by Tom Nelson, CFA, Head of Asset Allocation Portfolio Management, Miles Sampson, CFA, Lead Asset Class Analyst, Spencer Walling, Research Associate, Franklin Templeton Investment Solutions

While some stocks may seem expensive, there are areas of opportunity that feature attractive valuations and growth catalysts, according to the Franklin Templeton Investment Solutions team.

Key takeaways

- While the macro backdrop has improved, we believe risky assets are priced too optimistically. At a portfolio level, we remain slightly defensive.

- However, some risky assets have lagged the broader market rally and appear attractive, specifically, US small capitalization stocks (small caps) and emerging market (EM) equities.

- We explore some rationale for the performance lag in these two areas. Ultimately, we believe much of the bad news is priced-in, and catalysts are on the near horizon. We think these two assets offer positive asymmetry and are a smart place to add risk in multi-asset portfolios.

Are investors too optimistic?

In some regions, including the United States, the macro backdrop has been improving. Growth remains resilient, with strong service sector activity and a stabilizing manufacturing environment. Inflation continues to abate, with inflation surprises near three-year lows. Federal Reserve (Fed) policy is restrictive, but the odds of “peak Fed” rates have grown substantially over recent months. Overall, the probability of a soft landing has certainly risen.

How are asset prices reacting to this news? Risky assets—such as equities and high-yield credit—did not wait for the “all clear” sign from macro-land. Their rally began nearly a year ago in October 2022 at the first signs of a peak in inflation, but well before a substantial improvement in growth or monetary policy. Most equity markets have achieved bull market status, while corporate bond spreads are near cyclical tights.

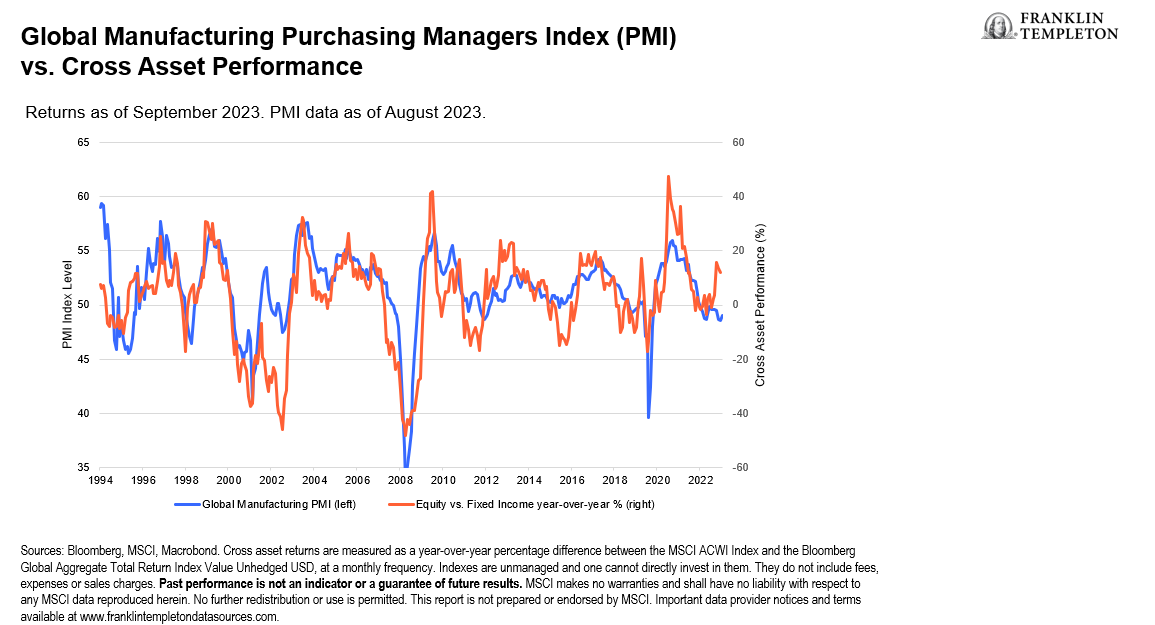

The challenge today is that most risky assets have rallied ahead of both the current and projected macro environment (see Exhibit 1). In our view, most risky assets are pricing in macro expectations that are overly optimistic. While the macro backdrop has improved, we still believe there is considerable uncertainty over what lies ahead next year.

