by Nicholas J. Paul, CFA, Institutional Portfolio Manager, MFS Investment Management

The global small- and mid-cap asset class we believe that the asset class remains a compelling area for asset allocators as the markets enter the next phase of the cycle.

Why consider investing in global small- and midcap stocks: The Base Case

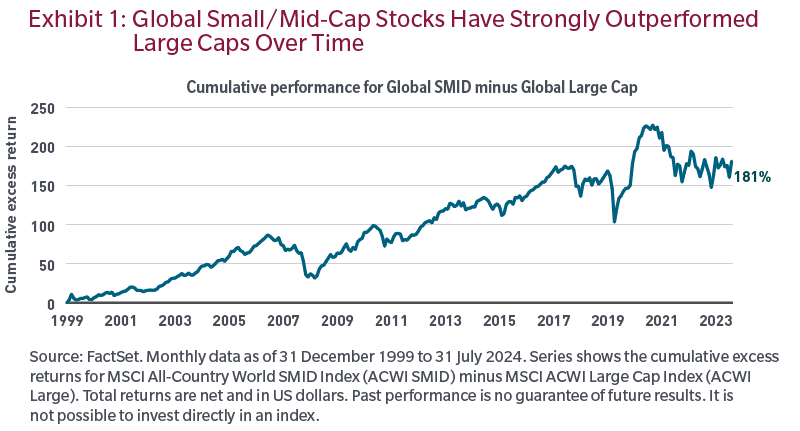

The global small- and midcap asset class has strongly outperformed large-cap stocks over the long term (Exhibit 1), and while market leadership ebbs and flows over shorter periods of time, we feel the asset class appears well positioned to potentially assume a leadership role in the next rotation.

Why consider investing in small and mid-caps?

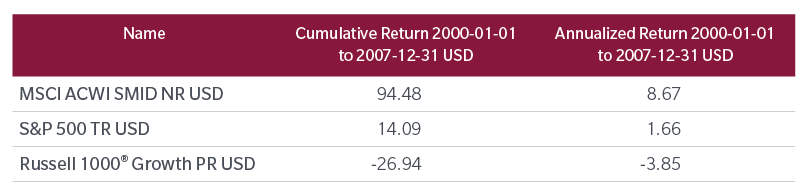

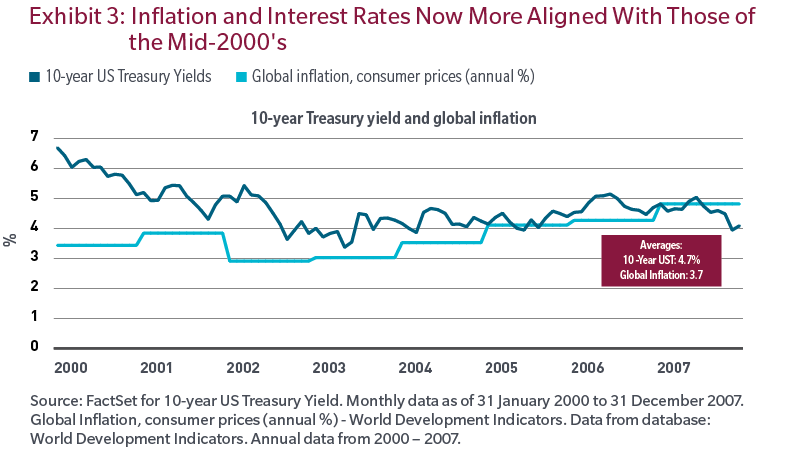

In our view, the opportunity set for global small- and midcaps appears particularly attractive. As noted, while leadership has tended to rotate every few years, we witnessed a sustained period of global small- and midcap outperformance during the eight-year period (2000 – 2007) coming out of the dot-com era, up until the Global Financial Crisis (GFC), with the MSCI ACWI SMID Index returning 94% versus the MSCI ACWI Large Cap Index return of just 21% (Exhibit 2). And while no two periods are alike, there are a number of parallels one could draw between that period in the early 2000s to today’s market environment.

