecting a 50 basis point cut is lying because nobody was. Um, very, very few people were, right? Very few people were. There was a lot of

Pierre Daillie: hope for it, right? And not, not so much expectations, but hope. And that’s an entirely different feeling.

Ilan Kolet: It is. I mean, and had you asked me the week before, I would have said. Not 50 basis points because it will signal some urgency and the Fed has, the Fed is looking at data that we’re not seeing. They’ve managed to communicate it as a strong start, right? Which is a remarkable thing. Now, the thing to [00:09:00] note there is we’ve had a view for a while that the Fed wants to cut

Announcement Disclaimer: Right.

Ilan Kolet: Bank of Canada has to cut, right? So there’s a difference there. Fed wants to cut because, again, keep that, keep that productivity expansion going. Keep a healthy labor market, pull in people who have historically not had a strong labor market attachment. That’s another remarkable stat we should chat about.

And in the, in Canada, it’s need to cut because. A huge portion of homeowners are going to renew their mortgage, you know, between now and the end of 2026, like, and,

Pierre Daillie: uh, Yeah, we’ve talked about that. We’ve talked about that in, in extensively in our past conversations this year. So that’s sort of a,

Ilan Kolet: a need to cut versus want to cut.

Pierre Daillie: That’s also, I mean, that’s a very, uh, big, uh, distinction to make because, you know, you know, I have to, I have this conversation with, with, uh, you know, my kids all the time. I have to. Want to, uh, two completely different [00:10:00] ideas, you know, motivations, right? Exactly. I mean, the Fed just wants to, the Fed wants to stick the landing and have, you know, mission accomplished actually come true.

Exactly. And, you know, for Canada, it’s, it’s more of a, you know, it’s more of a, a, It’s feeling like more of a rescue mission at this point. Well, that’s it. And you know, it’s

Ilan Kolet: interesting, Pierre, like this have to versus want to, I mean, that’s a conversation I have with my kids too. I have to go see Taylor Swift.

And no, no, no, you want to go see Taylor Swift. But, um. You know, again, what is the situation in Canada, right? In Canada, since the start of 2023, we basically had almost no economic growth, right? That line is almost flat. In per capita terms, because of the explosion in population, it’s a steep growth.

Downward sloping line, we, we haven’t had productivity growth. Now that, that problem is sort of 30 years in the making. I mean, that’s not a recent issue and we have a household that is vulnerable. I mean, this is problematic, right? If 60 percent of outstanding [00:11:00] mortgages approximately renew between now and the end of 2026.

Any, any sort of normalization and rates will, will, uh, dampen that sort of disastrous scenario of, of folks not being able to afford those, those renewals. Now there will still be a portion of people that can’t afford the renewals, but again, in, in, in historically in Canada, you know, we don’t give back the keys.

We have full recourse mortgages. You just cut discretionary spending to the bone to make sure that principal mortgage can get paid. That’s the Canadian story. Again, the U S I know we were talking about this earlier. Again, I, I pulled in some of these stats. Um, you know, it’s remarkable what we’re seeing in the U S for example, the number of, the number of disabled workers that have been pulled into the labor force has risen by 2.4 million people since pre COVID. That’s an increase of 40%. That’s, that’s [00:12:00] astonishing. That’s astonishing. I mean, that’s something that I think is going sort of unreported as one of the, you know, this COVID silver lining that Again, that boosts that that could potentially boost potential growth. The other one is the prime age, female participation rate, and sorry, I know we’re getting nerdy here, but prime age refers to 25 to 54 year olds participation rate is the engagement in the labor market is the highest on record for females.

Um, Right. And why is that? It’s because, you know, you have a more flexible labor market that allows for some, um, some time not in the office, which, you know, if you’re a new mother, that’s a, that’s a complete game changer. Again, I think a lot of this stuff is going underappreciated. Um, and, and it, it’s. It signals a really significant secular change.

Pierre Daillie: Those are both astonishing statistics. They really are. And I mean,

Ilan Kolet: you know, um, again, I think it’s going [00:13:00] sort of underappreciated. The, the person to follow on, you know, the person to follow on LinkedIn is this professor, Nick Bloom, Nicholas Bloom. B L O O M, um, he is really at the forefront of the research on the work from home, remote work revolution and what it’s doing.

He’s a, and he’s a fantastic writer. So I mean, if there’s one good takeaway from our discussion today is everyone should really follow him. Yeah. He’s, he’s, he’s at the forefront of it.

Pierre Daillie: I’m going to look it up. Look him up. Nick, Nick Bloom. Okay. Nick Bloom. I’ll send it to you. So talk about your attending the NABE.

What, what happened there? Where did you learn?

