by Ryan Boyle, Senior Economist, Northern Trust

Forecasts of disinflation in 2024 have thus far missed the mark. Some of the disappointment has lingered from last year: housing costs have been stubbornly high, while services remain an inflationary risk. Outright price declines of many goods provided a helpful offset.

Deflation for goods is unlikely to last. Supply chains are being realigned with an eye toward resilience rather than only low cost, while investment is concentrated in specific sectors that require particular inputs. No commodity tells the story more clearly than copper.

Demand for copper is elevated, and poised to grow. The metal is crucial to electronic components that are in high demand. The boom in artificial intelligence is pushing up the need for both microprocessors and power-hungry data centers. As market share shifts toward electric vehicles, the batteries and wiring of EVs require more copper than conventional powertrains do.

Infrastructure investments in the electric grid and power components like solar panels and EV charging stations will add to copper demand. Homebuilding also continues apace, and more residential construction means more copper purchases for home plumbing and wiring.

Copper is a critical component of both old and new technologies.

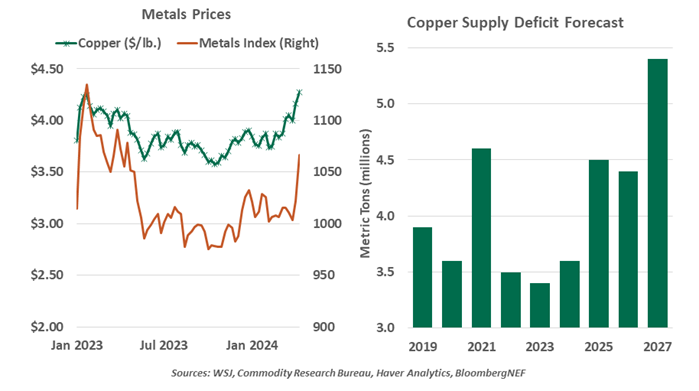

Given its wide range of uses, copper is often considered a proxy for global industrial activity. China’s policy priority of “new productive forces” suggests a renewed emphasis on exports. Copper’s price chart has a positive correlation with China’s economic prospects; the metal cooled along with China’s output last year, and is now picking up in tandem with China’s forecasts. Futures prices are ascending, reflecting forecasts of growing needs for copper in years to come.

But worries are also on the rise: can supply keep up? The majority of copper ore is mined in South America. Chile and Peru together account for 43.2% of copper exports, nearly all of which are bound for Asia. Operational issues and legal disputes have impaired mining output this year. New deposits are proving more difficult to find, and mining activity in general is facing greater scrutiny and environmental backlash. Chinese smelters have tapered their production to protect margins, rather than bidding up the limited supply of ore.

These forces are amplifying the supply deficit for copper. Objectives to reduce emissions and reinforce electricity supplies cannot be met without a large quantity of this particular ingredient. Higher prices for the metal will make those projects more costly, but may help to spur more investment in production. Supply will not come online overnight, setting the stage for a prolonged interval of higher prices.

Other industrial inputs like steel and aluminum are exhibiting firm price trends, but not surging in quite the same manner. Copper stands out in its performance and stands alone for its critical need in so many in-demand products.

Copper also serves as an illustration of the challenge of controlling inflation. More costly raw materials will either eat into profits or flow through to final prices. In prior economic cycles, goods were often a disinflationary force. Higher input prices raise the risk that goods will add to a difficult inflation dynamic.

As Fed Chair Jerome Powell sought to reset expectations of imminent rate cuts at the January Federal Open Market Committee press conference, he noted that inflation’s improvement was led by goods. For the Fed to be ready to cut, the composition of inflation needs to be more broad-based and balanced. We agree; our forecast of eventual rate cuts assumes continual moderation of inflation, but slow disinflationary progress led us to reassess the timing of cuts. Commodities like copper have compounded the case for cautious cutting.

Copyright © Northern Trust