by Richard Bernstein, Richard Bernstein Advisors

-

The Earnings Expectations Life Cycle, developed 30+ years ago, depicts how investor attitudes change through time.

-

History suggests that what’s hot becomes cold and vice versa.

-

The current market environment seems particularly worthwhile for revisiting the lessons of the Earnings Expectations Life Cycle.

Investors often forget that nothing in the financial markets is permanent. Regardless of the hype or castigation, what’s hot eventually becomes cold and what’s cold eventually becomes hot.

In May 1990, we introduced the Earnings Expectations Life Cycle to explain how Wall Street reacts to this inevitable metamorphosis. 34 years later, the original construct seems as appropriate as ever.

Calling a stock a “core holding” has often proven to be a curse, whereas universal acceptance that an asset is totally unworthy of investment consideration has typically provided an opportunity. To us, that dichotomy certainly seems to describe today’s global equity markets.

While we remain very skeptical of today’s market’s heroes, we think the range of investment opportunities is historically broad, historically attractive, and a once-in-a-generation opportunity.

The Earnings Expectations Life Cycle

The Earnings Expectations Life Cycle depicts investors’ changing attitudes through time. Every stock rotates around this cycle. Some may move rapidly, some may move slowly, some may do holding patterns at various points, but every stock does indeed rotate around this cycle.

Several aspects of the Earnings Expectations Life Cycle are particularly worth noting:

-

Both up and down cycles begin with the general denial that fundamentals are changing. Both initial good news and initial bad news are typically rationalized as being temporary. It takes a while for investors to comprehend their views of a company need to change.

-

Analysts are rarely original. Rather, they react with consensus to a series of positive or negative events. Note that “Estimate Revisions” are located at 3 o’clock and 9 o’clock, which is in the middle of improving or deteriorating expectations.

-

Investors’ maximum enthusiasm for a stock occurs right at the peak of performance (i.e., Midnight on the Life Cycle). At the other extreme, the best long-term investment ideas occur when stocks are not considered viable investments. (i.e., 6 o’clock). We will discuss the economic theory supporting this notion later in the paper.

-

Stocks can become so out of favor that buy- and sell-side analysts drop coverage. Ironically, their dropping coverage helps nurture an improving investment opportunity.

The Earnings Expectations Life Cycle seems very relevant today. Investors over the past year or so believed that a handful of companies, termed the “Magnificent 7”, were somehow special and unique, that their business models were invincible, and that they should be core holdings of any long-term equity portfolio.

Despite their recent extreme outperformance, history suggests investors should be wary. The Nifty 50, the Tech Bubble, Emerging Markets, housing, or many individual stocks, have shown through time that the extended underperformance associated with stocks moving down the right side of the Life Cycle can be long and painful.

Some of the Magnificent 7 stocks have already proved vulnerable and have started to meaningfully underperform in a short period of time. We see this as the very initial stages of a longer-term transition to a broader market.

What’s hot becomes cold and vice versa

One of the key aspects of the Earnings Expectations Life Cycle is that assets can move from hot to cold and cold to hot. It seems a total fallacy that any investment is “unstoppable,” and there are many supporting examples.

The Tech Bubble is widely recognized as a period during which investors thought technology stocks would lead the markets for an extended period, but instead the result was the so-called “lost decade” in equities. If one had bought NASDAQ® in March 2000, it would’ve taken one roughly 14 years just to break even.

Even worse, it took roughly 31 years for the Japanese Nikkei 225 stock index to finally recoup it’s losses from the 1989 bubble peak!

