by Andrew Ang, PhD., BlackRock

Key takeaways

- Factors are long run drivers of portfolio risk and returns. Having strategic allocations to factors may increase a portfolio’s expected return.

- As factor performance is cyclical, investors may be able to drive additional alpha in portfolios by tilting towards factors in a systematic way.

- Tilting decisions to any factor can be driven by the current economic regime, valuations, and sentiment.

Some of you may be familiar with an analogy that I’ve used during presentations and in my book, Asset Management – Factors are to assets what nutrients are to food. Just as individuals have different nutritional needs, investors have different optimal exposures to different risk factors.1

Long-term strategic overweights to certain style factors – value, quality, momentum, small size, and minimum volatility – can help investors increase their portfolio’s expected returns, reduce risk, or improve diversification. But sometimes things happen to us as individuals causing us to have varying nutritional needs. If you’re sick, some delicious chicken soup might help! A runner getting ready for a triathlon may decide to eat more carbohydrates to power her body for the run. If you’re anemic, then eating a diet with iron-rich foods like red meat, beans, and spinach would be appropriate. In a similar vein, factor investors may decide to overweight or underweight certain factors in their portfolio based on 1) what economic regime we’re in, 2) current valuations, and 3) sentiment.

Economic Regimes

Factors are cyclical and every factor can, and will, go through periods of underperformance. After a few challenging years for value from 2018 to 2020, value beat growth when our economy reopened after the covid pandemic in 2021 and 2022. As bond and equity markets experienced -20% returns in 2022, minimum volatility outperformed by 8.9% in the US and 8.1% in global markets.2 This cyclicality is expected. Part of the reason that factors have a long-term premium is to compensate investors for potential short-term underperformance. If factors never underperformed, investors could capture higher returns, risk-free.