Ilan Kolet: Yeah. So, um, you know, I’ve been a member of the national association for business economics, um, NABE for 22 years. I think my first conference, 21, 22 years. My first conference was 2003. When I was like a junior economist at the Bank of Canada. Um, and I, you know, I’ve, I’ve had a regular, um, ongoing involvement with, with this association.

It’s basically the largest [00:14:00] association in the world of non academic economists, right? And, um, which is a very different group than the academic economists. And last year So these are

Pierre Daillie: folks who work on Wall Street, in finance, who are, who are Yeah. Economists at, at, uh, at banks. Exactly. Or large firms, right?

Large firms, right. Or, uh,

Ilan Kolet: manufacturing companies or firms. Right. So, you know, Yeah, exactly. Yeah, sorry. Exactly. Yeah. Exactly. And so a year ago I got named, I got elected to the board of, uh, the, the board of directors of this, um, of this association. Um, and just to, just so you, You know, to provide some context, the board is made up of, you know, the chief economist of Ford, chief economist of Coca Cola, chief economist of Caterpillar, um, chief economist of Morgan Stanley.

So it’s a, it’s a mix of folks and me. Um, right. And, uh, That’s fantastic. Yeah, it, it really is because, I mean, If you want, if you have a question about supply chains or chip shortages, it’s great to be able to pick up the phone and talk to the [00:15:00] chief economist of Ford. Right. So again, it’s, um, it’s a great professional network, uh, but what’s happened is, you know, an increasing, increasing involvement and board membership means increased responsibilities, right?

So, uh, the conference that was held in Nashville, um, earlier this week, uh, you know, I, again, I had the opportunity to introduce, um, the session in, in, in in which Powell was delivering his luncheon address to a room of about 500, maybe 20, 000 people online. Um, and, and it was an excellent speech. It was a very tight speech with a really productive Q and A.

So the one thing that, um, Chair Powell has been, has made himself very accessible to the, um, to the NAME community in terms of answering Q and A, In a very open and honest manner, right? So this is, um, this is, I think like the evolution of central bank communication is interesting to me because we’ve learned that it’s, it’s okay to, you know, say [00:16:00] that there is some uncertainty, like you, that’s okay.

And to sort of discuss. How you arrived at the decisions you arrived at based on the inflow of data, right? So it was a very open discussion. The entire thing is online. If anyone wants to check it out. Right. Um, and then again, the next day we, I had a discussion with the former, uh, The regional fed president and another senior economist.

But what I really gained from these conferences is, you know, the conversations that you’re having really allow you to, um, to, to come up with new creative ideas. And then also just as important is the pushback, right? So I really appreciate it. I’ve known these folks a long time now. I really appreciate it.

When I sort of push back. Tell them my productivity thesis, which we just discuss getting that pushback saying, well, you know, you don’t want to overestimate it because the stats are showing this right. And then that opens up another door in the brain to say, when I get home, I’m going to go down this rabbit hole [00:17:00] and dig into this a little bit.

Um, so it’s a great conference. Um, Um, you know, I know we’re going to talk about, um, the path of rates and the neutral rate and what it means for bonds, but I attended an, an, the NABE international symposium in May of this year in, uh, Hamburg. Um, I, I can’t remember the last time we chat, we spoke was before or after that, but, um, you know, I sat next at dinner, I sat next to the, um, director, the head of research for the ECB.

And we were talking about the neutral rate at a dinner, which is dinnertime conversation with the ECB. Uh, right. Right. And. And, you know, he, he, we were, we were talking about the, you know, the, the, the path of rates and normalization and he sort of off the cuff said, what makes you think the US is not at neutral now, meaning consumer spending is strong, the labor market is strong.

Inflation is slowing, businesses are spending. Why would we need to change rates at all from where they are now? I, [00:18:00] I mean, that was almost a fall out of your chair type of moment, right? Um,

Pierre Daillie: And we’re talking about our star, right? We’re talking about the neutral, the neutral rate, which is not. 2. 5 is maybe it’s higher in your estimation.

It’s somewhere around three.

Ilan Kolet: Yeah, exactly. I mean, so, you know, this kind of links into, to the bond question, the investment grade debt question, and how we’ve been positioned in the portfolio on the bond side. I mean, so sometimes, sometimes the question is posed as. You know, neutral, neutral was two and a half.

The fed was at five. We have 250 basis points coming our way. How could you not be unbelievably optimistic on, on the bond side of the portfolio? If you don’t like bonds now, you’ll never like bonds. That’s sort of the thesis. And, and honestly, we’ve, we’ve been cautious around adopting that view. I mean, we’ve been underweight.

Um, investment grade debt, both in Canada and internationally and overweight the credit and the spread sectors. But when I think about, when I back up and I try to kind of remove the jargon [00:19:00] out of this discussion, I think about the, the thesis around bonds are back as really being premised in the notion that the Fed was at five neutrals, two and a half, we have 250 basis points of rate cuts coming our way.

