by Mark Nabi, Maria Karahalis & David Polak, Equities, Capital Group

The dominance of megacap tech stocks has prompted debate around how much higher equity markets can go, especially in the U.S. In our view, even accounting for the recent climb in stocks, overall valuations do not appear to be stretched. Global corporate earnings have bounced back from a near trough and are expected to improve further from here. Moreover, moderating inflation and declining interest rates could create a highly favourable backdrop. While we may see some volatility related to earnings, elections, the pace of interest rate cuts, or geopolitical events, we believe that equities are in a sweet spot, as we highlight in the charts below.

The year 2024 might not be exceptional for all the companies in the Magnificent 7. Nvidia continues to surge ahead of other companies given AI excitement, while Apple, Alphabet and Tesla shares are down thus far to begin 2024.

1. Earnings growth will be key driver for stocks

Forget the Oscars. Earnings season around the world has been a spectacle. Chipmaker Nvidia brought home the top prize, delivering a solid earnings beat and expanding its market capitalization by US$277 billion on February 22. Meta was a runner-up, with its bottom line reflecting the benefits of cost-cutting efforts initiated a couple of years ago. Meta added almost US$200 billion in market value on February 2, announcing a dividend for icing on the cake.

The blended earnings growth rate for the S&P 500 information technology sector rose 22.7% year over year, according to data compiled by FactSet. “Their valuations are rich, but they’re not stretched,” Capital Group chief investment officer Martin Romo told us recently. He referenced a broader group of technology companies, including the Magnificent Seven along with Broadcom, but made the point that one can’t ignore these companies as they’ll continue to impact markets and economies. Many of these firms are growing in a disciplined manner, and they’re getting operating leverage in a way they haven’t historically achieved, Romo says.

Earnings appear set to recover in 2024

Source: LSEG Institutional Brokers' Estimate System. As of March 1, 2024. Actual data from the first quarter of 2022, until the fourth quarter of 2024. Estimates from the fourth quarter of 2023 until the third quarter of 2024. E = estimate.

Companies in the S&P 500 grew earnings by 9.8% in the fourth quarter of 2023 year over year, and consensus estimates for 2024 suggest a sustained earnings rebound. Seventy-six percent of S&P 500 companies beat earnings expectations in the fourth quarter, while 63% reported higher revenues than analysts anticipated, according to data compiled by LSEG.