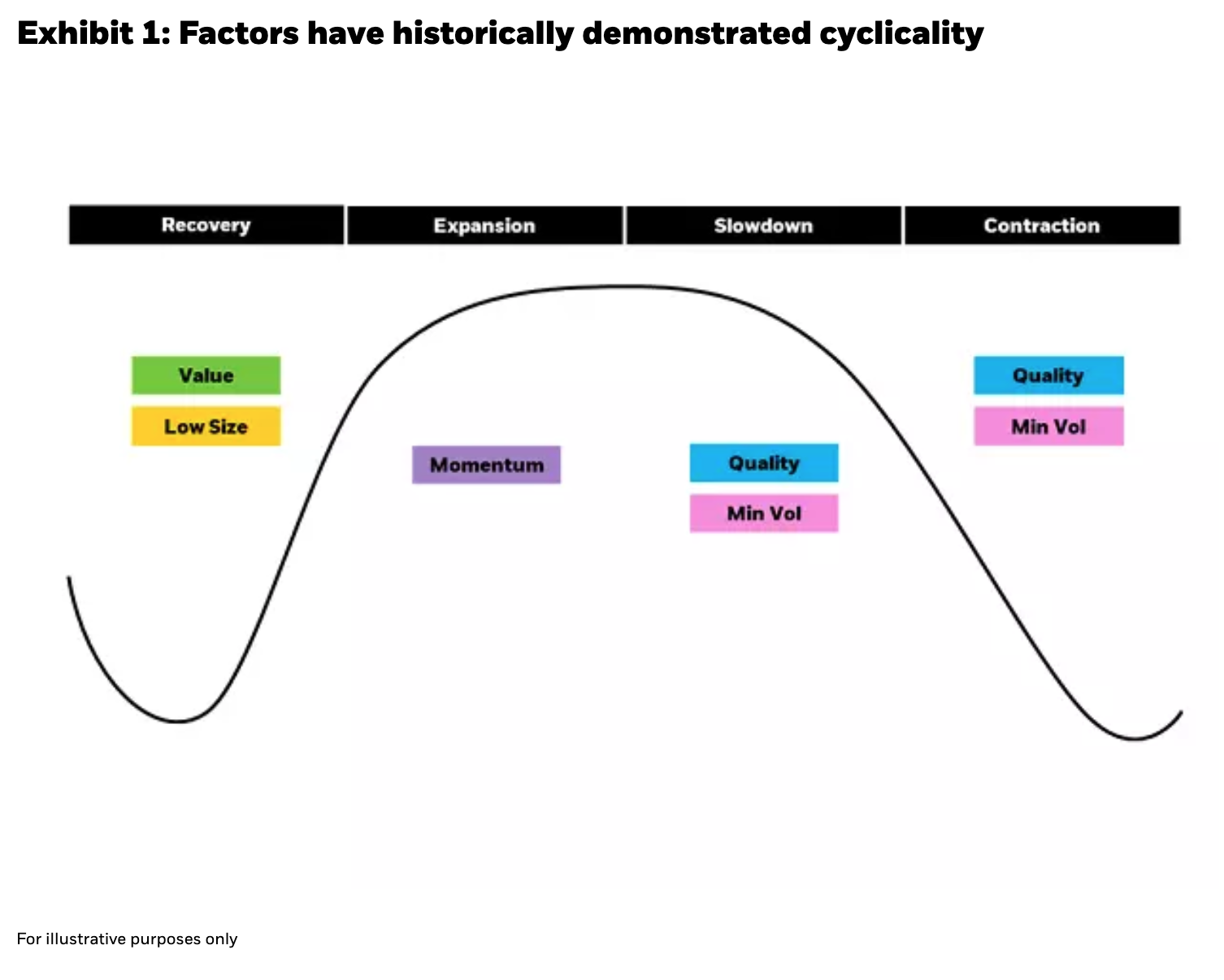

Investors can consider the current economic environment to help determine which factor may have some tailwinds (or headwinds).3 For example, in a risk-on environment, pro-cyclical factors such as value and small size may be best positioned to capture the upside. As trends form in markets, momentum may be able to ride the trend. During economic slowdowns or contractions, more defensive factors – minimum volatility and quality – may perform best.

Understanding the current regime may help investors decide whether tilting to certain factors may be prudent.

Valuations

Value investing is all about buying underpriced assets – companies with low relative prices to fundamentals or higher discount rates. Factors themselves go through periods when they become rich or cheap. A factor that is undervalued relative to its past may provide higher returns in the near term than a factor that is currently expensive relative to its history if factor valuations revert to their mean.