Arithmetically, mechanically, this is going to be a great time for bonds. And the reason, the primary reason in my view that we’ve not adopted that view is neutrals, not two and a half. Right. So if, if we are in the midst of this productivity expansion that I just discussed, right, again, growth can print higher without stoking inflation.

Inflation can slow, labor market can remain tight, earnings can push higher, equities can do well. The sixth one is neutral is higher. Right. And neutral is not two and a half. It might be three and a half, right. It might be four. We don’t really know. I mean, the, the truth is having, having spent almost a decade at the central bank in Canada, finding neutral is like, Trying to find your keys in the [00:20:00] dark after a few cocktails.

Right. So it’s, it’s like you’ve dropped your keys, you know, and it’s dark and you don’t want to wake anyone up in the house. I mean, maybe I’m revealing too much here, but, uh, you don’t, you don’t, You don’t know where neutral is. You find it in a very cautious and data dependent approach. And in the U S what I think that’s going to look like is strong start cut by 50, probably successive cuts will be 25 provided inflation continues to agree.

Inflation continues its path and it’s on and the labor market remains healthy. As you saw this morning, it’s doing just fine. Um, and. You find it in a slow and cautious data dependent approach, and you don’t, you’re not just mechanically marching towards two and a half or, or three, 3%, you don’t actually know until you found it.

Right. And so because again, because you remember last year we had six cuts priced in by the [00:21:00] fed, uh, this year, you know, so we’ve just never really subscribed to that view because. If we are, if we do believe we’re in the midst of a productivity expansion, neutral is higher, and we need to rethink that entire consensus around, you know, bonds are back.

Um, yeah, that’s,

Pierre Daillie: that’s, I mean, in fact, in, in your, in your, to, to quote your paper, I mean, uh, in your Q3 white paper, which precedes the September rate cut, um, you, you suggested you. And the two Davids suggested that the Fed will engage in a shallower cutting cycle due to the soft landing or no landing scenario, uh, and increased productivity.

And, um, so you still feel that way. Absolutely.

Ilan Kolet: Yeah. Right. So, um, we think neutral is higher in the U S and it is in Canada. And for,

Pierre Daillie: and for Canada, conversely, you suggest a deeper, uh, a deeper cutting cycle as you don’t feel the same way as you’ve already [00:22:00] alluded to about the Canadian economy.

Ilan Kolet: Exactly.

Exactly. Right. So, and the difference is the U. S. is in the midst of a productivity expansion. We’re not really, we don’t believe we’re seeing that in Canada. It’s not impossible we get that in Canada, but you know, we have 30 years of data to back up productivity growth happening in the U. S. and not having happening in Canada.

Again, I mean. We don’t really know the source of the weak productivity growth in Canada. Um, there’s a whole host of reasons. Check out that March, 2024 speech by deputy governor, uh, Carolyn Rogers from the bank of Canada, spectacular, uh, dissection of the issue in Canada, but I’m a taker of statistics, right?

I’m not a maker of them. So I, I, I see the productivity gap happening in the U S and Canada. We believe something, something, something Really special is happening in the U S and that means neutral is going to be higher, which as you said, Pierre, that shallower cutting cycle means the eventual landing spot is likely [00:23:00] higher in the U S than in Canada, which has, again, which has really important implications for the Canadian dollar.

I mean, that’s really, yeah, there’s going to be a divergence. Exactly, exactly.

Pierre Daillie: Yeah. There’s going to be a, uh, weaker Canadian dollar as a result, right. In the FX market. Yeah. Yeah. So,

Ilan Kolet: you know, the way that we think about. There’s the Canadian dollar is an interesting one because, uh, there’s a few answers here.

There’s like, how do we think about it? Uh, what are the factors that affect it? And what’s the direction of travel, right? So, um, we, we use the, so the Canadian dollar is a cyclical currency, right? It, it moves, uh, when there’s risk off sentiment, it depreciates, right? So March, 2020, back half of 2022, any sort of risk, global risk off event, or even a homegrown, um, risk off event.

You see, the function of a flexible exchange rate is to alleviate some of that pressure and sort of put Canada on [00:24:00] sale. And depreciate, depreciate the Canadian dollar. And so from a, from a strategic perspective, the way that we use the Canadian dollar in our funds is if we’re underweight, the Canadian dollar, and we get a depreciation, our funds get hurt less, right?

So 2022, good example of this, well, that none of us want to revisit, but 2022 was, you know, from a multi asset class perspective, from a bond and stock perspective, it was sort of a year. of down and downer. So, the way that you were able to preserve basis points and do better than your peers was To be underweight the Canadian dollar, which is an overweight to the US dollar Right.