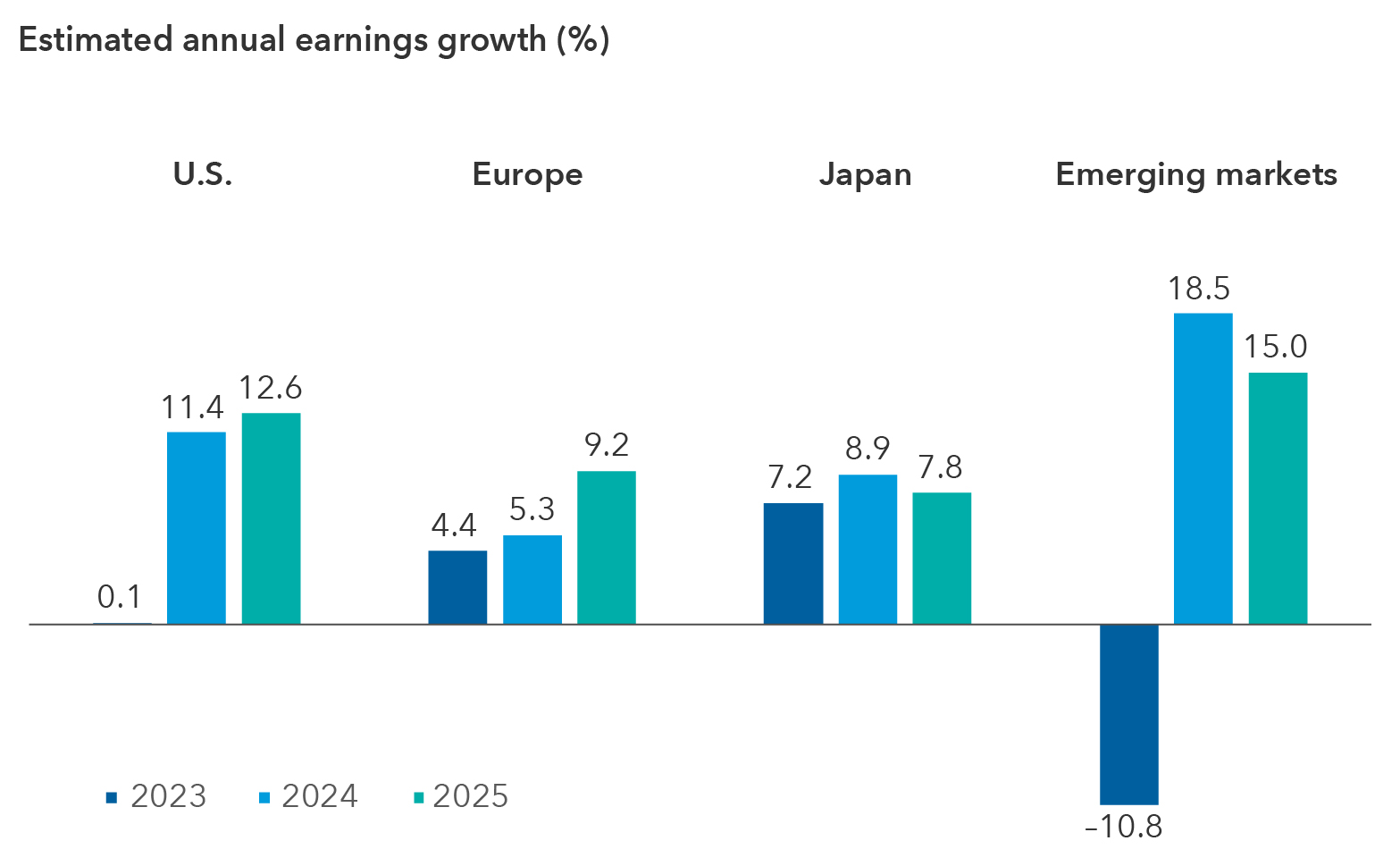

Consensus analyst estimates for S&P 500 earnings anticipate a gain of over 11% in 2024 versus 0.8% in 2023. In emerging markets, consensus estimates are for almost 18% growth this year, compared to a decline of about 10% in 2023.

Portfolio manager Chris Buchbinder reminded us recently that “stocks will follow earnings, and earnings will follow fundamentals.” Buchbinder, a portfolio manager for Capital Group U.S. Equity FundTM (Canada), still sees relatively attractive opportunities in the market, though he expects earnings performance to vary among companies — especially among tech favourites, with exceptional businesses and management teams differentiating themselves from the pack.

Corporate earnings set to rebound

Sources: Capital Group, FactSet, MSCI, Standard & Poor's. The chart shows estimated earnings growth for each region. Estimated annual earnings growth is represented by the mean consensus earnings per share estimates for the years ending December 2023, December 2024 and December 2025. U.S. = S&P 500 Index. Europe = MSCI Europe Index. Japan = MSCI Japan Index. Emerging markets = MSCI Emerging Markets Index. Estimates as of December 31, 2023.

