by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Everyone likes new market highs. We do too, even with our more defensive mindset of late. The S&P has been busy entering never-before-seen levels, along with the Canada and Europe. Asia is a little off of record highs, but not by much. If you look hard enough, you can find some markets that are down, like France, the UK and Israel, but the list is much longer for those reaching new levels. So this isn’t just an AI or Mag 7 story; there is a broadening of performance underway in 2024.

Is the world really so rosy? Global tensions abound, some of which are now regional hot wars. Then there is the gradual move back to a more polarized world. Multiple elections appear to be testing the fabric of democracy or what democracy will look like going forward. Markets don’t really care about this kind of stuff until it gets too extreme.

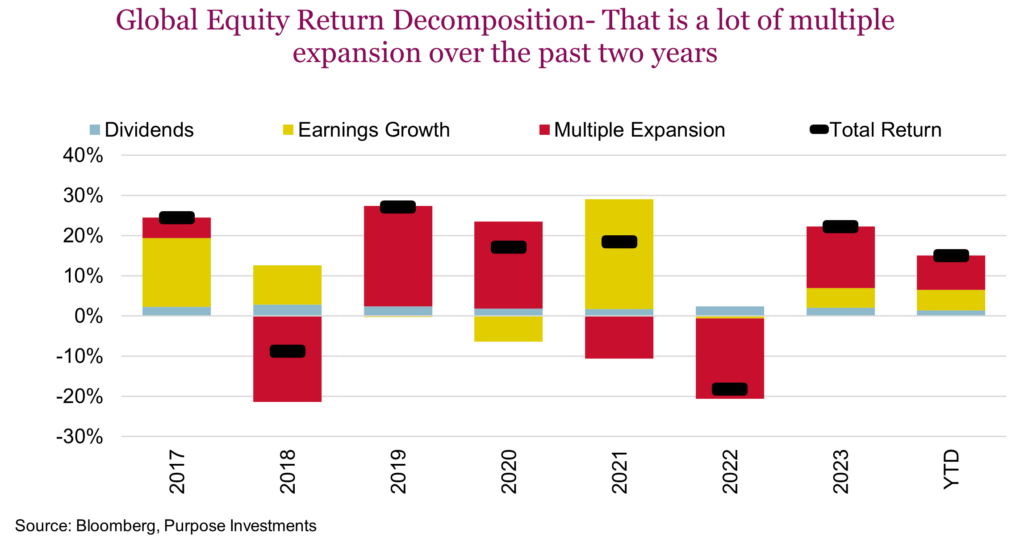

There are three things that move markets: dividends, earnings growth, and the market multiple. Dividends are pretty straightforward and don’t vary that much in the short term, but don’t underestimate their power over time. The annualized return for the TSX is 5.8% over the past 33 years compared to 8.5% including dividends. Yet from one year to the next, dividends are pretty stable.

Earnings growth moves around much more than dividends and is tethered to the economy in one way or another. It isn’t just the economy; financial and operational leverage is baked into earnings. That is why a 4% nominal economic growth is often driving 10-20% earnings growth. Or if interest rates fall, this fuels earnings growth in aggregate, as financing costs fall. Of course this varies considerably across companies, industries and countries.

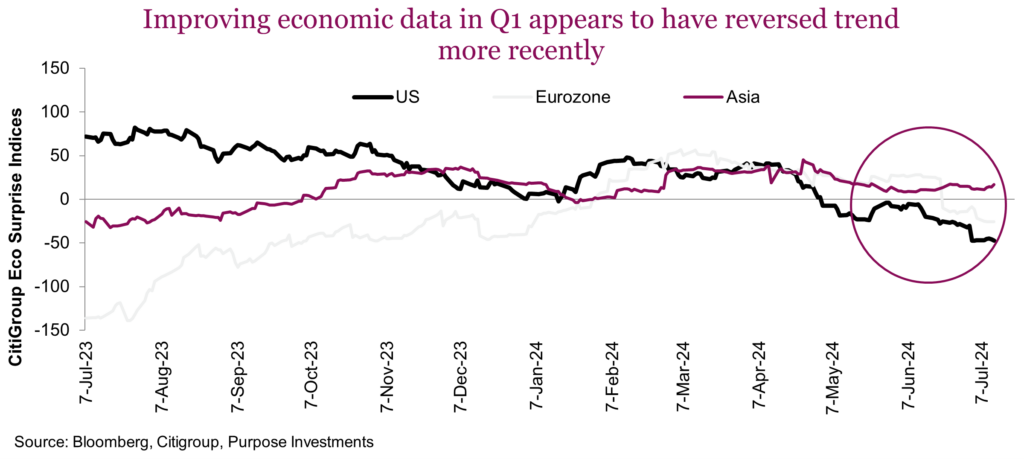

Global earnings growth is forecast to grow at a decent 12% pace from calendar 2024 to 2025, improving somewhat from the mid-single-digit growth pace of this year. Forecasts are useful but they are just forecasts. Helping earnings optimism has been an upturn in global economic activity from earlier in 2024. Hurting it has been higher financing costs that continue to slowly work their way through the economy and corporate income statements.

Then there is inflation. Inflation has been positive for earnings, as rising sales inflation has been outpacing rising cost inflation. Companies are pretty quick to raise prices for what they sell when the market will allow them; let’s just say they are a bit slower in raising wages. Wages lag, and with inflation coming back down now, the question will be whether the lagged cost inflation increasingly continues to bite when the topline sales inflation slows. Time will tell.