Own cash and, and own own commodities. And so we were underweight the Canadian dollar in 2022 and that helped us preserve basis points for the end investors. Now, relating it back to, and you expect that, to you, you, you

Pierre Daillie: expect that trend to

Ilan Kolet: continue. Exactly. I mean, so we, we, we are underweight the Canadian dollar.

We believe the direction of travel is lower. Right. And why is that? Well, so the first is related to this, [00:25:00] um, interest rate differential, right? So. Uh, we think the term, we think after all is said and done, the Fed will end here and Canada will end here. Sorry for the air graphs here, but, um, US will end here and Canada will end here.

That higher interest rates suggest capital inflow into the U S that’s an appreciation of the U S dollar. That’s a downward arrow for the Canadian dollar. But the other, I think.

Pierre Daillie: If you’re a Canadian investor, that the overweight to the U S dollar will actually translate back into more Canadian dollars.

On the back end, right?

Ilan Kolet: That’s, that’s right. Yeah. That’s right. Exactly. Um, exactly. So by being underweight, the Canadian dollar, that’s an overweight to the U S dollar, you are less exposed, right, to those Canadian dollar movements. But the other way to think about it, I think is. Like for the last 20 years, there’s basically been one engine of growth in Canada, right?

And it’s been housing and the consumer spending associated with housing. So buy the house and then fill the house with all the stuff. [00:26:00] Um, which in my experience all ends up on Kijiji, but anyway, so, uh, buy the house and then fill it with stuff. Um, yeah. And now it’s time basically for something else to be the driver of growth.

And when this, when this lag appears, um, in Canada, right, you know, the, the Canadian macro versus the U S the most natural mechanism to, to aid in that adjustment is a depreciation of the Canadian dollar. And the way to think about that is. The Canadian dollar depreciates, Canada goes on sale, right? The lumber that we export to, to the U S or the cost of filming a movie in Vancouver or a TV show in Vancouver that gets cheaper for the companies that do that.

Announcement Disclaimer: Right.

Ilan Kolet: Um, and that, that aids in that adjustment, right? So historically, I mean, trade was a major driver of growth in Canada, uh, you know, with three quarters of those exports going to the U S. Yeah. Uh, a depreciation of the Canadian dollar would, um, would [00:27:00] facilitate that. The last thing Pierre mentioned So, so long

Pierre Daillie: term, long term, is that a net

Ilan Kolet: positive for Canada?

Well, it’s hard to say if it’s a net positive. I would sort of call it a, an adjustment or a realignment, right? Okay. Um, now maybe that’s the, the ex central banker in me speaking, but the way to think about this is you, you want a, a better, um, distribution of the drivers of growth, right? Like you never, ever want something One thing historically sort of driving growth in an outsized way.

I mean, that was housing again, because of extremely low rates, um, and, and strong and strong incomes, but you know, for a company like, for a country like Canada, the historical driver being trade in, in this small open economy. I mean, we sort of need to move back towards that right now. The one thing I’ll add there is.

A lot of times people have said, well, you know, you’re expecting the direction of travel for the Canadian [00:28:00] dollar to be lower. So, you know, for it to start in the, for the, for the Canadian dollar to, to begin with the number six in the next 12 to 18 months, we don’t view as impossible. And people have sometimes pushed back saying, well, You know, but, uh, there’s a lack of energy supply.

And if, if the business cycle, if, if things sort of come back online, you know, you saw China, the China stimulus recently that, yeah, I’m meaning to ask you about that as well. So really significant sort of, um, uh, you know, uh, level of stimulus. If that pushes commodity prices higher and oil prices higher because of this sort of resurgence and industrialization, uh, that’s really good for the Canadian dollar and the Canadian economy.

And the answer, had you asked me this Basically in the nineties, in the 2000s and the early 2010s would have been yes, because the Canadian dollar and oil prices moved in lockstep. And I have a, I have a great chart that I can actually share, um, [00:29:00] after this, but they, they were, they were joined at the hip, right?

The petro currency, right? We remember this, this, this notion. Um, but in the last four years. The Canadian dollar has decoupled entirely from movements in the price of oil, right? A great example of that is 2022 Russia invades Ukraine. Oil goes to over 100, and not only does the Canadian dollar not go towards par, which is this, this sort of ocular model would have suggested, it actually moves in the other direction, right back half of 2022, with oil at 100, Canadian dollar goes from 82 cents down to 72 cents, because of the sentiment factor, the risk off factor.

And the last, the last point here to make, uh, is. Why has the Canadian dollar decoupled from movements in the price of oil? It’s because oil, oil extraction and oil capex is less of a tailwind for the Canadian economy. Right, so, [00:30:00] Oil capex in Canada, again, I don’t know how oil comes out of the ground, like the straws that they put in the ground.