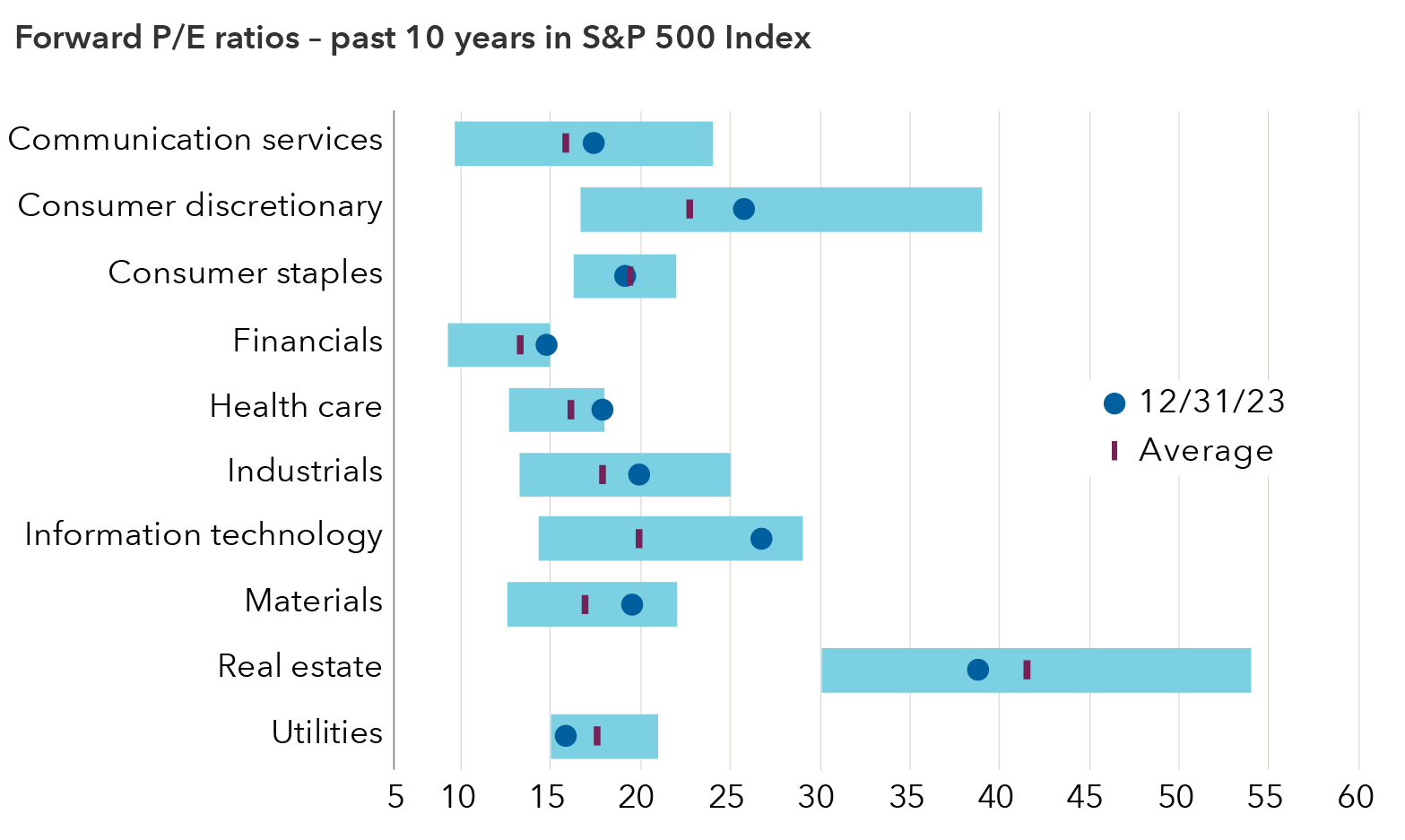

2. Despite their run-up, U.S. equity valuations don’t appear stretched

At first glance, valuations for a handful of S&P 500 sectors may appear on the rich side. But when looking at the range of P/E ratios on a 10-year basis for most sectors, there could still be some room to run. Earnings growth will be a key driver in determining if stocks continue moving higher, in contrast to the previous decade when multiple expansion and an ultra-low interest rate environment provided strong tailwinds. U.S. equity valuations don’t appear stretched given growth expectations, especially when factoring in recent earnings strength.

The economic backdrop in the U.S. also remains supportive, with a soft landing looking more likely than a recession. That said, we expect some bouts of market volatility amid ongoing jitters around the pace and magnitude of interest rate cuts and inflation readings. January’s higher-than-expected inflation figures, for instance, sparked concerns in the market about when the Fed may begin cutting rates. But as long as earnings growth continues to meet or exceed expectations and the labour market remains strong, U.S. equities should find support. Companies with clear earnings growth trajectories, pricing power and the ability to maintain market share should be able to weather potential storms.

U.S. equity valuations don’t appear to be stretched

Sources: Capital Group, LSEG. Forward price-to-earnings ratio reflects the current share price relative to the consensus estimate for earnings per share on a 12-month forward basis. Data from December 31, 2013, through December 31, 2023. P/E = price-to-earnings. Past results are not predictive of results in future periods.

