by Vaibhav Tandon, Senior Economist, Northern Trust

Negative interest rates have more cons than clear pros.

Silvio Gesell was an early 20th-century economist who was described by John Maynard Keynes as “a strange, unduly neglected prophet.” To stimulate demand, Gesell recommended measures that would make it costly to save. He suggested paper money with an expiration date, allowing extensions only if a fee was paid. Gesell’s ideas were deemed polemical back then; they didn’t even get a fair hearing during the Great Depression.

Nearly a century later, Gesell’s work provided the theoretical basis for an extended period of negative interest rates in many countries. Earlier this month, that era came to a close, inviting retrospection.

During economic downturns, central banks lower rates to revive growth. But in the aftermath of the 2008 financial crisis, even very low rates weren’t enough to boost activity in many markets. So, some central banks tried to extend their efforts by breaking the zero lower bound.

The concept is simple: If savers have to pay to store their money, instead of being paid, they will be more likely to spend. Negative borrowing rates should boost capital investment by businesses. Negative yields on sovereign bonds should also mean less demand for both a country’s debt and also its currency, which improves its terms of trade. All of these things can help economic growth.

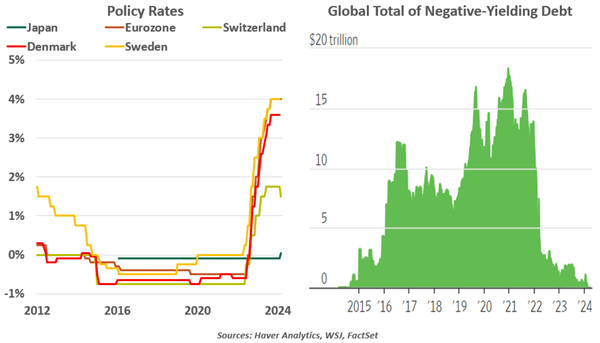

Denmark was the first country to impose negative rates on deposits held by commercial banks in 2012. The European Central Bank (ECB) adopted a negative interest rate policy (NIRP) in 2014. Other European central banks followed in the ECB’s footsteps. The Bank of Japan (BoJ) became the last one to join the club eight years ago.

In a 2021 study, the International Monetary Fund concluded that NIRP “eased financial conditions” and “has likely supported growth and inflation.” The research found that lending in the eurozone was declining prior in the 2010s, but negative rates helped boost volumes in the following years.

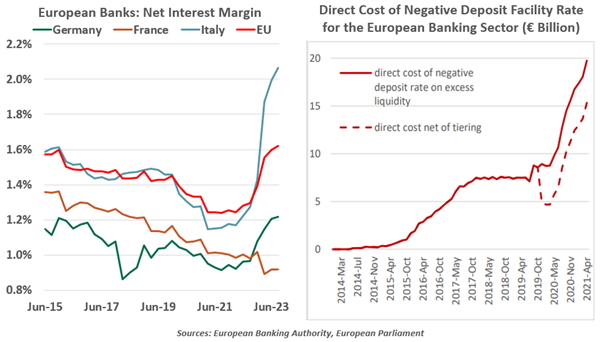

Other work reached very different conclusions. Negative rates damaged the earnings of European banks: the direct cost of holding liquidity rose significantly to €15 billion a year. Financial institutions were reluctant to begin charging their depositors (which would have been required if deposit rates were negative) for the fear of losing their balances.

A paper by the Organization for Economic Co-operation and Development (OECD) concluded that NIRP in the eurozone had an adverse effect on bank profitability. Lower profitability limits capital bases and credit growth, contrary to the objectives of a NIRP. Another study showed that bank lending was weaker in countries with negative interest rates than in markets that did not implement the policy, due to tight net interest margins.

Negative rates hindered banks and the flow of credit.

Negative interest rates may also have facilitated the buildup of public debt that has occurred over the past fifteen years. For a long while, European governments were getting paid by investors for the privilege of keeping their money safe. More borrowing was actually favorable to annual budget deficits. Aggressive fiscal policy was not only painless, but it was also profitable.

Those who borrow at variable rates should, of course, be aware that their costs will fluctuate with the business cycle. But many sovereigns have been squeezed as monetary policy normalized. The austerity measures that Europe has had to follow have limited their economies.

NIRP and the associated low yields on risk-free assets also induced a shift in investor portfolios towards riskier assets like equities and real estate. The search for higher returns fueled more risk-taking in the eurozone, leading to a convergence in sovereign credit spreads. Pension funds’ asset allocations, which are traditionally heavy on bonds, were also distorted by NIRP. Many stretched their risk appetites and acquired private assets, which have proven difficult to exit as rates have returned to more normal levels.

During the period of NIRP in Japan, investors turned to the equity market for higher returns, one of the factors that drove the Nikkei 225 index to its highest level in three decades. Similarly, the housing markets in Sweden and Denmark experienced a boom following the implementation of negative interest rates, with prices soaring to unprecedented levels. While the consequences of asset price excesses haven’t appeared yet, the risks of a significant correction are not negligible

What sounded good in theory did not work in practice.

The Federal Reserve chose not to join the NIRP club. There were concerns that financial systems might not be able to handle negative rates, and Fed leaders had a much stronger belief in quantitative easing (QE). Research on the efficacy of QE is mixed, and is it isn’t altogether easy to unwind. The long-term effects of running a very large central balance sheet are still not clear.

Despite years of negative rates, growth in the Japanese and European economies remained lackluster with inflation below central banks’ 2% targets. It was the disruptions caused by the pandemic and the Ukraine war that ultimately helped central banks hit their goals.

The grand experiment with negative interest rates ended in March when the Bank of Japan raised rates for the first time in 17 years. The experience is certain to be studied for many years to come, but the early conclusions seem to suggest that zero should be reestablished as the lower bound for interest rates.

Copyright © Northern Trust