by Research Team at Charles Schwab & Company

Stock buybacks have boomed in recent years. With corporate cash flows remaining high and potential rate cuts from the Fed, the trend appears set to continue.

Stock buybacks can be popular among some investors who like that it can increase demand for the stock, increase its price, and create liquidity. Others, however, might believe the company could find a better use for cash than repurchasing its own shares.

Either way, buybacks remain popular among corporations and appear likely to continue in part because of the expectation the Federal Reserve will soon start cutting interest rates. When interest rates are lower, like at the end of the financial crisis and the start of the 2020 pandemic, share repurchases tend to be more plentiful because of the diminished return from holding cash.

They've still been popular while rates have been higher, though. In the first quarter of 2024, S&P 500 companies made $236.8 billion in share repurchases. Companies had $187.3 billion in cash on hand and in bank accounts as of March 31, 2024, according to the Federal Reserve Bank of St. Louis. Share repurchases have been strong since January 2021, exceeding $174 billion every quarter.

For U.S. and Canadian companies that did buybacks, there were solid returns. The CIBC Canadian Buyback Index returned 22.8%, and the CIBC U.S. Buyback Index returned 21.47% for the fiscal year ending July 31, 2024. Those outperformed the S&P 500® index (SPX), which returned 20.34%. Buybacks are likely to increase as the Federal Reserve cuts interest rates.

"With interest rate cuts, you tend to see more share buybacks because holding cash is less attractive," said Joe Mazzola, director of trading and education at Schwab.

Source: S&P Global

Source: S&P Global

The outlook for buybacks

Buybacks reduce total assets and equity of a company's stock, which increases return on equity and earnings per share. "It's a way for management to optimize capital," Mazzola said.

While companies may still make share repurchases when rates are higher, buybacks are even more attractive when rates decline. When companies can earn 5% interest on their cash balances, management teams feel less pressure to find uses for those funds. Corporate cash balances are larger than they were a year ago, and unless the economy tips into a recession, a cut in interest rates should lead to repurchases.

Mazzola said that companies with the largest balances are mega caps that have already been active repurchasers, such as Alphabet (GOOGL), Apple (AAPL), and Microsoft (MSFT).

Rate cuts aren't created equal. If the Fed gradually eases rates down, it will most likely be interpreted as a response to stabilizing job market and inflation. Companies would have some assurance of a good economic outlook. If rate cuts are sharp and sudden, observers might see that as a sign that recession is imminent, so companies might hold on to cash rather than use it for share repurchases.

How stock buybacks work

There are three methods for buybacks:

- An open market purchase is most common. The company simply buys shares at the market price.

- With a tender offer, the company sets a price and number of shares it wants to buy, then asks shareholders if they want to sell on these terms. Tender offers are usually associated with a takeover or corporate restructuring.

- In a privately negotiated repurchase, the company approaches large shareholders and negotiates a price for buying back shares. The main reason to do this is to eliminate an activist shareholder, but it may also happen as part of a restructuring.