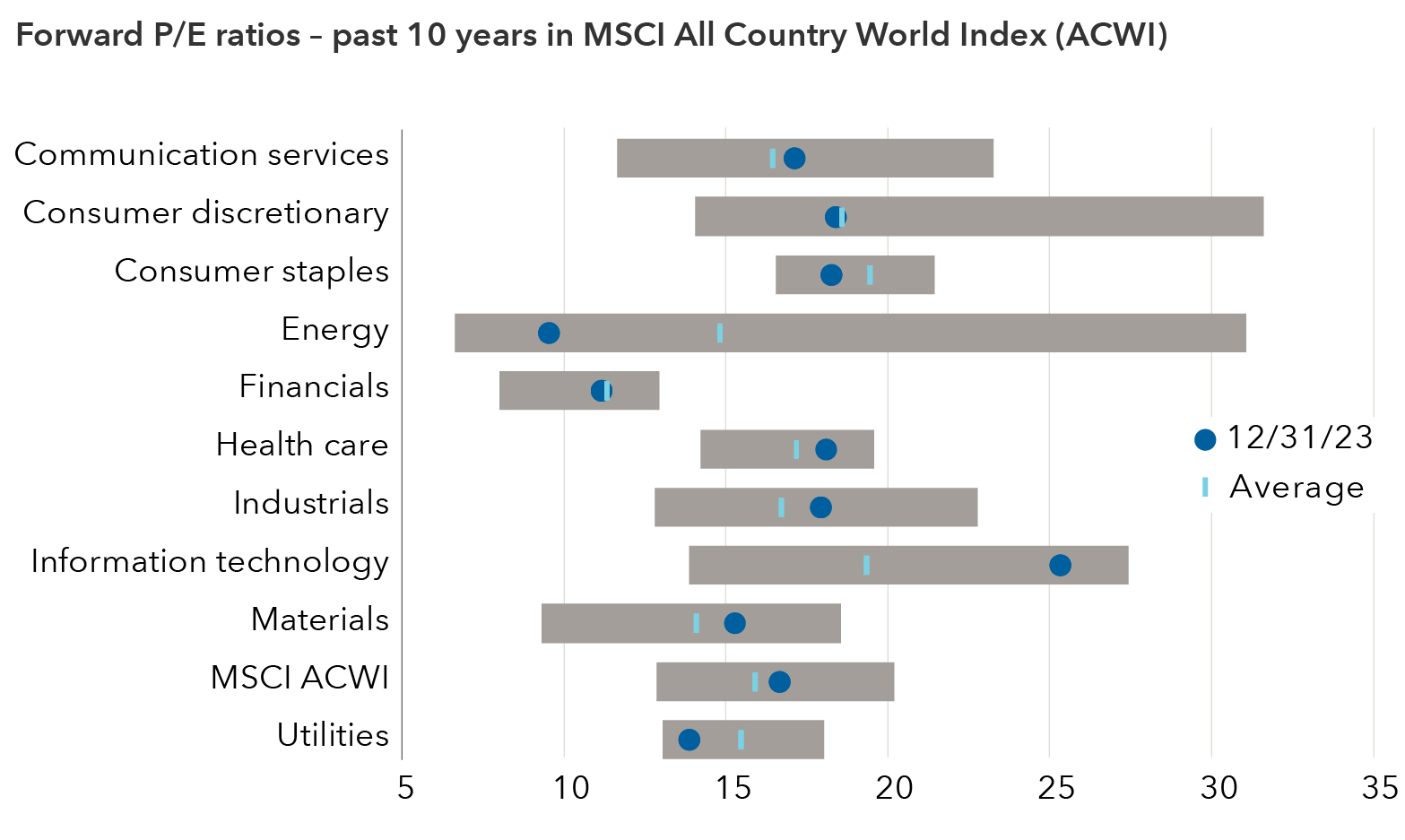

3. Global companies offer good value

At the high level, on a 12-month forward P/E basis, most of the industries in the ACWI Index appear to be attractively priced. Many are at or just above their 10-year average forward P/E ratio at a time when central banks around the world are set to ease monetary policy, and longer-term interest rates are likely to decline.