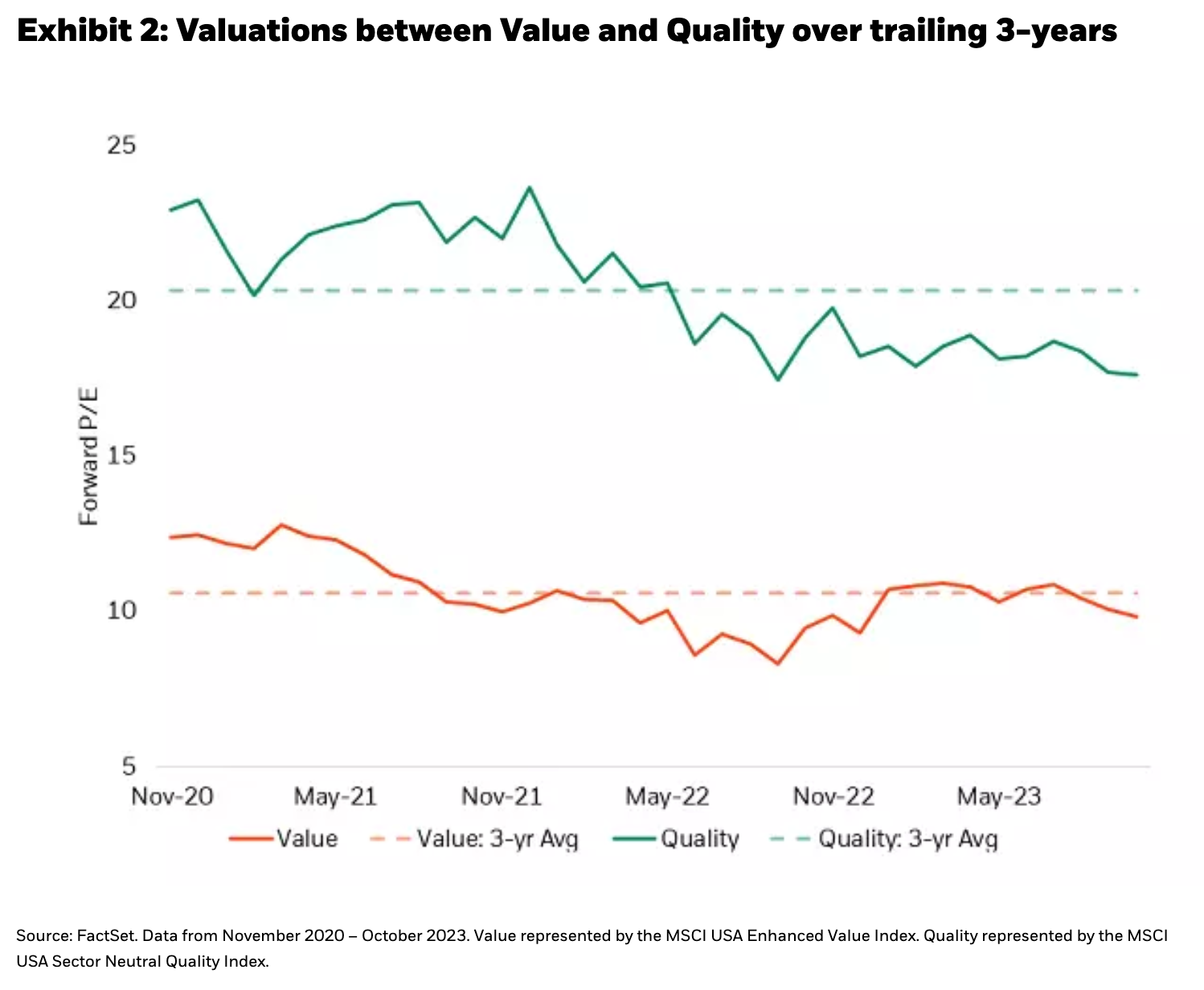

However, applying valuations as an indicator to position factors requires some nuance, because the value factor, by definition, always contains stocks that are cheap relative to fundamentals and looks cheaper relative to other factors. We first evaluate a given factor’s current valuation relative to its past valuations (which is called a “time series score” in the jargon of systematic investors), and then we can measure a given factor’s valuation relative to the valuation of other factors (or in jargon: the “cross sectional score”). For example, if we look at forward P/E ratios over the trailing 3-years, we see both value and quality are currently trading at lower relative prices compared to average over the period.

While both quality and value may look attractive compared to their average forward P/E ratio over the past 36 months, quality is at a slightly larger discount of -13% compared to -7% for value as of October 2023.

Sentiment

The underlying sentiment for a factor can also drive short-term performance. Think of sentiment as the “momentum” of a factor. Similar to momentum investing, a factor that has been trending upwards, may continue to outperform in the near term. Understanding the current sentiment of a factor can help drive tilting decisions. Additionally, investors can also consider other metrics of sentiment such as earnings surprises or short interest.

Putting it together – A framework for multifactor construction

Once an investor decides to invest in a multifactor product, a decision needs to be made on the best way to capture the exposure.

We believe using a bottom-up construction methodology makes the most sense. Netting underlying positions at the stock level can improve operational efficiency and minimize trading costs. A top-down construction approach – where a portfolio is built using individual factor sleeves and then combined into a portfolio – can lead to unnecessary turnover. Consider a security that was previously cheap but has seen significant price appreciation. The value sleeve may sell out of the security given its now higher relative price and the momentum sleeve may buy that same security to try to capture the trend (leading to double the transaction costs). A bottom-up methodology that evaluates each security based on their underlying exposures to each factor, may be a more sensible way to build a multifactor portfolio.

Once individual equities have been evaluated with a factor lens, the next decision in the portfolio construction framework is identifying the optimal way to combine the securities in a portfolio. We believe building a multifactor portfolio using an optimized approach is prudent. An optimized portfolio can provide more precise factor exposures, reduce unintended portfolio bets, and provide more controls on risk. A single factor portfolio can potentially be built using a simple, rules-based approach. A value strategy may not need an optimizer to build a diversified portfolio of lower relative priced stocks; however, when multiple factors with low or negative correlations are combined, it may be more practical to use an optimizer to ensure the final portfolio is balanced and behaves as expected.