The parallels are as follows:

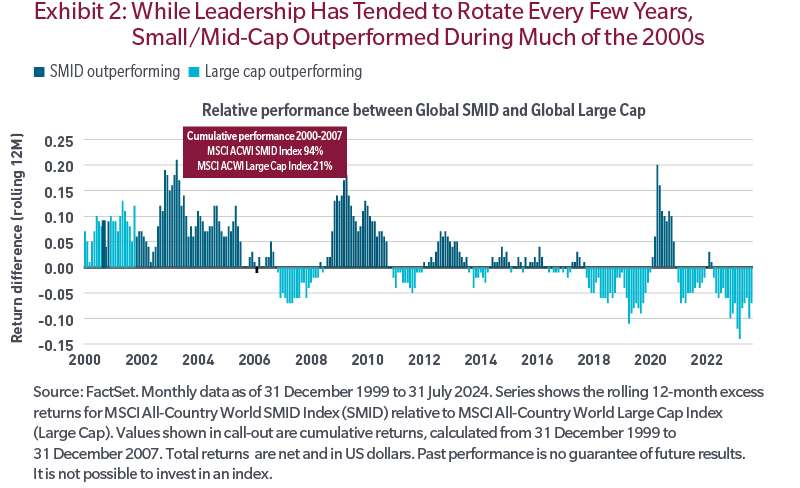

Inflation and interest rates – Directionally, the path of interest rates was much different during the start of the 2000s, with interest rates moving lower, versus what we witnessed in 2022 where rates moved sharply higher. However, over that eight-year period, interest rates and inflation were quite stable (Exhibit 3). In fact, over that eight-year period, 10-year treasuries averaged 4.7% and global inflation 3.7% (approximately 1% real rates), which is much more aligned with today’s reality — and the market backdrop we are likely to face moving forward — versus a world of zero inflation and the zero/negative interest rate environment that categorized the decade post the GFC. And while rates may in fact trend a bit lower over the near term (historically a positive for small- and midcap stocks), I think we’d all agree that the prospects of going back to a world of ZIRP (Zero Interest Rate Policy), benefiting higher multiple, long-duration large-growth stocks, is highly unlikely. In this context it makes sense that asset classes with more exposure to cyclical areas of the market (i.e., small- and midcaps) did quite well during this period as these have tended to be areas of the market that have benefited most from “healthy” inflation and higher rates. In fact, this trend started to play out, beginning in October 2022. Once the initial rise in rates was absorbed by the market, from October of 2022 through the early part of 2023, we witnessed a strong rotation from US large-cap growth stocks to small- and midcap stocks. . . and then what happened? Well, early in 2023, Generative AI swept in and “saved the day” for the Magnificent 7. But if not for Gen AI (I know, it’s hard to say that with a straight face), we would be looking at a very different market environment today.

