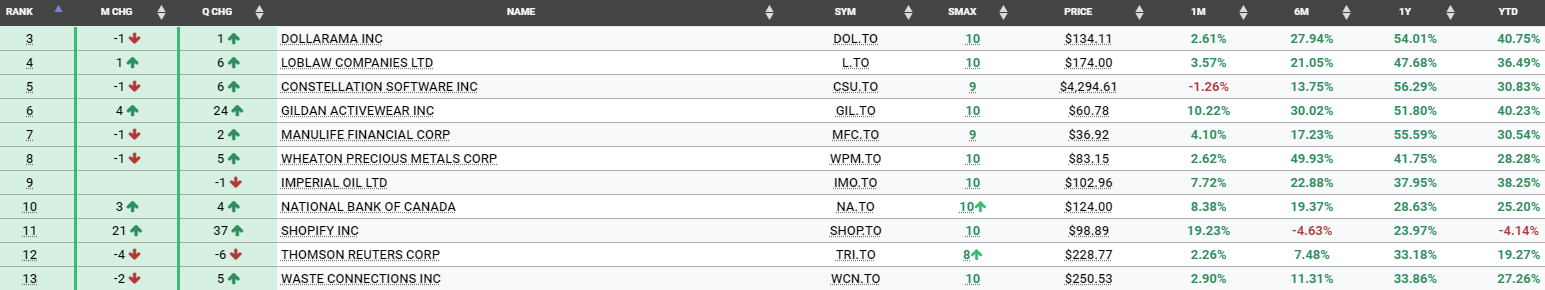

Dollarama is a prominent Canadian value retailer with over 1,000 locations. Led by Neil Rossy, a fourth-generation retailer and member of Dollarama’s founding management team, the company is currently ranked #3 in the SIA S&P TSX 60 Index Report. Dollarama is also a key pillar of the SIACharts Hypothetical Canadian 5-Stock Model, with 22,293 shares purchased on November 28, 2022, at a price of $80.67. This purchase followed the sale of shares in Teck Resources Ltd., which had a declining position in the report and remains at #33 in the Unfavored Zone. The investment strategy involves replacing the previous holding with the highest-ranked stock from the Relative Strength rankings that has a SMAX score of 6 or higher. On the day of the purchase in November, Dollarama was the top-ranked stock. This rules-based approach, as opposed to a gut-based method, ensures that only top-ranked names are included in the concentrated portfolio. This strategy contributes to SIA’s impressive CAGR of 13.06% compared to the benchmark’s 3.31%. The attached candlestick chart with the Report History Overlay tool illustrates how long DOL.TO has remained in the Favored Green Zone, reflecting its outperformance. The Bullish SMAX score of 10 out of 10, although more of a short-term indicator, suggests continued strong short-term performance relative to other asset classes. DOL.TO has achieved YTD gains of 54.01% and continued to add 2.61% in August, despite the turmoil from the unwinding Japanese carry-trade scare.

The following tables detail the performance of the High Relative Strength + Concentration strategy used by SIACharts, which consistently delivers returns exceeding market averages. The strategy has an Alpha of 2.71 and a Beta of 0.50. Over one year, the Canadian 5-Stock Model is up 36.58% compared to 14.48% for the TSX 60, and over five years, it is up 14.46% compared to 7.23%. These models are backed by a 10-year track record of market outperformance, with live trades signaled to brokers and further analyzed with SIA-AI backtesting tools. These portfolios streamline and optimize strategies, with advisors noting their effectiveness in scaling business operations. Currently, this strategy, combined with other SIA Hypothetical Models, is available in a SIA Wealth Pooled product format, incorporating multiple sleeves into a 16-stock Alpha Monster portfolio. For more information, please contact your representative. Stock Selection Process: FOR ADVISOR USE ONLY The hypothetical Canadian 5-stock selection process recommends the top 5 relative strength-ranked names from the SIA S&P/TSX 60 universe, limiting selections to one stock per sector for diversification. When a holding is sold, it is replaced with the highest-ranked stock from the Relative Strength rankings with a SMAX score of 6 or higher. If the top-ranked stock already has a sector holding in the current model, the next highest-ranked stock is chosen. The strategy will sell any investment that moves to the Neutral zone of the report with a SMAX score of 5 or less or to the Unfavored zone.

Disclaimer: SIACharts Inc. specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment whatsoever. This information has been prepared without regard to any particular investors investment objectives, financial situation, and needs. None of the information contained in this document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. As such, advisors and their clients should not act on any recommendation (express or implied) or information in this report without obtaining specific advice in relation to their accounts and should not rely on information herein as the primary basis for their investment decisions. Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources, believed to be reliable. SIACharts Inc. nor its third party content providers make any representations or warranties or take any responsibility as to the accuracy or completeness of any recommendation or information contained herein and shall not be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon. Any statements nonfactual in nature constitute only current opinions, which are subject to change without notice.