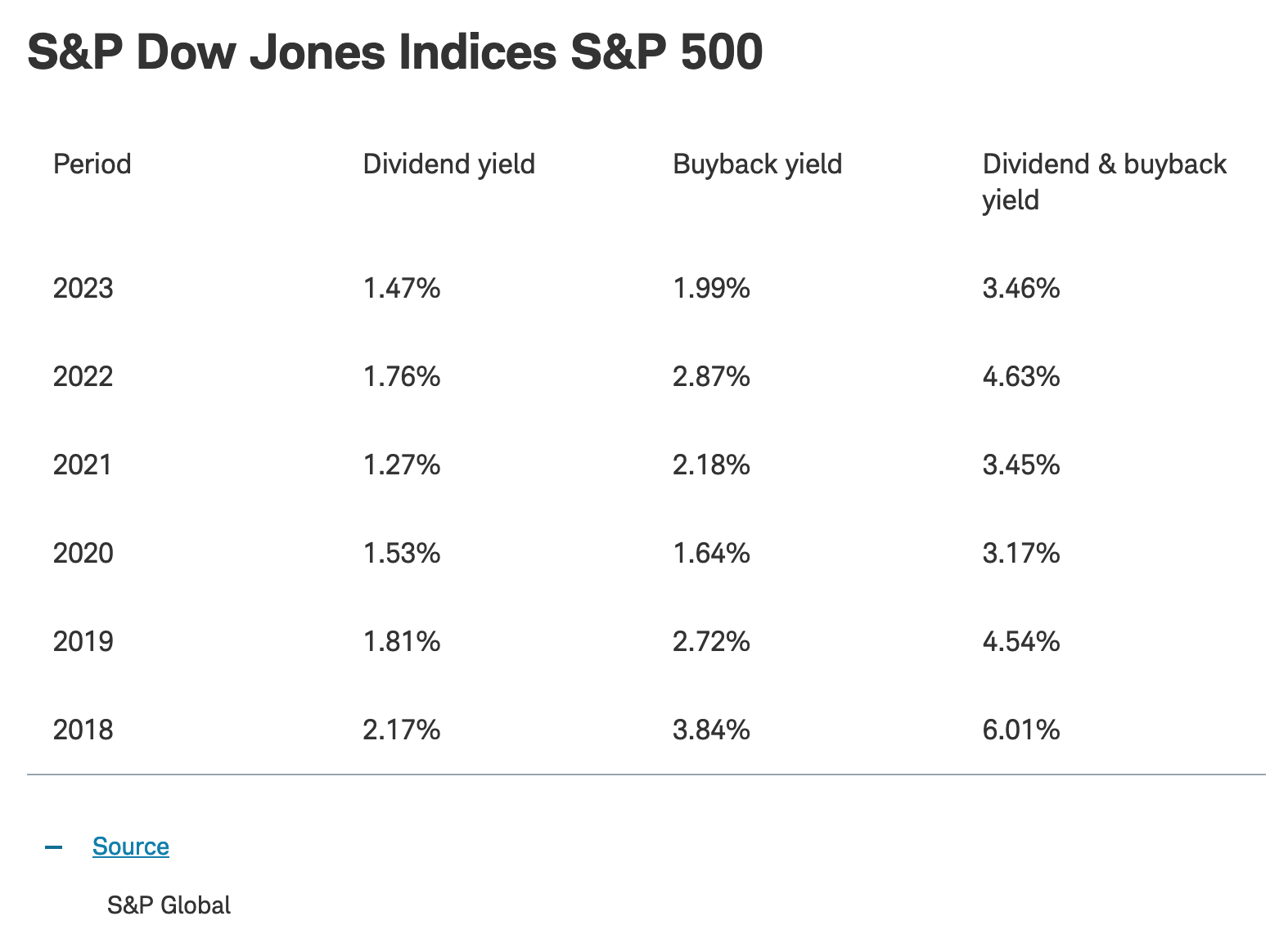

Dividend and share repurchase yields measure the total return investors have received from dividends and buybacks—and buybacks have generally provided shareholders of companies in the S&P 500 a better cash return than dividends since 2018. In 2023, the dividend yield for the S&P 500 was 1.47% and the buyback yield was 1.99%.

The largest companies are some of the largest repurchasers. S&P data show that the largest repurchaser over the last 10 years is Apple, which has bought back $663.9 billion in shares. Number two is Alphabet, buying back $255.7 billion, and Microsoft, buying $192.0 billion. These companies acquired the shares through open market purchases.

Company executives have plenty of options for using excess cash: They can find new investments for the business, pay shareholders a dividend, or repurchase stock. Companies sometimes favor buybacks over dividends, which are a commitment because they're quarterly payments to shareholders. A share repurchase returns money to shareholders without locking management into future payments.

In addition to the potential benefit of price appreciation and liquidity events for shareholders, buybacks can also be a way to award employees. Repurchased shares can result in additional employee compensation, which helps align employee interests with shareholders.

Will you buy into buybacks?

Companies with a lot of cash might be one place to look for investors who are looking to buy into the buyback trend. Mazzola said there are some important questions if you're looking for investments with share repurchase potential:

- Does the company have strong fundamentals? Businesses should be investing in their future at adequate levels—otherwise, they could be using buybacks to mask weakening fundamentals and keep their share prices afloat.

- Is the company likely to follow through? Companies sometimes announce a buyback but then fail to fulfill it, whether in whole or in part. This can happen when new priorities arise or a crisis hits. Generally speaking, companies with a long-term history of share repurchases are more likely to follow through on them.

- Is the company issuing new shares? Companies can simultaneously repurchase their shares and issue new ones, which sometimes happens when executives exercise their stock options. This dilutes the benefit of the buyback program because the number of outstanding shares may not decline at all and could even rise depending on the pace of buying and issuing. You can check for net declines or increases in a company's outstanding shares on its balance sheet at the close of each quarter.

If researching individual stocks feels daunting, or if you want to reduce the influence a single buyback stock has on your portfolio, you might consider buyback-focused ETFs or mutual funds. Adding a fund focused on U.S. buybacks and another focused abroad may spread your risk and reduce your exposure to single sectors and markets.

Bottom line

Share repurchases return cash to investors, can show that management is handling cash responsibly, increase opportunities for share-based employee compensation, and reduce the number of shares used to calculate future earnings per share. Buybacks are especially attractive when interest rates fall because companies receive less interest income on cash balances. With the expectation for interest rate cuts from the Federal Reserve on the horizon, already-strong share repurchase activity may pick up.

Copyright © Charles Schwab & Company