by Larry Adam, CIO, Raymond James

Key Takeaways

- Equity volatility increased with the S&P 500 down ~4%

- Political, economic, earnings uncertainty are all rising

- We remain cautious on the market near term

Is bad news becoming bad news for the equity market? For much of this year, investors cheered easing inflation pressures and softening economic data believing it would push the Federal Reserve (Fed) to cut interest rates. This, plus AI tailwinds, helped drive the S&P 500 to 38 record highs and a ~15% gain YTD. But, this week’s sentiment shift and market weakness (S&P 500 down ~4% from its recent peak) have been notable, particularly ahead of the Fed’s meeting and non-farm payrolls next week. So, the question is: Is bad news now bad news for equities once again or is this just a normal correction? Below we outline three building uncertainties weighing on the equity market and reiterate why we are cautious in the near term:

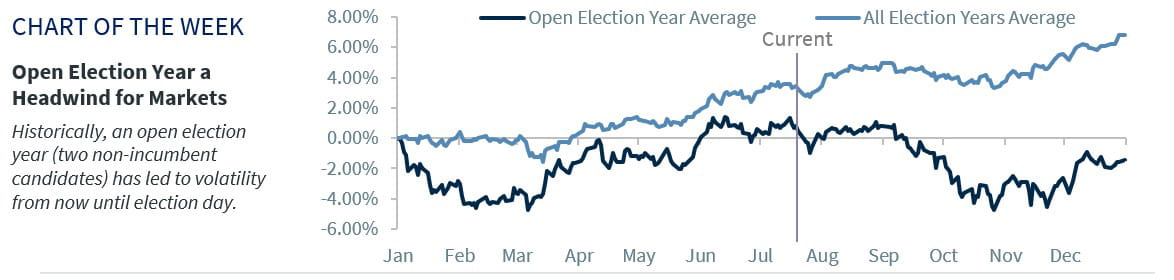

- Election uncertainty | The twists and turns in this election cycle have been unparalleled in modern history. In fact, with President Biden becoming the first sitting president to not seek reelection since 1968 this becomes only the eighth ‘open’ election between non-incumbent candidates. While Vice President Harris will likely represent a continuation of the Biden administration policies, investors need to be mindful of the platform she ran on in 2020. For example, Harris favored raising the corporate tax rate to over 30% – currently at 21%. For Trump, the impact of higher tariffs remains unclear. The point: with polls tightening, the market does not like the uncertainty that will likely ramp up as we move past the Summer Olympics. Using history as a guide, ‘open’ elections have not been positive for the markets. The incumbent party lost six of the seven times, with the equity market down over 2%, on average, leading into the election and returns were positive only 43% of the time. This is consistent with our near-term cautiousness leading into the election. The good news: once the election uncertainty lifts, the market has recovered the year after the election, gaining over 9%, on average, with positive returns over 71% of the time.

- The economy is at an inflection point | After years of persistent strength, the Fed’s efforts to cool the economy are working. Inflation pressures are subsiding – prices actually declined last month! The labor market has cooled, with job hiring and quit rates back to normal and the unemployment rate inching up. The interest-rate sensitive areas of the economy (e.g., housing, autos) are under pressure from elevated rates. And consumers, feeling the impact of price hikes, are slowing their spending. Case in point: car manufacturers and dealers have slashed prices and beefed up incentives to counter softening demand. Up until now, this has been good news for the Fed in its quest to tame inflation. But there is growing concern that the economy is cooling too quickly. Powell warned about the potential downside risks to growth from holding monetary policy too tight for too long, and former Fed Governor Dudley, one of the more vocal higher for longer hawks, is now openly calling for the Fed to start cutting rates. Hence, bad news may be turning into bad news, particularly if softer growth starts to weigh on earnings.

- Earnings under scrutiny | Positive earnings revisions have been a key tailwind for the market year-to-date. Thus far, the 2Q24 earnings season is off to a good start, with S&P 500 earnings on pace to climb ~10% YoY. However, softening economic activity has increased the uncertainty about future earnings strength – with forward-looking management guidance suggesting that consensus 2025 EPS estimates (~$277) may be too high. For example, consumer-facing companies, such as Visa, Nike, and Chipotle, highlighted that not only is consumer spending slowing, but consumers are becoming more discerning. As a result, businesses are refocusing on volume growth as their pricing power wanes. Within Industrials, select transports flagged that capacity is outpacing demand. And Communication Services companies reported slowing ad growth. The point: with valuations stretched and much of the good news already priced in, earnings will be the key driver of the market (38% of S&P 500 market cap report next week). As earnings uncertainty starts to creep back into the market, volatility is bound to follow.

Bottom line | In addition to these building uncertainties, several other indicators suggest caution in the near term. While we remain positive on the equity market longer term, four other factors suggest weakness ahead:

- History | The S&P 500 typically experiences 3-4, 5% pullbacks in any given year. This year has only seen one. In addition, the current max drawdown of 5% would mark the third smallest max intra-year drawdown dating back to 1990.

- Seasonality | From a seasonal perspective, we have entered the weakest period of the year for the S&P 500. In fact, over the last 30 years, the S&P 500 has been down 1.3% on average from mid-July to mid-October.

- Over Optimism | Investor optimism reached historic levels as the % of bullish investors rose above 50% to the highest level YTD. Historically the market has been down ~0.3% in the following 12 months when the % of bullish investors rose above 50%.

- Valuations | A lot of good news has been priced into the markets, as valuations rose to the 93rd percentile vs history. This leaves the market susceptible to earnings and economic misses.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.