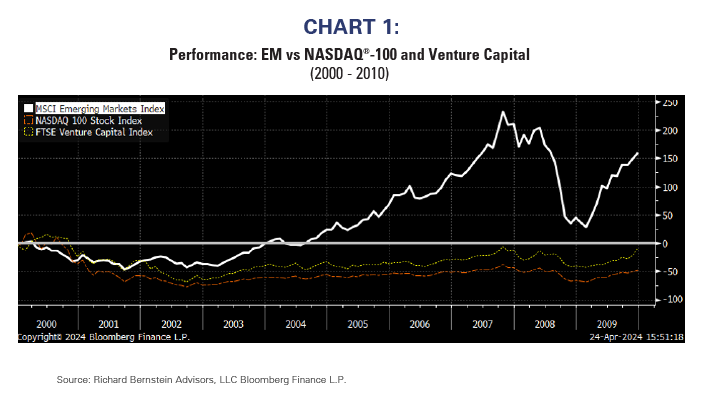

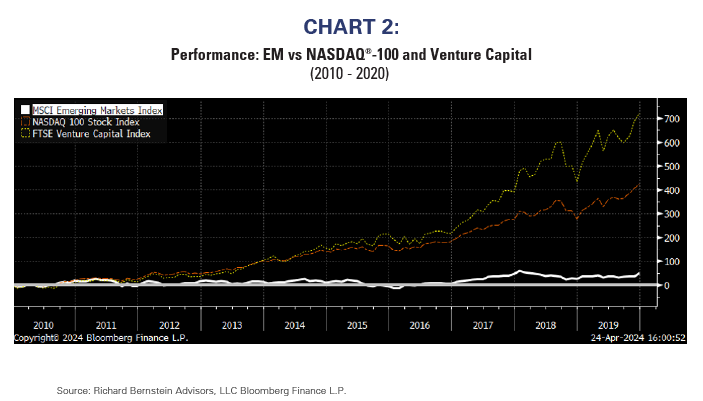

Charts 1 and 2 show how hot becomes cold and cold becomes hot by showing the performance of Emerging Markets, the NASDAQ®-100, and Venture Capital over two decades. From 2000 to 2010 Emerging Markets significantly outperformed both NASDAQ® and Venture Capital. However, the exact opposite occurred from 2010 to 2020.

Today NASDAQ® is perhaps an over-hyped investment, but virtually no one wanted Technology-related investments in 2010 because consensus was focused on Emerging Markets. Today, the opposite is true. Consensus is focused on Technology, and few investors have interest in Emerging Markets.

Why is there a rotation?

Return on investment is simply a function of the supply of and the demand for capital, and the highest long-term returns come from being the provider of scarce capital. By being the provider of scarce capital, one can charge more for providing funds, whether that be in a more conservative equity valuation or a higher interest rate.

In other words, one should try to be the lone banker in a town with a thousand borrowers. However, imagine a town in which there are a thousand banks and only one borrower. The odds are that one borrower will get a very low interest rate as the banks compete away the profitability of the loan.

Investments rotate through the cycle as capital becomes increasingly abundant and then scarce again. At 6 o’clock expected returns are highest because there is a scarcity of needed capital. At midnight, there is an overabundance of capital and little true need. Effectively at 6 o’clock there is one banker in a town with a thousand borrowers and at midnight there are a thousand banks competing for one borrower.

Where are the Magnificent 7 on the Earnings Expectations Life Cycle?

Because of the extreme outperformance (see Chart 3) and even the Magnificent 7 moniker, investors should consider where these stocks sit on the Earnings Expectations Life Cycle, and whether future stock performance is as bright as current consensus believes.

Analyst coverage tends to follow performance because investor attention tends to grow as stocks outperform. Accordingly, trading volume and related investment banking business increases (lowering the cost of capital). Deeply out of favor stocks are more likely ignored by investors and research coverage of such stocks is often not profitable.

Chart 4 shows that the Magnificent 7 are far from neglected stocks. Rather, coverage has increased significantly during the past 5 years. The median Magnificent 7 stock has 22 more analysts covering the stock than five years ago. Compare Magnificent 7’s increase in coverage over the last 5 years to the median decrease in coverage among the 25 worst performing stocks in the S&P 500®.

We use the term “unstoppable” on the Earnings Expectations Life Cycle because such accolades typically accompany the peak of a performance cycle. Analysts ignore competitive pressures and/or anti-trust concerns that could lead to slower earnings growth.