Conclusion

Academic research has traditionally focused on the cross-sectional differences in returns, assuming constant expected factor risk premia. In the last few decades, academics have explored the idea of time-varying factor premiums. In a world of constant factor risk premiums, our best estimate for future expected returns for each factor is its long-term average. If factor premia are time-varying, expected returns for each factor can also incorporate historical unexpected returns which may dominate realized returns, especially during shorter time horizons.4 For investors that believe in time-varying premium (like we do at BlackRock!), a systematic approach to tilting to factors may be attractive.

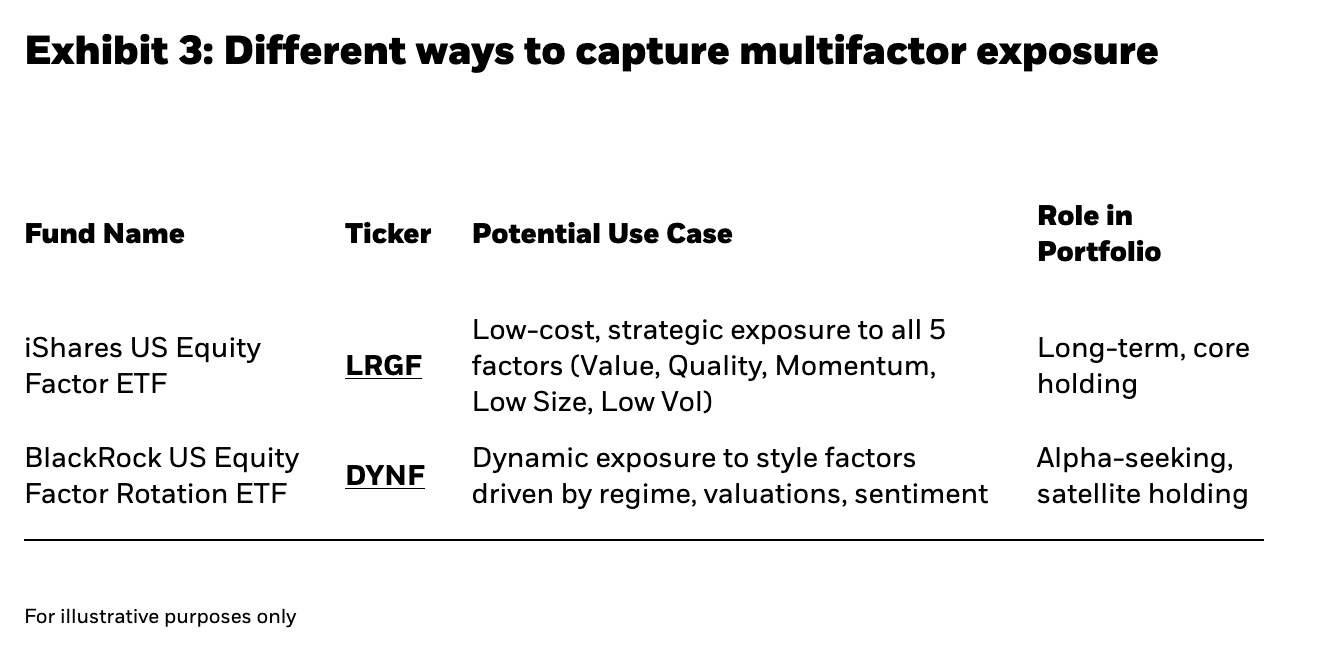

At BlackRock, we offer two primary ways to capture multifactor exposure.

An investor’s underlying risk budget and return target can help determine which multifactor solution makes the most sense for their portfolio. The most important thing is to consider remaining invested in these factors to harvest their long-term premiums—factors are the nutrients of investing. For certain investors, small tilts around these long-term strategic exposures may make sense – just as your nutritional requirements might change – but we need all the nutrients to be healthy!

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics ("factors"). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

Copyright © BlackRock