Exhibit 1: Risky assets are overly optimistic (right click on chart to enlarge)

The mispricing of risky assets is a key reason why we remain slightly defensive at the portfolio level. We favor fixed income over equities, where it is now relatively easy to find high-quality bonds yielding over 5% with little duration or credit risk.

Where to add risk in multi-asset portfolios

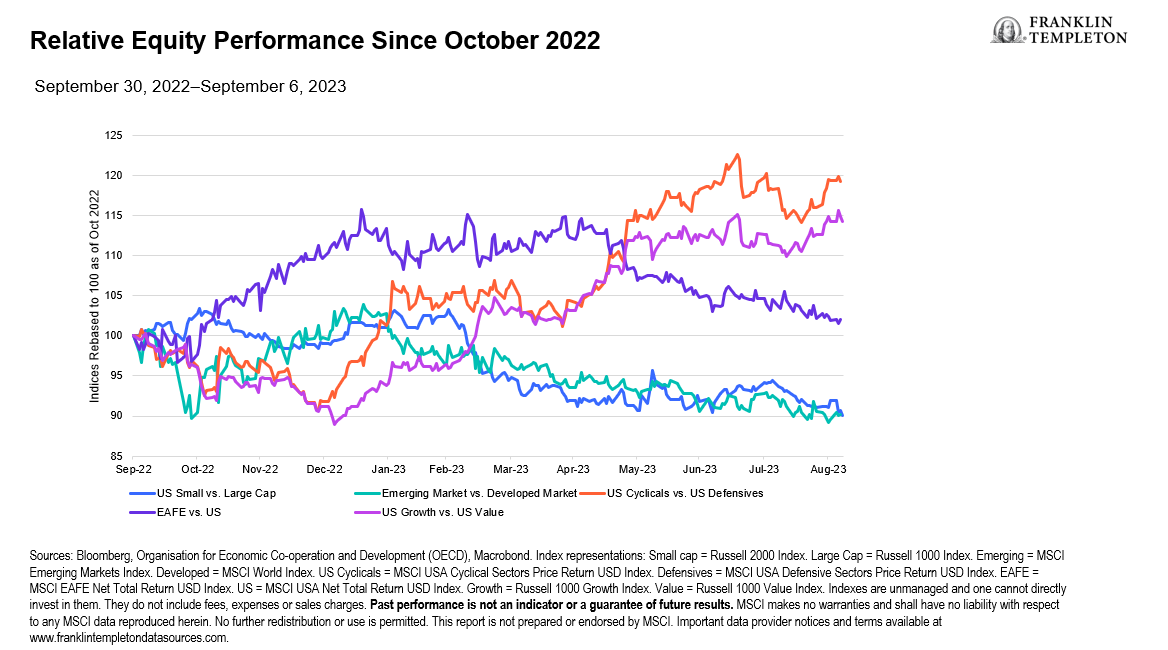

While most global equity markets have rallied since last October, not every index has performed equally. We examine equity pairings that historically perform well when growth is beginning to improve from below-trend levels, which is the environment many regions are in today (see Exhibit 2). While some parts of the equity market have performed well—cyclicals and growth stocks—other parts have lagged considerably, namely US small caps and emerging markets.

Exhibit 2: What Has Outperformed During the Most Recent Equity Rally? (right click on chart to enlarge)

It is not hard to rationalize why these equity markets have lagged.

US small cap stocks are generally more sensitive to higher interest rates, due to a larger amount of variable rate debt and weaker balance sheets (i.e., lower interest coverage ratios). Plus, exposure to the artificial intelligence (AI) theme and the “magnificent 7” group of technology stocks is much more limited within small caps. In emerging markets, China’s economy continues to struggle for momentum, and more broadly, we have observed a weak global manufacturing environment.

The good news is that these risks appear to be largely priced in. Valuation ratios, like price-to-earnings or price-to-book, suggest these assets are attractively valued. However, valuations are not good tactical indicators. Therefore, we identify some key catalysts that are developing in support of US small caps and emerging market equities that we believe markets have yet to fully reflect.