Analysts often refer to companies’ “moats” or a company’s ability to protect against competition, and the Magnificent 7’s moats have been widely considered to be unusually deep and unusually broad. However, some of the companies have already seen significant competitive pressure and global governmental interference, which is beginning to call into question the viability of those moats.

Valuations of the Magnificent 7 are not cheap, which argues they are in the top half of the Earnings Expectations Life Cycle. Chart 5 compares the PE ratios of the Magnificent 7 to other equity segments.

Given the excitement, the valuation (i.e., the overly cheap cost of capital), the potential over-coverage, and the risk of disappointment, we would argue that the Magnificent 7 are between 11 and 1 o’clock. Some have already started to move down the right side of the cycle whereas others are becoming more volatile. In our view, the Magnificent 7 presents more risk than opportunity.

What’s between 6 o’clock and 9 o’clock?

Investments are most attractive when they are between 6 and 9 o’clock on the Earnings Expectations Life Cycle. Hypothetically, these types of investments are generally still out of favor but offer higher expected returns and are beginning to show upward revaluation.

From a cyclical perspective, we think Energy, Materials, Industrials, smaller capitalization stocks, and Emerging Markets all fall within that attractive “3-hour” section.

From a secular perspective, we continue to believe that US investments focusing on the rebuilding of the American capital stock, defense, infrastructure, and related themes are attractive for the long-term because of the combination of the US’s massive trade deficit and contracting globalization.

Because the consensus is rather myopically focused on Artificial Intelligence as a long-term theme and capital is freely flowing to such investments (i.e., they are around midnight on the Earnings Expectations Life Cycle), the expected returns associated with deglobalization themes seem much higher.

What goes around comes around

Investors tend to lose objectivity and believe investment outperformance will last forever when an investment segment becomes very popular. The Earnings Expectations Life Cycle is a theoretical tool we constructed more than 30 years ago to help us stay dispassionate. One always must remember what’s hot eventually turns cold and what’s cold eventually turns hot.

Investors always should remember the importance of staying objective and dispassionate when investing. When an investor recently said to us, “It’s all so obvious. Why don’t you guys get it?”, it seemed to be further evidence that Megacap Growth/Mag7/AI might be near the peak of the Earnings Expectations Life Cycle.

Copyright © Richard Bernstein Advisors

INDEX DESCRIPTIONS: The following descriptions, while believed to be accurate, are in some cases abbreviated versions of more detailed or comprehensive definitions available from the sponsors or originators of the respective indices. Anyone interested in such further details is free to consult each such sponsor’s or originator’s website. The past performance of an index is not a guarantee of future results. Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index would require an investor to incur transaction costs, which would lower the performance results. Indices are not actively managed and investors cannot invest directly in the indices. Small Caps: Russell 2000. The Russell 2000 Index is an unmanaged, market-capitalization-weighted index designed to measure the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index. EM: MSCI Emerging Markets (EM) Index. The MSCI EM Index is a free-float-adjusted, market-capitalization-weighted index designed to measure the equity-market performance of emerging markets. Mag 7: The Bloomberg Magnificent 7 Total Return Index. The Bloomberg Magnificent 7 Total Return Index is an equal- dollar weighted equity benchmark consisting of a fixed basket of 7 widely-traded companies classified in the United States and representing the Communications, Consumer Discretionary and Technology sectors as defined by Bloomberg Industry Classification System (BICS). These consist of AAPL, AMZN, GOOGL, META, MSFT, NVDA and TSLA. Nasdaq®-100: The NASDAQ-100 Index is a modified capitalization-weighted index of the 100 largest and most active non-financial domestic and international issues listed on the NASDAQ. No security can have more than a 24% weighting. The index was developed with a base value of 125 as of February 1, 1985. Prior to December 21,1998 the Nasdaq 100 was a cap-weighted index. FTSE Venture Capital Index: Thomson Reuters Venture Capital Index (the "Index") is designed to measure the value of the US-based venture capital private company universe in which venture capital funds invest.