I mean, for me, it comes out of the pump, but anyway, how it comes out of the ground, that the amount of capex by Canadian companies in extracting oil and gas has fallen since 2014 in 10 years by 50, 5, 0%. So that’s less of a tailwind for the Canadian economy and less of a factor driving the movements in the value of our dollar, in the, of the Canadian dollar.

Pierre Daillie: Yeah, that’s, that’s interesting. I don’t think that’s what, I don’t think people expect to hear that. First of all, I, you know, it’s, you know, there there’s, um, you know, I, I think it also speaks to, I mean, the interesting thing that’s happening with natural gas. Right. Uh, and, and Mexico, you know, uh, natural gas exports to Mexico.

Uh, because it’s so inexpensive, um, and, uh, you know, so you can see where, you know, [00:31:00] Canada is having, I mean, Canada as a, as an energy exporter, um, would be having a hard time, just as an equally hard time. I mean, I, I saw, I saw a piece, a news item, uh, this week, which was about how Alberta was jockeying to provide, uh, Natural gas to the technology industry as a, as a source of electricity to drive AI, you know, AI server farms.

Yes,

Ilan Kolet: it is interesting. I mean, I think you, we can’t underestimate what’s happened in the U S right. So the shale revolution in the U S, um, is remarkable, right? They’ve added like, you know, two Canada’s and essentially to, to their, to their oil production. Um, and the natural gas developments are, are fascinating.

Um, what I would say though, again, and. Um, I’m sure you speak to commodity experts regularly who can get into this 10 levels more detail than I can. But what I think is interesting from a macroeconomic perspective and, and affecting our position is, [00:32:00] you know, I was working at the bank of Canada in 2008 under governor Carney, Canada came through the financial crisis, sort of first or second best in the G seven.

We just kind of skated through it. Part of that, and you know, there was a little bit of high fiving going on, you know, uh, Part of that was we didn’t, we had five well capitalized banks. We didn’t have the dodgy mortgages. I mean, I think we have some of those dodgy mortgages now, but we didn’t have those dodgy mortgages then.

And, um, the other thing, again, I think that goes underappreciated is. We had China growing at, I don’t know, 14 or 15 percent buying every commodity that we could export, right? That was a significant tailwind. That was a significant get out of jail free card, um, that we shouldn’t underestimate. That, it’s still there, it’s just a lot weaker than it was, right?

Um, and that has, that has really important, I think, short term and secular implications.

Pierre Daillie: Right. So this, I mean, this new China stimulus that we got at the end of September, um, is a [00:33:00] potential tailwind for Canada in, in relative to commodities.

Ilan Kolet: It is. I mean, so,

Pierre Daillie: you know,

Ilan Kolet: so you, in our positioning, what we’ve, what we’ve done most recently is, is a couple of things, and these are nuances here.

We, we, we remain cautious on Canada, right? So in our 60 40, 21 percent of the equities are Canadian equities. The underlying managers. Uh, we have a great slate of managers who, uh, who, who have historically done very well against their benchmarks. They’re incentivized to beat, uh, their benchmarks. If we own them, they boost the performance of our fund if they do well.

But we’ve trimmed that Canadian 21 percent by, call it, 4%. Okay. And allocated it into other areas. One of which Pierre is commodities, right? And so sometimes this is a bit of a head scratcher. How can, how can you be underweight Canada and overweight commodities? And the answer is we want to, we want exposure to that part of Canada that could do well if [00:34:00] com, you know, if commodities push higher.

And so we’re overweight commodities. So gold, oil, and, and global natural resources, the Fidelity fund, but we’re cautious on Canada, uh, because of that household debt concern and the lag that we expect and has in fact happened versus say the U S um, and other areas. Right. So. Um, it’s, you know, I it’s kind of positioning is a bit of an endogenous suit where everything affects everything else.

Um,

Pierre Daillie: yeah, that’s, I was just going to say that, I mean, it’s, it’s just so many moving parts that you have to consider. So based on, I mean, given, given what we’ve talked about up to this moment and I mean, Including all of your thoughts. Um, how has this, uh, change that we’ve had this year? How has, how has the, uh, fed rate cut and, and all of the underlying conditions that you see, how has it shifted your views on asset allocation?

I mean, I think you just mentioned that, that you’ve, you’ve trimmed the [00:35:00] underweight in Canada. And, um, now did you, you, you also mentioned, uh, that you had, uh, trimmed You’re a U. S. overweight. Yes. And, and, and you were favoring, uh, with the, the reallocation, you were favoring commodities. So I know we’re in the midst of that conversation right now.

Um, what do you think, what do you think is going to be the driver of, uh, a pickup in commodities?

Ilan Kolet: Yeah. So this is, um, this is an interesting one. So again, if I rewind to a year ago, when we first initiated this meaningful overweight to, to U. S. equities. Um, because of this productivity expansion idea, um, that ran, you know, really till like May, June of this year.