US small caps

- US interest rates are unlikely to move much higher from here. Historically, rate increases have had a lagged effect, with Treasury yields lower a year following the end of the Fed’s rate-hike cycle. Typically, performance for small cap stocks one year following the Fed’s final rate hike in the cycle has been robust.

- Small-cap stock performance has historically benefited from falling inflation.

- Small caps tend to outperform when leading indicators recover from below-trend, which our team believes is currently taking place.

Emerging markets

- Some measures of relative growth, like manufacturing PMIs, suggest stronger growth for EMs over developed markets (DMs).

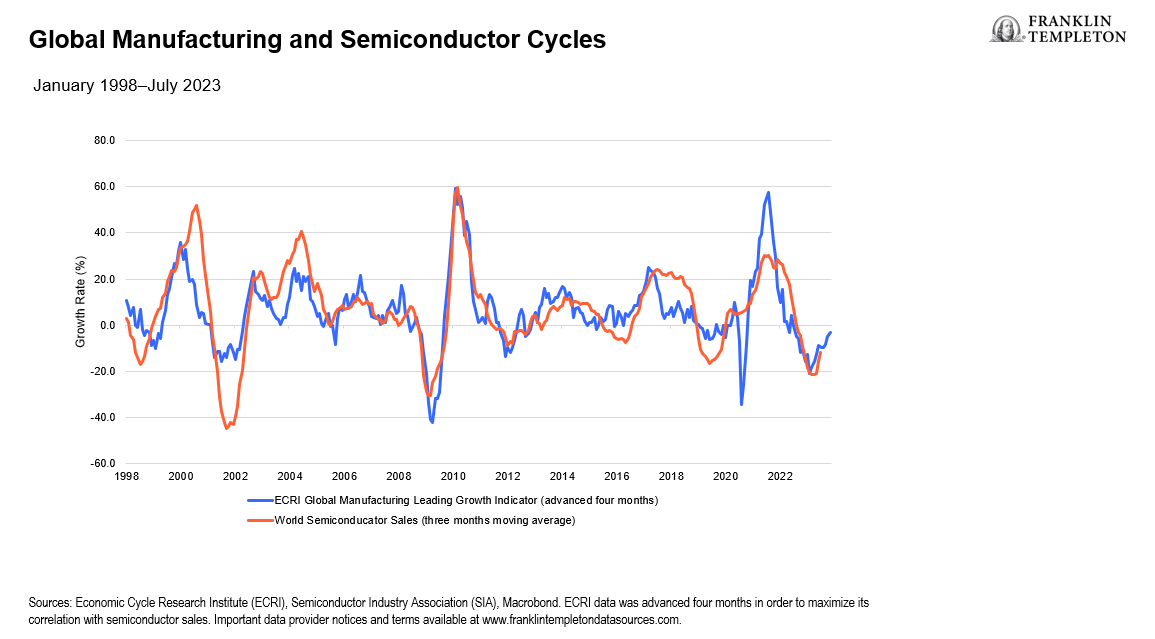

- Some leading indicators of global manufacturing are also rebounding. Along with rising AI demand, this trend should bode well for semiconductors (see Exhibit 3), a key export for EM Asia (Taiwan and South Korea). According to World Trade Semiconductor Statistics, global semiconductor sales are forecast to grow by 11.8% in 2024.1

- China’s policy environment is showing signs of proactiveness. In September alone, more than 30 provinces and cities have enhanced property policies to support growth.

- Disinflation is prevalent across many EM countries after strong rate hiking cycles. Over the next year, we expect policy easing to be more supportive compared to DM markets.

Exhibit 3: Leading Manufacturing Indicators Should Improve Semiconductor Sales (right click on chart to enlarge)

Putting it all together

We remain slightly defensive at the portfolio level due to the general expensiveness of risky assets, like equities and high yield credit, especially relative to many developed market government bonds. However, we have shown that not all equity markets seem expensive; US small caps and emerging markets have attractive valuations, in our view. Additionally, they are geared to an improving macro environment, have near-term catalysts, and can offer positive performance asymmetry over the next year. Overall, we think US small caps and emerging markets are smart places to add risk in multi-asset portfolios.

Copyright © Franklin Templeton Investments