It’s worth highlighting here that the bull run in U.S. stocks over the past decade has boosted the U.S. companies’ weighting in the ACWI index to a lofty 63%, which in turn lifts prices and valuations for the index. Outside the U.S., stocks are more attractively priced – companies with strong franchises and global brands trade at a discount to their U.S peers.

Many European and Asian companies, for instance, have achieved strong market share in industries such as semiconductors, aerospace, pharmaceuticals and luxury goods. Expectations for lower rates in various non-U.S. markets may also provide a tailwind for global stocks.

In the U.S., higher share prices mean that valuations have also increased. “And so, we have looked a little bit more for better value in other areas,” said Jody Jonsson, vice chair and portfolio manager at Capital Group.

Most industries trade around 10-year average on price-to-earnings basis

Sources: Capital Group, London Stock Exchange Group, MSCI. Forward price-to-earnings ratio reflects the current share price relative to the consensus estimate for earnings per share on a forward 12-month basis. Data from December 31, 2013, through December 31, 2023. P/E = price-to-earnings. Past results are not predictive of results in future periods.

Japan, the world's top-returning global equity market year to date (as of February 29), as measured by the MSCI Japan Index, is drawing interest given long-awaited equity market and corporate governance reforms. Meanwhile, emerging markets such as India and Mexico may benefit from reconstructed global supply chains as their new manufacturing hubs develop smartphones, automobiles, home appliances and computer electronics. “Despite China’s slowing economy, I think durable trends – including demographic shifts and the energy transition – could add more depth to emerging markets than we have seen in the past,” portfolio manager Brad Freer said.