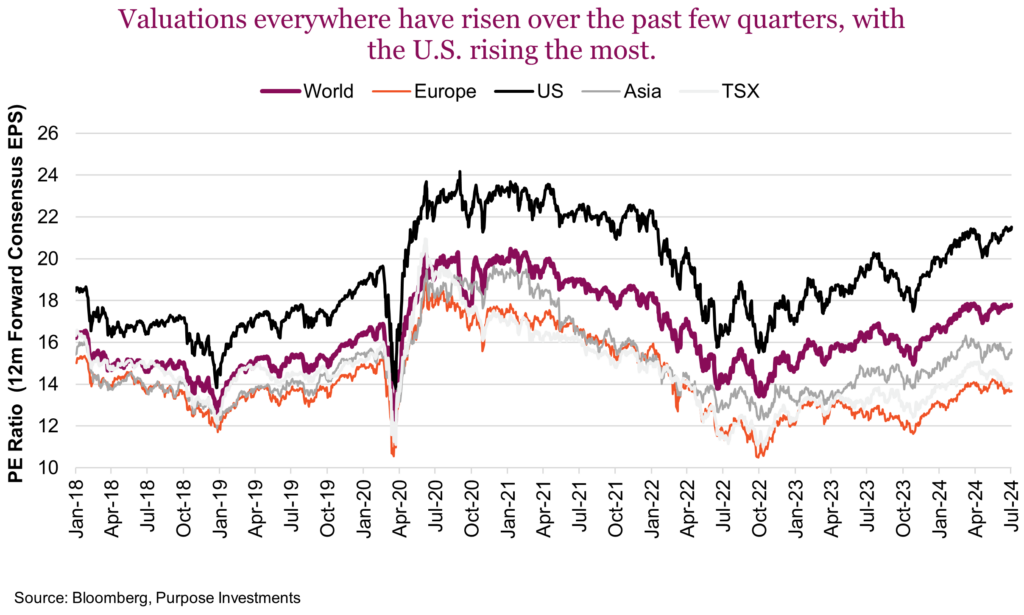

This brings us to the most manic ingredient in market return decomposition: the market multiple. It encompasses everything from optimism/pessimism of the future, the economic consensus, inflation, discount rates of future earnings, yields, and cost of capital… we could keep going. Or, on aggregate, let’s call it the market mood. Given that most of the gains for the past couple of years have come from multiple expansions, people may be pessimistic about the world or politics, but the mood for the market is clearly optimistic. Over the past couple of years, there has been broad-based multiple expansion in most markets.

This market optimism can be attributed to a few aspects. Inflation is improving and coming down, which opens the door for more central bank rate cuts. Lower yields beget a high market multiple. If the discount rate is lower, future earnings become more valuable. So inflation remains a big deal as it continues to move in the right direction.

This creates a bit of a paradox for economic data. Today, weaker data is good, but for only for so long. Weaker data, which has been the norm over the past couple of months following stronger data earlier in the year, is good news as that likely means inflation continues to come down. Yet, if the economic weakness goes too far, then the market multiple will become more sensitive to recession risk compared to inflation risk.

So, where is the line in the sand? We will only know once the market steps over it. For now, softer economic data is good for inflation, which is good for rate cut probabilities, which is good for bond yields coming down, which is good for the market multiple.

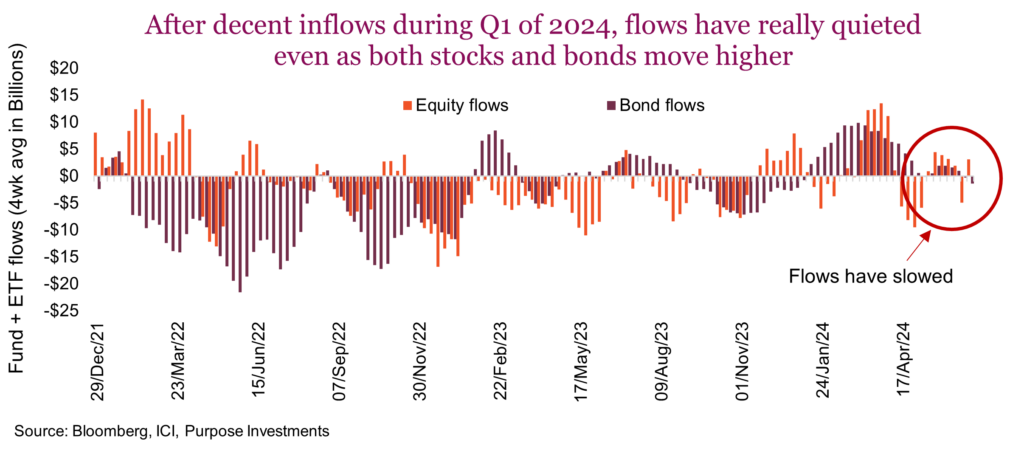

One interesting aspect of the recent move higher in markets is the lack of investor participation. Fund flows into both mutual funds and ETFs had been very strong in Q1 for equity and bond vehicles. However, over the past few months, flows have been rather anemic for both (see chart). Equally interesting, flows into money market vehicles (cash) were strongly positive in Q1 then have really slowed in Q2 as well.

So equity, bond and cash inflows are very low. Where is the money going? Hard to say but with inflation still running just as hot as wage growth, it could be that rising living costs are weighing on savings behaviour.

Final thoughts

Perhaps the market moves higher as inflation cools more, uncorking a little bit more from multiple expansion. But with each piece of news that helps the market multiple rise on lower inflation/yields, it adds to pessimism for the economy and future earnings growth. Given the dearth of retail inflows based on fund/ETF data, this increases the reliance on this market advance from just one lever (our one-legged stool) to multiple expansions. The problem with multiple expansion is it mean reverts – in some years providing a positive impact, in others a negative. Without follow through into improving earnings, the sustainability of the market advance remains precarious.