And then, you know, macro and, and bottom up are only two parts of our investment, our, our research based investment process. The other two parts, the other two pillars [00:36:00] are sentiment and value, sentiment and valuations, right? Now, valuations are not a great timing tool, right? As any EM investor will tell you, um, and sentiment.

You know, sentiment is tricky, very difficult to measure, but we basically took profits. Right. So we, we had a meaningful.

Pierre Daillie: US equities are, are stretched. Exactly. Especially in the high beta stocks. Yeah,

Ilan Kolet: that’s right. It was, it’s very concentrated. It’s had a significant run over, you know, over many, many months.

Um, we took, we took profits now. The core thesis in the U S still stands. We have a slight overweight to U S equities, but we, we want it to be just more regionally balanced across other asset classes, uh, still overweight equities, right? So the most important thing to talk about in terms of, in terms of our positioning is.

In our 60 40, which can be, call it a 70 30 or a 50 50, right? Generally, we think of them as having plus or minus 10 percent bands. We’re about halfway up that 10 percent band with, [00:37:00] and right now, that 60 40 is a 65 35. Uh, interestingly, on a different conversation that was recorded, I screwed up that math and said, 65, 25, but I practiced my math for this call.

Um, so, you know, we’re halfway up that, that risk spectrum and it’s generally, um, evenly, roughly evenly spread across, you know, Europe, uh, emerging markets and commodities, a slight overweight to the U S and then still cautious on Canada on, on the commodity side. I think there’s a couple of interesting things That can help us dissect the motivation there.

Um, so, you know, inevitably, in every conversation I’ve had. Uh, the U S election comes up. And sometimes when someone asks a question about the U S election, I say, I think we’re out of time, but, uh, so, you know, because it’s a tricky one to answer, but I think we should just dig right into it. Um, so I don’t know who’s going to win the election, [00:38:00] uh, I don’t, to be quite honest, it’s not our edge in predicting what an asset class is going to do if person A or person B wins.

Uh, I think we’ve spoken about this in the past. Our, our edge, we will always position and think deeply about policy and we will not position for politics, right? So policy, not politics. Policy is all the stuff we just discussed around R star, uh, and the neutral rate and all that kind of stuff. And politics is sort of the election noise.

It’s not our edge. Um, but There are a couple of important points worth highlighting. Regardless of who wins the U. S. election, I don’t think the U. S. is getting any less protectionist, right? So, under one scenario we’re getting tariffs. Under another scenario we’re getting Sort of industrial policy on shoring, re shoring kind of veiled protectionism.

Can’t the U S is not suddenly becoming more open, right? And if that’s the case, if the borders are getting thicker, that has really important implications for, for Canada, but [00:39:00] also it has important implications for inflation. And, and if it has important implications for inflation, you want to own out of benchmark, the asset class that does a great, does the best job of protecting investors against inflation, right again, 2022.

Which are, which are commodities. The second thing on, um, And, and how are you getting the commodities

Pierre Daillie: exposure? I know some of that is from Canadian commodities producers. Yes. Yeah. So

Ilan Kolet: it’s, um, it’s, it’s fairly diversified, right? So it’s two ETFs, um, a gold and an oil ETF, and, um, I’d happy to send the sizes afterwards.

Um, and then a small allocation to the, uh, Fidelity global natural resource fund, uh, run by, uh, uh, Joe and Darren. Now that, that, that position will evolve, right? So that’s, as of the end of July, it’s evolved. Um, it’s evolved a little bit. I’m happy to follow up. You know, when we’re out of that compliance window, but the other thing, the other motivation I think for the commodities exposure is [00:40:00] again, I don’t know who’s going to win, uh, regardless of who wins, I used to say, I don’t know which 80 year old is going to win, but I can’t say that now.

So, um, regardless of who wins, regardless of who wins, um, there will, the fiscal taps will be opened after that election, right? So there will be fiscal spending, um, you know, pro cyclical, uh, uh, fiscal spending. In the U S, um, it will be called different things, but fiscal spending on top of an already pretty tight U S economy is you guessed it inflationary.

Um, and so. To me, that’s kind of a medium term, underappreciated inflation risk. Um, and because of that, we want to own the asset class that again, 2022 was the Kate was the case study on how you need to own commodities to protect investors against the damaging effects of inflation.

Pierre Daillie: So, and, and thanks, thanks Ilan.

Thanks for explaining that. I think, you know, that’s, that might not always be [00:41:00] clear because right now, you know, We, we, you know, we’ve, we’ve been in a period where energy prices were low, gasoline prices, everybody’s sort of, you know, up until of course, um, the outbreak of, of this new, um, escalation with Iran, uh, Israel, the Iran Israel conflict, um, but, um, Um, in, so, so that’s commodities in Canadian fixed income, I think we’ve touched on it, but what do you, what do you see, like, if we’re, if we’re seeing, if we’re looking forward to, um, a deeper cutting cycle for Canada, what does that mean for, um, first of all, it means obviously lower short term rates, but what does it mean for, uh, longer term rates and duration in general, in, in terms of your exposure?