4. There are pockets of strength emerging beyond the Magnificent 7

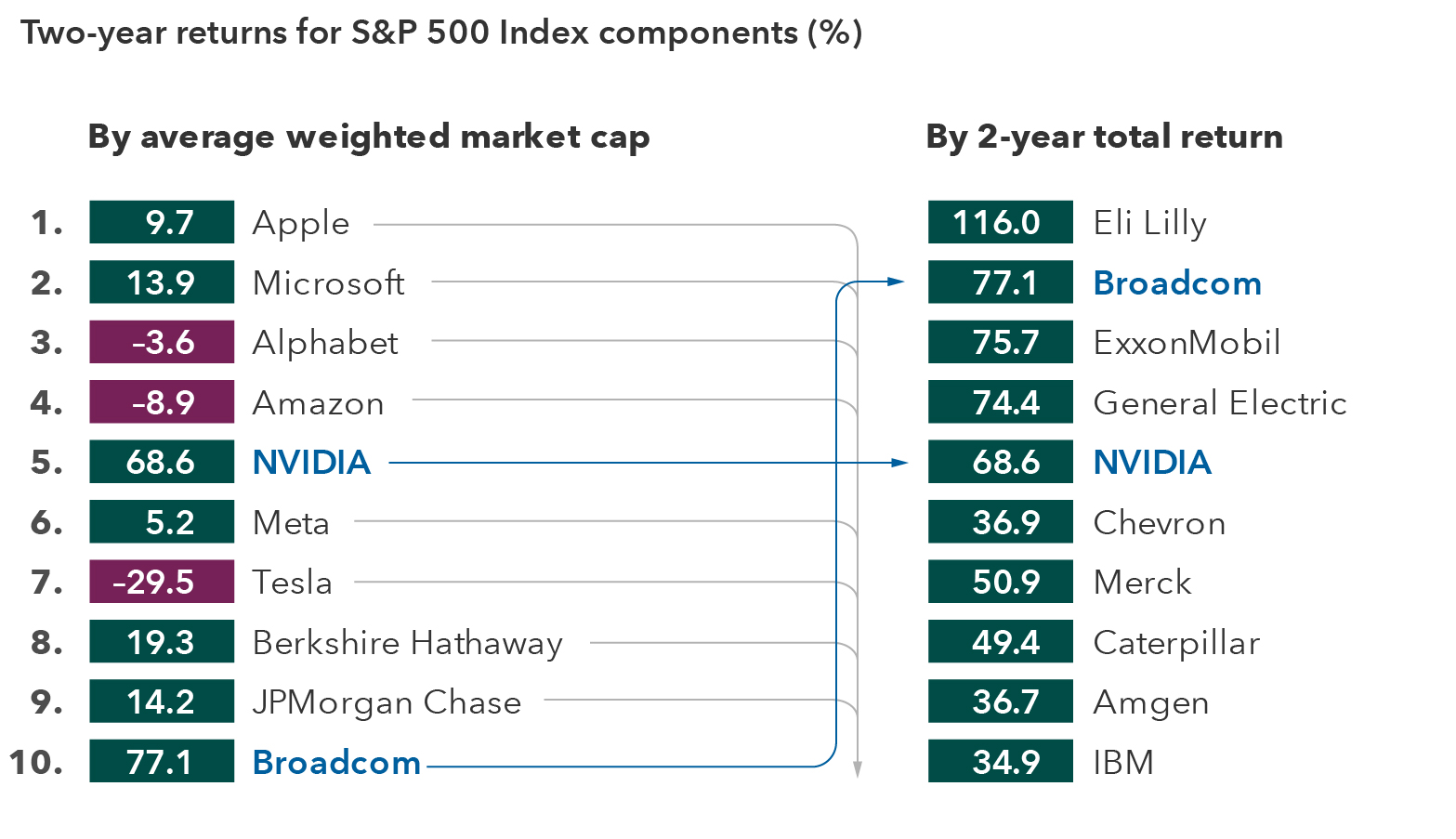

Despite eye-popping returns in 2023, the Magnificent 7 look less impressive over a slightly longer time horizon. In the two years from the start of 2022 through 2023, only one of the Magnificent 7 ranked among the top-returning companies in the S&P 500 Index due to severe drawdowns in 2022.

While one can argue that tech’s premium valuations are justified given their strong earnings and new growth runway in artificial intelligence, the chart shows a broader number of S&P 500 constituents posted relatively strong returns in areas such as energy, health care and industrials.

As earnings growth recovers in non-tech sectors, we could see a more diverse set of companies garner investor attention. To dampen portfolio concentration risk, an asset allocation program may want to seek greater diversification by reducing overall exposure to technology companies and U.S. equities.

Diversification can pay off despite Magnificent 7 exuberance

Source: FactSet. Data is based on the 55 most heavily weighted companies in the S&P 500 Index and filtered by the top 10 by average weight and total returns. Data as of December 31, 2023. The returns are shown from January 1, 2022, through December 31, 2023. Returns are in USD.