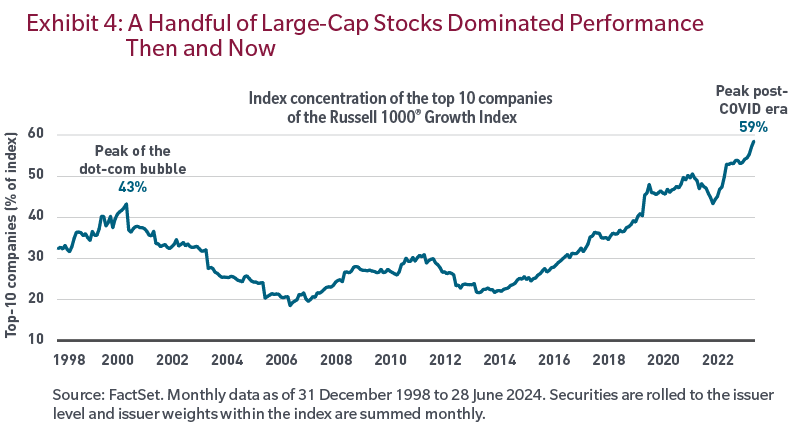

Concentration risk – Speaking of Gen AI, extreme concentration risk in US tech (Exhibit 4) is also reminiscent of the period leading up to the early 2000s (dot-com bubble ring a bell?). With that said, the mega-cap technology companies of today are clearly high-quality businesses and not analogous with the Pets.com or the eToys of the dot-com era. However, if earnings expectations for these largely concentrated areas of the market were not to live up to the lofty expectations embedded in their stock prices, and multiples derate, the relative value opportunity for small- and midcap stocks could be tremendous.

Low return environment for US stocks – Following the bursting of the dot-com bubble in the early 2000s, we witnessed a period of low returns for US equities. In fact, over that eight-year period, while global small- and midcap equities, as measured by the MSCI ACWI SMID Index, were up 94.5% (8.7% annualized), the S&P 500 was up just 14% (1.7% annualized) and the tech-heavy Russell 1000® Growth was down 21.2% (-2.9% annualized). So if, or perhaps more likely when, the euphoria around Generative AI becomes fully baked into these mega-cap tech stocks that dominate today’s US benchmarks, we could be setting ourselves up for an extended period of low absolute returns, which would also certainly rhyme with what we witnessed from 2000 to 2008.

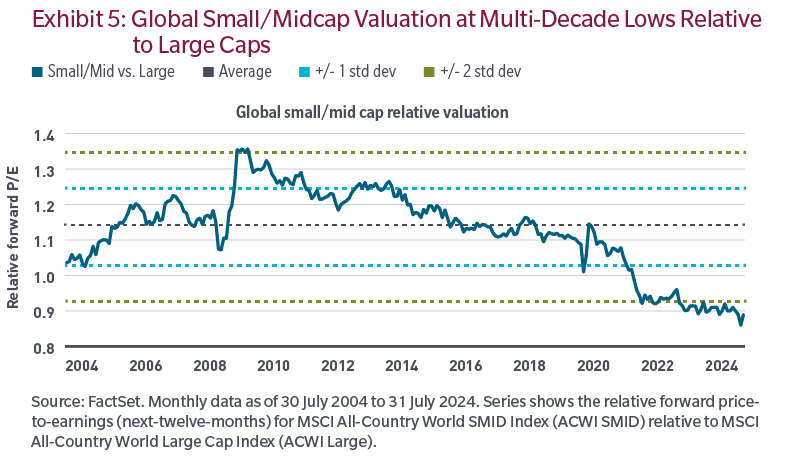

Valuations – I left valuations last on the list of parallels as this has been the “base case” for investing in many asset classes outside of US Large Cap Growth over the last decade. Unfortunately, as we’ve come to find out, valuation alone is not an investment thesis and things can stay “cheap” for a long time without a catalyst. However, in our view, you would once again have to go back to the early 2000s to find a buying opportunity as attractive as it stands today as global small- and midcap stocks are trading at two standard deviations “cheap” relative to their large-cap counterparts (Exhibit 5). Additionally, while lofty valuations didn’t matter much in a world of zero inflation, zero interest rates and access to essentially “free” capital, in world of higher rates, higher inflation and less liquidity, they matter greatly.

Future trends could benefit a broader range of companies

In addition to the parallels between today’s market environment and that of the early 2000s, perhaps more importantly, while technology and artificial intelligence will be an important part of our daily lives, we believe future trends could benefit a wider cohort of sectors and industries outside of just the technology-centric US companies of the past decade. Trends such as increased capex spending (versus opex only), spending to upgrade infrastructure, energy and the energy transition, defense and national security, as well as the reshoring and the localization of supply chains, just to name a few. And while many large-cap companies may stand to benefit from these trends, many small- and midcap companies may stand to benefit as well. And while the US dominates the landscape when it comes to large-cap tech, it would be naïve to assume that all the best companies in the world across a wide subset of sectors and industries reside in a single region or asset class.