Um, Yeah.

Ilan Kolet: So. You know, on the fixed income side of the portfolio, we, we really have, we really are sort of where we [00:42:00] were, um, almost a year ago, right? Well, we, we’re still underweight, the investment grade, uh, investment grade debt, both Canada and globally. But again, where we’ve really, um, added to the income side.

And sometimes this gets, this sort of gets, uh, um, left behind or forgotten because of how well equities have done. And so we’ve been overweight equity that U S equity overweight was obviously very additive. The overweight to the credit and the spread sectors. So, um, you know, really talented managers like Adam Kramer, um, who, who is actually really worth chatting with if you, if you get the chance, that’s also been additive on the income side as well.

Right. And what I would say though, is. The thing, the way to think about our portfolios is the managed portfolios, the private investment pools, these are tactical portfolios, right? So now they’re not getting swung around every day or week or month, right? Moves are incremental, moves are research based, but as we get, um, [00:43:00] you know, as we get further into the rate normalization cycle and more, uh, sort of certainty on these landing points, you will see, you know, You can expect to see the fixed income side of the portfolio evolve right now.

We’ve thought for some time that it would, it would, it’s better to take that risk budget on the equity side of the portfolio. And, and that’s been additive, but again, this will evolve based on that four input research based process of macro bottom up sentiment and valuation again, in 10 years, you might be talking to someone else, Pierre, or, but I hope not, but, uh, and a lot may change, but what will not change is that four pillar research based process.

Pierre Daillie: Great. That’s great. I, I, but I think the main thing also to, to consider is the fact that you may have a view today, which could change tomorrow and therefore the tactical asset allocation model could [00:44:00] change on relatively short notice as well, depending on what happens in the economy, in the bond market, what happens with rates.

Ilan Kolet: Exactly. Exactly. I mean, so, you know, and there’s, there’s, there are examples of this, right? So, you know, again. I think a lot of times It’s not, I mean, it’s

Pierre Daillie: not a buy, it’s not a buy and hold asset allocation model. It’s not a strategic, a long term strategic asset allocation. It is indeed a tactical model, which changes according to economic considerations, the bond market, the equity market, whatever’s, whatever’s actually, whatever’s actually happening.

Not, you know, Not just a long term strategic view.

Ilan Kolet: Well, that’s a, that’s a perfect way to put it. Right. So I’ve, I’ve sometimes described these portfolios as simple solutions to complex problems. I mean, think about the breadth of our conversation today, every single answer I provided is based on research and collaboration with our research team and my colleagues, David and David, uh, [00:45:00] 60, 40 dead, right?

So like, My grandfather 6040, that one’s dead, right? The all Canada strategically allocated, set it and forget it. That I think is probably dead. I mean, um, and what we have now is again, the managed portfolios and the private investment pools do the best example of this is, um, They’re diversified across managers, across geography, across styles, sectors, and they have an asset allocation overlay that’s research based.

Right. So the other thing to note, and, and maybe this is, um, a good spot to end on is there’s an ongoing research agenda. This is the symbol for research agenda. Sorry. There’s an ongoing research agenda. There’s an ongoing research agenda underneath the funds. To continually sharpen the tool, right? I know we talked about this last time in the middle of May, we introduced liquid alternatives into the managed portfolios.

We have a, uh, a partnership with Brookfield asset management to manage a sleeve of private real estate in the private [00:46:00] investment pools. So there’s a, you know, we’re continually trying to innovate and sharpen the tool, uh, for the end investor. Um, and I think, I think that’s what, you know, that’s what we’ve, we’ve shown to do really over, over a number of years.

Pierre Daillie: Has the edition in May of this year. To alternatives in the portfolio had the desired effect of smoothing out returns. I mean, we had a pretty rough early August and a S and, and subsequently early September, uh, in markets because of the Japan carry trade reversal that happened. How did the alternatives help out during that period?

Ilan Kolet: So I would say, I mean, it’s early days, right? This is a small amount of data. Yeah, I

Pierre Daillie: mean, I recognize as well, asking you this question. It’s very soon, too soon maybe. But again, I mean,

Ilan Kolet: um, it’s early days and we have some preliminary, preliminary data. And we did answer this, uh, we kind of attacked this question in, in our last paper.

It has helped in, [00:47:00] in, in smoothing out some of the end ride for the end investor, again, very early days in a small, small data set from, from when we initiated these positions. Um, but I, what I’ve noticed is, you know, what I’ve done a lot of is just sort of, uh, sort of, uh, Advisor, investor education around basically why did we add these things and what are they right?