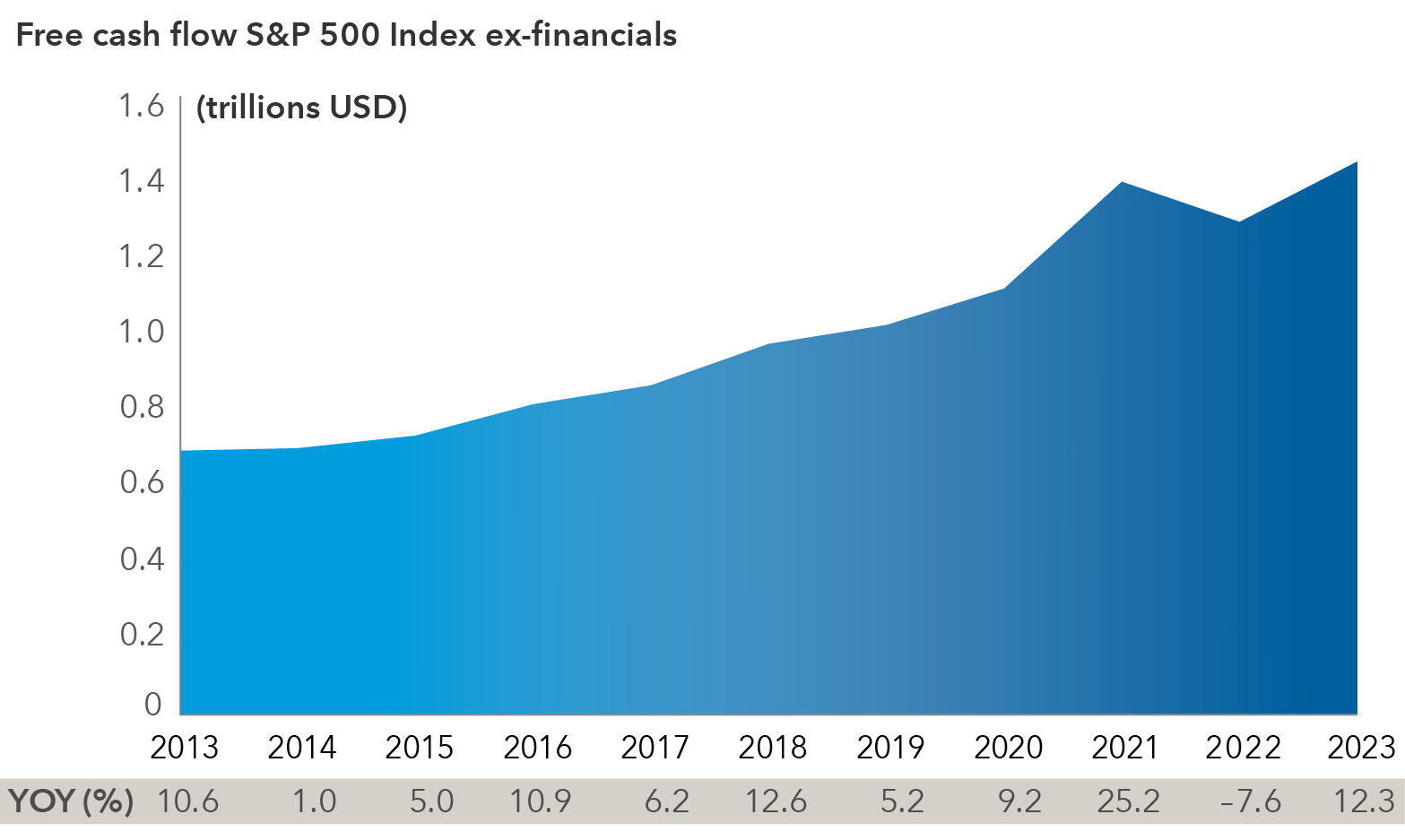

5. Rising cash flows could provide further support

At an aggregate level, companies in the S&P 500 Index excluding financials are holding cash at levels that are near 10-year highs. This could fuel stock buybacks, M&A activity or dividend payments. For instance, over the last few months, there has been an increase in M&A activity among some larger oil and pharmaceutical companies, deals that could help drive long-term earnings growth. Companies have also been increasing their dividend payouts, which contribute to total stock returns. Recent high-profile examples are Meta and Salesforce announcing their first-ever dividends, which bode well for capital allocation discipline.

Capital expenditures will no doubt be on the rise to meet the needs of technology companies, including the large investment in data centres required for AI, but also for the infrastructure investment needed to support the reshoring of supply chains. This investment should translate into steady cash flow growth for a broad array of companies across many sectors.

Free cash flow continues to climb

Source: Capital Group. Data from 2013 to 2023.

When looking at free cash flow, corporate America appears healthy. As our colleague, accounting analyst Dane Mott, reminds us, free cash flow (FCF) isn’t a perfect metric because it excludes M&A activities, but it still gives you a good indicator of corporate health. “Looking at FCF numbers for non-financial companies in the S&P 500 Index in 2023, they were the highest numbers ever recorded at nearly US$1.5 trillion, and they grew at a healthy 12.3% year over year,” Mott said. A valuation metric often used by investors is the market cap to free cash flow ratio, which was 26.4x at the end of 2023, compared to 52x at the height of the dot-com bubble in 1999.

Overall, despite various equity market indices testing recent highs, we believe that the fundamentals and the macroeconomic backdrop for equities remain robust. We may hit some air pockets because of economic or geopolitical events and domestic election year uncertainty. Selectivity will be key, yet we remain optimistic.

Marc Nabi is an equity investment director with 35 years of investment industry experience (as of 12/31/2023). He holds an MBA from New York University and a bachelor’s degree from the University of Michigan.

Maria Karahalis is an equity investment director and portfolio strategy manager with 37 years of experience (as of 12/31/23). She holds a master’s degree in management from MIT Sloan School of Management and a bachelor’s degree in economics from Wellesley College.

David Polak is an equity investment director with 40 years of experience (as of 12/31/2023). He holds a bachelor’s degree in economics from University College London graduating with honors.

Copyright © Capital Group