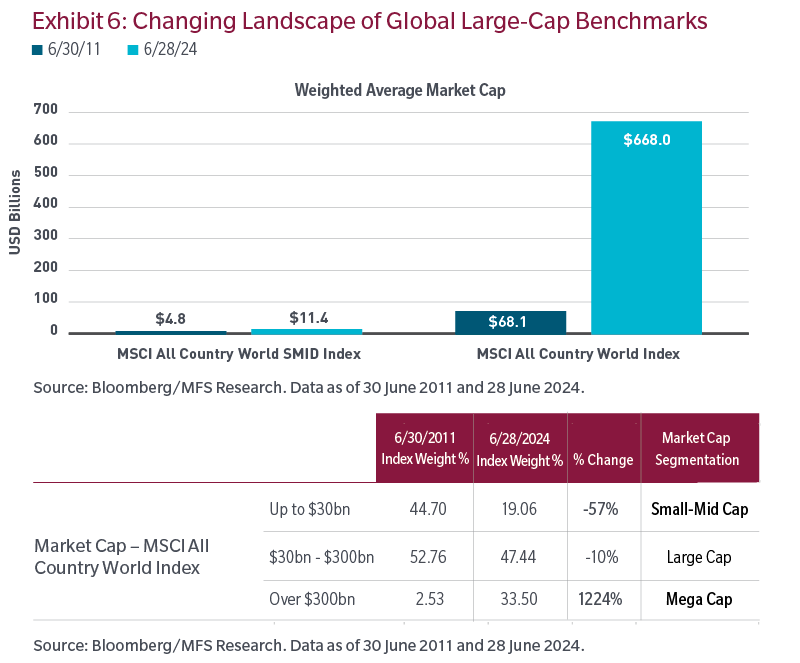

The changing landscape of global standard benchmarks

Last, and perhaps most important, we believe the biggest reason for suitable investors to consider a dedicated allocation to the global small- and midcap asset class today is that global investors are significantly less able to gain exposure to small- and midcap stocks through traditional standard global benchmarks. This is primarily due to the strong performance of a handful of US technology stocks during the past decade (and their ensuing increase in market capitalization). In our view, the dominance of the most influential large-cap stocks can be better appreciated when viewed from the perspective of market-capitalization buckets, as illustrated in Exhibit 7, where exposure to companies with a market capitalization greater than $300 billion has gone from just over 1% of standard benchmarks in 2010 to close to 30% of these same benchmarks. In fact, the weighted average market cap of the MSCI All Country World Index has gone from $66B to an astounding $468B over that same period, leaving many investors under allocated to small- and midcap stocks.

*****

The information included above as well as individual companies and/or securities mentioned should not be construed as investment advice, a recommendation to buy or sell or an indication of trading intent on behalf of any MFS product.

Important Risk Considerations:

Stock: Stock markets and investments in individual stocks are volatile and can decline significantly in response to or investor perception of, issuer, market, economic, industry, political, regulatory, geopolitical, environmental, public health, and other conditions.

International: Investments in foreign markets can involve greater risk and volatility than U.S. investments because of adverse market, currency, economic, industry, political, regulatory, geopolitical, or other conditions.

Mid cap: Investments in mid-cap companies can be more volatile than investments in larger companies.

Small-cap: Investments in small-cap companies can be more volatile than investments in larger companies.

*****

Index data source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

“Standard & Poor’s® ” and S&P “S&P® ” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC.(“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC and has been.licensed for use by MFS. MFS’s Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jone.Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such products.

Frank Russell Company (“Russell”) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed. Past performance is no guarantee of future results.

Diversification does not guarantee a profit or protect against a loss. Past performance is no guarantee of future results. You should consider your client’s financial needs, goals, and risk tolerance before making any investment recommendations.

Copyright © MFS Investment Management