So again, these are, these are very new to, to retail investors, right? Historically, historically, this was an asset class for sovereign wealth funds, pension plans, and giant family offices, right? So it is very fidelity to democratize that asset class. And, and, and we were excited about it. So.

Pierre Daillie: It’s hard to, I mean, I, I think the benefit is that you get, maybe you get, you know, over the longer term, you’ll get slightly more return.

But the real benefit is less risk. Exactly. Exactly. So, and again, less risk for the entire life, less adjusted risk for the [00:48:00] entire portfolio.

Ilan Kolet: Exactly. And, and that’s, that speaks to a really important point here. We should always be thinking in risk adjusted return, not return, right? Risk adjusted return is, is the metric we should be thinking about.

And I know our Q2 paper had some nice scatter plots. I mean, Who doesn’t love a good scatterplot, uh, showing the slight nudge left of risk and the slight nudge higher of, of return. And again, these are nudges, right? Um, stocks and bonds are still the foundations of all the portfolios that we manage, but if we can sharpen the tool, we will.

Pierre Daillie: Ilan, um, wow, what a, what a great conversation, what a comprehensive take, um, I loved your anecdotes and, and your, your new data that you shared, um, I think, I think there’s, there’s a lot of, uh, takeaways here for everyone, um, thank you so much for your incredibly valuable time and your insights. Thank you, Pierre.

I mean, I really enjoy

Ilan Kolet: these chats. Next time we’ll do it in person for [00:49:00] sure.

Listen on The Move

The Fed's Bold Moves and Canada's Economic Divergence: Insights from Ilan Kolet

Pierre welcomes back Ilan Kolet, Institutional Portfolio Manager at Fidelity Investments. This episode delves into Ilan's expert analysis on U.S. and Canadian economies amid ongoing global economic shifts. Discover insights on the Fed's unprecedented rate cuts, the productivity expansion in the U.S., challenges facing the Canadian economy, and Fidelity's tactical asset allocation positioning. Ilan also shares his experience and insight from the NABE conference and thoughts on the future of fiscal and monetary policy. Explore investment strategies and gain valuable perspectives on navigating today's markets.

Timestamped Highlights

00:00 Introduction and Disclaimer

00:20 Guest Introduction: Ilan Kolet

01:38 Market Overview: 2024 Insights

02:25 Fed's Decision and Implications

04:14 Productivity Expansion in the U.S.

09:05 Comparing U.S. and Canadian Economies

13:31 NABE Conference Highlights

22:47 Divergence in US and Canadian Monetary Policies

23:21 Strategic Use of the Canadian Dollar

24:58 Impact of Interest Rate Differentials

25:48 Canada's Economic Growth Drivers

29:11 Decoupling of the Canadian Dollar from Oil Prices

31:28 US Shale Revolution and Its Implications

32:31 China's Economic Influence on Canada

33:49 Tactical Asset Allocation Strategies

37:44 Impact of US Election on Economic Policies

40:57 Fixed Income and Commodities Exposure

45:28 Ongoing Research and Portfolio Adjustments

48:32 Conclusion and Final Thoughts

About Ilan Kolet, Fidelity Investments

Ilan Kolet is an Institutional Portfolio Manager in the Global Asset Allocation (GAA) group at Fidelity Investments.

In this role, Ilan serves as a member of the investment management team, maintaining a deep knowledge of portfolio philosophy, process, and construction. He assists portfolio managers and their CIOs in ensuring that portfolios are managed in accordance with client expectations and contributes to investment thought leadership in support of the team. He is also a principal liaison for portfolio management to a broad range of current and prospective clients and internal partners, providing detailed portfolio reviews and serving as a key conduit of client objectives, requirements, and marketplace insight back to the investment team. Ilan’s focus is Canadian Asset Allocation strategies.

Prior to assuming this role in January 2021, Ilan was the Head of Inflation and Commodities Research in the Global Asset Allocation group (GAA) at Fidelity Investments. In this role, Ilan was a member of the Asset Allocation Research Team (AART), which conducts economic, fundamental, and quantitative research to develop asset allocation recommendations for Fidelity’s portfolio managers and investment teams.

Before joining Fidelity in 2014, Ilan was an editor at Bloomberg News, where he contributed to coverage of the Canadian and U.S. economies. Previously, Ilan worked at the Bank of Canada as an economist covering the U.S. economy and commodity prices. In this capacity, he was responsible for performing regular forecasts in advance of interest rate decisions, communicating the results to members of Governing Council, authoring research papers, and re-designing the Bank of Canada’s commodity price index. He has been in the financial industry since 2002.

Ilan earned his bachelor of arts degree in economics from Carleton University and his master of arts degree in economics from Simon Fraser University.

Copyright © AdvisorAnalyst.com